Nufarm linked to acquisition hopes on two fronts

Nufarm is understood to be eyeing US-based crop protection company Albaugh for a takeover worth at least $US1 billion ($1.24bn) as it ventures closer to entering exclusive talks to buy The Century Group from ChemChina for about $US200 million.

The $2.4bn Australian-listed agrichemicals manufacturer is said to be taking on US-based private equity giant Blackstone in the contest to buy Albaugh, an Iowa-based herbicide supplier.

Investment bank UBS is working for Nufarm while JPMorgan is selling Albaugh, the largest US-based manufacturer and formulator of off-patent agricultural crop protection products.

It is understood that Nufarm would be eager to secure Albaugh for $US1.1bn despite suggestions the business has a $US1.5bn asking price.

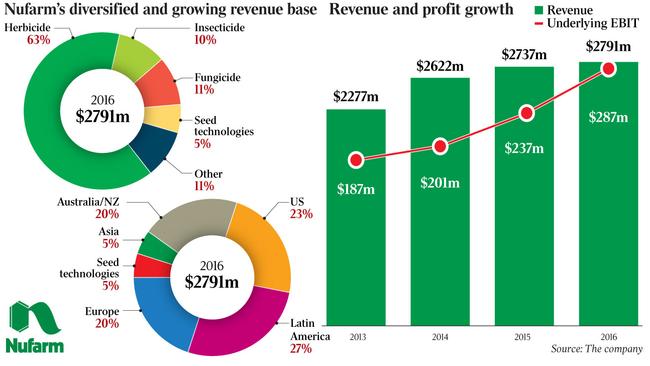

Nufarm will report its full-year results later this month and last month said it expected to increase its annual earnings by between 4 per cent and 6 per cent and that net profit was on track to increase by between 20 per cent and 25 per cent.

It remains in acquisition mode as various global opportunities present themselves.

Platform Speciality’s agrochemicals arm, based in Florida, was recently one of them.

However, the sales plans for the operation were abandoned last month after buyers were unprepared to pay the $US4.5bn Platform Specialty wanted, and it now plans to spin off the operation.

In recent months, the focus for Nufarm has been the acquisition of ChemChina’s crop protection products and registrations for products in certain geographies.

Those products offered were held within ChemChina’s subsidiary Adama Agricultural Solutions, an Israeli crop protection business.

The products have been separated out and named The Century Group to sell off.

While Nufarm has been competing to buy the assets, so was Nufarm’s 23 per cent shareholder Sumitomo.

It is understood that Nufarm is soon to enter exclusive due diligence to buy The Century Group.

ChemChina is believed to be asking $US400m for The Century Group.

But the understanding is that Nufarm wants to pay about $US200m, the value of the group’s annual turnover.

ChemChina is divesting the assets following its merger with Syngenta.

The EU has granted approval to ChemChina’s $US43bn takeover of Switzerland-based Syngenta, but its assets are being prepared for sale to appease European regulators for the merger to proceed.

Nufarm is an Australian manufacturer of crop protection products.

The company’s revenue increased by 15 per cent to $1.36bn for the six months to December, and it turned around from a loss in the previous corresponding period to book a $20m net profit.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout