Retail REITs’ shares fall amid structural, cyclic headwinds

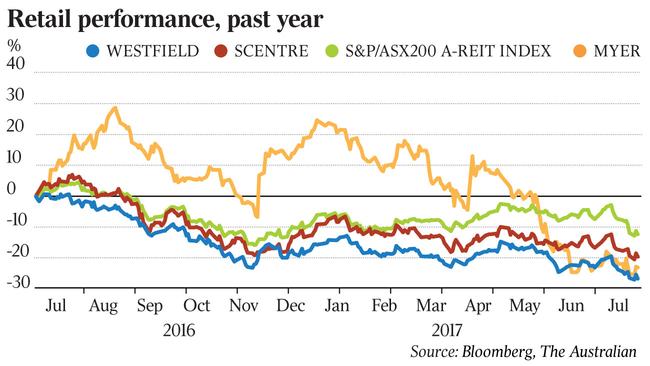

The retail sector is facing structural and cyclic headwinds as share prices for retail REITs hit multi-year lows.

The retail sector is facing structural as well as cyclic headwinds, analysts and fund managers say, as share prices for some Australian retail REITs hit two-year lows despite a pick-up in retail sentiment this week.

The trend to online shopping and the looming entry of Amazon in Australia have prompted concerns about the impact on retailers and mall owners, while some investors have been rotating out of retail REITs and into office names.

Westfield Corporation shares have fallen to their lowest level since November 2014, trading yesterday at $8.01.

Scentre has slipped to its lowest level since December 2015 and Vicinity was trading at its weakest point since October 2014.

Even so, retail sales rose more than expected in May, after an increase in April, according to ABS data.

Fund managers said although some of the issues facing retail were cyclic, such as high household debt reducing shoppers’ disposable incomes, others such as the growth of eCommerce were structural.

Resolution Capital portfolio manager Andrew Parsons said the retail mix had changed “constantly” over the past 40 years, with retailers in emerging categories replacing any failed tenants.

“Consumer spending patterns are shifting to online so finding replacement tenants is probably going to be a little more challenging,” he told The Australian.

Mr Parsons said the way to face the structural challenge was by “selling assets aggressively”, highlighting Westfield’s divestments particularly in the US over the past decade. “I think they’ve shown the way (but) others are too slow to cotton on.”

Managing director of Folkestone Maxim Asset Management Winston Sammut said investors thought the outlook for rental increases for retail landlords was “pretty well zero”.

A combination of the shift in spending to entertainment and food, and lower spending in general in addition to the threat of online retailing and the wave of retailer failures, was weighing on the sector.

“The perception is that the good times for retail landlords, and retail, is over,” he said.

CLSA head of Australian real estate Sholto Maconochie said rising mortgage costs were putting pressure on consumer spending, which was a cyclic issue, but the adoption of smartphones and growth in online shopping were structural changes.

The winners would be convenience formats and the highest quality centres, while losers would be subregional-style malls in the middle, in terms of size.

Morningstar analyst Tony Sherlock said pressure from digital retailers was a structural threat to which landlords needed to adapt. “The threat of online sales will not go away,” he said.

Adding office towers and apartments to mall sites was one way for landlords to adapt, he noted.

Michael Doble, chief executive of real estate securities at APN Property Group, said despite worries over the trend to online shopping, less than 5 per cent of online retail sales in the US and Australia were competing with bricks and mortar retailers.

“Structural change isn’t something to be feared the way that the market is pricing the apparent fears,” Mr Doble said.

“People will continue to want to go to a public place and gather and meet their friends and shop and eat something and see a film and then leave.

“If we all think that people are going to huddle around under their doonas and buy things and have them delivered for the rest of their lives … you’re absolutely kidding yourselves.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout