Trading Day: live markets coverage; Stocks weaker as sellers step in; plus analysis and opinion

The ASX falters as sellers buffet offshore leads, while insurance major QBE falls after lifting its claims forecast.

Welcome to Trading Day for Tuesday, October 3.

Bridget Carter 4.40pm: Citi in market for PropertyLink shares

Investment bank Citi is in the market buying shares in Propertylink as the listed company remains a takeover target for rival fund manager Centuria.

It is understood that shares are being purchased at $1.02 each and the buyer is said to be an international investor.

It comes after the Stephen Day-founded commercial property landlord and $1.8 billion property portfolio manager rejected a takeover bid from Centuria.

Under the proposal, Centuria Capital Group (CNI) would acquire Propertylink’s funds management business and co-investment stakes while Centuria Property Funds would acquire the company’s balance sheet industrial portfolio.

It proposed that shareholders would receive $0.055 cash per security; 0.23 Centuria Capital Group securities and 0.23 securities in Centuria Property Funds.

Speculation has recently emerged that there may be another suitor for Propertylink after its board rejected the offer.

Centuria Capital currently owns 17 per cent of Propertylink — more to come from DataRoom

PLG last $0.94

Samantha Woodhill 4.35pm: Stocks lose head of steam

The local share market closed lower despite strong leads from Wall Street and on the back of 1 per cent gains the previous session, in public holiday affected trade.

Commonwealth Bank fell 1.55 per cent closing at $75.16. Westpac slumped 0.37 per cent closing at $32.14 and ANZ edged 0.10 per cent lower, closing at $29.87. NAB inched down 0.69 per cent to $31.51.

In resources, BHP strengthened 0.11 per cent to $26.15 at the close. Rio Tinto climbed 0.72 per cent to $68.49 and Fortescue lifted 0.57 per cent to $5.26.

Shares in Australian-based insurer QBE plummeted 3.54 per cent, closing at $9.82 after it announced it would increase catastrophe and large claims allowance, causing the company to take a $600 million hit to its bottom line.

It warned that 2017 will likely be “the costliest year in the history of the global insurance industry”, after Hurricanes Harvey, Irma and Maria, Cyclone Debbie and the Mexican earthquakes resulted in significant claims for QBE — more to come

4.20pm: Evolution sees lower output on Edna sale

Evolution has revised down its FY18 gold production guidance range to 750-800k ounces from 830-880k ounces previously forecast.

The announcement comes following company’s sale of its Edna gold mine to Ramelius for $90m.

Evolution says it expects its FY18 all-in-sustaining-cost (AISC) to fall $30 to a range between $820-$870 and then by $40-$50 on an annualised basis thereafter.

EVN closed flat at $2.20

4.02pm: Macquarie hot on the lithium trail

With Paul Garvey

Macquarie has taken kindly to the news of the first direct deal struck with an electric vehicle (EV) manufacturer by an Australian miner, beefing up its price forecast for Pilbara Minerals by 50pc after it sealed a deal to supply 150k tonnes of lithium source mineral spodumene to Great Wall.

The investment banks’ analysts peg a $0.75 twelve month target price on the lithium play and say the deal is “a clear demonstration that electric-vehicle manufacturers are becoming increasing concerned over securing raw material supply.”

An injection of $63.6m in Great Wall debt funding and is set to boost Pilbara Mineral’s spodumene output from the Pilgangoora site in question to 800k tonnes per year — up from its current 314k output — and will slash C1 cash costs to $330/tonne from $330/tonne by the analysts’ estimates.

Macquarie sprinkles a dose of caution over the outlook and crops its FY19E earnings forecast by 40pc to cover upfront costs, however analysts at the bank lifts their FY20, FY21 and FY22 earnings predictions by 94pc, 160pc and 161pc respectively.

The deal comes after a report from UBS’s commodities team, based on its tour of lithium-ion battery suppliers in China and Korea, that noted the industry was “feverishly” adding capacity.

“Manufacturers are scaling capacity four to five times by 2020 and potentially up to 10 times by 2025,” UBS said.

“Securing raw material supply is taking precedence over price in supplier negotiations.”

PLS last down 2.7pc on $0.6425

4.00pm: Altura Mining in trading halt

Altura Mining has entered into a trading halt this morning pending the announcement regarding a proposed financial transaction.

Earlier this morning, Macquarie analysts downgraded Altura Mining stock to “underperform” after its secured an additional $US110m debt facility to fund production at its Pilgangoora project.

“The increased level of debt compared to our previous estimates increases the risk associated with the production ramp up, as any delay in achieving production specifications could create a funding gap,” said Macquarie.

“In the medium-term we believe AJM will need to extend the current debt facilities by at least a year to cover cash shortages.”

The analysts believe a ramp up in production at Pilgangoora in itself likely to be a positive and note the miner’s recently upgraded on-site reserves of 30 megatonnes at 1.04pc lithium oxide purity.

AJM last $0.27

3.55pm: Demography to sustain building pace: NAB

Building approvals data for August suggest the rate of home building could remain buoyed or even recover from its recent slowdown, according to NAB.

Approvals rose 0.4pc vs. 1pc expected, but strong population growth continues to underpin demand, NAB economist Tapas Strickland says.

“The population aged 15 years and over is growing at 325,000 a year, which according to historical ratios would necessitate around 216,000 dwellings a year to be built,” he says.

“The current annual pace of dwelling approvals is running at 213,000, so very much in line with population trends and suggestive of the construction cycle persisting for some time.”

He adds that credit growth and government planning will also factor in whether this underlying demand is met by builders and developers.

AUD/USD slipped from 0.7829 to 0.7809 after the building approvals data before bouncing to 0.7821.

Samantha Woodhill 3.40pm: Cash rate on hold: RBA

The Reserve Bank of Australia has left official interest rates on hold as expected after its monthly board meeting.

RBA Governor Philip Lowe said the central bank decided to leave the cash rate unchanged at a record low of 1.5 per cent.

The decision to leave rates unchanged for a 13th consecutive meeting was widely expected by financial markets.

A Bloomberg survey showed 100 per cent of economists expected rates to remain on hold for the rest of the year.

However, market pricing has a hike of 25 basis points priced as a near certain within the next 12 months.

The Australian dollar fell in reaction to the decision and trades 0.4 per cent lower at US78.03 cents.

3.25pm: Goldman weighs crypto plays

Goldman Sachs Group Inc. is weighing a new trading operation dedicated to bitcoin and other digital currencies, the first blue-chip Wall Street firm preparing to deal directly in this burgeoning yet controversial market, according to people familiar with the matter.

Goldman’s effort is in its early stages and may not proceed, the people said. The firm’s interest, though, could boost bitcoin’s standing among investors and fuel the debate around digital currencies, which were initially viewed as havens for illicit activity but are pushing further into the mainstream investment world.

China in recent weeks has banned exchanges that trade bitcoin, fearing the virtual currency could provide an avenue for capital flight. J.P. Morgan Chase & Co. Chief Executive James Dimon, whose bank is the largest dealer in global currencies, last month called bitcoin a “fraud” and said he would fire any employee who traded it.

Yet Japan’s government has embraced bitcoin, creating regulations to legitimatize its trading. India and Sweden have mused about creating their own virtual currencies, and the U.S. Federal Reserve has studied bitcoin and the technology underpinning it.

Bitcoin pioneered the cryptocurrency movement, but after eight years, the virtual currency is still struggling to find mainstream acceptance.

“In response to client interest in digital currencies, we are exploring how best to serve them in this space,” a Goldman spokeswoman said — read more

The Wall Street Journal

3.00pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Shane Oliver — Chief Economist and Head of Investment Strategy, AMP Capital

3.15pm: Politics Panel live

3.50pm: Ben Le Brun — OptionsXpress

4.00pm: Andrew Wielandt — Managing Partner, Dornbusch Partners

(All times in AEST)

Matt Chambers 2.45pm: Liveris joins Novonix board

Departing DowDuPont executive chairman Andrew Liveris has agreed to join the board of fledgling Brisbane battery and graphite company and buy $500,000 worth of shares in the company through a placement.

The Darwin-born, US-based corporate elder will take the role after he steps down from DowDuPont in the first half of next year.

Mr Liveris said he was excited about the opportunity to help create an integrated, global battery materials and specialist equipment company.

“The rechargeable battery market offers huge global growth, with the opportunity to supply differentiated products and establish market share during this relatively early stage of market maturity,” Mr Liveris said — read more

NVX last $1.00

Samantha Woodhill 2.10pm: Retailers fear Christmas coal

The retail sector’s expectations leading up to the crucial Christmas period have plummeted to a four-year low, according to a new survey.

Expectations in retail approaching the holiday period were down 50 per cent on the previous year and down 70 per cent from what they were in 2015, said Dun & Bradstreet’s Business Expectations Survey for September.

“Whether it’s talk of Amazon entering the market of the high levels of household debt affecting consumer spending, it’s clear many retailers are down in confidence and the upcoming Christmas period is doing little to lift spirits,” said Dun & Bradstreet CEO Simon Bligh.

1.20pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

1.50pm: Live cross — Bloomberg Asia

2.00pm: Jonathon Barratt — CEO, Ayers Alliance

2.20pm: Live cross — FIIG Securities

2.30pm: RBA rate call reaction with David Bassenese — Chief Economist, Betashares

(All times in AEST)

12.18pm: UBS rekindles Origin dividend hopes

Origin is likely to resume dividend payments in FY19 as net debt falls below $6bn after selling Lattice Energy to Beach, UBS says.

UBS analyst Nik Burns has a “buy” rating and $8.50 target price on Origin.

He foresees a dividend yield of 4.9pc in FY19 and 5.5pc in FY20, based on a 50pc payout ratio.

Origin hasn’t paid a dividend since Feb 2016.

ORG down 0.5 per cent at $7.37

12.00pm: Natixis makes move Down Under

Natixis Global Asset Management has expanded its regional presence with a majority stake in the value-based Australian fund manager Investors Mutual Limited.

ASX-listed Pacific Current Group — formerly Treasury Group — and IML founder and investment director Anton Tagliaferro have agreed to sell a total of 51.9 per cent of the Australian equities manager for $155 million in cash.

IML’s management team will remain shareholders in the strictly-active and bottom-up fund manager which will continue to be run by Mr Tagliaferro and head of research Hugh Giddy —

11.45am: ASX200 bucks lead to nose lower

The local sharemarket lumbers along in the red throughout the morning session, investors happy to sell into strength on the back of 1 per cent gains the session previous in public holiday affected trade.

The S&P/ASX200 index remains 0.4 per cent lower at 5705.9.

Sellers spread losses across the board as large-cap diversified miners and the Big Four banks trade mixed.

The energy feels the weight of a sharp 2 per cent fall in the price of crude oil overnight, while Beach Energy erases 5.8 per cent after stacking on over 12 per cent yesterday on a successful institutional capital raising for funds to buy Origin’s Lattice.

Insurer QBE also adds to broader sharemarket headwinds as it falls nearly 5 per cent after updating the market on its expected bottom-line impact this hurricane season.

Vocus shares tick up 1.8 per cent higher after it announced a board reshuffle earlier this morning.

Meanwhile, the Australian dollar trades flat per at US78.27 cents ahead of the Reserve Bank’s October cash rate decision at 2:30pm AEST.

11.35am: Building approvals lift in August

James Glynn writes:

The number of Australian home-building permits rose by 0.4 per cent in August from July, helped by a lift in apartment approvals.

Approvals to build or renovate houses and apartments declined by 15.5 per cent from a year earlier, the Australian Bureau of Statistics said Tuesday.

Private-sector house approvals fell by 0.6 per cent in August from July, while apartment approvals rose by 4.8 per cent — read more

Producers note: The Australian registered little reaction to the data and trades flat at SU78.27 ahead of the Rerserve Bank’s October rate call at 2:30pm AEST.

11.20am: TechnologyOne lowers FY17 guidance

Shares in enterprise software company TechnologyOne plunge over 10.6 per cent to $5.54 after it lowered its expected FY17 profit growth range to 7-9 per cent from a 10-15 per cent range previously forecast.

The company says recent underperformance in its consulting business has forced it to revisit its outlook. Management now forecasts the arm to contribute just $5.4m, compared with the previous guidance of $8.2m which itself represented a divisional slowdown.

The company expects 20 per cent underlying profit growth excluding significant events.

“Looking forward with the strength of both the cloud business and new licences, and the removal of these significant events in the new year, and the return of our consulting business to profit growth, the company is well positioned for continuing strong growth in the coming years,” said executive chairman Adrian Di Marco.

TNE last down 3.6pc at $4.89

11.15am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: John Milroy — Ord Minnett

11.20am: Rudi Filapek-Vandyck — FNArena

11.45am: Live cross — Shaw and Partners

12.15pm: Gerad Burg — Senior Economist, NAB

12.45pm: Janu Chan — Senior Economist, St George

1.00pm: Ben Le Brun — Market Analyst, OptionsXpress

(All times in AEST)

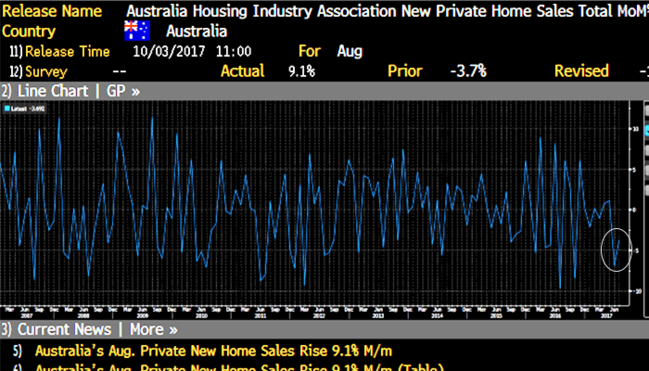

11.05am: New home sales jump in August: HIA

New homes sales rose 9.1 per cent in August, according to Housing Industry Association data, compared to a 15.4 per cent fall in July — see graph below for data series.

10.13am: QBE flags $600m disaster hit

QBE Insurance says it expects a $600m hit to pre-tax earnings after what it calls “the costliest year” in global insurance history.

The insurer has increased its large individual risk and catastrophe claims allowances to $1.75bn and cites natural weather events such as Cyclone Debbie, Hurricanes Harvey, Irma and Maria and earthquakes in Mexico this year as impacting its business — read more

QBE last down 4.3pc at $9.75

9.50am: ANZ snatches real estate app REALas

ANZ has acquired Australian property market analytics start-up REALas.

The consumer application uses its proprietary algorithm to predict listed property prices in Australia.

ANZ said the acquisition was an important part of the banks’ “digital transformation” with a consumer trend toward online resources for Australian property market navigation.

“Its predictions change in response to the market, which means buyers have access to the latest prediction right up to the time of sale,” said REALas CEO Josh Rowe — more to come

ANZ last $29.90

9.35am: Sonic UK JV wins NHS contract

Sonic Healthcare’s UK joint venture Health Services Laboratories (HSL) has won the exclusive contract to provide pathology/clinical laboratory services to Barnet Hospital and Chase Farm Hospital in London.

The new contract has a term of 12 years, and is expected to contribute in excess of $20.4m

of revenue per annum to HSL.

SHL last $21.12

9.30am: Analyst rating changes

A2 Milk cut to Hold — Deutsche Bank

Altura cut to Underperform — Macquarie

Ben Wilmot 9.25am: QIC strikes $4bn US mall deal

Australian fund manager QIC has struck one of the largest shopping mall deals in the United States this year with its global real estate unit agreeing to buy its joint venture partner, Forest City Enterprises, out of ten U.S. regional shopping malls.

The portfolio is valued at approximately US$3.175 billion ($4.05bn) and alongside the acquisition of interests in the malls, QIC will also take on Forest City’s retail operating platform — more to come.

9.05am: Vocus announces board shuffle

Vocus says former M2 chief executive Vaughan Bowen has been appointed as its next non-executive chairman, effective immediately after current chairman David Spence decided not to stand for re-election at its 2017 AGM.

Vocus merged with M2 in 2016.

In addition, the telco said existing board member and ex-Tesltra chairman Robert Mansfield has been appointed to the role of deputy chairman, succeeding Craig Farrow who will remain on the board.

Mr. Farrow says the board will continue the renewal process over the year to come and that the latest appointments will ensure the continuation of momentum in a “critical stage of the Company in its transformation period.”

VOC last $2.43

8.45am: Oil falls on production surge

Oil prices have pulled back, weighed down by a strong US dollar and data pointing to rising global production.

Prices have been on the rise, but gave up recent gains as the rally ran out of steam.

US crude futures fell $US1.24, or 2.4 per cent, to $US50.43 a barrel on the New York Mercantile Exchange. Brent, the global benchmark, fell 94 cents, or 1.66 per cent, to $US55.85 a barrel on ICE Futures Europe.

“There were definitely naysayers on the rally. Clearly, you can point to some things” said Michael Hiley, a trader at LPS Futures, noting rising production figures. “People are responding to breaks out of a narrow range, piling on.”

Investors are growing concerned about a recent Reuters poll showing output among the Organization of the Petroleum Exporting Countries rose by 50,000 barrels a day in September as the cartel’s overall compliance with its supply-cut deal fell to 86 per cent.

“It would definitely suggest there’s slippage in the agreement as far as adherence is concerned,” said Donald Morton, senior vice president at Herbert J. Sims & Co., who oversees an energy trading desk. Mr. Morton said the OPEC figures came as technical factors were already suggesting the market could be prone to a downward slide.

Dow Jones

8.35am: Cromwell eyes Singapore IPO

Bridget Carter and Scott Murdoch write:

Cromwell Property Group is understood to have resurrected plans for its initial public offering in Singapore after the deal to float the group’s real estate platform in Europe was reportedly called off.

Chief executive Paul Weightman told DataRoom at the weekend that attempts were now being made to ensure the listing of the property portfolio went ahead as planned.

CMW last $0.96

8.30am: Ardent halt on Dreamworld land

Bridget Carter and Scott Murdoch write:

Various investors in Ardent Leisure are believed to be eager for the company to put its plans for land adjoining its Dreamworld theme park on hold.

It is understood some shareholders are hoping to see the company’s long-term business plan for turning around the embattled theme park before any attempts are made to sell off parts of its property or embark on a sale and leaseback of the land — read more

AAD last $1.82

Turi Condon 8.20am: Westfield takes reins in retail ‘decline’

Department stores are “clearly in decline globally” with shopping centre giant Westfield continuing to buy back stores and reinvent the space, according to co-chief executive Steven Lowy.

“Within the industry you have premium players and you have players who are effectively going out of business over time. It’s not just an American issue, but America is at the pointy end of this,” Mr Lowy told The Australian.

Speaking ahead of the opening of Westfield’s $1 billion redevelopment of Century City shopping centre in Los Angeles tonight, Mr Lowy said the US had a large number of retailers that were no longer relevant to shoppers — read more

WFD last $7.85

Damon Kitney 8.15am: Boards demand energy certainty

The nation’s top company directors have demanded immediate bipartisan policy certainty to allow Australia’s stretched energy sector to invest in a range of technologies, to maintain retail and business supplies for the coming decades.

In a roundtable forum with The Australian hosted by the Australian Institute of Company Directors, AICD deputy chairman Gene Tilbrook — who is also a director of oil and gas exporter Woodside and explosives maker Orica — said the nation needed a “smart power” solution for the future that tapped a variety of different energy sources.

“Australia has a glaring need for well-delivered and smart power generation and energy sources. And the roadblock to that is that there isn’t a clear framework for those organisations to operate,’’ he told the forum. Mr Tilbrook was also formerly the long-serving finance director at Wesfarmers.

7.25am: Stocks set to open higher

The Australian market looks set to open comfortably higher after all three major Wall Street indexes found yet further record highs.

At 7.15am (AEDT) on Tuesday, the share price futures index was up 21 points.

In the US, stocks started the fourth quarter on a strong note as data pointed to underlying strength in the economy with a measure of manufacturing activity surging to a near 13-1/2-year high in September.

At the closing bell, the Dow Jones Industrial Average was up 0.7 per cent at 22,557.60, the S&P 500 had gained 0.4 per cent to 2,529.20 and the Nasdaq Composite had added 0.3 per cent to 6,516.72.

Locally, in economic news today, the Reserve Bank of Australia holds its monthly board meeting and announces its interest rate decision.

The Australian Bureau of Statistics releases August’s building approvals data, a key indicator of potential home construction activity and measuring the number of new home approved by local councils in the month.

The ANZ-Roy Morgan Consumer Confidence weekly survey is due out, as is the ANZ job advertisements series for September.

No major equities news is expected.

The Australian market yesterday closed higher after investors started the new quarter in a bullish mood following a positive lead from the US and encouraging economic data from China.

The benchmark S&P/ASX200 index rose 47.7 points, or 0.84 per cent, at 5,729.3 points.

The broader All Ordinaries index was up 46.4 points, or 0.81 per cent, at 5,791.3 points.

AAP

7.10am: US stocks close at records

Major US stock indexes have clinched new records, as fresh economic data bolstered investors’ beliefs in a resilient U.S. economy.

The Dow Jones Industrial Average, S & P 500, Nasdaq Composite and Russell 2000 index of small-capitalisation stocks set new closing highs. The last time all four indexes closed at records together on the same day was July 19.

The Dow industrials rose 153 points, or 0.7 per cent, to 22558, while the S & P 500 added 0.4 per cent. The Nasdaq Composite gained 0.3 per cent and the Russell 2000 rose 1.3 per cent.

Australian stocks are set to follow the US lead and open higher. At 7.15am (AEDT) the SPI futures index was up 21 points.

In the US shares of manufacturers and financial firms posted solid gains to help lead indexes higher.

Analysts and money managers partly attributed the fourth quarter’s healthy start to new data showing that manufacturing activity in the US reached a 13-year high last month. The Institute for Supply Management’s reading exceeded economist expectations and suggests the factory sector was enduring the impact of recent major storms.

A recent stream of economic data has portrayed a durable and growing US economy, helping investors brush off a range of geopolitical risks this year. The S & P rose 4 per cent last quarter — its eighth consecutive quarter of gains. Stocks have more room to advance, analysts say, with an unusually high number of S & P 500 companies issuing positive revenue guidance for the third quarter, according to FactSet.

Shares of financial firms advanced. Goldman Sachs Group rose after The Wall Street Journal reported the bank is weighing a new trading operation dedicated to bitcoin and other digital currencies. Goldman and Citigroup added 1.5 per cent each.

Still, some investors remained wary of the market’s ongoing grind higher. Trading activity has been lighter than usual over the past month, and with little risk currently priced in to the market, things could snowball quickly if anything goes wrong, some money managers said.

Dow Jones

7.00am: Aussie dollar climbs

The Australian dollar has crept higher against its US counterpart, which has consolidated its gains made earlier in the London-New York session.

At 6.35am (AEDT), the Australian dollar was worth US78.31 cents, up from US78.20 cents yesterday.

Westpac’s Imre Speizer says the US dollar had preserved its previous gains, while US equities made fresh record highs, and the local currency had rebounded from a six-week low.

“The US dollar index is up 0.5 per cent on the day, but most of those gains came before the London/New York session where it consolidated,” he said in a morning note.

“(The) AUD rebounded from 0.7796 (a six-week low) to 0.7840.”

The main local event risk today will be the Reserve Bank of Australia’s policy decision and interest rate announcement.

“(The interest rate) is widely expected to be on hold,” Mr Speizer said.

“Markets are pricing in the likelihood of hikes in 2018 but Westpac remains of the view that rates are on hold.”

August’s dwelling approvals would also be of interest to investors.

Mr Speizer said he expected the local currency would hold above US78 cents “for now”, adding that the “RBA is the key risk event today”.

The Aussie dollar is also higher against the euro and steady against the yen.

AAP

6.40am: Euro slides on Catalonia vote

The euro and the Spanish stock market slid on Monday as voting in a banned Catalonia independence referendum was marked by a violent police crackdown.

But most other European markets rose as the weaker euro is positive for exporters in the region, analysts said, with the Frankfurt DAX index reaching an all-time closing high, analysts said.

“European bourses are starting the new quarter positively as US dollar strength and subsequent sterling and euro weakness help to aid the army of foreign earning and exporting names in the region,” said Accendo Markets analyst, Henry Croft.

A firmer showing on Wall Street — following strong international economic data and ahead of a heavy calendar of US economic reports — also helped underpin prices in Europe.

Back in Europe, “traders are clearly a little concerned about the impact of the (Catalan) vote, not to mention how the situation was handled by the Spanish authorities,” said Oanda analyst Craig Erlam.

Spain’s IBEX stock index was “the worst performing major index in Europe on Monday, down more than one per cent, while the euro is also suffering in the aftermath of the vote, down more than half a per cent against the dollar,” Erlam said.

Frankfurt, Paris and London equities posted moderate gains, with the German market reaching an all-time closing high, while the British market was buoyed somewhat as the collapse of Monarch Airlines handed a boost to rival carriers.

Monarch Airlines ceased trading suddenly Monday following a financial collapse, the biggest failure of an airline in Britain, prompting the government into emergency action in returning home 110,000 stranded passengers.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout