Trading Day: ASX surges amid uncertainty toll

Heavyweight banks and miners haul the ASX higher as NAB reveals the lasting impact of uncertainty on the economy.

Welcome to Trading Day for Tuesday, September 12.

5.05pm: Banks, miners buoy stocks

The sharemarket rose on Tuesday as concerns over the global economic impact of Hurricane Irma eased, while the Australian dollar fell amid a mixed read on domestic business.

At the close, the S&P/ASX200 index rose 0.6 per cent, or 35.7 points to 5748.8, while the broader All Ordinaries index also rose 0.6 per cent, or 33.9 points to 5809.

The market response to Hurricane Irma’s landfall on the United States mainland appeared to show that heightened expectations of lasting economic impact were overly cautious, with local investors served a strong lead by offshore equity and commodity markets.

“An improved tone for industrial metals overnight and relief over Hurricane Irma have seen support for the major miners,” said CMC chief market analyst Ric Spooner.

“Bank stocks on the other hand have been under pressure for some weeks, suggesting potential for a more sustained rally which could see the ASX 200 index approaching the top of its trading range in the 5800/5830 range before long.”

CBA shot over 2.2 per cent higher to $75.92, Westpac rose 1 per cent to $31.85, ANZ added 1.4 per cent to $29.90 while NAB shares ticked 0.8 per cent higher to $30.76.

BHP Billiton rose 1.2 per cent to $27.12, Rio Tinto lifted 1.9 per cent to $68.80 and Fortescue Metals jumped 1.6 per cent higher amid what continues to be a volatile time for resource stocks and underlying commodities, according to Mr Spooner.

4.15pm: Platinum extends buyback period

Platinum Asset Management says it plans to extend the period of its current on-market share buyback scheme of 10pc of total securities “to buy back its shares should the PTM share price trade at a significant discount to its underlying value”.

PTM closed up 1.5pc to $6.17

3.52pm: Qintus cops shareholder class action

Embattled sandalwood firm Qintus has been officially served class action proceedings flagged in The Australian last week.

Disgruntled shareholders have brought the suit against Quintis on allegations the company breached its disclosure obligations in relation to the termination of a sandalwood oil supply agreement to pharmaceutical company Galderma.

QIN last $0.30

3.40pm: Business confidence hit in August: NAB

Business confidence fell below its long run average in August, according to NAB’s monthly business survey, while conditions rose to their highest level since 2008.

NAB’s read on business confidence fell to 5 points in August, down from 12 points in July, while business conditions rose to 15 points from 14 on the same basis.

NAB chief economist Alan Oyster said the drop in confidence looks to show recent domestic and international pressures on the economy, and at the same time urged analysts to exercise caution in interpreting the read due to recent volatity.

“It is possible that external shocks, such as escalating tensions with North Korea, contributed to the decline,” said Mr. Oyster, “although new information from the survey indicates that customer demand, margin squeeze, government policy are having the greatest influence on confidence at present.”

“In trend terms, business conditions are positive for most industries, although retail is a notable exception and appears to be deteriorating once again.”

The Australian dollar fell 0.1 per cent on the release of the survey and remains 0.2 per cent lower for the session at US80.16 cents — read more

3.20pm: Market bids up Galaxy farewell

Galaxy Resources sits top performer on the ASX200 index in late trade with gains over 10 per cent leading it to a six-month high of $2.62.

Shares leapt up at the open, far higher than peer miner stocks after the company said recently appointed director Ms. Xi Xi had accepted a request by the company for her resignation promptly after Mineral Resources had welcomed her to its board yesterday.

Ms. Xi Xi served as director of the Shanghai International Group-backed $2bn private equity firm Sailing Capital after managing oil, gas and mining portfolios in New York.

Galaxy Resources said it tailored the request “upon becoming aware of the obvious and direct conflict of interest, and a potential breach of fiduciary duties.”

The market seems relieved — GXY last up 10.6 per cent at $2.62.

Darren Davidson 3.05pm: Gordon camp slams Ten bid ‘poisoning’

Lawyers for Bruce Gordon have accused Ten Network administrators KordaMentha of “poisoning” the broadcaster’s employees against a takeover proposal from him and Lachlan Murdoch.

KordaMentha, which backed a rival bid by US media giant CBS, has been forced to defend its actions during a sale process in the NSW Supreme Court.

Andrew Bell, SC, representing Gordon’s private investment firm Birketu and his regional television operator and Ten affiliate WIN Corporation, rejected claims Birketu was a “disappointed underbidder”.

Instead, Birketu was a “disappointed overbidder” and the administrator should put its proposal to creditors for a vote, Dr Bell told the court this morning — read more

TEN last $0.16

2.40pm: Fund manager bows to ethical demand

If it’s tobacco, cluster bomb, landmine, chemical or biological weapon exposure you’re after, options are becoming increasingly limited as an Australian investor.

State Street Global Advisors has become the latest fund manager to do away with the practice of funnelling Aussie dollars to international companies with such dealings, shortly after AMP Capital announced a similar measure on ethical grounds earlier this year.

The decision — from the same fund manager that brought you Wall Street’s new ‘Fearless Girl’ statue — sees 12 of the State Street Global Index Plus Trust roster of over 600 ditched amid growing demand from institutional investors increasingly integrating environmental, social and governance considerations into their portfolios.

“We are keen to make ethical investing more accessible to all institutional investors, not just the very large ones able to use a separate mandate,” said Jonathan Shead, SSGA head of Portfolio Strategists, Asia Pacific.

2.00pm: Investors cough it up for Resapp Health

It’s punny territory, but investors aren’t fooling around when it comes to coughing up for Resapp Health shares today.

The $54m minnow finds itself over 10 per cent higher on $0.09 after an update on trials of its smartphone-based respiratory disease diagnosis software — or pocket cough checker.

On August 9, faithful shareholders weathered a near 80 per cent plunge Resapp Health’s share price after the company said a study in its key medi-tech hungry US market “did not meet our expectations based on previous studies.”

In short, the quality of cough recordings themselves via smartphone to pinpoint conditions such as pneumonia, croup and bronchiolitis proved a sticking point, while some patients in the study were found to have in fact been treated before the recordings were taken.

Resapp management cleared this all up for investors earlier this month and threw forward plans for another trial in an effort to ensure the market all was not lost — shares jumped 67pc — albeit off a lower base.

The bulls have yet again rallied around Resapp on today’s update to lift shares a full cent — hurt feelings over its $0.54 share price this time a year ago alleviated for now.

RAP last $0.091

Michael Roddan 1.30pm: QBE chief Neal to step down

John Neal, the chief executive of global insurance giant QBE, will be replaced by his former chief financial officer Patrick Regan in a shock announcement following a boardroom scandal and a surprise profit downgrade earlier this year.

Mr Neal, who has led the $16 billion insurance giant for five years, will be replaced on January 1. The company said it had been undertaking a “detailed succession” plan over the last two years and had looked at both internal and external candidates for the role.

Mr Neal as recently as April had said he was on a contract that required 12 months notice of any change and that he had no intention of leaving the insurer — read more

QBE last up 2.6pc at $10.51

Michael Roddan 12.15pm: CBA faces huge capital call

Commonwealth Bank could be forced to hold billions more in regulatory capital after levels of risk-weighted capital fell in recent years, in contrast to rival lenders.

The threat of a huge new regulatory bill comes as analysts forecast the “significant” and “vicious” plunge in the bank’s share price will continue, with the regulatory hangover facing the sector to persist for years. Since the anti-money laundering agency Austrac filed allegations in August that the nation’s largest bank had breached the law more than 53,000 times, CBA shares have sunk about 13 per cent.

While the threat of large fines from both Australian and international authorities looms for CBA, the bank is also likely to face large increases in regulatory costs — read more

CBA last $74.28.

Elizabeth Redman 11.55am: Home price growth ranking jumps

Australia has shot up a global ranking of housing price growth for the second quarter, buoyed by the strength in the red-hot Sydney market.

But gains are likely to be more modest in future given the recent restrictions on bank lending, according to research from Knight Frank.

Australia took the 11th spot in the Knight Frank Global House Price Index for the June quarter, with housing price growth of 10.2 per cent over the prior 12 months.

This compares to 20th place in the March quarter with 7.7 per cent growth and 16th spot in the June quarter of 2016 with a 6.8 per cent increase.

Samantha Woodhill 11.15am: Slater wields cost-cut axe

Troubled law firm Slater & Gordon says seven per cent of its Australian employees will feel the impact of cost cuts and structural changes.

The firm today released a proposed transformation plan as part of a major operational review, following a $546.8 million loss for full-year 2107.

It comes after Slater & Gordon’s board recently approved a debt-for-equity deal which will see a consortium of hedge funds take control of the law firm — read more

SGH last $0.07

10.40am: ASX200 pulls higher on easing angst

The local sharemarket posts solid opening gains, carrying over a strong lead from offshore markets overnight as investors put equities back on the menu amid subsiding concern over North Korea and Hurricane Irma.

The S&P/ASX200 index sits 0.5 per cent higher at 5737.

Heavily weighted big bank shares prove the main beneficiary of renewed global risk appetite, CBA up 0.9 per cent, Westpac 1.2 per cent higher, ANZ up 1.1 epr cent in early trade while NAB shares add 1.3 per cent.

BHP and Rio both post gains over 1.4 per cent after bullish commodities trade overnight gave resource stocks a tailwind.

“US crude prices have closed 1.3pc higher and have retraced close to 50pc of the losses seen on Friday,” said IG chief market strategist Chris Weston.

“Spot iron ore was smashed 5pc, but more importantly has been the 1.8pc and 1pc rally in iron ore and steel futures traded on the Dalian exchange in China. Coking coal futures have risen an impressive 4.2pc.”

QBE Insurance jumps over 2 per cent in the wake of chief executive John Neal’s announced resignation, while Evolution Mining sheds 2.7 per cent after taking a fresh look at its Edna May gold mine in Western Australia.

AGL Energy shares drop 0.7 per cent as its discourse with the Federal government over the Liddell power plant takes its latest turn and Ardent Leisure lifts 2.2 per cent after it said the CEO of its US Main Event is to step down.

Meanwhile, the Australian dollar trades 0.2 per cent in the red at US80.15 cents ahead of NAB’s survey of business confidence and conditions in August released 11:30am AEST.

10.05am: Nufarm ‘continues to consider’ options

Nufarm Limited has this morning responded to an article in The Australian’s DataRoom, affirming it “continues to consider opportunities which may result from consolidation in the global agrochemical industry.”

The company further said there is no guarantee that agreement will be reached in relation to any of the opportunities being pursued and will update the market in accordance with its continuous disclosure obligations.

NUF last up 0.3pc at $9.10

9.53am: ASX looks set to open higher

The Australian market looks set to open higher joining the positive mood in international markets after North Korea did not fire a missile on the weekend and Irma proved less destructive than feared.

At 7am (AEST), the share price futures index was up 31 points, or 0.54 per cent, at 5,736.

Key equities markets in the US, Europe and Asia all lifted amid relief that North Korea had not test-fired another missile as it marked its founding day over the weekend, and as Hurricane Irma, once ranked as one of the most powerful hurricanes recorded in the Atlantic, lost power.

The Dow Jones Industrial Average rose 1.19 per cent, its largest one-day gain since February, while the S&P 500 gained 1.08 per cent and the Nasdaq Composite added 1.13 per cent.

Locally, in economic news today, the Reserve Bank of Australia releases credit and debit card data for July while the Australian Bureau of Statistics releases overseas arrivals and departures figures.

The ANZ-Roy Morgan Consumer Confidence weekly survey is expected as is the National Australia Bank’s monthly business survey.

Meanwhile, ASIC chairman Greg Medcraft speaks at a Reuters event in Sydney, the BIS Oxford Economics Business Forecasting Conference starts in Brisbane, and the Melbourne Mining Club showcases the mining industry’s activities, management and business strategies at an informal event.

No major equities news is expected. However the legal challenge by WIN Corporation, majority owned by Billionaire Bruce Gordon and Murdoch family’s 21st Century Fox, to the takeover of Network Ten by US media giant CBS, is in the Supreme Court in Sydney.

The Australian market yesterday closed higher as investors took some comfort from North Korea refraining from any more provocative missile launches over the weekend.

The benchmark S&P/ASX200 index rose 40.5 points or 0.71 per cent, to 5,713.1 points.

The September SPI200 futures contract gained 36 points, or 0.6 per cent, to 5,705 points.

AAP

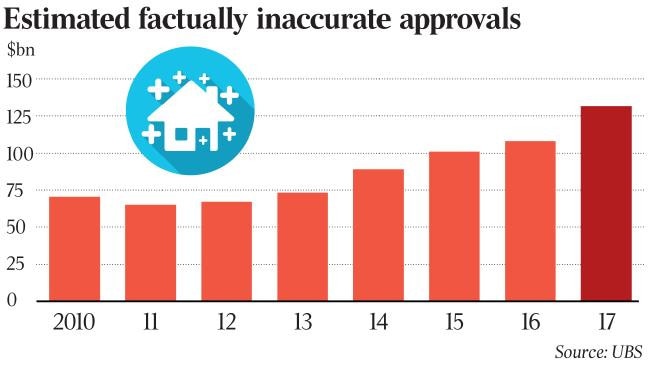

Michael Roddan 9.15am: Banks sitting on ‘liar’ loans

Australian banks are vastly underestimating the risks of a housing collapse, with the financial system sitting on $500 billion worth of “liar loans” sold to borrowers who gave lenders false information to get a mortgage.

The problem, evident in the latest mortgage survey carried out by investment bank UBS, could threaten the financial system as interest rates rise from record lows.

UBS found a third of borrowers were not “completely factual and accurate” on their home loan application in the past year. A quarter of all borrowers said they were “mostly” accurate, while almost 10 per cent said they wee only “partially factual” with their bank — a figure that has doubled in two years.

8.57am: Analyst rating changes

Macquarie raised to Outperform, target price: $91.00 — UBS

Ardent Leisure raised to Buy — Morning Star

IVE Group initiated at Buy, target price $2.69

8.50am: QBE chief Neal to step down

QBE chief executive John Neal will step down at the end of the year to be replaced by Pat Regan.

Mr Regan, a former chief financial officer who currently heads QBE’s Australian and New Zealand operations, will take over on January 1 following a transition period alongside Mr Neal.

Mr Neal, who led QBE for five years, this year lost more than $550,000 in pay for a delay in telling his board about a relationship with his personal assistant but chairman Marty Becker said succession planning had been ongoing for the past two years — AAP

QBE last $10.19

Greg Brown 8.46am: AGL still in Canberra crosshairs

Energy Minister Josh Frydenberg says energy giant AGL wants to “have its cake and eat it too” with the company claiming it wants to get out of coal while making most of its profits from the resource and being committed to it for decades.

Mr Frydenberg criticised the owner of Liddell Power Station, a day after the company promised to consider a government request to keep the coal power station in the NSW Hunter Valley open for another five years.

“I don’t think the company is placing the priority that it should be on the need for dispatchable power in the system, the fact it will want to see the closure of Liddell of 2022 without any other significant options on the table is a major concern for us,” Mr Frydenberg told ABC radio.

Mr Frydenberg said AGL Andy Vesey admitted in a meeting yesterday that he had previously told the government he would consider selling Liddell rather than closing it in 2022. Mr Vesey last week rejected the company made any commitment. — read more

AGL last $24.80

8.30am: Ardent Main Event CEO to resign

The chief executive of Ardent Leisure’s US Main Event wing Charile Keegna will resign effective 24 November.

Ardent says Mr. Keegan will consult to the business over the next 12 months to facilitate a leadership transition, while Ardent Group CEO Simon Kelly praised his tenure at the helm of its US arm.

“During that time Charlie transformed Main Event Entertainment from a 6 centre bowling concept in Texas to a leading entertainment company with 38 centres operating across the US,” said Mr. Kelly.

AAD last $1.74

Darren Davidson 8.20am: Rival bids for Ten ‘lineball’ call

A second report into a sale process for Ten Network that led to US media giant CBS being named the preferred bidder has revealed the decision was a lineball call.

Ten administrators KordaMentha yesterday defended their decision-making process in a 94-page supplementary report to creditors, following pressure from rival bidders Bruce Gordon and Lachlan Murdoch.

The new report comes after a successful application to the NSW Supreme Court seeking a delay of the second creditors’ meeting, and requests for further information from Mr Gordon, Mr Murdoch and content supplier Twentieth Century Fox amid claims the initial 215-page report was deficient in several respects — read more

TEN last $0.16 in trading halt

Matt Chambers 8.15am: AGL rejects call to extend coal

AGL Energy chief executive Andy Vesey says building coal-fired power stations is no longer “economically rational”, committing to deliver a coal-free plan to avoid a market shortfall when AGL closes the Liddell coal-fired power station in NSW in 2022.

In doing so, Mr Vesey has implicitly rejected the federal government’s calls for the company to extend the life of the ageing Liddell or sell it to someone who will, after being hauled to Canberra yesterday to meet with Malcolm Turnbull.

“Following today’s meeting with the Prime Minister, we have committed to deliver a plan in 90 days of the actions AGL will take to avoid a market shortfall once the Liddell coal-fired power station retires in 2022,” the AGL boss said last night — read more

AGL last $24.80

7.00am: Dollar slips against greenback

The Australian dollar has slipped further against its strengthening US counterpart but is still above the US80 cent psychological threshold. At 6.35am (AEST), the Australian dollar was worth US80.28 cents, down from US80.37 US cents yesterday.

Westpac’s Imre Speizer says the US dollar, US bond yields and equities have risen amid a calmer environment for risky assets after Hurricane Irma was not as damaging as feared, and North Korea did not escalate geopolitical tensions.

“The US dollar index is up 0.6 per cent on the day (while the) AUD ground slightly lower, from 0.8060 to 0.8019,” he said in a morning note. The main risk event for local markets today was the August NAB business survey conditions which were last at 15, having maintained an elevated level through 2017.

“However, results vary by industry, with the retail and mining sectors lagging behind,” he said.

He expected the local currency to trade in a 0.80-0.81 range “if the US dollar can hold its overnight gains”.

The Aussie dollar is higher against the yen and the euro.

AAP

6.50am: Oil edges higher

Oil prices settled higher, as refineries planned restarts and Saudi Arabia debated the possibility of extending a deal to curb output among major producers.

Light, sweet crude for October delivery settled up 59 cents, or 1.2 per cent, at $US48.07 a barrel on the New York Mercantile Exchange. Brent, the global benchmark, rose 6 cents, or 0.1 per cent, to $US53.84 a barrel.

Hurricanes Harvey and Irma have spurred volatile trading in energy markets in the past few weeks, as traders assess how the damage across major cities will impact demand for oil. When Harvey made landfall at the end of August, the wind and rain knocked out more than 20 per cent of the country’s refining capacity.

However, prices began to recover as several refiners affected by the storm announced plans to restart operations.

Meanwhile, Saudi Arabia — the world’s largest exporter of crude oil — said Sunday that the country’s energy minister and his Venezuelan counterpart had discussed the possibility of extending OPEC’s oil output cut deal beyond the March expiration date.

Dow Jones

6.45am: Dow back above 22,000

The S & P 500 hit a fresh record and the Dow Jones Industrial Average closed above 22,000 for the first time in nearly a month, as investors’ fears eased about North Korea and Hurricane Irma.

Stocks rose broadly and haven assets retreated, a reversal from last week when major US stock indexes, the dollar and Treasury yields fell as investors worried about worst-case scenarios from summer storms and threats from North Korea.

The gains catapulted the Dow up 259.58 points, or 1.2 per cent, to 22057.37, its biggest one-day gain in six months. The last time the Dow industrials closed above 22,000 was August 16, and prior to last night they hadn’t posted a 1 per cent gain since April.

The S & P 500 rose 26.68 points, or 1.1 per cent, to 2488.11 — its 31st record close of 2017 — and the Nasdaq Composite jumped 72.07 points, or 1.1 per cent, to 6432.26.

Australian stocks are set to follow suit and open stronger. At 7am (AEST) the SPI futures index was up 29 points.

Some analysts had expected North Korea to conduct a weapons test on Saturday, coinciding with the country’s founding day, as it did last year to mark the celebration. The absence of news from Pyongyang supported stocks and the dollar, while weighing on haven assets, analysts say.

“That North Korea didn’t do anything, on a weekend they knew our country was going to be in flux because of hurricanes, is the primary reason we’re seeing this big rally,” said JJ Kinahan, chief market strategist at TD Ameritrade. “The market has gone back up to where we were in early August before these North Korea fears.”

Government bond prices declined, pushing up yields. The yield on the 10-year US Treasury note rose to 2.125 per cent from 2.058 per cent Friday, its largest one-day yield rise in more than a month.

Meanwhile, concerns about Hurricane Irma’s impact on the U.S. economy decreased. A reduction in the storm’s strength and a shift in its expected course — there was no direct hit on Miami — meant insured damage estimates were likely to be less than originally anticipated by some analysts.

Reinsurance companies, which tumbled last week, jumped on Monday. The KBW Nasdaq Insurance index rose 1.8 per cent, nearly wiping out its 1.9 per cent drop last week.

The WSJ Dollar Index, which measures the US dollar against a basket of other currencies, rose 0.7 per cent, after sinking to its lowest level in more than two years on Friday.

Dow Jones Newswires

6.40am: Stocks climb as concerns ease

Stock markets rallied on receding concerns over North Korea and Hurricane Irma, analysts said.

After a robust start in Asian trading, equities moved higher in Europe and then on Wall Street.

“The lack of hostilities in relation to North Korea and the downgrading of Hurricane Irma to a category one storm has prompted traders to buy back into the market,” said market analyst David Madden at CMC Markets UK.

Investors had been concerned that Pyongyang could use a Saturday holiday to launch another missile, as it has done in the past.

“Seeing as the North Korean regimen didn’t show off its military might over the weekend, traders were encouraged to take on more risk,” added Madden.

Asian stock markets pushed higher in relief, with Tokyo gaining 1.4 per cent. The previous week saw a sell-off in risk assets sparked by Kim Jong-un’s nuclear test, in turn benefiting haven assets such as the yen and gold, which retreated Monday alongside a pick-up for the dollar.

European equities then took the baton, with both Frankfurt and Paris posting gains of more than 1.0 per cent. London added 0.5 per cent.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout