Trading Day: live markets coverage; ASX recovers on health boost; plus analysis and opinion

The ASX shrinks losses as CSL lifts, while investors await Tabcorp, Tatts trade as their proposed merger hits a hurdle.

Welcome to Trading Day for Wednesday, September 20.

5.05pm: Cautious market closes lower

Local stocks fell in timid trade as anxiety over iron ore hit resource stocks and investors held back from risk plays ahead of the outcome early tomorrow of a US Federal Reserve meeting.

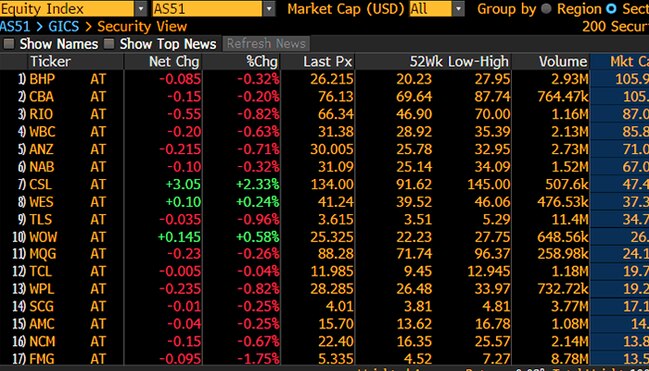

At the close, the S & P/ASX200 index was 0.1 per cent, or 4.5 points lower on 5709.1 while the broader All Ordinaries also fell 0.1 per cent, or 2.7 points to 5769.7.

By closing lower, the sharemarket defied a strong Wall Street lead after all three major US indices hit new record highs overnight.

Lingering hesitation left the bourse short of means to offset weakness in commodities and exposed resource stocks.

“Volumes have been under $4 billion for the second day running — indicative that there’s a lot to focus on overnight,” said OptionsXpress’s Ben Le Brun. “We’ll be able to look with afresh set of eyes after the Fed tonight.”

Miners felt the weight of a sharp drop in iron ore. BHP lost 0.4 per cent to $26.19, Rio Tinto shed 1.2 per cent to $66.06, while iron ore pure-play Fortescue closed down 1.8 per cent to $5.33.

Increasing uncertainty over the volatile steelmaking commodity resonated into the second half of the trading week, with comments from the Reserve Bank hitting home for investors monitoring demand.

5.00pm: Sirtex slapped with $100k ASIC fine

Sirtex Medical (SRX) has been slapped with a $100,000 by ASIC after it allegedly breached continuous disclosure obligations in relation to an update on projected dose sales growth on December 9 last year.

James Kirby 3.55pm: REITs stretched too far again?

Just in time to mark the tenth anniversary of the GFC when many Australian property trusts turned into wealth destruction machines, the issue of stretched borrowings — also known as high gearing — is on the table again with Cromwell Group ringing the bell.

With quite woeful timing, Moody’s rating agency this week put the Cromwell Property Group on ‘review for a downgrade’: a move which would push some of Cromwell’s debt into the ‘speculative’ category just as the wider group plans a listing in Hong Kong.

A quick look at the latest gearing tables for Australia’s so-called REITs shows the sector is allowing the issue of leverage to cloud its achievements once again. Moreover, Cromwell is not alone with a gearing level of 40 per cent plus — often a warning for ratings agencies and others

In fact, it’s not that REITs have cooled off on borrowing — rather they have been borrowing at low rates against a prolonged period of rising asset values … and that can’t go on forever — more to come.

CMW last up 2pc at $1.00

3.30pm: iPhone X to rile stout economics

Josh Zumbrun and Tripp Mickle write:

Thorstein Veblen was a cranky economist of Norwegian descent who coined the phrase “conspicuous consumption” and theorised that certain products could defy the economic laws of gravity by stoking more demand with superhigh prices.

His 1899 book, “Theory of the Leisure Class,” made him famous in his time and more than a century later his ideas are embodied in products like Hermès handbags, Bugatti cars and Patek Philippe watches.

Now Apple and Samsung are testing whether the social commentator’s theory on what has come to be known as the “Veblen good” can work for one of the most common of all consumer products — the phone.

The gambit is striking because prices tend to fall in technology and products become obsolete fast. In this case, though, it just might work in its own way.

Typically, raising the price of a good lowers demand for it. If beef becomes too expensive, people will buy more chicken.

Mr. Veblen’s theory posits that some consumers want a product even more when the price rises because the expense broadcasts status, taste and wealth.

By unveiling the new iPhone X last week with a price of $US1,000, Apple Inc. is pushing the envelope even further than Samsung Electronics Co., which unveiled the $US950 Note 8 phone this year. Rather than trying to attract consumers with cheaper prices, the companies are fighting for customers with expensive price tags.

The starting price of the new flagship iPhone X is about 50pc more than the $US650 starting price of last year’s iPhone 7. The most expensive version of the iPhone X, with 256 gigabytes of storage, will cost 19pc more than last year’s most expensive device, the iPhone 7 Plus, with the same memory — read more

The Wall Street Journal

3.10pm: And then some: TPG sheds gains

If the above doesn’t say it all, TPG Telecom has given back more than everything it gained in the session previous in which the company released full-year results.

Shares jumped nearly 7 per cent after the company said it booked a 9pc increase in profit over FY17, but shocked the market with a slashed dividend and stern warning on the pressure of the NBN on its broadband margins.

TPM last down 7pc at $5.10

2.45pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

3.00pm: Shaw and Partners

3.05pm: Jack Lowenstein — Morphic Asset Management

3.15pm: Politics Panel

3.30pm: Jo Horton — St George

4.00pm: TMS Capital, John Noonan — Reuters

(All times in AEST)

Scott Murdoch 2.22pm: Tabcorp, Tatts merger hits hurdle

The $11 billion Tabcorp and Tatts Group merger will return to the Australian Competition Tribunal after the Federal Court upheld an appeal against the deal progressing.

The ACCC appealed to the court on the ACT’s ruling that the mega merger should be allowed to go ahead.

The decision delivered in Sydney today means the case will again be heard by the ACT.

The reasons for the judgement was embargoed for the next five days.

TAH and TTS both in trading halt.

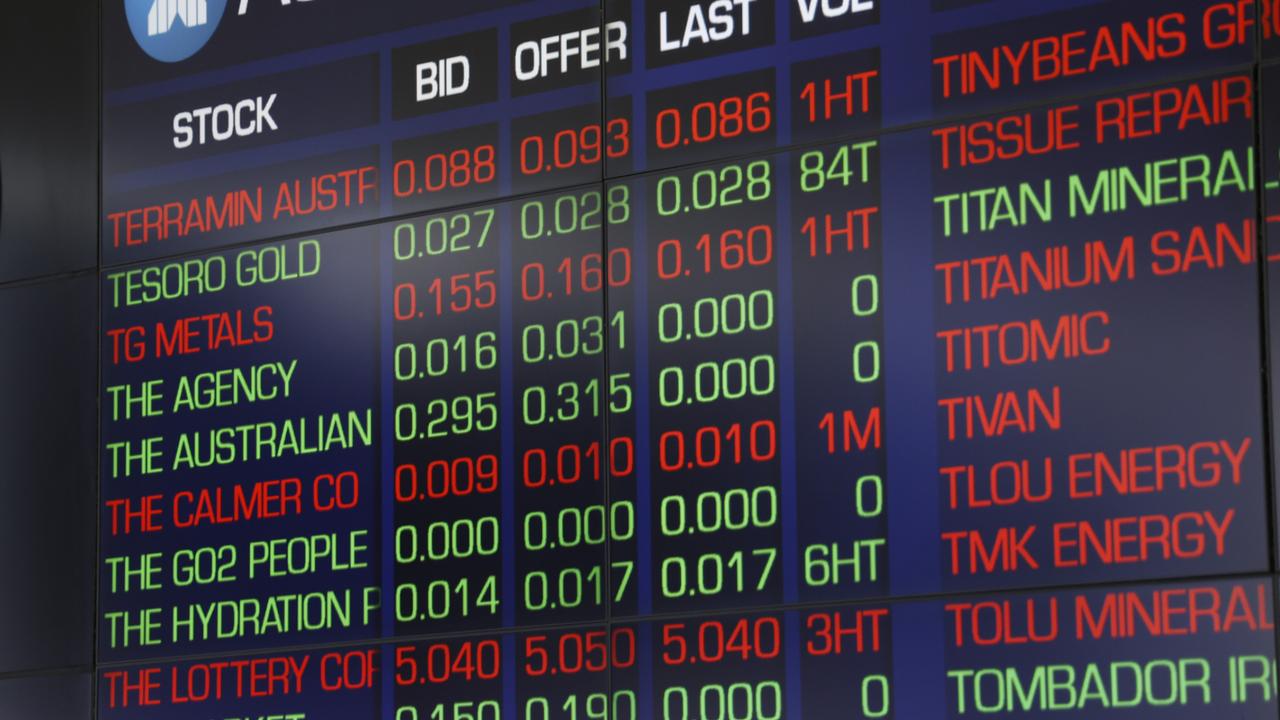

2.00pm: ASX200 clambers toward flat on CSL hike

The local sharemarket reverses steep early losses to trade just south of flat as healthcare heavyweight CSL goes from strength to strength — last 2.3 per cent higher at $133.96.

Meanwhile, the rest of the leaderboard still clambers along in the red, albeit on smaller losses for the big miners:

Index last 0.1 per cent down at 5708.4

Michael Roddan 1.50pm: ‘Crunch time’ for Brisbane property: RBA

Reserve Bank assistant governor Luci Ellis said “this year is crunch time” for the Brisbane housing market as an oversupply of apartments loom over the city.

Speaking in Sydney on Wednesday, Ms Ellis said population growth in Melbourne and Sydney would likely provide greater support to prices in the apartment markets of both cities.

However, she said the central bank had been “most concerned” about the Brisbane apartment market due to the concentrated nature of the construction. Ms Ellis also said older apartments were also more vulnerable than newer apartments, as tenants were likely to leave older buildings for newer ones.

Chris Griffith 1.20pm: New iPhone 8: Pros & cons

I’ve been redecorating our newspaper office in new furniture. Frankly, I don’t think the paper would be thrilled with my taste. But they’ll never see what I created unless they grab my iPhone 8 and look through the camera lens in augmented reality, or AR.

If they did, they’d see the foyer of our office with a superimposed array of sofas, lights and chairs.

AR is one of the new features that gets full support with Apple’s latest iPhone 8 and the larger 8 Plus handsets that go on sale on Friday.

Apple Holds Product Launch Event At New Campus In CupertinoEverything you need to know about the Apple launch

Last year the world saw AR in action with the Pokemon Go app. People were energised by seeing little Pokemons in the real world when looking through the phone’s camera.

VIDEO: Today I decorated the foyer of the Australian's office with virtual Ikea furniture using Apple iPhone 8 https://t.co/ChnMfnu040 pic.twitter.com/yX0KJFPj2E

— Chris Griffith (@chris_griffith) September 19, 2017

12.50pm: Iron ore tests market’s patience

Iron ore miners are feeling the heat this session, extending losses as the volatile underlying commodity bends to the will of speculators and traditional market forces.

Taken once at the outset of trade, iron ore’s spot price fell over 3 per cent and brings heavyweights BHP, Rio Tinto and Fortescue along for a ride in the red — the latter down as much as 2 per cent in lunchtime trade.

While the bears rule over resource stocks this session, investors willing to take a step backward — and losses thus far — may find comfort on the horizon according to Optionsxpress’ Ben Le Brun.

We’re right at the bottom of the curve in terms of cost,” Mr. Le Brun says, “those growing cash piles played out over earnings season, that really does wet the beaks of market participants

“Maybe it could take another from here, but I think at some stage its going to buy some support and that will be the time when you’ll be happy you’ve bought into the dip of big miners.”

Read: ‘Nervousness’ at iron ore trend, writes Samantha Woodhill

Read: BHP clears the air on climate, writes Matt Chambers

Read: BHP boss pockets $US7m, writes Matt Chambers

12.25pm: Fed enters uncharted waters

In the US later today the Federal Reserve Board starts what will be one of the milestone meetings in its post-crisis history, with a general expectation that when the meeting ends tomorrow it will announce the beginning of the protracted process of shrinking a balance sheet bloated by its response to the crisis.

The Fed has conditioned markets to expect that it will move cautiously and in a very measured and predictable fashion to begin unwinding the $US3.6 trillion of bond and mortgages it made during the three quantitative easing programs that began in 2008 and which inflated its balance sheet from about $US900 billion to $US4.5 trillion.

It is expected that when it stops reinvesting all the proceeds of maturing securities, perhaps from next month, it will initially reduce its balance sheet by about $US10 billion a month, with the level of non-reinvestment rising subsequently every quarter until it eventually reaches $US50 billion a month.

By laying out a formulaic “set and forget’’ approach to the winding down of its balance sheet the Fed hopes that it won’t unsettle financial markets.

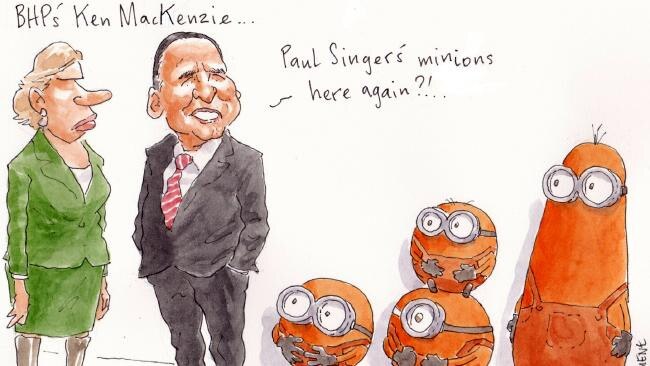

Matt Chambers 12.05pm: BHP boss pockets $US7m

New BHP Billiton chairman Ken MacKenzie has promised continued engagement with shareholders and better capital allocation in his first official comments in the role.

The comments were in the big miner’s latest annual report, released today, which shows chief executive Andrew Mackenzie’s total 2016-17 remuneration jumped to $US7.092 million, from $US5.9m the previous year, under Australian accounting standards.

Under BHP’s separately calculated “actual total remuneration” — a British standard that the miner believes better represents what the CEO received — Mr Mackenzie’s pay rose to $US4.55m, from $US2.24m the previous year, after a strong year for the miner on the back of commodity price gains.

11.45am: Seven swipes Coates from rack

Simone Ziaziaris writes:

Seven Group Holdings has announced it will buy the remaining half of its stake in equipment hire company, Coates Hire, for $517 million.

The Kerry Stokes-controlled company, which bought almost half of Coates Hire in 2008, said it will raise the money to buy the remaining 53.3 per cent stake through existing earnings and cash flow, including proceeds from the sale of its WesTrac business in October which is expected to be in excess of $500m — read more

SVW last up 7.8 per cent at $12.06

11.30am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Byrnn O’Brien — ACCR executive director

11:40am: Andy Penn — Telstra CEO

12:00pm: Ben Le Brun — Optionsxpress

12:15pm: James King — Afex Australia

12:45pm: Paul Dales — Capital Economics

(All times in AEST)

Bridget Carter 11.20am: Yili primed in Murray contest

Chinese dairy powerhouse Yili has made a knockout bid for Murray Goulburn, according to sources, in the first round of the contest for Australia’s largest dairy processor.

Investment bank Deutsche called for first round bids for the company by Friday and a raft of the country’s largest dairy groups are believed to have lobbed offers as well as Chinese suitors.

Yili, which has the full name Mongolia Yili Industry Group Company, is working for Bank of America Merrill Lynch and is a privately owned Chinese dairy company that processes and manufacturers milk products such as ice cream and powdered milk.

Speculation is mounting that Yili has made a generous offer for the business, which some estimate could be worth about $1.20 per unit — almost double the price it was trading at before it was placed up for sale — more to come from DataRoom

MG Unit Trust (MGC) last

11.15am: TPG shares reverse all gains

TPG Telecom has shed everything it gained in the session previous to trade 6.4 per cent lower at $5.14.

The stock shot higher yesterday after it slashed its dividend depside booking a 9 per cent increase in its full-year net profit. The telco also announced it increased its debt facility to $2.4bn ahead of its planned rollout of a mobile offering in Australia.

11.05am: Elliot’s stickybeaking Down Under

Will Glasgow and Chrisine Lacy write:

Lieutenants from New York billionaire Paul Singer’s hedge fund Elliott Partners are back in Australia. Should new BHP chairman Ken MacKenzie be worried?

Margin Call understands the activist Elliott crew are Down Under to meet fellow investors in the global miner.

That provides a good forum for Elliott to take a bit of credit for recent about-faces at the Big Australian, most notably the exit of blink-and-you-missed-him BHP director Grant King and MacKenzie’s humbling announcement that the global miner was calling time on its $US40 billion shale adventure in the US.

Read more from Margin Call

10.40am: ASX200 falls amid iron ore nerves

The local sharemarket veers lower in early trade as commodity markets play havoc with big miners and buyers put their plans on hold ahead of the US Federal Reserve rate decision.

The S & P/ASX200 index was 0.4 per cent lower at 5692.5 shortly after the opening bell.

It’s a sea of red in the large-cap end of town with healthcare heavyweight and offshore earner CSL the only stocks edging up into the black.

Pure-play Fortescue finds itself 1.7 per cent in the red as the spot price of underlying commodity iron ore sunk over 3 per cent overnight, coveted volatility in the steelmaking material enough to rile investor nerves, according to CMC chief market analyst Ric Spooner.

“Markets may remain a little circumspect ahead of next month’s Chinese Peoples’ Congress,” said Mr. Spooner, “this may represent an opportunity for China’s leadership to tilt policy a little further towards reform and away from stimulus and infrastructure spending.”

The Australian dollar climbed up a full percentage point against the greenback overnight as anticipation ahead of the Fed’s rate call expected early tomorrow morning stifles USD bulls.

The local currency was 0.1 per cent lower in morning trade at US80.03 cents.

10.20am: Goyder’s pay breaches $12m

Wesfarmers managing director Richard Goyder landed a $12.1 million pay packet in his final full year in charge of the Coles and Bunnings operator. Mr Goyder’s fixed remuneration remained steady at $3.35m, but his annual incentive payment swelled nearly fourfold to $4.1m and he picked up another $4.2m in long-term incentives.

Deputy chief executive Rob Scott received a total $5.6m in remuneration, but Wesfarmers has already confirmed his salary will remain far lower than Mr Goyder’s when he takes charge following the October 13 annual general meeting in Perth — AAP

WES last down 0.1pc at $41.11

Bridget Carter 10.15am: Lattice trade sale to Beach logical: RBC

Analysts from Royal Bank of Canada are betting that Origin Energy’s $1.6 billion Lattice Energy spin-off will be divested via a trade sale, with Beach Energy the most logical buyer.

It comes as final bids for Lattice Energy now look likely to be due sometime next month, with plans for an initial public offering expected to get into full swing by the end of next month with a view to list in November if a trade buyer does not come forward — more to come from DataRoom

ORG last $7.57

Matt Chambers 9.56am: New BHP chair breaks silence

New BHP Billiton chairman Ken MacKenzie has promised continued engagement with shareholders and better capital allocation in his first official comments in the role.

The comments were in the big miner’s latest annual report, released today, which shows chief executive Andrew Mackenzie’s total 2016-17 remuneration jumped to $US7.092 million, from $US5.9m the previous year, under Australian accounting standards.

Under BHP’s separately calculated “actual total remuneration” his salary rose to $US4.55 million, from $US2.24m the previous year, after a strong year for the miner on the back of commodity price gains.

“As incoming Chairman, I spent much of the past three months engaging with shareholders and other stakeholders around the world in order to better understand their perspectives,” Mr MacKenzie said.

“I plan to engage with investors on a regular basis.”

Mr MacKenzie replaced Jac Nasser this month, with the succession process occurring amid a campaign by activist shareholder Elliott for a restructure and more capital discipline after BHP spent $US40 billion on US shale for next to no return since 2011 — read more

BHP last $26.30

9.55am: ASX200 to lift amid bulk hit, Fed watch

Futures tip the local sharemarket to open higher after Wall Street hit new records and traders around the world keenly await the outcome of US Federal Reserve’s rate decision due early tomorrow morning.

At 7:00am AEST, the share price futures index was up 14 points, or 0.25 per cent, at 5,716.

All three Wall Street indices hit record highs overnight, and following their US counterparts bank shares look set to open higher after failing to fully convince in the session previous.

Resource stocks, meanwhile, are behind the Eight ball as pressure from the iron ore futures price finally weighed on the spot according to ANZ senior commodity strategist Daniel Hynes.

“Bulks fell sharply, led by a collapse in iron ore prices,” said Mr. Hynes, ”the weaker sentiment in the market was fuelled by comments from the RBA, which said prices are expected to fall ahead of the ongoing expansion of the global iron ore supply chain.”

Elsewhere, the full Federal Court is expected to deliver its verdict on the ACCC appeal of Tabcorp-Tatts merger approval, while Telstra shareholders are on high alert as CEO Andy Penn addresses the company’s conference in Melbourne at 10:15am AEST.

The Australian dollar added a full percentage point overnight as the local currency was given a leg up by US dollar bulls patience tahead of the Fed decision — last near flat at US80.09 cents.

9.42am: Strike Energy to power up $9.1m

Strike Energy is raising about $9.1 million of equity Wednesday morning.

The raise is by way of a placement with the issue of 130 million shares and Bell Potter Securities is the sole bookrunner and lead manager.

Corporate Advisor is Chieftain Securities.

Strike’s last traded share price was 8.8c and the offer is at 7c per share, which is a 20.5 per cent cent discount to its last close.

The company’s market value is $85m.

Proceeds will be used for working capital and to deliver part of its Jaws Project.

Shares remain in a trading halt until Thursday — STX last $0.088

Bridget Carter 9.38am: JPMorgan raising Nib’s $60m

Nib Holdings is raising $60 million of equity through investment bank JPMorgan after it acquired GU Health for $155.5 million

The private health insurer is tapping the market via an institutional placement, with 10.9 million new shares issued representing 2.5 per cent of its current issued capital.

The underwritten floor price for the offer is $5.48 per share, which is a 5 per cent discount to its last trading price of $5.77.

Shares remain in a trading halt until Thursday.

GU Health is Australia’s only specialist corporate group private health insurer, servicing over 34,000 policyholders across more than 260 clients.

The business has been owned by Australian Unity since 2005 — read more from DataRoom

NHF last $5.77

Damon Kitney 8.45am: UBS rainmaker’s market alarm

One of the world’s top investment bankers says he is “uncomfortable’’ with the state of global markets, warning the world “has moved from the management of risk to the management of uncertainty’’, prompting clients to remain increasingly on the sidelines.

UBS Global Investment Bank president Andrea Orcel told a special media briefing in Hong Kong yesterday attended by The Australian that the Swiss bank continued to take a risk-averse approach to business in a world where markets continued to defy gravity.

“We are uncomfortable with this market ... We have moved from management to risk of management of uncertainty. Investment banks are very good at managing risk. Certainty is very different,’’ he said.

Richard Gluyas 8.40am: Competition probe shakes pillars

The contentious Four Pillars ban on mergers between the major banks is back on the agenda after the ACCC asked the Productivity Commission to consider the impact of the policy on competition in the financial system.

Australian Competition & Consumer Commission chair Rod Sims last night said the watchdog had a neutral position on Four Pillars.

“What we’re doing is lobbing the issue over the net for the PC to have a look at, and we’re also asking if the policy should be extended to other banks if it’s found to confer advantages on the big four banks,” Mr Sims told The Australian.

Simon Benson 8.35am: Abbot to ‘cross floor on energy’

Tony Abbott has sent a warning to Malcolm Turnbull that he will cross the floor of parliament and vote against any government attempt to legislate a clean energy target, in a move that threatens to increase divisions in the Coalition party room over energy policy.

The threat came as the Prime Minister yesterday blamed Mr Abbott for subsidies flowing to energy companies under the Renewable Energy Target being “too generous”.

In an escalation of the backbench-led campaign to kill off plans for a CET, Mr Abbott this week relayed his staunch opposition to a senior member of the government, saying he could not in good conscience vote for a policy that continued to subsidise renewable energy sources.

8.30am: Seven swoops on Coates Hire

Seven Group Holdings has purchased the remaining 53.3 per cent stake it did not already own in machinery rental company Coates Hire.

In a statement to the ASX this morning, Seven said it bought the stake from a Carlyle Group managed fund for $517m, that the purchase will contribute 15 per cent to underlying group earnings-per-share and a 91 per cent increase in free cash flow based on a FY17 basis — read more

SVW last $11.22

7.40am: Oil slips below $US50

Oil prices faltered, giving up gains in earlier trading as investors weighed the possibility that OPEC will extend its production cuts again against the prospect of rising U.S. oil output at higher prices.

US crude futures fell US43 cents, or 0.86 per cent, to $US49.48 a barrel on the New York Mercantile Exchange, after climbing as high as $US50.42 in earlier trading. Brent, the global benchmark, fell US34c, or 0.61 per cent, to $US55.14 a barrel on ICE Futures Europe.

“We’re zigzagging in the range,” said Michael Hiley, a trader at LPS Futures. “We failed the highs from last week and are back down into the same range we’ve been in for three days.”

Prices were buoyed in earlier trading by a weaker dollar and signals from Iraq’s oil minister that the country could be open to extending OPEC’s production-cut agreement through next year. But analysts and traders say that $US50 a barrel remains a staunch resistance point for US crude futures amid a persistent glut that could begin growing again next year.

Dow Jones

7.27am: Stocks set for positive start

The Australian market looks set to open higher after US stocks edged higher, on low volumes as trader wait for the US Federal Reserve policy announcement, early on Thursday morning, Australian time.

At 7am (AEST), the share price futures index was up 14 points, or 0.25 per cent, at 5,716.

The Dow Jones Industrial Average was up 39.45 points, or 0.17 per cent, to 22,370.80, helped by gains in financial, and technology stocks. Locally, in economic news on Wednesday, Reserve Bank of Australia assistant governor (Economic) Luci Ellis is slated to speak at the Australian Business Economists (ABE) conference in Sydney.

No major equities news is expected.

The Australian market on Tuesday closed lower, as investors turned cautious ahead of the US central bank’s monetary policy decision.

The broader All Ordinaries index dropped 6.6 points, or 0.11 per cent, to 5,772.4 points.

Meanwhile, the Australian dollar followed Wall Street higher. The local currency was trading at US80.10 cents at 7.29am (AEST), from US79.81c on Tuesday.

AAP

7.14am: Dollar tracks US stocks higher

The Australian dollar has followed US stocks higher as investors stayed away from making major bets ahead of the Federal Reserve’s policy meeting. At 7.18am (AEST), the Australian dollar was worth US80.09 cents, up from US79.81c on Tuesday.

Westpac’s Imre Speizer says there was scant news to drive markets overnight, and there’s also caution ahead of the US Federal Reserve policy decision, which is expected early Thursday morning, Australian time.

“The FOMC interest rate decision is widely expected to be on hold. It has been well-telegraphed that the specific start date of the balance sheet normalisation plan will be announced at this meeting,” he said.

AAP

7.10am: Wall St taps fresh highs in quiet trade

Major US indexes hit a trifecta of records Tuesday despite relatively muted trading as investors braced for the Federal Reserve’s policy decision this week.

Easing geopolitical concerns and steady global growth have encouraged investors to keep lifting stocks higher in recent sessions, with the gains Tuesday fuelled by telecommunications and financial companies.

Still, the subdued trading environment Tuesday saw the S & P 500 notch one of its smallest intraday ranges since May.

The Dow Jones Industrial Average gained 39.45 points, or 0.2 per cent, to 22,370.8 — the blue-chip index’s eighth consecutive session of gains. The S & P 500 added 2.78 points, or 0.1 per cent to 2,506.65 and the Nasdaq Composite rose 6.68 points, or 0.1 per cent, to 6,461.32. Each of the major indexes closed at new records Tuesday.

Dow Jones Newswires