Trading Day: live markets coverage; ASX drops as Korea caution reins; plus analysis and opinion

The ASX clinches slim gains for the week and ends on a cautious note as North Korean risk sidelines investors.

Welcome to Trading Day for Friday, September 15.

5.00pm: Stocks slip as heavyweights retreat

The local sharemarket finished the week on a low note as it lost ground on a fresh dose of geopolitical risk on the latest North Korean provocation.

At the close, the S & P/ASX200 index was 0.8 per cent, or 43.8 points lower at 5695, while the broader All Ordinaries index fell 0.7 per cent, or 42.5 points to 5755.9.

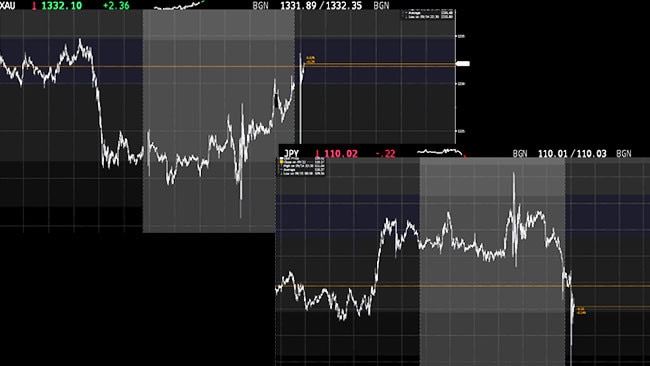

Risk appetite fell from the outset of trade after Pyongyang fired another missile over Japan into the Pacific Ocean. Safe-haven spot gold and Japanese yen reacted instantly, while uncertainty kept local equity investors on the sidelines.

IG chief market strategist Chris Weston noted heavyweight financials had risen nearly 4 per cent over the week. The sector unwound these gains throughout the session to drag on local indices.

“Our call for the ASX 200 sits at 5742 and should see any gains capped into 5777, while the downside should be limited to 5718,’ said Mr. Weston, “although on a positive note the index looks destined to snap three weeks of losses.”

Samantha Woodhill 3.50pm: Bitcoin licks China wounds

The price of a bitcoin hovers around $US3302 in late afternoon trade, down more than 12 per cent this time yesterday after crypto-exchange BTCC closed up shop in China.

The second time the cryptocurrency has shed that kind of value this week, mania over Initial Coin Offerings takes an audible breath in the wake of a decision by the Chinese government this week to ban ICOs such as bitcoin.

IG Chief Market Strategist Chris Weston says it’s too early to tell whether or not the bubble has popped on Bitcoin.

“Bitcoin has been smashed of late, and the cynics would say the ‘bubble’ has popped, although I would be fully focused now on the 4 August gap high of 2877,” he said.

“That is the key line in the sand for me and the bulls will want to see this hold.”

3.20pm: $650m same-sex wedding boost: ANZ

The economic benefit of legislation approving same-sex marriage equality related to weddings alone could exceed $650m, according to ANZ research.

As enrolled citizens around the country start receiving the ABS postal survey on same-sex marriage equality, ANZ plays down wider macroeconomic implications but finds “meaningful” economic potential on an industy level.

“If marriage equality were legislated, we believe same-sex weddings would have a positive, though very small, impact on economic activity and confidence,” said ANZ economist Cherelle Murphy

“Expenditure on weddings could benefit a range of industries including retail trade, hospitality, arts and recreation, and professional services.”

“Service exports [could increase] as offshore visitors choose to marry and honeymoon in Australia, while Australian same-sex couples returning home may further boost these industries.”

The number of same-sex couples living together rose 39pc between 2011 and 2016 according to the 2016 census and if those that currently state a desire to marry all were to do so within a year of being granted the right, Ms. Murphy predicts wedding consumption could lift by around $1.3bn.

“The wedding spend by same-sex couples could be higher than the existing average given their family incomes are on average higher than opposite-sex couples,” she said.

However, the impact of same-sex marriage equality comes in at a “minuscule” 0.06pc of annual nominal consumption by Ms. Murphy’s estimates, while the logistics of the survey she sees as another issue entirely.

“Whether or not the legislation is successful, the $122m cost of the postal survey plus campaigning by lobby groups and other organisations will add up to hundreds of millions of dollars.”

Robert Gottliebsen 3.05pm: Metropolis tilt Down Under

Let me introduce you to two young professional couples who society would regard as middle to higher income. On the surface their situations are the same. Both are aged in their 30s but one couple is at the higher end. Both have combined incomes in the approximate $225,000 to $250,000 range.

All four people have what society would regard as good white-collar career jobs covering four professions — law, health, journalism and areas relating to advertising.

Their situation could equally apply to a range of other professions including accountancy and engineering.

While the surface pointers are the same, the outlook and financial fear of each of the couples is totally different, not because of the professions they happen to work in but rather the city that hosts their jobs. One couple lives in Sydney and the other in Melbourne. The Melbourne experience would have been either duplicated or improved had the jobs been hosted in Brisbane, Adelaide Perth or Hobart.

2.40pm: RBA’s Lowe shows Fed real income

The Reserve Bank has retained its position as one of the world’s best- paying central banks, with governor Philip Lowe’s salary holding at just over $1 million, or almost four times the earnings of US Federal Reserve chairwoman Janet Yellen.

Dr Lowe has resumed the publication of senior management salary levels in the bank’s annual report, after his predecessor Glenn Stevens abandoned the standard corporate practice two years ago.

The report shows the bank has 11 executives earning more than $500,000, with little movement in the top salaries since they were last published in the 2014 annual report.

Eli Greenblat 2.00pm: Aussie vitamins given Alibaba boost

Australia’s vanguard of vitamins and supplements companies doing a roaring trade in China are set to get an extra boost to their already strong profiles in the region with the country’s leading online trading site, Tmall Global, today announcing it will collaborate with Chemist Warehouse, Swisse, Blackmores (BKL) and Sanofi Consumer Healthcare.

Alibaba, China’s largest e-commerce company and owner of Tmall, signed individual agreements and memorandums of understanding in Melbourne today between Tmall and the four companies.

The Tmall Global collaborations are expected to build capability in marketing and product traceability, while opening new sales channels for the brands to reach more of China’s growing middle class.

1.30pm: ASX200 bears, iron ore plays drag on trade

The local sharemarket extends losses as an early hit to risk appetite by fresh North Korean provocation tightens its hold on sentiment throughout the afternoon.

The S & P/ASX200 index trades 0.8 per cent lower at 5694.9 as it fails to post significant moves toward the black since the open.

Heavily weighted on the index, big banks bear losses while mining stocks succumb to a confluence of pressures including a 3pc drop in Australia’s biggest export iron ore overnight.

BHP sheds another 2 per cent after a similar fall in the session previous, Rio Tinto drops 1.9 per cent, while Fortescue lumbers along over 4 per cent in the red after the company announced chief Nev Power will be stepping down next year.

Meanwhile, Myer shares (-4pc) have given up all they gained in the session previous as buyers evacuate after tempering the market’s response to its worst-ever profit result as a listed company yesterday.

Consumer bulls run out of retail and into Domino’s, taking the stock over 4 per cent higher as the top 200’s best performer in the session thus far.

Session bears do, however, their work cut out for them should the index be dragged past last Friday’s close. The index is on track to post a 0.4 per cent gain for the week with just over 2 ½ hours left of trade.

Darren Davidson 12.45pm: Gordon, Murdoch launch fresh Ten bid

Bruce Gordon and Lachlan Murdoch will lob a new bid for Ten Network within the next few hours.

It is understood the new offer is higher than the original proposal, and delivers a better return to creditors.

In the latest twist to a dramatic battle for control of Australia’s third-placed free-to-air broadcaster, Ten’s administrators KordaMentha will receive the new proposal this afternoon, sources close to the deal said — more to come.

TEN last $0.16 in trading halt.

11.31am: Foretescue chief Power to step down

Fortescue chief executive Nev Power will step down from the role on the February 16 2018 after seven years at the helm of the mining heavyweight.

In a statement to the ASX, chair Andrew Forrest praised Mr. Power leadership and said the decision is consistent with the company’s long term succession plan.

“We both share great confidence in the quality of internal and external candidates to continue Fortescue’s legacy,” said Mr. Forrest — read more

FMG last down 2.4pc at $5.79

Darren Davidson 11.10am: Shares dip as ‘New Myer’ falls short

Myer has skidded to its worst result since it was floated on the sharemarket in 2009, prompting chief executive Richard Umbers to apologise for its failure to meet profit benchmarks he set down two years ago.

But he held out the promise of better times ahead as he reshapes the department store to deal with the harsh realities of the retail sector.

Unveiling an 80.4 per cent slide in full-year net profit to $11.9 million, which was dragged lower by $56m in write-offs, impairments and charges linked to a stable of underperforming fashion labels and businesses, Mr Umbers put a brave face on the latest results for the nation’s biggest department store.

Mr Umbers, the former British army officer and Australia Post executive, said in light of the headwinds whacking retailers it was a credible result, with Myer’s online channel growing profits and the slimming down of its floor space helping with productivity while cash conversion was strong.

But he admitted Myer had fallen short of his expectations when he unveiled his ambitious “New Myer” strategy in 2015 that would harness $600m in investments and initiatives that would eventually deliver earnings growth — read more

Producers note: Myer shares cut to “underperform” by Credit Suisse

MYR last down 3pc at $0.71 cents.

Eli Greenblat 10.47am: AFIC chief Barker to step down

Ross Barker, the chief executive of the nation’s biggest and oldest listed investment company, Australian Foundation Investment Co, will step down as its boss after 16 years of investment guidance to its 120,000 shareholders.

AFIC, whose portfolio of mostly Australian equities is worth nearly $7 billion, will retire as CEO of the investment company on December 31st, making way for Mark Freeman, currently chief investment officer at AFIC, effective 1 January 2018.

Mr Freeman will also replace Mr Barker as CEO of Australian Investment Company Services Limited which provides investment and administration services to AFIC and three other listed investment companies in the stable: Djerriwarrh Investments, Mirrabooka Investments and AMCIL — read more

AFI last up 0.3 per cent at $5.86

Bridget Carter 10.40am: AIA takes CommInsure race lead

Insurance giant AIA is believed to be poised to buy Commonwealth Bank’s life insurance unit, according to sources.

It comes as AIA and Zurich lobbed final bids to buy the insurance operations by the deadline last night.

It is thought that CommInsure and the New Zealand Sovereign business that are up for sale are worth more than $4 billion.

As flagged by DataRoom last night, Asian insurer AIA was thought to be the most likely group to buy CommInsure — read mor e from DataRoom

10.30am: ASX200 hit by N Korea ‘wait and see’

The local sharemarket falls at the open, investors opting for a cautious stance toward Pyongyang’s latest provocation as risk appetite subsides at the outset of the week’s final session.

The S & P/ASX200 index remains 0.3 per cent lower at 5791.7 in early trade.

“Markets are likely to be relatively cautious today, preferring a wait and see stance in case of any further near term developments in this situation,” said CMC chief markets analyst Ric Spooner ahead of the open.

Industrial metals continued to weaken overnight alongside at 3 per cent drop in the nation’s largest export iron ore — exposed heavyweights BHP, Rio Tinto and Foretscue are all over 1 per cent in the red.

“Data indicating further softening in the growth of China’s infrastructure spending suggests bargain hunters may wait on pullbacks rather than being aggressive buyers of mining stocks at this stage,” said Mr. Spooner.

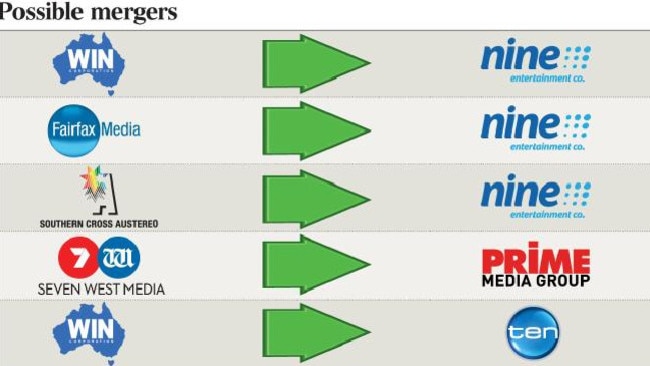

Meanwhile, media stocks remain mixed after the Senate passed through new industry reform including the removal of Australia’s longstanding two-out-of-three ownership provision.

Cliona O’Dowd 9.55am: Defensive stocks under threat

Deflationary events will see interest rates around the world fall over the long term and investors must be alert to the threats facing defensive sector stocks, Magellan Financial CEO Hamish Douglass told an investor briefing in Melbourne yesterday.

Mr Douglass expects interest rates to rise in the next three to four years, but says they’re not going back to 5 per cent or above. Instead, deflationary pressures, driven by the digital and sharing economy, will see rates actually fall over the long term.

“Our base case is a 50 per cent reduction in support from the major central banks in the next 14-15 months. And with that quantum of change you can’t believe interest rates and asset prices won’t be affected,” he said.

“But deflationary events mean rates may well come down in the long term and that creates a dilemma for investors.”

9.50am: ASX200: N Korea launch veils sentiment

The SPI200 futures price index tips the local share market to rise, while the news North Korea fired a second missile over Japan has investors on edge ahead of the open.

US index futures have fallen in Asia trade following the fresh provocation from Pyongyang, while safe haven gold and Japanese yen against the US dollar both reacted sharply.

Iron ore fell over 3 per cent overnight while oil also lost ground. Together with further cooling in base metal markets the elements bear down on resource investors’ hopes of respite after materials dragged on the broader share market yesterday.

“The psychological barrier of $US50/bbl remains a big hurdle for WTI, after it failed to settle above it once again,” said ANZ Head of Australian Economics David Plank.

“Increased estimates of oil demand by IEA and OPEC, driven by China and the US, continue to reverberate through the market.”

The Australian dollar found footing after stronger than expected US CPI data trimmed USD gains, but remains slightly weaker in the morning session at US79.97 cents.

Ben Butler 9.30am: Millions spent boosting Malley

Accounting association CPA Australia splurged more than $4 million on a TV show in which its controversial former chief executive, Alex Malley, interviewed celebrities and laid out millions more on the Australian Open tennis and NRL team the Rabbitohs.

In addition, almost $2m was spent promoting Mr Malley’s book The Naked CEO and website, which served to boost the profile of the former CPA boss.

A report commissioned by CPA into Mr Malley’s reign, which ended with his sacking in June amid a membership revolt and a media firestorm, paints a picture of an organisation out of touch with members and helmed by a “largely unconstrained” Mr Malley.

9.15am: AIA, Zurich in buyers race

Bridget Carter and Scott Murdoch write:

Commonwealth Bank’s move to sell CommInsure will gather momentum in the next few days, after AIA Group and Zurich Insurance lobbed bids to buy the troubled insurer.

The two companies met the expedited deadline last night and put in final and binding offers which could value CommInsure and the New Zealand Sovereign business at more than $4 billion.

CBA will consider the offers over the next few days and is expected to select a preferred bidder by the middle of next week. Negotiations will then become exclusive and DataRoom understands CBA is keen for a speedy resolution — read more

CBA last $74.28

Matt Chambers 9.10am: AGL the last to quit coal

AGL Energy will be the last of the nation’s big three power companies to exit coal-fired power under current closure plans, despite the power giant’s advertising campaign highlighting its plans to get out of the fossil fuel.

Origin Energy and EnergyAustralia both say they are planning to close their coal-fired generation assets years before the 2050 date by which AGL has declared it will close what will then be its last coal plant — Loy Yang A in Victoria — read more

AGL last $24.80

9.05am: Investors rush to venture capital

Andrew White and Damon Kitney write:

Backing venture capital and entrepreneurs is gaining in popularity among high net worth investors, with plenty of money willing to bet on higher-risk, high-return ideas and the individuals behind them, says Credit Suisse.

A record year of capital raising for venture capital funds and some landmark floats such as WiseTech Global, which has more than doubled in value since listing in April last year, has highlighted growing interest in early stage investing.

Venture capital funds raised a record $568m, including $250m from Daniel Petre’s AirTree Ventures, whose chief executive, Craig Blair, said yesterday a lot more could have been raised.

Credit Suisse Australian chief executive John Knox said: “I see an increasing number of people who have made a lot of wealth in the last few years. They have monetised it and are increasingly looking to invest into these opportunities.

8.50am: Analyst rating changes

Myer cut to Underperform; target price $0.67 — Credit Suisse

8.32am: N Korea launches second missile over Japan

North Korea has launched a ballistic missile over Japan for the second time in less than a month.

South Korea’s Joint Chief of Staff said this morning Pyongyang had fired a missile eastwards toward the Sea of Japan.

The missile was launched from near Pyongyang, the JCS said.

Japan issued an emergency alert at 07.06AM stating the missile flew over Hokkaido, Tokyo broadcaster NHK reported, suggesting the missile is either medium or long range.

Producers note: Safe haven spot gold (XAU) spikes and Japanese yen/USD reacts as news drops.

Darren Davidson 8.30am: Leaders hail media reform

Corporate chiefs in the $15 billion media industry have enthusiastically endorsed the Turnbull government’s policy reforms after years of false dawns, amid hopes the changes could spur growth.

After months of torturous negotiations with the crossbenchers, the government yesterday passed sweeping overhauls of media ownership and concentration laws, with Communications and Arts Minister Mitch Fifield succeeding where so many before him had failed.

Major changes include the removal of the two-out-of-three ownership rule and the 75 per cent audience-reach rule that the industry blames for creating an uneven playing field against the likes of Facebook and Google.

7.45am: ASX set to open slightly higher

The Australian market is tipped to open slightly higher, despite negative sentiment prevailing virtually across the board of major international bourses.

At 7am (AEST), the share price futures index was up seven points, or 0.12 per cent, at 5,742.

In the US key exchanges, only the Dow closed in positive territory, thanks to a lift in Boeing after Deutsche Bank raised its price target on the aerospace and defence stock.

In Europe and Asia, shares fell, in large part after Chinese data hinted that the world’s second largest economy could start to lose some steam. China’s fixed-asset investment grew a disappointing 7.8 per cent in the first eight months of 2017, the weakest pace since December 1999 and cooling from 8.3 per cent in January-July, while factory output growth rate was the weakest in nine months.

The Dow rose 0.2 per cent, while the S & P 500 lost 0.11 per cent and the Nasdaq Composite dropped 0.48 per cent, hurt by Apple’s 0.86-per cent decline. Locally, no major economic news is expected today.

In equities news, Qantas is slated to release its annual report.

The Australian market yesterday closed slightly lower for a second day running as mining stocks dipped but better-than-expected jobs growth helped lift the Australian dollar back around 80 US cents territory after an overnight dip. The benchmark S & P/ASX200 index fell 5.6 points, or 0.1 per cent, to 5,738.7 points.

The broader All Ordinaries index lost 5.6 points, or 0.1 per cent, to 5,798.4 points.

Meanwhile, the Australian dollar has retraced some losses against a weakened US dollar to again touch US80 cents.

At 7am (AEST) the local currency was trading at US80.05 cents at, from US79.96c yesterday.

AAP

7.10am: Dollar slips against greenback

The Australian dollar is slightly lower against its US counterpart, which enjoyed a brief boost from US CPI data before turning back lower.

At 6.35am (AEST), the Australian dollar was worth US79.93 cents, down from US79.96 cents yesterday.

Westpac’s Imre Speizer says the greenback enjoyed only a brief boost from US consumer price index data.

He said the US CPI rose 0.4 per cent in August, against an expected 0.3 per cent, taking the year-on-year rate to 1.9 per cent, when the market had expected 1.8 per cent.

“The core measure was up 1.7 per cent year-on-year, versus the 1.6 per cent expected,” he said in a morning note.

“The US dollar index is down 0.4 per cent on the day ... (while the) AUD reversed its Australian jobs data gains, falling from 0.8010 to 0.7956 before retracing in New York to 0.7995.”

Locally, there are no major risk events but overseas, US August retail sales are expected to increase just 0.1 per cent following a 0.6 per cent jump in July.

“Westpac forecasts a 0.3 per cent gain with stronger consumption growth continuing into the third quarter.”

He said the local currency could rise a little higher on Friday. “(But) fresh North Korean headlines plus any lingering effects from the US inflation data should cap it at 0.8020 today.” The Aussie dollar is also lower against the yen and the euro.

AAP

7.00am: US consumer prices spike

Rising fuel and shelter costs drove up US consumer prices in August, a sign inflation could be gaining pace after remaining stubbornly sluggish for months, according to government data.

The new figures come the week before the Federal Reserve is due to review benchmark US interest rates and could boost the position of those who support a third rate increase this year, although that would be unlikely to happen before December.

The Consumer Price Index, which tracks the cost of household goods and services, jumped 0.4 per cent last month, its biggest increase since January and a tenth of a point higher than the consensus forecast.

The energy index rose 2.8 per cent, driven in large part by a 6.3 per cent jump in gasoline prices, while costs for shelter rose 0.5 per cent, its biggest monthly gain in ten years.

On a 12-month basis, the index rose 1.9 per cent over the same month in 2016, up from 1.7 per cent last month.

Economists had been flummoxed in recent months as inflation and wage gains remained tepid despite steady job growth and economic expansion. The Fed initially wrote off stagnant and falling prices, attributing them to a series of one-off “idiosyncratic” figures, but even they were starting to look deeper.

“The spell has been broken,” Ian Shepherdson of Pantheon Macroeconomics wrote in a client note, noting that the important categories of rent, and owners’ equivalent rent, had surged.

AFP

6.55am: Trump ‘respects’ Yellen

President Donald Trump has yet to make up his mind about who should succeed Federal Reserve Chair Janet Yellen when her term expires in February, saying he has respect for the incumbent.

“I do respect Chairman Yellen a lot. I like her and I respect her but I haven’t made that decision yet. I think the country is doing well,” Trump told reporters travelling back with him from Florida on air force One.

Reuters

6.50am: Dow in 3rd straight record close

The Dow Jones Industrial Average logged its third record close of the week, even as other major US indexes edged slightly lower.

Stocks hovered between small gains and losses for much of the day, marking a pause after the Dow industrials, S & P 500 and Nasdaq Composite closed at records together two consecutive sessions in a row.

Tensions between the US and North Korea have eased somewhat, and political gridlock in Washington has appeared to ease, helping stocks generally move higher this week.

Still, some investors said they are avoiding new bets while they wait for clarity on a number of potential risks — including signs of rising inflation, a coming Republican tax proposal and the start of the next earnings season.

“The market continues to hit all-time highs, yet there are a myriad of excuses for it to sell off,” said Michael Scanlon, a portfolio manager at Manulife Asset Management. “Until we get to the next earnings season and see a draft of the tax proposal, markets may cool.”

The Dow industrials rose 45 points, or 0.2 per cent, to 22203. The S & P 500 declined 0.1 per cent, while the Nasdaq Composite fell 0.5 per cent.

Australian stocks are poised to move modestly higher at the open. At 6.50am (AEST) the SPI futures index was up nine points.

US investors proceeded to buy up shares of hard-hit energy companies, putting the S & P 500 energy sector, up 0.4 per cent, on pace for its best week since September 2016. US crude has rebounded this week as data have pointed to falling global oil supplies and stronger demand.

Dow Jones Newswires

6.40am: Pound shoots higher as stocks slide

The British pound surged after the Bank of England hinted at an early interest rate hike, while most of the world’s stock markets languished after disappointing Chinese economic data.

Asian equities declined on profit-taking, having rebounded earlier this week on easing North Korea tensions and relief that Hurricane Irma had not been as devastating to Florida as feared.

Hong Kong and Shanghai stocks each slid after a disappointing print on Chinese factory production, retail sales and state investment.

The negative sentiment spilt over into the eurozone where Frankfurt closed lower, but Paris remained, just about, in positive territory.

The Bank of England (BoE), as expected, maintained its key interest rate at a record-low 0.25 per cent despite surging inflation. But analysts remarked that despite no change to the rate at September’s meeting, the tone of the minutes indicated that the BoE was readying for a rate rise.

“The accompanying statement contained some hawkish rhetoric with perhaps the most telling line revealing that all MPC members think that rate hikes will be faster than the current market pricing and this has provided the catalyst for a strong move higher in the pound,” said David Cheetham, chief market analyst XTB online currency trading platform.

Sterling shot up from around $US1.32 when the decision was announced to over $US1.33 as the currency took “centre stage on the back of a hawkish Bank of England policy statement”, as Forex.com analyst Fawad Razaqzada put it.

But that sent London’s FTSE-100 tumbling as many companies listed on the blue-chip index make most of their earnings abroad, and a strong pound dampens profits when they are converted into sterling.

The FTSE closed down 1.1 per cent, Frankfurt ended down 0.2 per cent and Paris closed up 0.2 per cent.

AFP