Trading Day: live markets coverage; Costa shares bear fruit: JPMorgan; plus analysis and opinion

The ASX surges into positive territory, while Australia’s largest horticulture stock leaps to an all-time record high.

Welcome to Trading Day for Friday, September 29.

4.15pm: Costa victor in fruit fight: JPMorgan

Shares in Costa Group hit an all-time record high of $5.58 at the open and continue to trade near the lofty levels after the retailer food supplier was served an upgrade to ‘hold’ from ‘lighten’ from JPMorgan analysts with renewed appetite for Australian horticultural exposure.

On the tip of the analysts’ tongues after scouting around Costa’s competitors and peers are dearer citrus exports prices, a segment of Costa’s sales they tout as a significant enough portion of group operating earnings.

“Higher citrus export pricing was a focus of our discussion,” said JPMorgan analysts.

“Given we believe this unit’s lower-than-average margins, and that typically agriculture businesses have a high degree of leverage from changes in prices, we believe Costa’s FY18E profit growth could be boosted significantly by higher citrus export pricing.”

JPMorgan recently went cold on Costa after picking up the scent of deflationary blueberries, and while the concern lingers, its analysts believe economic forces abroad behind the citric sweetening can buffet the sour berry category and predict a 24pc increase in net profit to $72m this financial year.

“We have increase our assumption for price growth in citrus to more than 5pc on a blended average basis, while decreasing our forecast berry price decline to 10pc,” they say.

“Our June 2018 target price increases to $5.01 as a result.”

CGC closed up 6.7pc at $5.58

David Swan 4.00pm: Musk reveals mission to Mars

Billionaire tech mogul and SpaceX CEO Elon Musk has unveiled design specs for the “BFR” spaceship that he expects will take about 100 people at a time to the Moon and Mars, and plans to send six advance ships, two with crew, by 2024.

“I’m confident we can complete the ship and be ready for a launch in five years. Five years seems a long time to me,” he told an audience in Adelaide.

Mr Musk had hinted he would show off “something really special” at the Adelaide Convention Centre today, where about 5000 people have descended on the city to talk space and the future of mankind.

Musk is the most anticipated part of a week which has seen Australia announce its own space agency, and Lockheed Martin detail plans to get to Mars.

Elon's plan for using local resources on Mars to refuel ships pic.twitter.com/j06ttE2IiW

— David Swan (@swan_legend) September 29, 2017

"Anywhere on earth in under an hour" #IAC17 pic.twitter.com/Q9XinaMFxU

— David Swan (@swan_legend) September 29, 2017

3.50pm: Quintis extends trading halt

Quintis has extended its voluntary trading suspension until October 31st, or on an earlier announcement by the company in regards to ongoing discussions with third parties over its recapitalisation.

QIN last $0.30

Samantha Woodhill 3.44pm: Gary Weiss grabs Ardent chair

Corporate raider Gary Weiss is taking over as chairman of Ardent Leisure following a battle for control of the Dreamworld owner, and after current chair George Venardos agreed to step aside.

It come after a dissident investor group including Dr Weiss’s Ariadne had campaigned for change at Ardent, unveiling a rescue plan for the company in July.

The dissident push culminated in Dr Weiss and Brad Richmond being invited on to the board earlier this month and then today, Dr Weiss being named the new chairman.

Mr Venardos, chairman since November 2016, said he had decided to retire to help “unity and harmony” on the Ardent board.

AAD last up 1.7pc on $1.83

3.25pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Sean Callow — Senior Currency Strategist, Westpac

3.50pm: Ben Le Brun — OptionsXpress

4.00pm: George Boubouras — Contango Asset Management

4.30pm: Winston Sammut — Folkestone Maxim Asset Management

(All times in AEST)

Michael Roddan 2.55pm: Loan crackdown starts to bite

The banking regulator’s strict limits on investor borrowing and riskier lending appear to be slowing the housing market, with the latest official figures showing a decline in the value of loans held by the banks.

However, separate Reserve Bank figures show borrowers may just be shifting to the unregulated non-bank sector in a bid to escape rising interest rates and tougher lending standards.

The Australian Prudential Regulation Authority’s latest monthly banking statistics showed an overall 0.1 per cent decline in the value of mortgages held on the books of the regulated banking sector, falling to $1.57 trillion worth of outstanding loans in August.

While there was a 0.1 per cent increase in owner-occupier loans during the month, investor loans fell 0.5 per cent. Investor loans account for a third of all mortgages in the market.

Elizabeth Redman 2.10pm: Sydney bubble risk alive and well: UBS

Sydney is at risk of a housing bubble after low interest rates supported demand and sent prices soaring ahead of income growth, according to research from UBS.

The bank warns of “elevated risk” in the harbour city’s overheated housing market, singling out foreign investment as another factor fuelling price growth.

The research comes amid a regulatory clampdown on investor and interest-only lending designed to take some heat out of the east coast capital property markets.

1.40pm: Telstra has further to go: Shaw

With David Swan

Locked away in its Melbourne headquarters, the Telstra annals certainly will not have 2017 bookmarked after the company cut its fiscal year-ahead dividend forecast, welcomed TPG as a new mobile competitor and had its near-term cash flow plans swept off the table by NBN Co..

Unleash the analysts downgrades, and up top on the bandwagon after attending a TPG presentation lies Shaw and Partners, posting a follow-up cut to their 12-month price target to $3.16.

“No good option,” say Shaw analysts, “Telstra will face the twice issue of the end of the one off NBN disconnection payments and a new low cost mobile provider.”

“TLS can try and hold market share or cut prices. We assume average revenue per user (ARPU) is $5 lower in the outer years (2020-22).”

Telstra shares hit a fresh 5-year low on Wednesday which sunk its implied dividend yield to 6.3 per cent or about 8.2 per cent including franking credits.

“We need to be able to maintain a strong balance sheet to withstand the disruption that we’re seeing, and to compete with the new competitors that we’re seeing in the future,” chief executive Andy Penn said at the company’s Vantage summit in Melbourne earlier this week.

TLS last up 0.1pc at $3.48.

Samantha Woodhill 1.25pm: Woodside’s Coleman joins BCA

The Business Council of Australia has announced that Woodside Energy boss Peter Coleman will take Richard Goyder’s position on its board when he retires from Wesfarmers in November.

Mr Coleman, who has been in the Woodside top job since 2011, chairs the Australia-Korea Foundation, the Advisory Group for Australia Africa Relations and is an adviser to the Asia Society.

BCA chief Grant King welcomed Mr Coleman to the board, saying he’d be a voice for Western Australian business as well as the hydrocarbon industry.

Mr King also announced the appointment of Joanne Farrell of Rio Tinto and Tim Reed of MYOB to the board to fill two vacancies.

David Swan 1.15pm: Musk readies SA SpaceX unveiling

Billionaire tech mogul and SpaceX CEO Elon Musk is set to show off “something really special” at the Adelaide Convention Centre shortly, where he’s expected to detail plans to put one million people on Mars.

About 5,000 people have descended on the city to talk space and the future of mankind, and Mr Musk is the most anticipated part of a week which has seen Australia announce its own space agency, and Lockheed Martin detail plans to get to Mars.

Mr Musk tweeted earlier this week that he will be unveiling “major improvements” to the technology he plans to use, along with new “unexpected applications” — read more

12.50pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Ben Le Brun — OptionsXpress

1.50pm: Live cross — Bloomberg Asia

2.10pm: Justin Smirk — Westpac

2.20pm: Live cross — FIIG Securities

(All times in AEST)

12.30pm: ASX200 stuck in large-cap limbo

The local sharemarket finds itself wedged between a large-cap slowdown and a surge in big miners as indices oscillate around flat in afternoon trade.

The S & P/ASX200 index sits near unchanged at 5671.3 with the wider All Ordinaries in toe.

Mining sector investors turn their backs to unconvincing lead from commodity markets to take BHP and Rinto Tinto over 1 per cent higher each.

Oil-linked Wooside lumbers along 1.4 per cent in the red, while iron ore pure-play Fortescue surges over 2 per cent higher with no signs of life from the underlying commodity.

Steel watchers note a procession of national holidays in China next week, inevitably slowing down activity.

CBA and Tesltra shares provide fresh doses of downside as both tip toward intraday losses, each in lock-step with recent underperformance responsible for broader market stasis, according to CMC chief market analyst Ric Spooner.

“Those stocks cumulatively account for about 11.5 per cent of the index,” said Mr. Spooner, “in particular, concerns over CBA have seen people rotating out and into the three other major banks, now well off their lows and not necessarily at bargain hunter’s levels.”

“All those things are combining to somewhat cap the index.”

Meanwhile, the Australian dollar remains trades 0.2 per cent lower at US78.34 cents after a surge in job vacancies in the three-months to August set economists alight amid recent highs above US81 cents.

11.45am: Double take for city homeowner

Turi Condon and Elizabeth Redman write:

The housing boom across Sydney and Melbourne has stoked the wealth of the cities’ homeowners, with just under half of the dwellings worth more than twice the price paid by their owners.

In some Sydney suburbs, particularly in the city’s west, more than 70 per cent of homeowners — who have held the property an average of about 14 years — have seen their home at least double in value, researcher CoreLogic said.

There was a massive difference in wealth from real estate depending on the region, CoreLogic head of research Tim Lawless said.

Paul Garvey 11.30am: Pilbara first in lithium cart

Lithium play Pilbara Minerals has become the first company in the sector to lock in an offtake agreement directly with an electric vehicle manufacturer, snaring a deal with Chinese heavyweight Great Wall Motors.

The deal, announced late yesterday, will see Pilbara supply Great Wall with up to 150,000 tonnes a year of source mineral spodumene concentrate from Pilbara’s Pilgangoora lithium mine for use in the carmaker’s electric and hybrid vehicles — read more

PLS last $0.55

11.00am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Ben Le Brun — OptionsXpress

11.15am: Rudi Filapek-Vandyck — Editor, FNArena

12.00pm: Ric Spooner — Chief Markets Analyst, CMC Markets

12.15pm: Janu Chan — St George

12.45pm: Jeff Lang — CEO, Titomic

(All times in AEST)

10.35am: Offshore cyclicals as A$, RBA eases: Deutche

Investors should buy offshore cyclical equities like Aristocrat, Amcor, Boral and James Hardie, according to Deutsche Bank.

The firm’s Australian equity strategist Tim Baker expects the companies to outperform as the Australian dollar stops amid a cooling of market expectations that the RBA will keep pace with Fed rate hikes.

Moreover, he’s hesitant to load up on defensive stocks because their earnings revision momentum is worse than for cyclicals and defensives aren’t cheap versus cyclicals.

While domestic jobs growth has been surprisingly strong this year, Mr Baker says that’s been skewed to lower-paying industries, and a lack of quality in jobs creation is reflected in underemployment.

“This has bothered us since late last year, and the RBA has increasingly focused on the issue,” he cautions.

Low-quality jobs creation is one contributor to soft wages growth, which has in turn weighed on consumer spending, and the spending growth we have seen has been partly funded by a likely unsustainable cut in the saving rate.

Mr Baker doesn’t see firmer wage growth in the near term, given there’s been little pick-up in NZ, US or UK, despite the sub-5 per cent unemployment rates in those countries.

“As a result we are generally cautious on domestic exposure,” he says.

“Instead we go for offshore cyclicals, to benefit from the solid growth backdrop and reasonable valuations.”

“The firmer Australian dollar has been a headwind, but we don’t see that getting worse.”

The one bright spot he sees in Australia is Queensland, where cheap housing should see interstate migration continue to lift from record lows.

“The key pushback has been that securing employment could prevent a move, but Queensland job growth has actually led all major states over the past year.”

He notes that the industries hiring in Queensland are similar to the national level — construction, tourism-related, and health/education.

“We see this theme continuing, given migration is still below long-run average levels,” Mr Baker adds, “this supports our positive view on Stockland.”

10.30am: ResMed hits Munich court hurdle

Simone Ziaziaris writes:

A German court has suspended two patent proceedings brought by ResMed against Fisher & Paykel Healthcare due to “validity concerns”.

New-Zealand based Fisher & Paykel says a regional court in Munich had ruled that both cases brought by medical products manufacturer ResMed be suspended pending the final outcome of oppositions filed by Fisher & Paykel Healthcare with the European Patent Office.

In August 2016, the court granted two preliminary injunctions preventing Fisher & Paykel from selling three of its face and nasal masks in Germany. But months later, Fisher & Paykel succeeded in overturning the injunctions and resumed selling the products in the country amid concern about the validity of ResMed’s patents — AAP

RMD last up 0.2pc at $9.78

10.12am: Costa Group hits all-time record high

Costa Group (CGC) hits an all-time record high in early trade of $5.51 with a 5 per cent leap on sixfold volume after JPMorgan served the stock with an upgrade.

Eli Greenblat 10.05am: Oroton swings to heavy loss

Embattled fashion and accessories retailer Oroton has swung to one of its worst losses in decades, as like-for-like sales at its chain of up-market stores plummeted and the company’s earnings were derailed by nearly $10 million in charges linked to a strategic review and the looming closure of its Gap outlets.

Oroton today posted a 514 per cent swing in its bottom line, as it plunged from a profit of $3.443 million in 2016 to a loss of $14.258 million for the year ended July 29.

Revenue for 2017 was down 9.7 per cent to $123.2m, as like-for-like store sales sank 6 per cent and same store sales growth at its soon-to-be-closed Gap stores plummeted 11 per cent.

Underlying EBIT for Oroton was down 79.1 per cent to $2.7m. For the year the retailer was forced to swallow $9.7m in non-core pre-tax items that included $8.9m of costs linked with the termination of the Australian Gap franchise agreement and other corporate expenses of $800,000 — read more

ORL last $0.78

9.50am: ASX200 eyes gains in tapered trade

Australia’s S & P/ASX 200 should be very quiet amid long-weekend holidays in Victoria today and NSW on Monday.

If anything the market should creep higher after slight gains on Wall Street and a fresh record closing high in the S & P 500.

Overnight SPI 200 futures relative to fair value implies an early gain of 0.1pc.

Economists and commodity watchers note China will take national holidays for the majority of next week.

Index last 5670.4

9.45am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

10.00am: Fortescue, ANZ live announcement

10.15am: Andrew Ticehurst — Nomura Capital

10.30am: Live cross — Shaw and Parnters

10.45am: Live cross — NAB Asset Management

11.00am: Ben Le Brun — OptionsXpress

(All times in AEST)

9.15am: BCA board taps Rio, MYOB execs

Business Council of Australia has announced the new appointment of MYOB chief executive Tim Reed and Rio Tinto’s Heatlh, Safety and Environment group executive Joanne Farrell to fill two vacancies on the board.

More to come.

9.00am: Analyst rating changes

Costa raised to Neutral — JPMorgan

Beach Energy raised to Buy — Citi

Oraca cut to Hold — Deutsche Bank

Michael Roddan 8.45am: Suncorp’s interest-only rates rise

Australia’s sixth-largest bank Suncorp says it is already complying with the prudential regulator’s interest-only limit, which comes into effect at the end of the week, despite overhauling its system to allow higher rates on riskier loans.

Suncorp yesterday said it was raising interest-only loans for investors by 38 basis points from the start of November, while owner-occupiers with interest-only loans would face a 10-basis-point increase — read more

SUN last $13.08

Adam Creighton 8.25am: Trumpeting in step with boomers

Donald Trump’s courageous tax plan could be the last hurrah of the baby-boomers, delivering a remarkable windfall to the richest generation in history courtesy of a massive debt burden for the next generation.

Don’t get me wrong. There’s a lot to like about the Trump plan — a nine-page sketch of what the White House hopes US congress will pass in coming months, released earlier this week.

But slashing US taxes by about $US2.2 trillion ($2.8 trillion) over a decade (one estimate of the net impact of the proposals on the US budget) without cutting spending will only push the US government further down the path to fiscal oblivion, a problem boomers won’t have to worry about.

US federal debt, already about $US19 trillion, is headed for 100 per cent of GDP on business as usual.

The Trump plan to collapse the number of individual tax thresholds from seven to three and abolish most deductions for individuals and businesses would be major wins for simplicity, and create scope for lower tax rates in and of themselves.

8.23am: Activist puts Newcrest on notice

Could Australia’s biggest gold producer, Newcrest Mining, be the next local company to come on the radar of activist investors?

Newcrest was one of a dozen global gold heavyweights singled out for criticism in a scathing attack on the sector by John Paulson’s US fund Paulson & Co this week.

The fund’s partner, Marcelo Kim, used a speech to the Denver Gold Forum to attack the underperformance of the big end of the gold sector in recent years, noting that average total shareholder returns by the gold majors had lagged by an average of 65 per cent since 2010 — read more from DataRoom

Sarah-Jane Tasker 8.20am: Tatts pushes back tie-up vote

Tabcorp’s long-held dream of buying Tatts Group to create a multi-billion dollar gaming giant could be forced into renegotiation, as the end date of the agreed deal fast approaches.

Tatts and Tabcorp returned to court today to push back a shareholder meeting on the tie-up, after appeals on competition approval of the transaction frustrated an already delayed deal timeline.

Tatts’ shareholders were hoping to vote on the deal early next month but they will now have to wait until the annual general meeting on November 30 — read more

TAH last $4.26, TTS last $4.00

8.15am: Trump tax talk fuels growth hopes

Rising momentum behind US President Donald Trump’s long-awaited plan for tax cuts is fuelling expectations of stronger earnings for US companies and faster growth in the world’s biggest economy.

The Australian dollar continued to retreat after the announcement by Republican leaders — which includes a reduction in the US corporate tax rate to 20 per cent from around 35 per cent — as the greenback jumped on the back of a rise in US bond yields.

After hitting a two-year high of US81.25c this month amid rising expectations of a rate increase from the Reserve Bank and some lessening of US rate hike expectations, the Aussie slipped to a two-month low of US78c as its interest rate differentials versus equivalent US rates started to narrow.

On equities markets, the S & P 500 share index hit a record intraday high on Wall Street before closing up 0.4 per cent. Australia’s ASX 200 edged just 0.1 per cent higher.

Notwithstanding a lack of details and uncertainty over whether the President’s proposed tax cuts will be passed into law, economists said they should add to growth in the US.

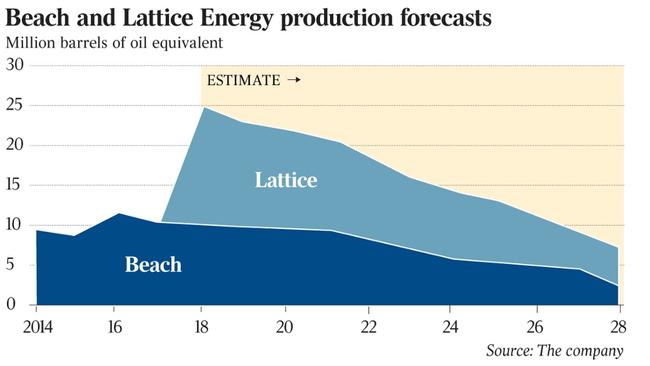

Paul Garvey 8.08am: Beach bulks up with Lattice deal

The balance sheet pain across the bulk of the oil and gas sector has opened the door for Beach Energy to reclaim its position as Australia’s mid-tier producer, with the Adelaide-based group striking a deal to buy Origin Energy’s conventional oil and gas assets for $1.585 billion.

Despite paying more than its market capitalisation and taking on board $1.3bn in debt to acquire Origin’s Lattice Energy business, Beach managing director Matt Kay said the company should have net cash by as early as 2021 due in part to the long-term gas sales agreements secured with Origin as part of the deal.

7.40am: ASX looks set to open higher

The Australian market looks set to open higher after Wall Street mainly gained with investors remaining hopeful that US President Donald Trump will be able to progress his tax reform plan.

At 7am (AEST), the share price futures index was up 14 points, or 0.25 per cent, at 5,660.

In the US, the S & P 500 eked out a record on gains in McDonald’s and healthcare names, but gains were tempered with stocks at record highs and valuations elevated.

The forward price-to-earnings ratio on the S & P stood at 17.9 compared with its long-term average of 15.1 while the forward P/E on the Russell is 26.3 against an average of 21.3.

Also, a Commerce Department report showed that the economy grew a bit faster than previously estimated in the second quarter, but the momentum probably slowed in the third as hurricanes Harvey and Irma temporarily curbed activity. The Dow Jones Industrial Average rose 0.18 per cent, the S & P 500 gained 0.12 per cent and the Nasdaq Composite was flat.

Locally, no major economic news is expected today.

In equities news, luxury goods retailer Oroton is due to release its full-year results, while Fortescue Metals Group chief executive Nev Power and ANZ launch an indigenous business funding initiative in Sydney.

The Australian market yesterday ended the day modestly higher, while a surge in the US greenback has helped push the Aussie dollar to its lowest level in more than two months.

The benchmark S & P/ASX200 index rose 6.1 points, or 0.11 per cent, to 5670.4 points.

The broader All Ordinaries index lifted 6 points, or 0.1 per cent, to 5,731.5 points.

AAP

6.55am: Dollar rebounds

The Australian dollar is higher against its US counterpart, recouping the losses it suffered in its previous onshore session as the greenback’s tax-plan inspired gains were partly forfeited.

At 6.35am (AEST), the Australian dollar was worth US78.56 cents, up from US78.13 cents yesterday.

Westpac’s Imre Speizer says the US dollar’s positive reaction to President Donald Trump’s tax plan and expectations of a December Federal Reserve interest rate rise had dissipated.

“The US dollar index is down 0.3 per cent on the day ... (while the) AUD rose from 0.7800 to 0.7860 ... (and the) AUD/NZD consolidated between 1.0845 and 1.0890,” he said in a morning note.

Iron ore had also fallen, losing around two per cent on the day, to be down 20 in September, he added.

The main local event risk today would be Australia’s August private sector credit data.

“(It) is expected to rise 0.5 per cent, but Westpac sees a smaller increase of 0.4 per cent as housing credit gradually slows while business credit posts another modest gain.”

Also, regionally, China’s September Caixin manufacturing PMI is out ahead of official National PMIs on Saturday.

Mr Speizer said the local currency would likely consolidate just above US78.00 cents, “following its three cent fall this month”.

The Aussie dollar is also higher against the euro and hardly changed against the yen.

AAP

6.50am: Oil rally stalls

Oil prices moved into the red, erasing much of this week’s gains as investors took profits.

Prices had been on the rise earlier following concerns that Iraqi Kurdistan’s independence vote could hit supply from the oil-rich region and after US data showed that record-high exports of US crude and additional demand from refineries helped drain 1.8 million barrels from US crude inventories last week.

But investors pulled back, sending oil prices tumbling amid concerns that the rally had gone too far.

“I think more than anything there was some profit-taking here,” said Tariq Zahir, managing member of Tyche Capital Advisors. “It’s had a heck of a run.”

US crude futures fell 58 cents, or 1.11 per cent, to $US51.56 a barrel on the New York Mercantile Exchange. Brent, the global benchmark, fell 49 cents, or 0.85 per cent, to $US57.41 a barrel on ICE Futures Europe.

Dow Jones

6.45am: S & P 500 edges to record

US stocks finished slightly higher, with the S & P 500 edging to a new record, as initial euphoria about President Donald Trump’s tax plan began to ebb.

Stocks rallied yesterday as Trump and Republican leaders released a long-awaited outline of a proposal to cut the corporate tax rate from 35 per cent to 20 per cent as part of a broader overhaul of the system.

Analysts were heartened by the fact that Trump has worked more closely with Republican congressional leaders than on the failed health care reform they attempted. But there is still a long way to go before the tax proposal becomes law, said Karl Haeling of LBBW.

“Today people are realising this is going to be hard work,” he said.

The Dow Jones Industrial Average ended up 0.2 per cent at 22,381.20. The broadbased S & P 500 advanced 0.1 per cent to 2,510.06, topping the previous all-time high by almost two points, while the tech-rich Nasdaq was essentially unchanged at 6,453.45.

Australian stocks are set to edge higher at the open. At 7am (AEST) the SPI futures index was up 14 points.

In the US, Dow member Chevron climbed 0.2 per cent after announcing it tapped longtime executive Michael Wirth as chief executive and chairman, effective in February and replacing John Watson.

Cereal giant Kellogg lost 0.4 per cent after announcing that Steven Cahillane will take over as chief executive, replacing John Bryant, who is retiring. Cahillane has worked as chief executive of Nature’s Bounty, which makes vitamins and nutritional supplements.

Media shares were broadly lower, with Disney losing 1.2 per cent, Comcast 1.8 per cent and 21st Century Fox 2.8 per cent.

AFP

6.40am: Trump bump fades fast

A rebound in sentiment after US President Donald Trump unveiled market-friendly tax cut plans proved short-lived as stocks traded mixed.

In Europe, equities advanced modestly, while Asian indices struggled to track Wall Street’s Wednesday gains, despite a broad move back to riskier assets like equities.

After months of waiting, Trump released a tax reform blueprint that would slash corporate rates, provide relief for firms that repatriate cash from overseas, and reduce the number of tax brackets from seven to three.

The bill is expected to face a tough passage through Congress, with both sides of the aisle likely to question its affordability, while it received a mixed review from economists, and business and union leaders.

In European trading, shares in Ryanair fell nearly 4 per cent in Dublin as investors came to grips with the low-cost airline cancelling the flights of another 400,000 passengers due to scheduling problems with its pilots.

Market analyst David Madden at CMC Markets UK said the cost of cancelling flights is relatively small in comparison with Ryanair’s annual profits.

Oil market investors are meanwhile keeping tabs on events in the Middle East after Kurds overwhelmingly voted for independence from Iraq, which has sparked fears of a crackdown by Baghdad and possible military confrontation.

London closed up 0.1 per cent, Frankfurt ended up 0.4 per cent, and Paris was up 0.2 per cent.

AFP