QBE leadership quandary

QBE chair Marty Becker is back home in West Virginia but would have heard grumblings from shareholders.

QBE chair Marty Becker is back home in West Virginia but no doubt would have heard the grumblings from his Australian shareholders calling for chief executive John Neal’s departure.

In CFO Patrick Regan there is an immediately available replacement, which puts QBE in a better position than, say, CBA, where there is no obvious immediately available alternative to Ian Narev.

Narev would dispute this call with good reason, nominating retail boss Matt Comyn as the logical heir, but the circumstances of his departure make it hard for chair Catherine Livingstone to appoint from within.

The 10 per cent fall in QBE’s stock price this week in the wake of revelations of losses in its emerging markets business mean the stock has fallen some 34 per cent in the past four years.

It should be stressed Neal has no plans of walking and indeed is keen to stay to help restore the troubled empire he inherited close to five years ago.

He is a capable and likeable CEO who inherited a company built on multiple acquisitions and a somewhat difficult internal culture. As with Narev the choice may not be his, and a growing number of fund managers contacted yesterday say Neal seems accident-prone.

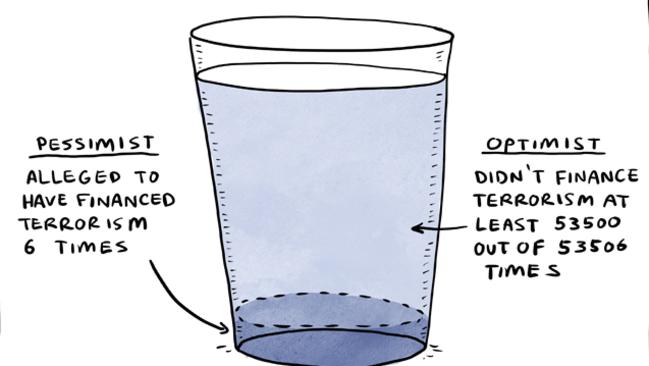

Half a dozen profit downgrades in his term have all come with the hope that that will be it, only to get another one. After a time the market just gets tired of the promises.

Like his chairman, Regan has had all the right insurance experience, joining QBE in 2014 after five years as CFO of Aviva in Britain, where his chair was former ANZ boss John McFarlane.

The downside to appointing Regan as boss is that just over a year ago he also took on the role of running the local operations.

This week’s QBE results showed good improvements in Australia and Europe, so the question is why would you rock the boat now when the home business is returning to top form.

QBE is a global player, which means it doesn’t have the same pricing power as, say, IAG and Suncorp do with their domestic duopoly. Fund managers like pricing power.

As events transpire the QBE board is also blessed with a recently retired IAG boss in the form of Mike Wilkins, who could step up to the plate on an interim basis while a replacement is found.

All of which depends on just how strong the disenchantment with Neal is and whether the US-based chair wants to take any notice of his Australian share base.

Poor report card

Approaching the halfway mark in the corporate reporting season, the read is “marginally disappointing”, but to make matters worse, leadership from Canberra is abysmal.

The country is in the middle of the lowest level of corporate investment since 1994, has an energy crisis as the peak summer season approaches and the nation’s capital is focused on Pauline Hanson, where politicians were born and same-sex marriage.

Somehow, it seems, the big issues are not being debated.

There are several ways of looking at this, starting with the obvious, being that we are the dummies who voted for the people in Canberra, so perhaps we can assume some blame.

Second, if we don’t care about reform then what is happening in Canberra — nothing — is just fine, which means we can all get on with our lives.

Trouble is we need some decisions, and when the papers highlight the nonsense it does start to negatively affect sentiment.

With 73 of the top 200 companies having reported, the results are disappointing. On Credit Suisse numbers there have been net downgrades of about 0.3 per cent, which is better than the average of 0.9 per cent, but also comes off the back of net upgrades in February.

Credit Suisse’s Hasan Tevfik puts it slightly differently: “Good but not good enough.”

Some highlights included IOOF, Orora, JB Hi-Fi, Bendigo and Origin, while the lowlights included James Hardie, ResMed, Crown, Magellan and Domino’s.

As the accompanying table from UBS shows, this week saw financial year 2018 forecasts cut slightly and some rapid re-basing at Telstra, which saw 11 per cent of its value wiped away in the wake of its dividend downgrade.

The degree of the market sell-off surprised some, given the cut in dividends was well flagged. What shocked some was the severity of the cut and the speed with which it is happening. That said, earnings are still OK, albeit not the monopoly rents Telstra has enjoyed in its time as a listed company.

The Telstra experience puts a different perspective on the market because the company is actually behaving like a good corporate and investing for growth. It seems punters would rather have dividends and forget about the long term.

When the market sells off, as it has in stocks like QBE and Telstra, it does offer long-term investors a chance to get back in, but this clearly hasn’t happened with these two so far. The market has no patience for negativity, particularly from perennial disappointments like QBE.

Pumped up

Contrary to the drums beating in competition mafia land, BP says it is not about to take its $1.8 billion Woolworths petrol deal to the Australian Competition Tribunal rather than work the matter through the ACCC.

BP is advised by Corrs Chambers Westgarth, while Clayton Utz is advising Woolies and they are proceeding as planned through the ACCC process.

The ACCC was not impressed when Tabcorp took its Tatts deal to the tribunal, and after comprehensively losing its argument has appealed a few administrative matters to the Federal Court, which is due to hear those arguments next week.

The ACCC in its statement of claim in the BP matter made clear the key concerns were the loss of Woolworths as the rogue competitor in the market, along with the obvious geographic issues of petrol station overlaps.

The amendments to the competition law are presently before parliament and due to pass next month, and once these go through no appeal to the Tribunal will be allowed until the ACCC has made a final ruling, which is not due until October 26.

There is another complication because the transaction is a combination of an acquisition and an authorisation of a joint venture between Woolies and BP to roll out convenience stores and continue the petrol loyalty scheme.

In effect there are separate transactions that are joined and it would be complicated to go the tribunal on the acquisition while working with the ACCC on the authorisation.

Tabcorp will be appearing in next week’s hearing while its team prepares the Supreme Court application to approve the dispatch of the Tatts scheme booklet to shareholders in early September for a final vote in October.

Separately, as canvassed last week, the ACCC has formally announced an inquiry into the Aurizon sale of its train container business to its competitor and biggest customer Pacific National.

Expect some opposition to this deal.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout