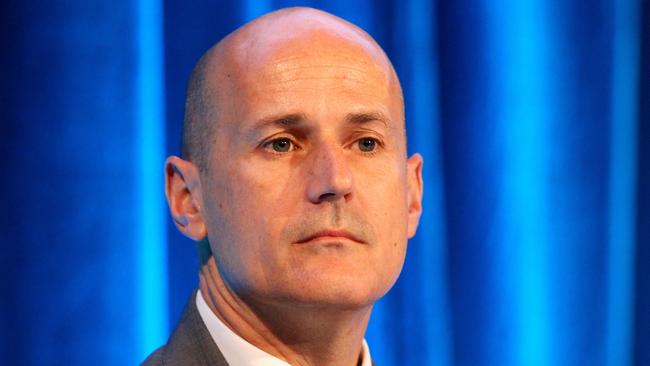

QBE chief executive John Neal to step down

News that John Neal will be replaced as QBE boss by Pat Regan follows a profit downgrade and a boardroom scandal.

John Neal, the chief executive of global insurance giant QBE, will be replaced by his former chief financial officer Patrick Regan in a shock announcement following a boardroom scandal and a surprise profit downgrade earlier this year.

Mr Neal, who has led the $16 billion insurance giant for five years, will be replaced on January 1. The company (QBE) said it had been undertaking a “detailed succession” plan over the last two years and had looked at both internal and external candidates for the role.

Mr Neal as recently as April had said he was on a contract that required 12 months notice of any change and that he had no intention of leaving the insurer.

Mr Regan’s contract also has the same clause, requiring 12 months notice on both parties for any resignation or termination.

Chairman Marty Becker thanked Mr Neal for his leadership and for leading the group “through a significant transformation and a challenging period in the insurance industry globally”. He added Mr Neal had “been working closely with the board to ensure a smooth transition for his succession”.

The credibility of management at QBE came under fire after it took a beating by investors following a relatively small downgrade in its problematic emerging markets division.

After years of attempting to turn around the diversified behemoth following decades of questionable acquisitions, Mr Neal had overseen a string of unwanted surprises in recent months.

The latest downgrade came just ahead of the group’s half-yearly results, caused by a small claims blowout in Latin America and Asia after an increase marine and fire damages in Hong Kong and Singapore, a poor crop insurance result in Ecuador and Chile, where floods have gripped the countries, and continued problems in the Colombian third party motor insurance business, which has been plagued by fraud, gang car use and hospital fee gouging.

They arrived hot on the heels of a $160 million blowout in the group’s outstanding claims liabilities after the British government in late February dramatically changed the rates used to calculate compensation for injuries.

That news of financial problems came just days after QBE’s management team was engulfed in a boardroom scandal in February, with the insurer announcing a pay cut of $550,000 for Mr Neal after he failed to disclose a relationship with a company secretary.

At the time, QBE was also dealing with the sudden departure of former chief operating officer Colin Fagen, to which it admitted after questioning by The Australian. Mr Fagen weeks earlier had been appointed president of industry body the Insurance Council of Australia, a post that he will no longer be taking up.

Since the latest earnings downgrade in June, QBE shares have sunk almost 25 per cent.

Mr Regan, who is the current chief executive of the Australia and New Zealand division of QBE, is a former chief financial officer of UK company Aviva.

“In the last 12 months Pat has led a strong turnaround in the Australian and New Zealand operations, highlighting his operational skills and business acumen and, in his previous role as group chief financial officer, had been pivotal in stabilising the balance sheet and enhancing the Group’s capital management,” Mr Becker said.

Mr Regan said one of his first priorities will be to find a new chief executive officer for the Australian and New Zealand division.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout