Trading Day: live markets coverage; ASX gold stocks in the furnace; plus analysis and opinion

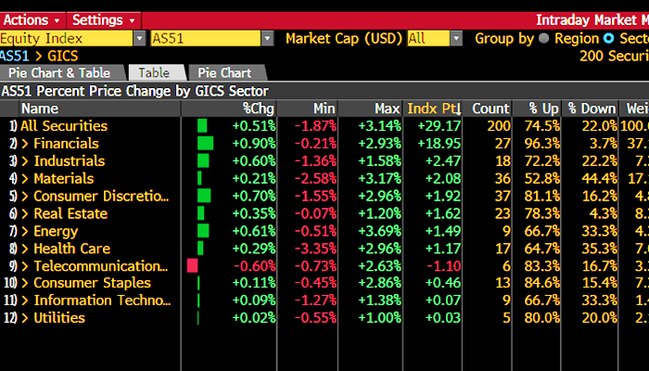

The ASX200 lifts as strength in large-cap financials buffets headwinds from commodity markets and China concerns.

Welcome to Trading Day for Monday, September 18.

5.00pm: Stocks lift on banking strength

The local sharemarket posted gains on a fresh tailwind from heavyweight financials as the major indexes dodged a blow from lower commodity prices amid concerns over China demand.

At the close, the S & P/ASX200 index was 0.5 per cent, or 25.5 points higher at 5720.6 while the broader All Ordinaries index close up 0.4 per cent, or 23.1 points on 5779.

Investors met big bank shares with renewed optimism from the outset of trade, with recent concerns over industry culture and practice making way for a fresh cycle out of the mining sector, according to IG chief market strategist Chris Weston.

“There’s been a repricing of financial markets and a move higher in interest rate expectations in the UK, certainly in the US and our market but to a lesser extent,” said Mr. Weston.

“The iron ore futures price has been coming off and that re-enforced the message that if you want to be in a sector at the moment it’s the financials over the mining stocks.”

CBA closed up 0.5 per cent to $76.69, Westpac added 0.7 per cent to $31.67, ANZ rose 1 per cent to $30.18, while NAB shares finished 1.1 per cent higher on $31.20.

Early weakness in resource stocks paved the way for a mixed session as underlying commodities diverged. BHP shares edged 0.1 per cent higher to $26.28, Rio Tinto lost 0.2 per cent to $66.67, while iron ore pure-play Fortescue shed 2.7 per cent to close on $5.40.

3.45pm: ‘That’s Sheriff Buffett to you son’

Howard Buffett, son of legendary investor Warren Buffett, is adding a new title to his unusual resume: sheriff.

The younger Mr Buffett was succeeding the retiring sheriff of Macon County in central Illinois, the county said. In addition to being in line to take over for his father as non-executive chairman of Berkshire Hathaway, Mr Buffett has served since 2014 as under-sheriff of Macon County.

That role is one of a long list that are far afield from his father’s business interests.

Mr Buffett, 62, is also a corn and soybean farmer, a conservationist and philanthropist.

A college dropout, Mr Buffett has travelled the globe as a photographer and has written several books on poverty, wildlife and conservation. He also worked for a short time as an executive at Archer Daniel Midlands, which brought him to Decatur, Illinois, in 1992. He has served on several corporate boards as well.

“Knowing that Howard will occupy my vacancy in a professional and competent manner makes the decision to leave this position less difficult,” said Thomas Schneider, the Macon County sheriff who announced his retirement on Friday — read more

The Wall Street Journal

Samantha Woodhill 3.30pm: Mortgage stress arrears its head

The proportion of Australian households in mortgage arrears ticked higher in July, according to Standard & Poor’s.

The share of housing loans underlying Australian prime residential mortgage-backed securities that were delinquent rose to 1.17 per cent in July, from 1.15 per cent the previous month, said S & P Global Ratings.

Residential loans backing the securities account for 6 per cent of all residential loans in the country.

The proportion of Western Australian delinquent loans rose by 0.05 percentage points, despite recent signs of economic recovery, rising to 2.38 per cent. The state’s seasonally adjusted unemployment rate rose from 5.4 per cent to 5.9 per cent in August.

3.10pm: Gordon to appeal Ten ruling

John Durie and Darren Davidson write:

Bruce Gordon and Lachlan Murdoch will appeal today’s Supreme Court ruling against them in the Network Ten administration case, taking the matter to the Court of Appeal.

The appeal is likely to be lodged either today or tomorrow morning before the scheduled creditors meeting.

Administrator Mark Korda will present the rival Murdoch and CBS bids to the meeting leaving it for creditors to decide what to do — read more

TEN last $0.16 in trading halt

3.00pm: What’s in the Trading Day ahead

Join the conversation with our experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Raymond Chan — Morgans

3.15pm: Shane Wright — The West Australian and Primrose Riordan — The Australian

3.30pm: David Bassanese — Betashares

3.40pm: David Lennox — Fat Prophets

3.50pm: Michael McCarthy — CMC Markets

4.00pm: Scott Phillips — The Motley Fool

4.00pm: Tony Farnham — Patersons Securities

4.30pm: Stephen Roberts — Alexander Funds Management

5.15pm: Steve Keen — Debunking Economics

5.30pm: Evan Lucas — The Lucas Report

2.50pm: ASX200 lifts with sole telco drag

Local investors cheers firm gains in late trade, the S & P/ASX200 index trades 0.5 per cent higher at 5721.8 as bargain hunters swoop on big banks and bring the wider sharemarket along for the ride.

“There’s been a repricing of financial markets and a move higher in interest rate expectations in the UK, certainly in the US and our market but to a lesser extent,” said IG chief market strategist Chris Weston.

“The iron ore futures price has been coming off and that re-enforced the message that if you want to be in a sector at the moment it’s the financials over the mining stocks.”

With the sole exception of a slightly weaker CBA (+0.8pc), Big Four bank shares all remain over 1 per cent higher. Iron ore pure play Fortescue lumbers toward the close 1.9 per cent lower, while diversified giants BHP (+0.2pc) and Rio Tinto (-0.3pc) diverge.

Telcos are the slim source of drag on the wider market and on closer observation, the culprit is clear:

Australia’s biggest telco Telstra affirmed this morning the outlook for its sacrosanct dividend in FY18 at 22 cents/share including both special and normal distributions, down from 31 cents/share in FY17.

2.25pm: Evolution to sell WA gold mine

Robert M. Stewart writes:

Evolution Mining has agreed to a deal to sell its Edna May gold mine in Western Australia to Ramelius Resources for up to $90 million.

The agreement comes a week after Evolution said it was reviewing several offers for the mine, which was one of its founding assets and produced 70,188 troy ounces of gold in the last fiscal year and accounted for about 8 per cent of Evolution’s total gold output.

The sale of the mine, located about 350km east of Perth, will reduce the company’s all-in sustaining cost and raise the average estimated mine-life of Evolution’s operations, it said — read more

EVN last down 2.2pc at $2.60

2.10pm: Aussie dollar goes pound for GBP

The Australian dollar surfaces against the British pound to the tune of 0.3pc and buys just above 59 pence as investors around the world take a second look at the local currency — easing focus on North Korean tensions giving the Asia-Pacific region a rest.

“The pound rose sharply against all major currencies last week, in response to the Bank of England policy meeting,” said Westpac’s Sean Callow.

“While keeping their benchmark interest rate at a record low 0.25pc, their commentary made clear that a rate hike was not far away.”

That may explain some of last week’s AUD/GBP action:

As global currency traders seek signs of rate rises in the era of easy money, all eyes remain on the Aussie dollar ahead of the RBA’s September meeting minutes released tomorrow.

AUD/GBP last up 0.3pc at 59.1 pence.

1.45pm: Gold bugs in the furnace

ASX-listed gold miners are feeling heat as the underlying precious metal veered southward amid easing geopolitical nerves and a second look at western currencies by investors around the world.

Risk appetite ebbed last week after North Korea sent a missile over Japan into the Pacific Ocean for the second time this month, sending traders scurrying for defensive plays such as gold and derivatives.

However, the safe-haven rush came at a noticeably slower pace as expectations showed signs of becoming condition to Pyongyang aggression. ANZ Head of FX Research Daniel Been noted a quick pivot in the direction of market anxiety from the tensions toward that over easy money.

“Expectations of a rate hike by the Fed in December have risen sharply in recent weeks, and now sit at around 46pc,” said Mr. Been, “higher inflation has been a big reason for this.”

“After five consecutive months of undershooting expectations, US core CPI inflation hit the mark in August, registering a firm 0.2pc month-on-month reading.”

Across the Atlantic, Britain’s central bank ramped up its rhetoric around the possibility of a near-term rate hike last week, while at home all eyes turn to the RBA’s September statement of monetary policy released tomorrow for indications it sees the Australian economy in a global updraft.

Any global growth optimism would be wasted on gold bugs today, however, the sector lumbering along in lunchtime trade swathed in red with only large cap Newcrest (NCM) showing signs of life.

John Durie 1.30pm: Familiar face scoops up Vocus stock

Amid a flurry of insider sales, Vocus executive director Vaughan Bowen has taken out his wallet and spent $249,705 to buy another 106,000 shares in the bealeagured company, lifting his holding to 8.9 million.

Bowen, the long time “brains” behind M2 and Vocus, is a key supporter of Geoff Horth as chief of the company.

He acquired the stock at $2.35 per share, well down on the year ago high at $7.05/share.

Earlier this year KKR and Affinity looked at the company with indicative bids around the $3.50 per share mark but walked without lodging a bid — read more

VOC last up 3pc at $2.42

Lisa Allen 1.10pm: PE grabs Byron Bay’s Beach Hotel

The Beach Hotel in Byron Bay, developed by Paul Hogan sidekick John Cornell, has sold for an aggressive $70 million to a Melbourne-based private equity firm believed to be backed by the wealthy Liberman family.

The vendor, racing car driver Max Twigg, vehemently denied to The Australian last week that he was selling the pub in the iconic northern NSW township, adding: “I am a happy owner, I have been for ten years.”

But it has been confirmed the hotel, overlooking Byron’s Main Beach, has sold under a long settlement agreement. It’s believed to have gone to the Impact Investment Group, in a record-breaking deal.

Mr Twigg paid about $44 million for the hotel a decade ago.

Samantha Woodhill 12.50pm: Iron ore, China outlook bleak

The price of iron ore is likely to continue to fall in coming sessions, continuing recent declines, say analysts.

The price of Australia’s biggest export slipped to a one-month low on Friday, down 3.4 per cent to $US70.90 a tonne, according to The Steel Index.

It comes as recent Chinese data, including retail sales, industrial production and fixed asset investment data, have showed signs of slowing.

“I’d say that given where we are and the trends we’re seeing and the failure to hold key level are probably the further downside risks here,” IG chief market strategist Chris Weston said.

He noted that iron ore futures had a greater reaction in the futures price which dropped 18 per cent to “just below the 50 per cent retracement level of the rally that we saw through June and into August”.

“Spot prices have fallen a little bit but probably not at the same magnitude,” he said — read more

Update: Dalian port iron ore futures (below) shows signs of spot price improvement after coming online in late-morning trade. The spot price of iron ore is taken daily, while futures contracts trade continuously.

11.35am: Aussie dollar lifts, motor sales grow

New motor vehicle sales rose in August by 1.7 per cent on the same period a year prior and came in flat on a month-by-month basis following a fall over 2 per cent in July.

The local currency rose US0.17 cents in the 45 minutes leading up to the data release at 11:30am AEST, swinging into the black to trade 0.2 per cent higher for the session at US80.13 cents.

Elizabeth Redman 11.20am: Suitor tussle for APDC seats

Data centre operator NextDC has asked for two seats on the board of its takeover target and landlord, Asia Pacific Data Centres.

The request comes after NextDC lifted its stake in the target to 29.2 per cent while its $1.87 per security bid for APDC was live.

NextDC has now allowed its offer to lapse, as flagged in The Australian’s DataRoom column today.

A sweetened proposal is on offer from rival suitor Tony Pitt’s 360 Capital, in the form of $1.95 in cash per security — read more

AJD last down 0.5pc at $1.95

10.40am: ASX200 posts gains on bank glee

The sharemarket leaps higher at the open as much as 0.6 per cent as investors flick the switch on big banks and oil hopes buoy big miners over a plunge in iron ore.

The S & P/ASX200 index was last 0.4 per cent higher lofty opening gains to sit on 5720 in the first half-hour of trade.

The big four banks all post healthy gains over 0.5 per cent, diversified miners BHP and Rio Tinto shrink opening losses while iron-ore pure play drops over 2 per cent in the first week following the announced retirement of chief Nev Power.

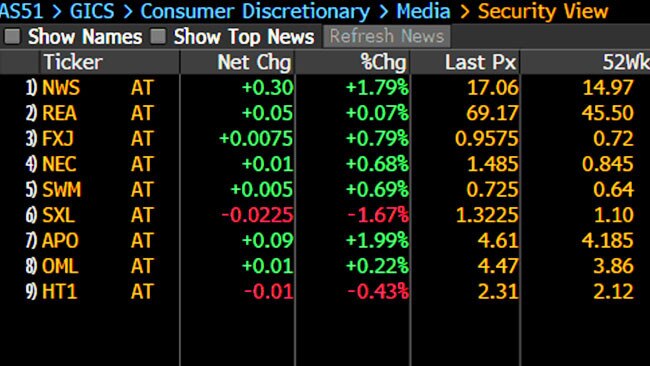

Evolution Mining sinks 1.5 per cent in the wake of news it has reached an agreement to sell its Edna gold mine in Western Australia, while media stocks see green after the Senate passed the Federal government’s proposed media reform bill including the abolition of two-out-of-three broadercaster channel restrictions.

Darren Davidson 10.05am: Gordon loses Ten takeover case

The NSW Supreme Court has dismissed a legal action brought by Bruce Gordon against Ten Network’s administrators KordaMentha claiming they failed to provide adequate information about his joint bid with Lachlan Murdoch.

Justice Ashley Black handed down his judgment this morning, also ordering that a second meeting of Ten’s creditors should not be restrained.

Administrators KordaMentha had recommended the US television giant’s bid over one by Mr Gordon and Mr Murdoch — read more

TEN last $0.16 in trading halt

10.00am: ASX200 set to rise as heavyweights split

The SPI 200 futures index tips the local share market to rise at the open despite a sharp drop in the price of the nation’s biggest export iron ore overnight as bulls eye battered financials for value.

At 7am (AEST), the share price futures index was up 16 points, or 0.18 per cent, at 5,708.

Wall Street closed out its best weekly gain of the year on Friday on the back of banks and telco stocks, while commodity watchers approach Monday trade with fresh nerves after the spot price of iron ore fell nearly 3 per cent overnight.

IG chief market strategist Chris Weston says a recent rotation out of mining stocks into Aussie financials is set to continue, a “simple sense check” enough for most investors to expect the big banks to outperform in the coming session.

“I suspect that’s still going to be the right trade this week,’ said Mr. Weston. “there’s been a repricing of financial markets and a move higher in interest rate expectations in the UK, certainly in the US and our market but to a lesser extent.”

“The iron ore futures price has been coming off and that re-enforced the message that if you want to be in a sector at the moment it’s the financials over the mining stocks.”

All eyes will be on ANZ shares after it responded to media speculation over buyers for its wealth management arm, while investors in Evolution Mining are poised to make moves following its announcement it has penned an agreement to sell its Edna gold mine in Western Australia.

Index last 5697.5.

9.40am: Bruce Gordon loses Ten court battle

NSW Supreme Court has found against Bruce Gordon’s challenge of a CBS takeover offer for Ten Network.

Mr. Gordon had launched court proceedings on the basis that CBS had treated creditors unfairly and therefore presented a transaction risk.

TEN last $0.16 in trading halt

David Uren 9.30am: Low volatility sounds eerie quiet

It is quiet, too quiet, says Claudio Borio, head of economics and monetary policy at the Bank of International Settlements, with volatility in equity and, particularly, bond markets dropping to extreme lows.

He worries that the snail’s pace at which the world’s central banks are moving to tighten monetary policy is leading to excessive risk-taking, evident in what the BIS says is a debt-fuelled rise of the S & P 500 index, which reached a record 2500 points on Friday.

Volatility in the US sharemarket, as measured by the VIX index, is at its lowest level since 2005. Short selling of the VIX index — representing bets that volatility will remain low — has been at record levels and is more than three times higher than the 10-year average.

Volatility in bond markets is also at a record low, despite the US Federal Reserve lifting rates and other major central banks inching towards tightening, or at least unwinding their asset purchase programs.

“We do not fully understand the factors at work. But surely the unprecedented gradual pace of monetary policy normalisation has played a role,” Borio says.

9.20am: ANZ keeps wealth arm options open

ANZ has responded to media speculation surrounding the possible divestment of its Australian wealth management arm.

In a statement to the ASX this morning, the bank said the process is ongoing, that it remains in discussion with a number of parties and continues to work through options including “exploring capital market solutions to create a stand-alone business.”

ANZ last $29.38

9.10am: Telstra confirms dividend outlook

Telstra sees its total FY18 dividend at 22 cents/share inclusive of both ordinary and special distributions.

TLS last $3.74

9.00am: What’s in the Trading Day ahead

Join the conversation with our experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

8:30am: David DeGaris — NAB

9:00am: Beau Mulder — AFEX

9:15am: Mark Bayley — FIIG

9:30am: Chris Weston — IG

10:00am: Alex Leyland — Leyland Private Asset

11:00am: Ben Le Brun — OptionsXpress

11:15am: Daniel Hynes — ANZ

12:00pm: Joe Mayger — Lakehouse Capital

12:15pm: James King — AFEX

12:45pm: Stephen Walters — AICD

8.55am: Bankers drum up media deals

Bridget Carter and Scott Murdoch write:

Investment bankers in the media space will be working hard to drum up fresh business following last week’s industry reforms.

Among the deals said to be back up for discussion are: the acquisition by Nine Entertainment of the digital mastheads of The Sydney Morning Herald, The Age and The Australian Financial Review.

As part of the same deal, Nine would buy the remainder of streaming service Stan that is owned by Fairfax, and also the radio stations 2GB in Sydney and 3AW in Melbourne. The radio stations are jointly owned by Fairfax and John Singleton.

8.50am: Evolution enter Edna sale deal

Evolution Mining has this morning announced it has entered into an agreement to sell its Edna gold mine in Western Australia to Ramelius Resources for $40m.

Alongside the announcement, Evolution said it expects annualised group production to lift by 54pc to 195-205,000oz — more to come.

EVN last $2.60

Michael Roddan 8.40am: Super insurance revolution

The nation’s largest superannuation fund, the $120 billion AustralianSuper, will today announce an industry-leading move to cancel automatic but savings-eroding life insurance cover for new members under 25 years of age.

With the industry this week poised to release a draft code of practice put together by the Insurance in Superannuation Working Group, which was established in the wake of numerous scandals in the life insurance sector, AustralianSuper said it was going “further” than what the draft code propose to prevent life insurance from eroding the savings of young Australians.

David Crowe 8.30am: AGL to bet $500m solar boost

Australians are on track to pay more than $500 million to AGL to fund its flagship solar generators, as the energy giant prepares to shut down its Liddell coal power station, a move that has prompted warnings of a power shortfall that could lead to blackouts and price hikes.

The company has already secured $230m in direct grants and is forecast to gain far more under the renewable energy target, deepening the political divide on energy policy as the federal government considers cutting future aid to make coal more competitive.

The scale of the subsidy is now a key question in the government’s debate on whether to embrace a clean energy target, as opponents of the idea challenge AGL and others to prove that wind and solar schemes can work without taxpayer handouts — read more

AGL last $24.80

7.40am: Stocks set for higher open

The Australian market looks set to open comfortably higher after Wall Street closed higher with both the Dow and the S & P 500 hitting record highs.

At 7am (AEST), the share price futures index was up 16 points, or 0.18 per cent, at 5,708.

In the US, telecommunications and technology sectors bounced back after two sessions of declines as investors shrugged off reports showing an unexpected drop in US retail sales in August and the first drop in industrial output since January, both in part due to the impact of Hurricane Harvey. The Dow Jones Industrial Average rose 0.29 per cent, the S & P 500 gained 0.18 per cent and the Nasdaq Composite added 0.3 per cent.

Locally, in economic news today, the Australian Bureau of Statistics releases new motor vehicle sales figures for August.

The CoreLogic capital city house prices and clear rates survey for the week just ended is due out.

No major equities news is expected, although the NSW Supreme Court is expected to bring down its ruling on Bruce Gordon’s challenge to the CBS takeover of the embattled Ten Network.

The Australian market on Friday closed lower for a third consecutive session as North Korea’s latest missile launch over Japan spooked investors. The benchmark S & P/ASX200 index fell 43.7 points, or 0.76 per cent, to 5,695 points.

The broader All Ordinaries index dropped 42.6 points, or 0.73 per cent, to 5,755.8 points.

AAP

7.00am: Dollar back above US80c

The Australian dollar has edged higher to creep just above US80 cents.

At 6.35am (AEST), the Australian dollar was worth US80.03 cents, up from US79.96 cents on Friday.

Westpac’s Imre Speizer says the US dollar fared badly after a mixed bag of economic data.

“US retail sales fell 0.2 per cent in August (versus +0.1 per cent expected), with the core measure falling 0.2 per cent (vs. +0-. 2 per cent expected). Hurricane Harvey’s disruptions are one likely explanation,” he said in a morning note.

Also, industrial production fell 0.9 per cent in August, against an expected 0.1 per cent lift; New York manufacturing activity (Empire) was stronger than expected at 24.4; Consumer sentiment (Michigan Un) slipped from 96.8 to 95.3 (versus 95.0 expected), with the 5-10-year inflation expectation component rising from 2.5 per cent to 2.6 per cent, he said.

“The US dollar index closed down 0.3 per cent on the day ... (while the) AUD closed unchanged on the day at around 0.8000, but did spike to 0.8021 after the disappointing US data.

The main event risk today is August new vehicle sales which were last down 2.0 per cent.

“Westpac expects another 0.5 per cent drop based on FCAI figures but this still leaves annual sales at +2.0 per cent.”

But he doesn’t expect much shift in the Aussie dollar on Monday, with the currency “finding some short-term equilibrium around 0.8000 (US cents)”.

The Aussie dollar is also higher against the yen but hardly changed against the euro.

AAP

6.40am: Aussie stocks set to open higher

A strong start is tipped for the Australian share market after Wall Street closed with record highs after a surge in technology markets.

The S & P 500 information technology sector in the US rose 0.3 per cent, powered by an Nvidia-led surge in chipmakers, while Apple rose one per cent in its first gain since unveiling the new iPhones.

The Dow industrials rose 64 points, or 0.3 per cent, to 22,267, notching its 39th record of the year and its sixth consecutive session of gains. The S & P 500 added 0.2 per cent and the Nasdaq Composite rose 0.3 per cent.

Local stocks are set to rise at the open. At 6.50am (AEST) the SPI futures index was up 16 points.

Investors will look to the Reserve Bank this week when it publishes minutes from its September board meeting tomorrow, and there will also be speeches from Governor Philip Lowe and Assistant Governor Luci Ellis later in the week. AMP Capital’s chief economist Shane Oliver expects the central bank to show a degree of comfort in how the economy is evolving, while expressing concern with the rise of the Australian dollar.

“The RBA indicated last month that a higher Australian dollar will threaten growth and inflation,” Dr Oliver said.

“I think rates will be on hold for sometime yet.”

The Australian dollar closed at US79.96 cents on Friday.

AAP