Local stocks lift as buyers return

The sharemarket posts gains as China comes back online, while Australia’s largest citrus player hits an all-time high.

The sharemarket posts gains as China comes back online, while Australia’s largest citrus player hits an all-time high.

The ASX posts gains on a tailwind from heavyweight banks, while the Aussie takes a hit from fresh RBA commentary.

The ASX erases gains as sustained dollar weakness hits offshore appetite and leaves heavy lifting for small-caps.

The ASX posts steep losses in a global uptrend, while Goldman lumps on a2 Milk upside atop all-time record highs.

The ASX falters as sellers buffet offshore leads, while insurance major QBE falls after lifting its claims forecast.

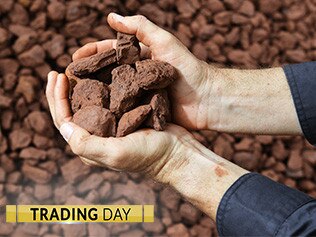

The ASX200 posts solid gains in public holiday affected trade as miners surge with a brighter China backdrop.

The ASX surges into positive territory, while Australia’s largest horticulture stock leaps to an all-time record high.

Financials and resource stocks diverge as the ASX posts gains in the wake of fresh Trump tax developments.

The ASX200 closed lower ahead of a key speech from Trump on tax reform, while Telstra hits its 2012 lows.

The ASX closes lower as geopolitical pressures test investor nerves, while a crude oil surge sures up energy names.

The ASX steadies as investors turned a cold shoulder toward global politics and a push by big banks ran out of steam.

The local bourse has clawed its way to a positive close amid choppy trade, as bank strength offset falls among the miners.

The ASX shrinks losses as CSL lifts, while investors await Tabcorp, Tatts trade as their proposed merger hits a hurdle.

The ASX falls as investors tread cautiously near Aussie stocks amid growing speculation of a higher rate environment.

The ASX pares early gains as investors draw breath and TPG ignites the telco sector in the wake of profit results.

The ASX200 lifts as strength in large-cap financials buffets headwinds from commodity markets and China concerns.

The ASX clinches slim gains for the week and ends on a cautious note as North Korean risk sidelines investors.

The local bourse has inched lower in choppy trade, as banking strength failed to offset drag from the major miners.

AGL could lose $32m a year in earnings if the Liddell power station stays open until 2027, UBS says.

Heavyweight banks and miners haul the ASX higher as NAB reveals the lasting impact of uncertainty on the economy.

Original URL: https://www.theaustralian.com.au/business/trading-day/page/92