Don’t buy these tokens

People punting on bitcoins and the like are betting that trust in the existing monetary system will break down completely.

Which one? Their lips are sealed until after the offering closes, which is reminiscent of the company launched in 1720, at the height of the South Sea Bubble, with the immortal name: “A Company For Carrying On An Undertaking Of Great Advantage, But Nobody To Know What It Is.”

As of last Monday, we can rule out China. The People’s Bank of China issued an edict banning ICOs, adding that even the holding and trading of crypto-currencies, including bitcoin, was illegal.

In response, the price of bitcoins fell 13.6 per cent from US$4,950 to US$4,726 between September 1 and Friday, which seems a relatively minor correction in the circumstances — that is, of being peremptorily banned by the country that had previously been rumoured as the likely first to sponsor its own crypto money.

Maybe China will still do that, and banning competitors is just the Party’s time-honoured way of preparing the ground. And after all, the field of competitors has become rather crowded.

The website coinmarketcap.com records that there are now 1,106 crypto-currencies, although the ones after 861 have a question market in the market capitalisation column. The smallest of the ones with a value — Xenixcoin — is worth $154, so the “?” stands for either zero or “don’t know” — I don’t know.

The largest of them is bitcoin, with a market cap of $69.6 billion and Ethereum is next, worth $27.6bn. “Bitcoin Cash”, is now capped at $9bn — it’s the one created by the so-called “hard fork” of bitcoin on August 1, caused by a disagreement among the bitcoin powerbrokers, whoever they might be.

The fork was, in effect, an ICO with the brand name bitcoin attached, and with $9bn invested after just six weeks, you’d have to say that was a successful wheeze.

The fork also doubled the potential cryptos that are labelled bitcoins. The original “classic”, as it’s called, is limited to 21 million units, of which 16,545,700 are currently on issue, with the mining getting progressively more difficult. Bitcoin Cash also has a possible 21 million, making a total of 42 million.

The list of crypto-currencies includes one called Useless Ethereum Token (UET), which says on its website: “You’re going to give some random person on the internet money, and they’re going to take it and go buy stuff with it. Probably electronics, to be honest. Maybe even a big-screen television. Seriously, don’t buy these tokens”.

Someone did — UET’s market cap is $47,710.

In the FAQ section of the website there’s this question: “How do I get a refund for the tokens I have bought?” The answer provided: “You’re kidding, right?”

And then there’s PonziCoin, carrying the strapline: “Let’s cut to the chase”. And further down the website: “After you invest, vote on the colour of my Tesla”.

PonziCoin’s market cap is $48,224, and a Tesla Model 3 sells for US$35,000, so Josh Cincinatti, described as the Chief Executive, Principal Architect, Keeper of the Flame, Supreme Allied Commander, Mythic Lone Genius and Seems Like An Asshole, But Pretty Nice In Person, can afford his Tesla now.

This is all good bubble fun and likely to end in a glorious bust.

The serious bull case for bitcoin is that one day it will take its place as a global currency alongside the US dollar. The bull case for the 1,105 others is that some of them — perhaps all — will ride bitcoin’s coat-tails to become a one of the subsidiary currencies, like the 180 different actual currencies that now exist in bondage to the global reserve currency — the US dollar.

But as Josh Cincinatti and the (anonymous) founder of Useless Ethereum Token imply with their work, a world in which it’s possible for anyone to create a new currency on a blockchain and then persuade sane people to part with real currency in return for it, is eventually going to grind to a halt in a chaos of loss and distrust.

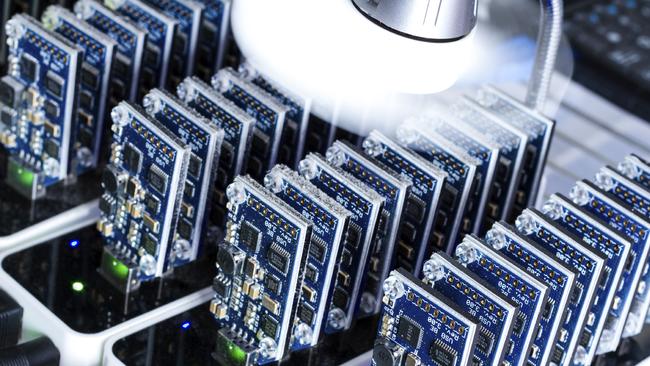

Apart from anything else, mining bitcoins consumes colossal amounts of energy, far more than the stroke of a digital pen required to create dollars.

Which is the basic attraction of cryptoworld, of course. bitcoin devotees are disillusioned with fiat money, with good reason: it’s too easily created by central banks and skimmed by commercial banks transacting it.

The lack of central control is what attracts bitcoin devotees — the distributed ledger called blockchain sits on everyone’s computer and is unhackable (so they say, although there have been some very expensive hacks so far).

Money is a store of value and a medium of exchange. bitcoins can fulfil the latter function, but not the former — they create and destroy wealth, rather than store it.

The essential characteristic of money is trust. To the extent that they’re not simply playing “pass the parcel” — and maybe they all are — the people putting their hard-earned real money into are bitcoins and the other ICOs are betting that one day trust in the existing monetary system controlled by economists and politicians will break down completely.

Maybe they’re right, but I suspect they probably hope that they’re not.

Alan Kohler is the Publisher of The Constant Investor

Last week there was a new Initial Coin Offering called Exio Coin (rarely does a week go past without an ICO or two). This one’s claim to distinction, if not fame, is that it’s the first to “receive the endorsement of a sovereign nation”.