The rise of Ethereum — inside the bubble

Since the start of the year, Ethereum’s price has increased more than 40 times while its rival Bitcoin has only tripled.

This is not about the cashless society or never having to go an ATM because you can just wave your card everywhere. It’s about a “dollarless” society, where money is just computer code, not units of exchange meted out by a banks and controlled by government-owned central banks.

The whole system of coinage dating back thousands of years is starting to come into question, as the digital world races to develop a new way of managing and validating transactions: 2017 will probably go down as the turning point.

The price of one Bitcoin hit $US3000 over the weekend, three weeks after it went through $US2000, and up 10-fold in 18 months.

But Ethereum, Bitcoin’s main rival crypto-currency, is a newer and even bigger bubble: its price has roughly tripled at the same time and is now $US350. Since the start of the year, Ethereum’s price has increased more than 40 times while Bitcoin has only tripled.

Ethereum’s surge, outpacing the original and biggest digital currency, seems to be partly due to the fact that Russian President Vladimir Putin met with Ethereum’s founder Vitalik Buterin recently on the sidelines of a conference in St Petersburg.

According to the Kremlin’s website, Putin supported the idea of setting up ties with Russian partners to develop digital currencies, and specifically Ethereum. Other reports have suggested the Russian central bank is looking to use it to digitise the rouble.

Separately, the Royal Chinese Mint (royal?) is testing Ethereum as a base protocol to digitise the Renminbi.

But there’s much more than this going on.

One’s mind quickly starts to grind its gears and produce smoke when thinking about these things, but the momentum for digital, crypto-currencies is now growing rapidly and Ethereum is apparently outpacing Bitcoin.

Ethereum was launched in 2015 by a group of programmers inspired by the success of Bitcoin, but instead of just making a currency that worked off blockchain and was “mine-able” with computing power, the platform they created allows for “smart contracts”.

The problem with Bitcoins, as I understand it (I don’t own any, and have never used them to buy anything) is that transactions can take anywhere from 10 minutes to hours, depending on how busy the network is. It’s also fairly expensive to use, especially for small transactions.

Ethereum, on the other hand, takes 12 seconds to transact and is much cheaper, but it’s also much more than a currency: it’s a platform for something called decentralised applications (dApps) that run on peer to peer computer networks and are designed to disintermediate all kinds of transactions that currently require banks, stock exchanges and the legal system itself.

Everyone is now flocking to the Ethereum side of the boat, it seems. In March, 116 organisations formed Enterprise Ethereum Alliance, including Samsung, Microsoft, Intel, JP Morgan, Deloitte, Accenture, Banco Santander, ING and National Bank of Canada.

Royal Bank of Scotland has announced that it has built a clearing and settlement mechanism based on the Ethereum distributed ledger and smart contract system, and JP Morgan is doing something similar.

The rise of these cryptocurrencies and in particular Ethereum parallels and extends the intrusion of data and algorithms into our lives.

Data and algorithms decide what news and advertising we see, what music and videos we are presented with. The healthcare system, banking, retail — everything now comes down to data, and as a result the way the economy itself works is changing.

The idea of cryptocurrencies is that they don’t need gold or governments declaring them to be “legal tender”, or a system of central banking behind them, and instead use a “public ledger” system called blockchain.

Transactions, in this case currency deals but they could be any transactions, are “announced” to the network and bundled into “blocks” which are then authenticated by traders. Once authenticated, the block is added to the chain that goes back to the start of the currency, which provides a fully transparent, unchangeable history of what has taken place.

In some ways it’s like the internet itself: no one controls it — there is no central authority. And just as the internet has become the way humans communicate with each other, blockchain looks like becoming the way we transact.

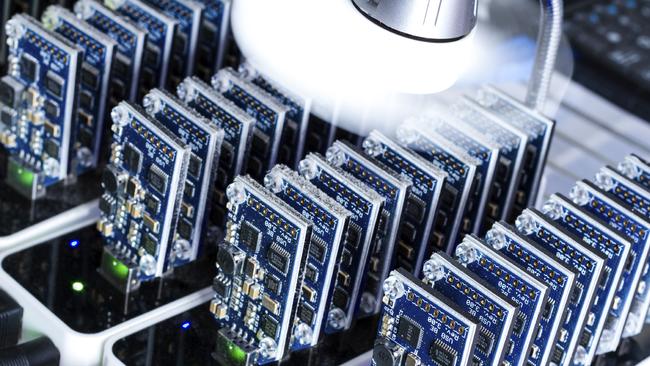

The people developing Bitcoin, Ethereum and the other cryptocurrencies (there are about 25 of them, and counting) want to prove that money can actually become computer code.

Not that code can represent money, as it does with internet banking or waving our cards at the supermarket, but that it can BE money.

For the moment, these new cryptocurrencies look more like a speculative bubble, but there is definitely something else going on inside bubble, that might emerge when, or perhaps if, the bubble bursts.

Alan Kohler is Publisher of The Constant Investor — www.theconstantinvestor.com

The world is rapidly being confronted with the question of what, exactly, is money?