Credit Suisse: Global sell-off fears baseless

It may seem inevitable, but talk of a pullback in the global sharemarket may be premature.

It may seem inevitable, but talk of a pullback in the global sharemarket may be premature.

Bond yields should rise modestly amid signs of synchronised global economic growth and the start of quantitative tightening by the Federal Reserve next month, but there are no good reasons for a sharp sell-off in equities, according to Credit Suisse global equity strategist Andrew Garthwaite.

As of last week, the S&P 500 was up 12 per cent this year after hitting a fresh record high. Moreover, it hasn’t fallen by more than 5 per cent for more than 14 months — something it has only done twice since 1964. But six months after those two occasions the flagship global index was higher.

Despite rising geopolitical tensions over North Korea, the level of calm in global financial markets is perhaps unprecedented, with the MSCI All-Country World index rising 10 months in a row.

Volatility is extremely low again, with the S&P 500 volatility index, or VIX, recently falling back to 9.6 per cent after hitting a record low of 8.84 per cent in July.

However, that’s not necessarily a sign that investors are complacent, even if they don’t have much demand to protect their portfolios from a potential sell-off by buying put options.

Indeed, it may be justified by low volatility in economic growth and inflation, low volatility in corporate earnings, low corporate default rates and the low level of the real or inflation-adjusted Fed funds rate.

To be sure, the Fed Funds rate is rising and the market may be underestimating a December rise that could push bond yields higher due to their close relationship with short-term rates.

Credit Suisse finds that changes in the real Fed funds rate have historically led realised equity volatility by about two years due to the lags between official rate moves and risk-taking by financial institutions. On that basis, volatility should start to pick up since the Fed started hiking in December 2015, but previous instances of very low volatility haven’t necessarily preceded a big fall in equities.

But the current low volatility in markets, which is boosting the relative risk-adjusted return of equities — particularly relative to low bond yields — could encourage an almost $1 trillion shift in asset allocation to equities by risk parity managers and CTA managers, according to Garthwaite.

“It is quite possible in our minds that, with nearly $0.5 trillion of risk parity fund assets and $0.4 trillion of CTA assets, the low relative risk seen in equities over the past year does lead these market participants, as well as retail investors, to raise their equity weightings,” he says.

Fear of a repeat of the GFC crash in financial markets may have stymied that potential bond-for-equity switch in recent years, but, in his view, the further markets move away from this event, and the longer period of stability, the greater the likelihood that investor excess overcomes fear.

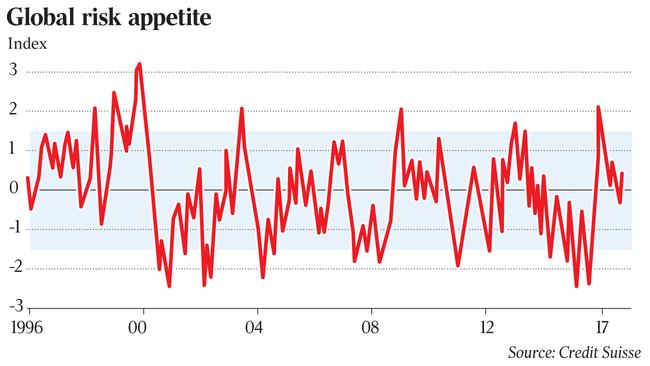

So far there have been few signs of investor excess. Despite equity markets pushing ever-higher — perhaps contrary to what one may expect — many indicators of sentiment or risk appetite are just at neutral or justified levels, and are “far from signalling excessive optimism”.

At the aggregate market level, global risk appetite is marginally above average levels but exactly in line with the levels he expects given the extent of new manufacturing orders.

His aggregate equity sentiment indicator is at neutral and the only individual components that show optimism are institutional investors’ net bullishness and skew relative to its short-run history.

Within equity markets, investors don’t appear to be discounting an overly bullish view of the economic cycle, as equity risk appetite on a sector basis is merely at neutral levels, while global cyclical stocks relative to defensives are trading in line with their 200-day moving averages.

Whereas the S&P/ASX 200 is almost flat after a pullback in earnings estimates since May, a strong performance by global equities has been driven by earnings estimates — rather than an expansion of price-to-earnings multiples — amid a “co-ordinated pick-up in global growth momentum”.

With new manufacturing orders near four-year highs and the share of global PMI’s above 52 at the highest in nearly six years, Garthwaite says the absence of headwinds is now improving the transmission of loose monetary policy to real economy outcomes.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout