Trading Day: live markets coverage; Energy stocks shine under pressure; plus analysis and opinion

The ASX closes lower as geopolitical pressures test investor nerves, while a crude oil surge sures up energy names.

Welcome to Trading Day for Tuesday, September 26.

Samantha Woodhill 4.55pm: Stocks slip as uncertainty drags

Big miners and financials weighed on the stock market today as geopolitical tensions dragged on investor confidence, while energy names provided shelter underlying crude oil shot higher.

The benchmark S&P/ASX200 was down 12.7 points, or 0.22 per cent, at 5,671 points. The broader All Ordinaries index was down 12.1 points, or 0.21 per cent, at 5,729.6 points.

The bourse bore a choppy session and investors failed to show a convincing push toward risk options as the latest retort from North Korea’s foreign minister in the rouge nation’s war of words with the United States sparked worry.

“Without question the biggest worry is that the North Koreas shoot down a US aircraft or worse take out a US warship. That would change everything dramatically and the immediate ramifications would be dire,” said Institutional Sales and Trading Director Bell Potter’s Richard Coppleson.

Commonwealth Bank stocks were down 0.94 per cent at $75.10, ANZ shares were down 0.47 per cent to $29.86. Westpac was up 0.09 per cent, closing at $31.89 and NAB gained 0.16 per cent, closing at $31.33.

In resources, BHP slid 0.73 per cent at $25.79 and Rio Tinto shares shed 0.24 per cent to $65.85. Fortescue was down 1.95 per cent to $5.03.

Rosanne Barrett 4.00pm: Syrian billionaire scoops up GBR port

The acquisitive international company backed by Syrian billionaire Ghassan Aboud has bought Port Douglas’ Reef Marina with plans to pour more than $100m into its redevelopment.

In its fourth far north Queensland tourism development purchase in less than two years, Crystalbrook Collection today announced it had bought the marina and development site and planned to upgrade it into a superyacht facility with a 100-room hotel, 50 apartments, and a shopping and dining precinct.

Crystalbrook Collection owner, the Dubai-based Mr Aboud, said the company wanted to put the tourist enclave on the international map.

3.55pm: Federal budget’s $590m corporate bonus

Corporate tax revenue overshot Federal government estimates by $590m in the 2017 fiscal year, according to official budget data released this morning.

The government brought in $68.4bn from companies over the period, a significant component of total tax revenue that also came in $4.4bn over Canberra’s estimates.

“Revenue was up $4.1bn on the last estimate we provided for the 16-17 year in the budget, but was down around just over $1bn from what we announced on budget night in 2016-17,” said Treasurer Scott Morrison.

“What this shows is that the government has been keeping expenditure under control.”

. @ScottMorrisonMP : There is a $33.2 billion deficit for 2016-17, down from $37.6 billion forecast in May. MORE https://t.co/fZjHzo0vwE pic.twitter.com/IL9TpnylBw

— Sky News Australia (@SkyNewsAust) September 26, 2017

3.45pm: ASX200 hits new intraday low

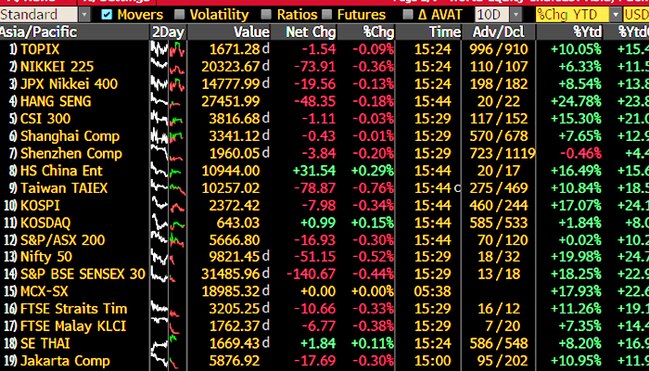

The S&P/ASX200 hits an intraday low of 5666.8, down 0.3 per cent as most major sharemarkets across Asia-Pacific remain under pressure.

Bridget Carter 3.35pm: Credit Suisse puts figure on Netwealth

Netwealth has been valued at between $683 million and $902 million by analysts at Credit Suisse and UBS.

The company has plans to tap the market for about $300 million ahead of a listing on the Australian Securities Exchange around November.

Credit Suisse analysts estimate the company’s equity value to be between $710 million and $902 million, which equates to between 26 and 33 times the group’s pro forma net profit for fiscal 2018.

UBS analysts have valued the company at between $683m and $847m, equating to between 25 and 31 times its forecasted earnings — more to come from DataRoom

3.25pm: ASX200: Energy holds firm in fickle trade

The local sharemarket bears the weight of investor indecision as North Korean angst tests risk resolve and weakness in Australia’s largest export iron ore ripples through sentiment.

The S&P/ASX200 index was last down 0.1 per cent at 5677 as the session continues to serve up volatility to those trading the index.

Big banks manage to eke out slight gains aside from CBA, down 0.5 per cent, while diversified miners BHP and Rio both trade lower by 0.6pc and 0.2pc respectively.

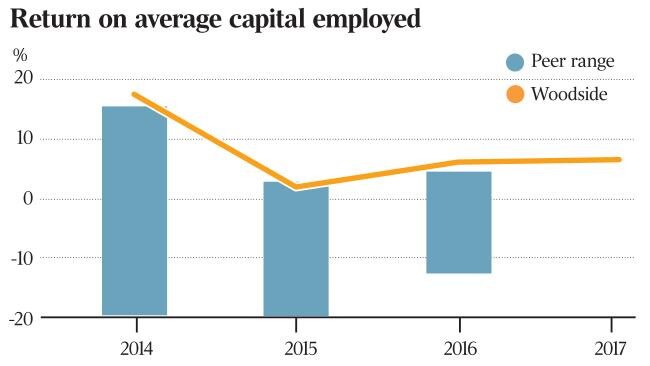

Energy names are on a tear as Woodside, Santos and Oil Search all stack on nearly 3 per cent each in the session following a surge in underlying commodity crude oil overnight.

“Supply disruptions, combined with solid global demand, are working to support prices,” said ANZ senior economist Cherelle Murphy.

“Supply in the US continues to be hampered by rough Atlantic seas while concerns about potential supply disruption related to the Kurdish independence vote also impacted.”

Eli Greenblat 3.15pm: Woolies to air minority interests

The annual general meeting later this year for the nation’s biggest supermarket chain Woolworths looks in danger of being hijacked by unnamed human rights and social activists after Woolworths revealed that two resolutions put by a tiny minority of shareholders would be put to the AGM in late November.

In a brief release to the Australian Securities Exchange this afternoon, Woolworths said that resolutions for consideration at the AGM had been received under section 249N of the Corporations Act from 106 Woolworths shareholders representing roughly 0.0097 per cent of shares on issue.

The first resolution is for an amendment to the Woolworths constitution that will insert a new clause allowing member resolutions at general meetings.

However, the more murky resolution to put to Woolworths shareholders in November is on human rights as it applies to the retailers operations and supply chains — more to come

WOW last up 0.3pc $25.26

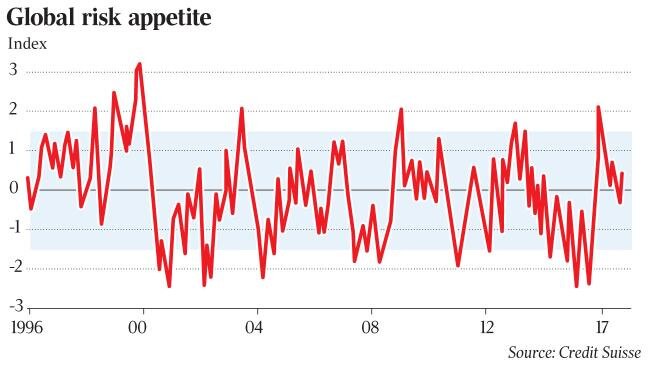

Stephen Bartholomeusz 2.50pm: The eerie quiet on Wall Street

One of the peculiar aspects of this post-Trump environment is how calm, indeed buoyant, markets have been despite the turbulence and threats to stability around them.

There was a little tremor overnight after the latest bout of sabre-rattling between North Korea and the US, with North Korea declaring that President Trump had declared war on it and threatened to shoot down US warplanes regardless of whether they were in its airspace or not.

After an initial sell-off, however, the US market closed only about 0.2 per cent lower and remained just below the record levels reached earlier this month and still on track to achieve one of the longest winning streaks in history.

A piece of research from Goldman Sachs’ international equity strategists issued yesterday puts the current bull market in context. The analysts said the S & P 500 is currently in the fifth-longest period in history without a five per cent correction. Should it continue, by December it would be the longest such streak in history.

Volatility, not just in equity markets but across most asset classes, is at all-time lows despite the volatility in the external environment. That’s not necessarily a good signal, given that prolonged periods of exceptionally low levels of market volatility have tended to end with a bang.

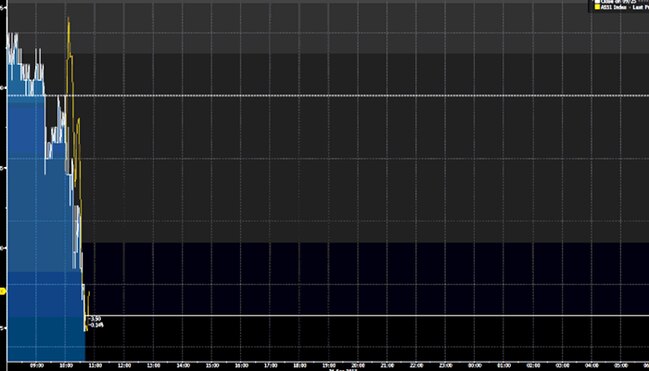

2.00pm: ASX200: ‘Death cross’ pattern looms

The S&P/ASX200 index continues to trade within the tight range established early June, technical traders keenly tuned into price action after the index established a ‘Death Cross’ pattern on Friday last week (see below)

An ominous pattern signified by a break below a long term moving average by its shorter term counterpart, pictured below a notable cross of the 100-day (green) and the 200-day (yellow).

Confirmation of a downside break to the current trading range likely at 5630.

Index last down 0.1pc at 5679.1

1.45pm: Iron ore’s China outlook foggy: Goldman

Iron ore prices are likely to face pollution cuts in China in the December quarter according to Goldman Sachs.

But at the same time the firm sees healthy steel demand in China which should offset attempts to reduce pollution.

After rallying 40pc in July and August, iron ore prices fell 20 pc to $US64 a tonne in the past three weeks, within 10pc of Goldman’s year-end target of $60 a tonne.

“If part of the recent sell-off was driven by China growth concerns, then we don’t think the downside to iron ore prices is huge as upcoming data should be supportive of risk sentiment,” says GS analysts led by Hui Shan.

“Overall, we see some but not a lot of downside to iron ore prices and our year-end forecast remains $60 a tonne. Moreover, we expect persisting divergence between steel and iron ore prices and between high-grade and low-grade iron ore prices on China policies.”

Ben Butler 1.40pm: Tabcorp, Tatts merger hits date setback

The timetable set down by gambling giants Tabcorp and Tatts to execute their $11bn merger has blown out despite a court win this morning.

Justice John Middleton, the president of the Competition Tribunal, granted Tabcorp a speedy re-hearing of its application to approve the merger over the protests of the competition watchdog and James Packer-backed corporate bookmaker CrownBet.

However, the dates set down by Justice Middleton — October 24 and 25 — fall after a proposed meeting where Tatts shareholders are to vote on the deal, on October 18, and clash with the date by which Tatts hoped to get court approval, October 24 — read more

TAH last down 0.6pc at $4.34, TTS last down 1.3pc at $4.08

1.20pm: Sydney Airport names new CEO

Sydney Airport has named Geoff Culbert as its new chief executive officer effective January 2018 following Kerrie Mather’s announced retirement in March this year.

Mr. Culbert has been president and chief executive of GE Australia and New Zealand & Papua

New Guinea since 2014 after ten years as a legal practitioner.

“Aviation is one of the most dynamic and fast changing industries in the world,” said Sydney Airport chair Trevor Gerber, “Geoff embraces innovation and technology and this ongoing focus will position Sydney Airport for future success.

“He also has strong and established relationships with many of Sydney Airport’s key airline and business partners, and across all levels of government” — read more

SYD last $7.22

Paul Garvey 1.10pm: Guard dies in Mustang ruby heist

A guard has died during a robbery at a ruby mine run by ASX-listed Mustang Resources.

Mustang owns the Monetpuez ruby mine in northern Mozambique and said this morning that a safe containing 19,000 carats of mostly low-quality rubies had been stolen in the early morning raid.

The company did not provide any details of the circumstances that led to the guard’s death — read more

MUS last down 10pc at $0.08

Samantha Woodhill 12.40pm: Profits safe from ATM fee cut: Deutsche Bank

The decision by the four major banks to stop charging fees for foreign bank ATM withdrawals will have a negligible impact on profit, Deutsche Bank says.

In a report released today, Deutsche said the move indicates that political pressure on the banking sector remains following recent “mishaps” around conduct and consumer protection.

NAB, Westpac and ANZ quickly followed suit after the Commonwealth Bank announced it would axe withdrawal fees for non-bank customers on the weekend.

Deutsche said the move will have a negligible impact on profit as the major banks each only generate less than $40m in revenue from foreign ATM withdrawals.

“This translates into a small impact on earnings, of around 0.2 and 0.3 per cent a year,” the report said — read more

12.20pm: Capex sword double-edged: Credit Suisse

A revival in Australian firms’ capital expenditure plans has mixed implications for equities, according to Credit Suisse.

“Rising capex will hopefully support growth in the future, but it does so at the expense of dividends now,” Credit Suisse Australia equity strategist Hasan Tevfik says.

“For the first time in many years, Australian shareholders are being asked to endure less dividends today for potentially more tomorrow.”

He notes that while capex for S&P/ASX 200 ex-financials companies is expected to rise by a solid $9bn to June 2018, dividends are forecast to rise by paltry $1bn.

In this environment, he favours companies that generate most of the business from other businesses. ANZ, NAB, Macquarie, AGL and Computershare are among the latest companies in that group.

Stocks which will be able to grow dividends and capex are also expected to outperform. BHP, CSL, RIO, AGL and RHC are among the biggest in that group.

Overall, Mr Tevfik maintains that a pick-up in capex will help sustain the current Australian earnings expansion, keeping him positive on Aussie equities.

11.35am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Shaw and Partners

12.15pm: Gerard Burg — NAB Senior Asia Economist

12.45pm: Janu Chan — St George Senior Economist

(All times in AEST)

11.15am: ASX can duck FANG sell-off: CMC

Aussie shares may be somewhat insulated from a potential sell-off in FANG (Facebook, Amazon, Netflix and Google) stocks, according to CMC Markets.

“Last night’s weakness in US markets was heavily influenced by a sharp sell-off in the big, highly valued US tech stocks,” he says.

“Of all the stocks vulnerable to a pullback in valuations due to concerns over rising interest rates, the FANGS loom large. This is a circumstance when the Australian index may benefit from its lack of exposure to this sector.”

He also says investors are likely to be “looking for value” as the S&P/ASX 200 nears the bottom of a 3 month trading range.

Rachel Baxendale 11.10am: Federal budget deficit, revenue shrink

Australia’s budget deficit is $4.4 billion lower than forecast in the May budget, but revenue is also down almost $23bn on predictions, according to 2016-17 budget data released this morning.

Treasurer Scott Morrison announced the budget deficit has come in at $33.2bn, or 1.9 per cent of GDP, down from the $37.6bn forecast.

Mr Morrison said social services payments had come in at 25 per cent of GDP, down on the 25.8 per cent announced as part of the 2015-16 Midyear Economic and Fiscal Outlook (MYEFO) — read more

. @ScottMorrisonMP : There is a $33.2 billion deficit for 2016-17, down from $37.6 billion forecast in May. MORE https://t.co/fZjHzo0vwE pic.twitter.com/IL9TpnylBw

— Sky News Australia (@SkyNewsAust) September 26, 2017

11.00am: ASX200, US futures fall in tandem

Australia’s S&P/ASX 200 share index fell as much as 0.2pc after erasing a 0.3pc rise in early trading.

It’s tracking a slight fall in US index futures after belligerent comments from N Korea overnight.

10.30am: ASX200 swings at the open

Australia’s S&P/ASX 200 is flat at 5684 after rising 0.3pc to 5698.5 in early trading amid gains in energy, healthcare, utilities and industrials.

Santos, Oil Search, Woodside and Origin are up 1.4-2.5pc after WTI crude rose 3.1pc last night.

Premier Investments is down 4.4pc, weakest in the S&P/ASX 200 after its results yesterday.

Fortescue Metals is down 2pc after Morgan Stanley cut its rating on the miner.

10.15am: Premier Investments opens down 7pc

Shares in Premier Investments have shed over 7 per cent at the open to as low as $12.67 in the second session after the retail portfolio manager released its full-year results and chair Solomon Lew launched a scathing attack on management of its brand new investment Myer (MYR).

10.05am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Michael McCarthy — CMC Markets

10.15am: Nigel Littlewood — Harness Asset Management

10.45am: Richard Gluyas — The Australian

11.00am: Peter Cohen — Leyland Asset Management

11.15am: Rudi Filapek-Vandyck — FNArena

(All times in AEST)

10.00am: ASX200 to lift amid resource assortment

Australia’s S&P/ASX 200 share index is expected to open up about 0.3pc based on overnight futures relative to estimated fair value.

Belligerent comments from N Korea pushed the S&P 500 down as much as 0.6pc last night but it recovered to close down 0.2pc.

While spot iron ore slipped 0.8pc to $US63.06 a tonne, BHP ADR’s equivalent close at $26 was just 0.1pc below the local close.

WTI crude jumped 3.1pc to $US52.22 and spot gold rose 1pc to $US1310.78, potentially helping the energy and gold sectors.

But Morgan Stanley has downgraded Fortescue, Evolution and Whitehaven, while Goldman cut Western Areas.

The calendar is quiet apart from a speech from Fed chief Janet Yellen later today.

Overall the index remains range bound within the 5630-5836 range.

Index last 5683

9.55am: Woodside eyes Quandrant assets

Bridget Carter and Scott Murdoch write:

Woodside Petroleum is believed to have cast its eye over Quadrant Energy for a second time as owners Brookfield and Macquarie Group forge ahead with plans for a listing in April next year.

However, while the $25 billion Australian-listed oil and gas company is believed to have circled Quadrant, its interest is said to extend only to its liquefied natural gas assets rather than its domestic gas operation — read more from DataRoom here

9.50am: Oil prices return to bull market

Alison Sider writes:

US oil prices returned to bull-market territory while the global benchmark hit a two-year high, as investors gained faith that OPEC will successfully shrink a global supply glut.

A drumbeat of bullish data in September, including the International Energy Agency’s upward revision to its demand outlook, has lifted prices. Investors have become more confident that the Organization of the Petroleum Exporting Countries will continue cutting production and that its efforts are helping bring oil’s supply and demand into balance.

Paul Garvey 9.45am: Exchange raises gold stock flag

The Australian Stock Exchange has flagged it will force the suspension of the bulk of Australia’s listed gold sector should the West Australian government’s new gold royalty hike find its way through the state’s parliament.

A spokesman for the ASX told The Australian that the exchange expected the affected gold producers and developers to update the market on the impact of the royalty change once it had been passed.

It means the ASX could repeat the dramatic steps it took earlier this year, when it suspended more than a dozen resource stocks after the African nation of Tanzania introduced a sweeping overhaul of its royalty and tax regime.

9.35am: JPMorgan abandons rate cut call

JPMorgan chief economist Sally Auld has abandoned her prediction of two more RBA rate cuts.

“We now expect the RBA to be on hold for the foreseeable future,” Ms Auld says.

“While growth, inflation and unemployment rate outcomes have broadly tracked as we forecast this year, we have been wrong in our call for further easing from the RBA.”

She says the state of household balance sheets is a stronger binding constraint on lower rates in Australia than anticipated, and inherent flexibility in the inflation target and strong growth in the global economy have allowed the RBA to sustain a period of policy stability, despite a run of softer GDP outcomes and little progress in reducing excess capacity in the labour market. Stronger than expected employment data and upbeat comments from RBA Governor Lowe this month saw ANZ and NAB predict two rate hikes next year.

Richard Gluyas 9.30am: Livingstone to front bank grilling

The parliamentary committee that grills the major bank chief executives has reached further into the industry’s boardrooms, calling Commonwealth Bank chairwoman Catherine Livingstone as a witness next month.

Ms Livingstone and CEO Ian Narev will appear before the house economics committee, which is chaired by Liberal MP David Coleman, on October 20 — read more

CBA last $75.87

9.20am: Woolies, Harvey returns policy: UBS

Prospects for capital management in the consumer sector have increased due to depressed valuations, conservative gearing and relatively-low funding costs, with Harvey Norman and Woolworths at the top of the list, according to UBS.

UBS tips a $300m buyback on HVN which would be 4-5pc accretive to EPS. On WOW it sees an offmarket buyback up to $1bn, which would be about 2pc accretive to EPS.

“We favour companies with international expansion (CGC), low exposure to a macro slowdown (CGC) and upside from turnaround (WOW),” UBS analyst Ben Gilbert says.

“While competition in retail is expected to intensify (Amazon report), we see an opportunity in HVN given the depressed valuation and scope for capital management.

We are negative on retailers with high correlation to a slowing consumer and those facing structural headwinds (MYR, MTS, CCL).”

WOW last $25.14, HVN last $3.98.

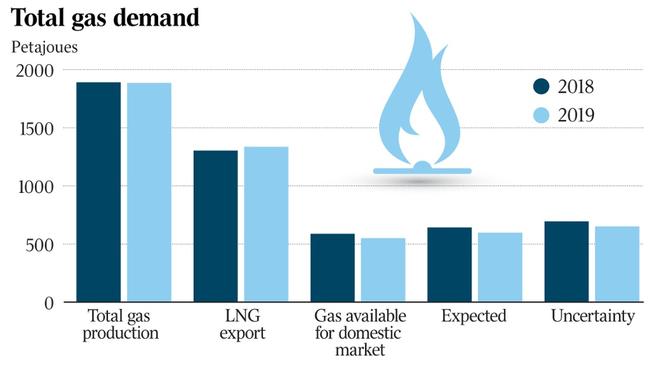

Matt Chambers 9.15am: Majors to head off gas squeeze

Gas exporters say they will push more production into east coast domestic markets after a surprise drop-off in Bass Strait’s production outlook and increased gas power demand drove alarming supply shortage forecasts from the nation’s energy and competition watchdogs.

The unwelcome return to forecasts of a gas shortage next year came with revelations from the Australian Competition & Consumer Commission that records of board meetings at LNG exporters show expectations of a long-term domestic market shortfall that will not balance without more Queensland supply.

9.10am: Pullback talk: Timing is everything

It may seem inevitable, but talk of a pullback in the global sharemarket may be premature.

Bond yields should rise modestly amid signs of synchronised global economic growth and the start of quantitative tightening by the Federal Reserve next month, but there are no good reasons for a sharp sell-off in equities, according to Credit Suisse global equity strategist Andrew Garthwaite.

As of last week, the S&P 500 was up 12 per cent this year after hitting a fresh record high. Moreover, it hasn’t fallen by more than 5 per cent for more than 14 months — something it has only done twice since 1964. But six months after those two occasions the flagship global index was higher.

Despite rising geopolitical tensions over North Korea, the level of calm in global financial markets is perhaps unprecedented, with the MSCI All-Country World index rising 10 months in a row.

9.05am: Analyst rating changes

Fortescue cut to Underweight — Morgan Stanley

Whitehaven cut to Underweight — Morgan Stanley

Sandfire raised to Equalweight — Morgan Stanley

Evolution Mining cut to Underweight — Morgan Stanley

Sonic Healthcare raised to Neutral — JPMorgan

Western Areas cut to Sell — Goldman Sachs

Downer EDI raised to Buy — Citi

9.00am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Shaw and Partners

9.15am: Steven Dooley — Western Union Business Solutions

9.30am: Felicity Emmett — ANZ

9.45am: Ric Spooner — CMC Markets

10.00am: Michael McCarthy — CMC Markets

10.15am: Nigel Littlewood — Harness Asset Management

(All times in AEST)

8.55am: Nufarm profit, dividend lifts

Agricultural chemical company Nufarm booked a FY17 net profit of $114.5m, a 24.7pc increase on a pre-items basis and below Bloomberg’s analyst consensus estimates of $118m.

Alongside results, the company announced a 1cps increase in its final dividend to 8 cents-per-share.

“It was a challenging year for the industry, with extremely competitive conditions driven by lower crop prices and lower demand for crop protection chemistry,” said Nufarm managing director and CEO Greg Hunt.

NUF last $8.97

8.45am: Winter came through for Kathmandu

Adventure gear retailer Kathmandu has lifted full-year profit by 13.5 per cent to $NZ38.04 million ($A34.8 million), helped by strong winter sales and improvements in promotions.

Revenue for the 12 months to July 31 was up 4.6 per cent to $NZ445.35 million, it said.

The company will pay a fully-franked final dividend of 9.0 NZ cents a share, up one cent from a year earlier — AAP

KMD last $1.94

7.45am: ASX set to open higher

The Australian market looks set to open around a quarter of a per cent higher, ignoring Wall Street’s negative lead where risk-averse sentiment, fortified by North Korea’s latest comments, pulled stocks lower.

At 7am (AEST), the share price futures index was up 14 points, or 0.25 per cent, at 5,685.

Many major equity markets fell in the offshore session, including Wall Street with investors shying away from riskier assets in favour of bonds, gold and the US dollar.

Investor sentiment was dented by North Korea’s statement that the US president Donald Trump had declared war on the country and it reserved the right to take countermeasures, including shooting down US bombers even if they were not in its airspace.

The White House disputed the declaration, calling the suggestion “absurd”.

The Dow Jones Industrial Average fell 0.24 per cent, the S&P 500 lost 0.22 per cent and the Nasdaq Composite dropped 0.88 per cent.

The US dollar index rose 0.5 per cent while gold bullion lifted one per cent.

Locally, in economic news today, Reserve Bank of Australia Assistant Governor (Financial Stability) Michele Bullock is slated to take part in a panel discussion at a Lander & Rogers and Westpac-hosted briefing entitled Where to from here? in Sydney.

Meanwhile, the ANZ-Roy Morgan Consumer Confidence weekly survey is due out.

In equities news, Kathmandu is releasing its full-year results and ASX holds its annual general meeting in Sydney.

The Australian market yesterday closed just in positive territory after shedding earlier gains across energy, mining and banking and a decline in consumer stocks.

The benchmark S&P/ASX200 index rose 1.6 points, or 0.03 per cent, to 5,683.7 points.

The broader All Ordinaries index gained 1.1 points, or 0.02 per cent, to 5,741.7 points

AAP

7.00am: Dollar slips

The Australian dollar has slipped against a strengthening US counterpart which has benefited from more risk-adverse sentiment.

At 6.35am (AEST), the Australian dollar was worth US79.37 cents, down from US79.59 cents yesterday.

Westpac’s Imre Speizer says markets had adopted a risk-adverse stance after inflammatory comments from North Korea.

North Korea’s foreign minister said US president Donald Trump had declared war on the country and it reserved the right to take countermeasures, including shooting down US bombers even if they are not in its airspace. The White House disputed the declaration, calling the suggestion “absurd”.

“The US dollar rose and bond yields and equities fell,” Mr Speizer said in a Tuesday morning note.

“The US dollar index rose 0.5 per cent ... (and) the safe-haven yen (and Swiss franc) outperformed, USD/JPY falling from 112.30 to 111.48.

“AUD slipped from 0.7970 to 0.7926.”

He said the main local risk event today would be Reserve Bank of Australia (Financial Stability) Michele Bullock’s participation in a panel discussion at the Landers & Rogers and Westpac-hosted briefing entitled Where to from here? in Sydney.

The Aussie dollar “could slip further to 0.7910 if the risk averse mood persists” on Tuesday, he said.

AAP

6.55am: Oil set to return to bull-market territory

Oil prices are poised to return to bull-market territory after a slow, laborious climb from their slide three months ago.

US crude futures are trading 22 per cent above this year’s low of $US42.53 on June 21.

West Texas Intermediate, the US benchmark, rose $US1.03, or 2.03 per cent, to $US51.69 a barrel on the New York Mercantile Exchange. US crude hasn’t settled above $US51 a barrel since May.

Brent, the global benchmark, was up $US1.50, or 2.64 per cent, at $US58.36 a barrel, trading at its highest level this year.

The shift has been triggered by renewed confidence that the Organization of the Petroleum Exporting Countries will continue cutting production and that its efforts are helping to drain a supply glut that has weighed on prices for more than three years. A drumbeat of bullish data in September, including the International Energy Agency’s upward revision to its demand forecast, have helped lift prices in recent weeks.

Iraqi Kurdistan’s independence referendum Monday also played a role in boosting prices, analysts said. Prices rose after Turkish president Tayyip Erdogan made a veiled threat to close the pipeline that allows Kurdish oil to reach the global market.

Dow Jones Newswires

6.50am: US stocks fall amid N Korea worries

Wall Street stocks fell overnight, pressured by the latest flare-up between Washington and North Korea, while petroleum-linked shares rose with spiking oil prices following Turkish threats to block Kurdish oil exports.

North Korea’s foreign minister accused US President Donald Trump of declaring war against his country and said Pyongyang was ready to defend itself by shooting down US bombers. The White House dismissed the claim as “absurd.”

With those tensions increasing daily, technology shares, which have had a good run for most of 2017, pulled back. Apple, Amazon, Microsoft and Google-parent Alphabet each lost one per cent or more.

But petroleum-linked companies such as ExxonMobil, Halliburton and Schlumberger advanced one per cent or more after Turkish President Recep Tayyip Erdogan threatened to block the key oil exports from Iraq’s Kurdish region which is holding an independence referendum.

The Dow Jones Industrial Average ended down 0.2 per cent at 22,206.09. The broadbased S & P 500 also shed 0.2 per cent to close at 2,496.66, while the tech-rich Nasdaq Composite Index tumbled 0.9 per cent to 6,370.59.

Australian stocks are poised to open higher. At 7.05am (AEST) the SPI futures index was up 14 points.

In the US, Facebook fell 4.5 per cent after disclosing late Friday that chief executive Mark Zuckerberg planned to sell up to 75 million shares to fund his philanthropic work. The social media giant also announced it was scuttling a plan to issue a new non-voting class of shares.

AFP

6.40am: euro slides after Germany election

The euro lost ground as investors worried about looming political infighting in Germany after an election that won Angela Merkel a fourth term as chancellor, but also gave a hard-right opposition party parliamentary seats for the first time.

“The markets’ initial reaction to the outcome of the German federal election has been negative,” said Fawad Razaqzada, an analyst at Forex.com. Merkel’s “poor showing” was weighing on the euro, he said.

Major equity markets across Europe were also lower by the end of trading although Frankfurt managed a stable finish, partly thanks to the eurozone currency’s weakness which tends to favour exporters.

Sentiment was not helped by Wall Street which, worried by Germany but also by Japan after Prime Minister Shinzo Abe called a snap election, turned resolutely lower approaching midday in New York.

Markets had already fully priced in a win for Merkel ahead of Sunday but her score, and that of the opposition AfD party, turned it into an “unconvincing election victory”, said London Capital Group analyst Jasper Lawler.

A dent in German business confidence, as reported by the Ifo institute Monday, also dragged on the single currency, analysts said.

But they also cautioned against excessive pessimism, saying that overall, positive sentiment prevailed towards Europe’s biggest economy.

London closed down 0.1 per cent, Frankfurt ended flat and Paris was down 0.3 per cent.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout