Trading Day: live markets coverage; ANZ shares inflated: Bell Potter; plus analysis and opinion

Financials and resource stocks diverge as the ASX posts gains in the wake of fresh Trump tax developments.

Welcome to Trading Day for Thursday, September 28.

4.40pm: Stocks lift as investors eye Trump tax

Local stocks closed higher as investors around the world lauded fresh detail of US President Donald Trump’s tax agenda as a tailwind to global equity growth.

At the close, the S & P/ASX200 index was 0.1 per cent, or 6.1 points higher at 5670.4, while the broader All Ordinaries index also closed 0.1 per cent, or 6 points higher on 5731.5.

Caught up in the wake of growth optimism, the equity market eventually wound back decisive early gains as local investors looked onward to the political passage of a cut in the corporate tax rate from 35 to 20 per cent in the world’s largest economy.

“As negotiations intensify in coming weeks significant procedural, fiscal and political constraints are likely to become more apparent,” said Wespac FX strategist Richar Franulovich.

“Both the USD and US fixed income yields will be pressured higher near term amid heightened hopes.”

In Financials, Commonwealth Bank closed 0.36 per cent higher at $7.512 and Westpac was up 0.56 per cent at $32.13. NAB gained 0.54 per cent, closing at 31.47 and ANZ was down 0.20 per cent at 29.75 at the close — read more

James Kirby 4.20pm: ETFs woo fixed income investors

Australian investors love affair with hybrid notes — a widely held alternative to bonds — is about to be challenged. And it won’t be due to a sudden realisation they are riskier than most people think ... that message seems to fall on deaf ears.

Rather, as global broker Morgan Stanley points out it will be thanks to the arrival of ETFs (Exchange Traded Funds).

A string of new ASX listed bond-based fixed income ETFs offer local investors an exposure to what the global broker calls ‘true fixed income’.

Implicit in the new research from Nicholas Lim is the point that hybrids are ‘false’fixed income and the point is hard to deny. Hybrids are a melange of shares and bonds with shares acting as the dominant force: The woeful performance of even the most highly regarded ETFs such as CBA’s PERLS notes in the depth of the GFC proved that beyond doubt with the giant PCAPA note falling 25 per cent in the dark days of 2009.

3.50am: US tax upside circles pharma: Citi

Donald Trump’s US tax plan is potentially positive for the US pharma sector, according to Citi.

“Our initial take is that this tax blueprint, if enacted into law, would constitute a positive for the US pharma sector due to lower corporate tax rates, repatriation of offshore earnings — which would likely facilitate increased M & A, preservation of the R & D tax credit,” says Citigroup Global Markets vice president Liav Abraham. “We need to more fully explore the impact of a minimum US tax on foreign profits of multinationals.”

Otherwise he says the plan is “light on details” and leaves unanswered questions on the treatment of interest expensing and the “provision to stop corporations from shipping jobs and capital overseas”.

He also says it’s unclear whether the proposals are revenue neutral, but he feels the likely aim will be pass the legislation via the process of reconciliation — which requires revenue neutrality.

“The next step in the process will be to pass a budget resolution that includes reconciliation instructions for tax reform,” he says.

Producers note:CSL and Mayne Pharma both with exposure to US pharmaceutical sector.

3.20pm: Down Under moves up in expat eyes

After a higher salary? It’s simple really — move overseas.

A new survey by HSBC has found Australian expats earned an average salary of $173,535 in 2017, while the average earnings of a full-time adult at home would have been $83,637 according to the most recent Australian Bureau of Statistics data.

The international bank spoke with over 27,587 expatriates in 159 countries and territories to find that even if blind statistical opportunism was leading salary hungry Australian’s abroad, it isn’t keeping them there.

Of all expatriates Australian’s currently spend the shortest amount of time away from their home country according to the survey, with 34 per cent staying abroad for less than two years.

At the same time, Australia climbed the ranks of top destinations for surveyed expats to 7th from 11th the year before.

The data also ousts Switzerland as the best place to hunt a salary overseas at present with an average $AUD246,855 expat salary, while the Netherlands was voted the best place to raise a family away from home.

It was, however, Singapore that took out first prize with all things considered, and according to HSBC’s table below we’ll first need to climb the Rockies for a sporting chance at the top.

2.50pm: Wage growth ‘may never recover’

Philip Aldrick writes:

Wage growth may never recover to its level before the financial crisis because the structure of the labour market has changed, the International Monetary Fund claimed.

Across the developed world, pay is rising more slowly than before 2008 even though unemployment in many countries is lower.

The IMF said that higher levels of “involuntary part-time employment” were partly to blame and that the change may be permanent.

The fund’s work is a response to one of the more troubling post-crisis economic puzzles. Unemployment has fallen below 2008 levels in Britain, Germany, Japan and America, four of the world’s five largest economies, yet pay “remains markedly lower”.

2.23pm: ANZ reins hauled in by Bell Potter

Bell Potter has cut ANZ to “hold” vs. “buy” after share price gains reduced its appeal.

“Our estimates are largely unchanged and we have maintained the $32.50 price target,” says Bell Potter’s TS Lim.

“However, ANZ’s share price has had a strong run in the last quarter and the 12-month expected total shareholder return is now below 15 per cent.”

He says ongoing restructuring of the business to improve capital generation suggests ANZ will comfortably exceed APRA’s 10.5 per cent requirement by 2020.

And prospects of higher dividends and further capital management initiatives are more than likely over the next few years all else being equal.

He expects the potential sale of ANZ’s remaining investments should release a further $2.2bn in CET1 capital, lifting the ratio by about 55 basis points.

ANZ last up $29.86

2.20pm: Central bank inflation patience grows: Citi

Central banks are becoming more patient on inflation, lowering long-term volatility for financial markets and economies, according to Citigroup’s head of global economics, Ebrahim Rahbari.

For central banks with below-target inflation, many of the near-term implications are similar to if they had lowered their targets, notably the hurdle for incremental easing is rising and for tightening falling, he says.

“In our view, many central banks, including the BoJ, ECB, Fed and BoC, are turning increasingly patient due to limited ability to push inflation up more quickly, less concern about deflation and more concern about future inflation, and rising concerns about the implications of extraordinary monetary policies — including their political and financial stability costs,’ Mr Rahbari argues. “We generally think that greater central bank patience is probably a good idea and probably lowers long-term financial market and economic volatility by forging ever more extreme monetary policy.”

David Swan 2.05pm: ASIC sounds ICO bubble alarm

The corporate regulator ASIC today released guidance for businesses that undertake initial coin offerings (ICOs), amid fears of an asset bubble.

An ICO is a form of internet-based crowd-funding that can be a source of capital for start-ups, with organisations offering digital coins such as bitcoin in return for investment.

Though an increasingly popular fundraising method for cryptocurrency based start-ups — with celebrity endorsements coming from the likes of boxing champion Floyd Mayweather — the space is largely unregulated and ASIC is warning investors have a high chance of losing their cash.

“We want to ensure innovative firms understand the regulatory framework they may be operating under and ensure they meet any obligations they may have when raising funds in Australia,” ASIC Commissioner John Price said in a statement.

“ICOs are highly speculative investments, are mostly unregulated, and the chance of losing your investment is high — read more

1.55pm: All-time low for balding Shavershop

Personal grooming retailer Shavershop shears off as much as 35 per cent to hit an all-time record low of $0.42 cents on the market’s dire assessment of its updated FY18 forecast.

Investors can’t say they weren’t warned — in August Shavershop said key product supply issues were “expected to moderate our growth” in FY18 despite strong sales in the first seven weeks.

The moderation: a $13-15.5m range for FY18 earnings before interest, tax, depreciation and amortisation, at best a 4 per cent increase on its 18pc EBITDA improvement last year to $14.9m.

Shavershop raised $98m for its IPO last year with a share issuance of $1.05.

The company’s market cap now sits at $54.3m, SSG last $0.43.

1.40pm: Origin sells $1.6bn Lattice to Beach

Mike Cherney writes:

Australian energy producer Origin Energy Ltd. said it would sell its conventional upstream oil and gas business, called Lattice Energy, to Beach Energy Ltd. (BPT) for $1.6 billion.

Origin, which previously said it planned to sell the unit, will use proceeds from the sale to pay down debt. The deal has an effective date of July 1, 2017, but is subject to customary conditions.

Origin said that as part of the deal, the company secured access to a significant portion of Lattice Energy’s future east coast gas production through long-term gas supply agreements — read more

ORG last up 1.4pc to $7.56, BPT last $0.82 in trading halt.

Producers note: Beach Energy says it will fund the deal with a $1.575bn syndicated debt facility and $300m in equity capital via a $0.75/share entitlement offer.

Dow Jones Newswires

Samantha Woodhill 1.20pm: Trump’s ‘de facto’ Aussie tax hike: BCA

Donald Trump’s proposed tax reforms will push Australia’s competitiveness “further behind”, the Business Council of Australia has warned.

The BCA says there is “no question” tax reform in the US will have an impact on investment in Australia, and that is bad news for workers and businesses here.

“Every company tax reduction overseas is a de facto tax increase in Australia and a disincentive for investors,” BCA chief executive Jennifer Westacott said.

The US President early today unveiled a plan to overhaul the US tax system, including a proposed cut in the corporate tax rate from 35 per cent to 20 per cent.

“It isn’t just the United States acting, other nations like France are also moving towards more competitive company tax rates,” said Ms Westacott.

1.00pm: Outlook ‘as good as it gets’, adjust: PIMCO

PIMCO says the global economic and markets outlook is “as good as it gets.”

“When the macroeconomic environment is as good as it gets and valuations are tight, it is time to emphasise caution, capital preservation and diversified sources of carry away from the crowded trades,” PIMCO’s Jochaim Fels and Andrew Balls say in the report.

Their baseline economic forecast is for a continuation of synchronised world real GDP growth at a decent 3 per cent pace in 2018, low near-term recession risks, a moderate pick-up in underlying inflation in the advanced economies, mildly supportive fiscal policies and an only gradual removal of monetary accommodation.

Political risks emanating from nationalist/populist movements look more contained in their view — particularly in Europe — partly as a function of better economic growth.

China may well be successful in continuing to suppress volatility well beyond the 19th National Party Congress in October, but “there are a few problems that might pop up even over the short-term cyclic horizon and upset the eerie calm in financial markets.”

The risks that they see include the geopolitical threat from North Korea, the ageing US economic expansion, the coming end of central bank balance sheet expansion, and China’s political and economic course following the National Party Congress.

“We think it makes sense to emphasise portfolio liquidity and to avoid less liquid positions as a rule and focus on those bottom-up opportunities where we are truly paid for the risk,” Fels and Balls say.

They aim to generate above-market return from US non-agency mortgages, US agency mortgages, other select structured product opportunities, curve positioning, instrument selection, bottom-up credit positions, Emerging markets foreign exchange positions, EM local rate and external bond positions, and optimisation of bottom-up positioning with a high quality/income-focused bias more generally across specialist sectors.

“We expect to be slightly underweight duration overall, anticipating fairly range-bound markets but with the potential for a shift higher in yield across market levels that are low even in the context of our New Normal/New Neutral framework.”

Rachel Baxendale 12.35pm: Trump thrown down tax gauntlet: ScoMo

Treasurer Scott Morrison says Donald Trump “has laid down the challenge” on company tax cuts with his plan to reduce the US rate from 35 per cent to 20 per cent.

Mr Morrison said the Labor Party would leave Australian businesses “stranded on a tax island” and uncompetitive with the US, the UK, Singapore and other countries around the world if it did not allow the Turnbull government to proceed with plans to lower Australia’s rate to 25 per cent.

“Having a lower tax environment for business to invest is good for jobs, it’s good for investment, and the Labor Party through their politics of envy frankly just don’t get it, and they are putting a very heavy tax on jobs by not supporting us to have a more competitive tax environment,” Mr Morrison said.

12.20pm: Blood-bound boardroom beat: Credit Suisse

Family-owned companies tend to outperform global equity markets, according to Credit Suisse.

A Credit Suisse Research Institute review of the investment case for family-owned companies found they have outperformed broader equity markets in every region and sector by an annual average of about 400 basis points per year since January 2006.

It found that the financial performance of family-owned companies is also superior to non-family owned peers and family businesses appear to focus more on long-term growth and their share price returns have been stronger than their peers.

“The top league of these businesses is known worldwide, among them BMW, Nike, Roche, Tata Group or Walmart,” the CSRI review says.

“However, most observers are likely to underestimate just how successful many of the less publicly known family businesses have been over the past decades.”

11.50am: ASX200 gains as tax talk ignites markets

The local sharemarket shrinks earlier gains after its first decisively positive open this week, markets around the world rallying behind the prospect of a lower corporate tax rate for the world’s largest economy.

The S & P/ASX200 index remains 0.1 per cent in the black at 5669.3 after earlier gains as much as 0.4 per cent.

Heavily weighted to the index, financials are doing the main lifting — the Big Four up between 0.1-0.5pc — with most of the buying action further down the market cap ladder in Macquarie (+1.8pc) and Suncorp (+1.6pc), the latter upgraded by Goldman Sachs analysts in a note to clients.

Big resources struggle after mixed overnight commodities trade, BHP is in the red by 0.3pc while Rio and Woodside both bear losses near 1pc.

Bond proxies Transurban and Sydney Airport lose ground as the opportunity cost of shirking debt paper proves too high.

US and Australian 10-year government bonds came under pressure and yields jumped as funds flowed out the opposite direction into US corporate equities after President Donald Trump unveiled the Republican tax agenda.

The greenback similarly tracked northward as currency traders saw scope for expediency behind a widely anticipated near-term hike in the Federal Funds rate and positive US durable goods data.

The US-denominated Australian dollar remains 0.2 per cent in the red at US78.34 cents after it registered a reaction at 11:30am (AEST) when ABS jobs vacancy data revealed the number of open posts increased across the national economy in August.

11.30am: DATA: Jobs vacancies lift 6pc in August

Job vacancies rose 6pc in August after a 3.3 per cent uptick in July, according to data from the Australian Bureau of Statistics.

Stephen Bartholomeusz 11.25am: What markets gleaned from Trump tax

The release of the Trump administration’s plan for tax reform set markets alight overnight. The reaction may have been premature.

US stockmarkets hit another record, the US dollar surged and bond yields climbed in response to the unveiling by President Trump of the plan put together by the White House and Congressional Republican leaders that would, if implemented, produce the most comprehensive tax reform in the US for more than 30 years.

If the plan were implemented, the headline US corporate tax rate would be slashed from 35 per cent to 20 per cent. The US would move to a ‘’territorial’’ system for taxing the overseas earnings of US companies — US companies would largely pay tax only on US-based earnings — and there would be a one-off levy at a preferential rate on the accumulated past earnings of US companies offshore. The top tax rate for partnerships and small businesses would be cut to 25 per cent.

Seven individual tax brackets would be collapsed to three, standard deductions doubled, deductions for state and local taxes eliminated and estate taxes eliminated.

The market reaction to the plan suggests they were blindsided and that they had, after the debacle of the three failed attempts to ‘’repeal and replace’’ Obamacare, assigned a very low probability to any meaningful tax reform proposal being developed this year. The rise in higher taxpaying companies’ share prices, in particular, reflected a rush to price in the plan — more to come.

11.05am: Starpharma jumps, trial raises eyebrows

Starpharma has surged 3.2pc to a fresh 4.5 year high of $1.28 today with volume remaining strong.

Sustained strength in the share price follows the surge above major resistance at $1.00 last week.

Bell Potter’s Tanushree Jain raised his target price from $1.17 to $1.29 last month after the company reported positive data from its Phase 1 trial of DEP docetaxel.

Investors will be hoping that successful results will eventually lead to a takeover attempt by a major pharma company.

On the charts there’s potentially strong resistance at $1.32 and $1.40.

But the $1.00-$1.10 area now offers strong support for a further move toward the record high of $1.88.

SPL last up 1.6pc to $1.26

11.00am: A2 Milk wins China approval

Simone Ziaziaris writes:

The A2 Milk Company has had its application to continue selling its infant formula products in China approved by Beijing’s regulatory body.

The mandatory application to the China Food and Drug Administration (CFDA) was submitted in May by New Zealand formula manufacturer Synlait Milk (SM1), which has been in partnership with A2 Milk since 2010.

All manufacturers of infant formula must register brands and recipes with the CFDA in order to import products into China from January 1 — read more

A2M last up 2.5pc at $6.14

10.45am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Ben Jarman — JPMorgan

11.00am: Ben Le Brun — OptionsXpress

11.15am: Eli Greenblat — The Australian

11.45am: Martin Crabb — Shaw and Partners

12.00pm: Ric Spooner — Chief Markets Analyst, CMC Markets

12.15pm: Tony Boyadjian — Compass Global Markets

(All times in AEST)

10.05am: ASX risk back on the menu: CMC

Risk is back in favour judging by overnight market action, says CMC Markets chief market strategist Michael McCarthy.

He notes that the US S & P 500 Index hit another all-time high, European bourses rallied, copper and oil added to recent gains and the USD gained ground against other major currencies, while defensive investments such as gold and bonds slumped further.

“The positive moves point to gains across the Asia Pacific region today,” he says.

Overnight SPI 200 futures relative to estimated fair value implies an early gain of 0.2pc for Australia’s S & P/ASX 200 share index.

CMC’s McCarthy says strength in US durable goods orders in August underpinned a key market thematic of stronger global growth.

That was amplified by RBNZ’s comments that “global economic growth has continued to improve in recent quarters”.

“Despite concerns about a seasonal downturn for shares at the moment it appears the only way is up,” McCarthy says.

The $1.59b purchase of Origin’s conventional oil and gas assets to Beach Energy is a positive sign for the energy sector.

S & P/ASX 200 index last 5664.3

9.35am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

9.45am: Colonial First State Global Asset Managements

10.00am: Adam Dawes — Shaw and Partners, Tom Madden — CBD

10.45am: Ben Jarman — JPMorgan

11.00am: Ben Le Brun — OptionsXpress

11.15am: Eli Greenblat — The Australian

(All times in AEST)

9.00am: Analyst rating changes

Suncorp raised to Buy — Goldman Sachs

ANZ Bank cut to Hold — Bell Potter

Melbourne IT raised to Buy — Bell Potter

AGL raised to Outperform — Credit Suisse

Murray River Group raised to Add — Morgans

Investa Office Fund raised to Outperform — Credit Suisse

Oz Minerals raised to Add — Morgans

Scott Murdoch 8.55am: Stokes, Seven in on Beach $1.6bn deal

Beach Energy has entered a trading halt to carry out a capital raising today to fund the $1.6 billion deal to buy Lattice Energy.

The raising has locked in Seven Group and Kerry Stokes as cornerstone investors.

The equity issuance is being done by Credit Suisse, Goldman Sachs and UBS and is thought to be about $300m.

Beach’s offer was slightly higher than Questus Energy and includes gas supply agreements.

More to come from DataRoom

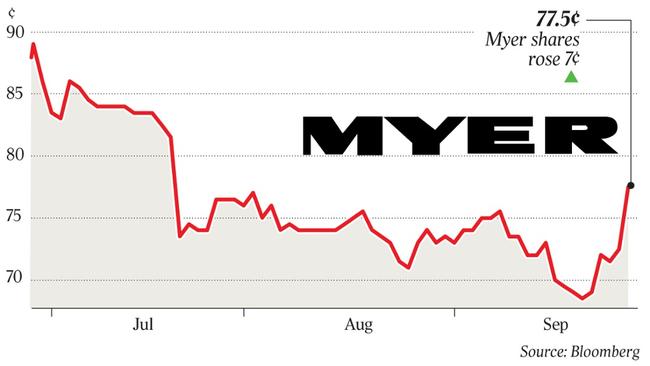

8.50am: Myer stalker Lew declares war

Embattled department store Myer was facing a war on two fronts last night after its biggest shareholders, billionaire rag-trader Solomon Lew and fund manager Anton Tagliaferro, criticised the retailer for its collapsing earnings, strategic missteps and lack of retail expertise on the board.

The stinging assessment that goes to the heart of Myer chief executive Richard Umbers’s turnaround strategy now threatens to break out into open warfare at its annual meeting in November, when Mr Lew is tipped to lash chairman Paul McClintock and directors for what he cites as the destruction of $2 billion in shareholder funds.

The fuse was lit yesterday when Mr Lew’s Premier Investments revealed it had requested from Myer a copy of its share register to consider writing to shareholders in relation to any resolutions proposed at the AGM — read more

MYR last $0.79

Rachel Baxendale 8.48am: Frydenberg dismisses executive gas avenue

Energy Minister Josh Frydenberg has dismissed calls from Tony Abbott for the federal government to invoke defence powers and take control of state and territory gas reserves.

The former prime minister made the comments after Malcolm Turnbull, Mr Frydenberg, Treasurer Scott Morrison and deputy PM Barnaby Joyce yesterday met with the bosses of gas export giants Santos, Origin and Shell, securing a pledge to fix an “emergency” shortfall that threatens to drive up prices and shut down factories.

Mr Frydenberg said Mr Abbott’s proposal was not the “only way” to force the states to lift their moratoria on gas exploration — more to come.

8.40am: Trump unveils US tax plan

Richard Rubin writes:

US Republican leaders have released a plan to overhaul the US tax code, proposing sharply reduced tax rates on businesses and many individuals and kicking off an effort by President Donald Trump and congressional leaders to mount a challenging legislative push in the months ahead.

The ambitious framework sketches out a range of tax changes — including lower taxes on corporate profits, incentives for business investment, fewer and lower individual income tax brackets and the end of estate taxes — that Republicans say will boost economic growth and benefit middle-income families.

But the proposal leaves many questions unanswered, including how the government will tax the nation’s highest earners and how the plan’s fiscal math will add up. According to a rough estimate from the nonpartisan Committee for a Responsible Federal Budget, the framework calls for about $US5.8 trillion in tax cuts over a decade and includes about $US3.6 trillion in revenue-raising provisions, for a net cut of $US2.2 trillion — read more

The Wall Street Journal

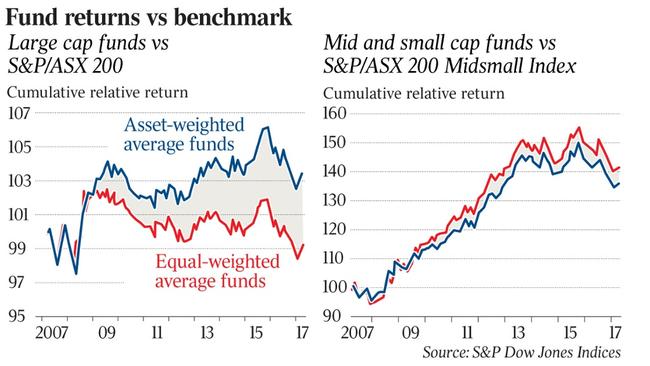

8.26am: Active funds vow to lift the game

Active fund managers with a strong track record are confident of a return to form after a tough year.

The latest S & P Dow Jones Indices “SPIVA Australia Scorecard” of the active versus passive debate showed 62 per cent of Australian equity funds underperformed their benchmarks in the year to June, only slightly better than longer-term horizons where the vast majority have lagged behind.

More worrisome for investors seeking better performance in small-caps and mid-caps — where active Australian fund managers have traditionally had an edge — 81 per cent underperformed the benchmark, whereas only 37 per cent have underperformed over the past 10 years.

But for Ophir Asset Management’s Andrew Mitchell — whose Ophir Opportunities Fund has been the top performer in Australia with a 36.8 per cent annual return in the past five years — the future is brighter after a “transition” year in the market.

The fund generated a gross return of just 3.2 per cent in the past year, its worst in the last five years.

Matt Chambers 8.15am: AGL digs in over Liddell

New AGL Energy chairman Graeme Hunt has dispelled any notions he will cede to Malcolm Turnbull’s call to extend the life of the Liddell black coal power station in the Hunter Valley, saying a non-coal plan to cover the lost capacity is expected to be delivered to the Prime Minister in the next three months.

Mr Hunt, who took over as chairman from Jerry Maycock at the end of yesterday’s AGL annual general meeting in Melbourne, said the company had been working on a plan involving renewables, a gas-fired plant, battery storage and demand management for the past two years.

“We’re looking at technologies that will deliver reliable energy at the lowest cost, which meets our emission targets,” Mr Hunt said after yesterday’s meeting — read more

AGL last $22.91

7.40am: ASX set to open higher

The Australian share market looks set to open higher, following Wall Street’s positive lead amid investor confidence following the release of US president Donald Trump’s tax plan.

At 7am (AEST), the share price futures index was up 20 points, or 0.35 per cent, at 5,661.

In the US, stocks rose with gains in financial shares powered by growing expectations for a December interest rate rise and on hopes President Donald Trump’s administration may be making progress on a tax plan.

The Dow Jones Industrial Average rose 0.25 per cent, the S & P 500 gained 0.41 per cent and the Nasdaq Composite added 1.15 per cent.

Locally, in economic news today, the Australian Bureau of Statistics releases August’s job vacancy data.

Well after the markets have closed, Reserve Bank of Australia deputy governor Guy Debelle is expected to speak on the topic of Central Bank Independence in Retrospect at the Bank of England conference in London, at around 7pm (AEST).

No major equities news is expected.

The Australian market yesterday lost ground as investors trod cautiously ahead of a speech by US president Donald Trump that is expected to detail his plans for tax cuts and reform.

The benchmark S & P/ASX200 index fell 6.7 points, or 0.12 per cent, to 5,664.3 points.

The broader All Ordinaries index lost 4.1 points, or 0.07 per cent, to 5,725.5 points.

AAP

7.00am: Dollar slightly lower

The Australian dollar is slightly lower against its US counterpart which has strengthened amid optimism over proposed US tax reforms.

At 6.35am (AEST), the Australian dollar was worth US78.52 cents, down slightly from US78.56 cents yesterday.

Westpac’s Imre Speizer says the US dollar, along with US interest rates and equities, rose after Trump’s proposed tax reforms were unveiled.

“The US dollar index rose 0.5 per cent to a one-month high ... (The) AUD fell from 0.7880 to 0.7836 — a one-month low.,” he said in a morning note.

The main risk events for today include Reserve Bank of Australia deputy governor Guy Debelle’s expected speech on the topic of Central Bank Independence in Retrospect at the Bank of England conference in London, around 7pm (AEST), Mr Speizer said.

“The (Australian dollar’s) next downside target is 0.7810 (a mid-August low), subject to the US dollar rally persisting.”

The Aussie dollar is a little higher against the yen and barely changed against the euro.

AAP

6.50am: Wall St up on interest-rate hopes

A surge in shares of financial companies lifted major US stock indexes.

Stocks had pared gains slightly as Republicans’ tax plan was unveiled earlier in the session, but the reaction was fairly muted and the day’s moves appeared to be driven largely by interest-rate expectations and corporate news.

The Dow Jones Industrial Average gained 56 points, or 0.3 per cent, at 22341, after rising nearly 87 points earlier. The S & P 500 rose 0.4 per cent and the tech-heavy Nasdaq Composite climbed 1.2 per cent.

The S & P and Nasdaq flirted with records, but came up short in the end.

Australian stocks are set to rise at the open. At 7am (AEST), the SPI futures index was up 23 points.

The US tax plan proposes to sharply reduce tax rates on businesses and many individuals. Investors have cheered a tax overhaul as a potential boon to corporate profits — in particular for smaller firms that generate more revenue domestically — but some analysts said Republicans’ inability to repeal the Affordable Care Act has lowered expectations for tax changes.

While GOP leaders signalled that could pave the way for Republicans to focus on taxes, some investors remain wary.

“People are very sceptical that any of this is going to get done,” said Ian Winer, head of equities trading at Wedbush Securities.

Rising Treasury yields supported financial stocks, as investors continued to bet on higher US interest rates. Last week, the Federal Reserve reiterated its plans to gradually raise rates, sending bond yields and the dollar higher.

Fed Chairwoman Janet Yellen and other central bank officials have defended those projections this week, further supporting bank shares. The S & P 500 financial sector gained 1.3 per cent Wednesday. Higher rates tend to boost lenders’ profitability.

While years of ultra-easy monetary policy have been seen as a boon for stocks, many investors say the stock market is ready to handle the long-anticipated gradual tightening of policy.

Dow Jones Newswires

6.40am: Stocks climbed ahead of Trump tax plan

European and US equities rose as investors waited for US President Donald Trump to reveal his tax reform plans.

“Global stock markets have taken a major step out of their recent malaise today, with traders spending much of the day waiting with bated breath to see exactly what the Trump tax plan is going to look like,” said market analyst Joshua Mahony at online trading firm IG.

Investors have been salivating for months over the prospects of lower corporate taxes, which would boost profits of blue-chip companies and other businesses considerably.

In European trading, shares in Alstom were among the strongest performers with a gain of 4.3 per cent to close at 35.07 euros on news of the merger of its rail activities with German industrial giant Siemens. Siemens’ stock meanwhile won 1.2 per cent to 117.95 euros.

Shares in Ryanair gained more than 3.4 per cent in Dublin to 16.99 euros after the low-cost airline announced more flight cancellations and the abandonment of its bid for Italy’s Alitalia as it sought to overcome its pilot shortage.

London and Frankfurt both closed up 0.4 per cent, while Paris ended up 0.3 per cent

AFP