Trading Day: live markets coverage; Telcos shine as stocks trade mixed; plus analysis and opinion

The ASX pares early gains as investors draw breath and TPG ignites the telco sector in the wake of profit results.

Welcome to Trading Day for Tuesday, September 19.

4.30pm: Stocks fall as investors hold breath

Local stocks fell as hesitation paved the way for a mixed session, while the dollar eked out gains in the wake of upbeat Reserve Bank commentary.

At the close, the S&P/ASX200 index was 0.1 per cent, or 7 points lower on5713.6 while the broader All Ordinaries index also closed down 0.1 per cent, or 6.6 points to 5772.4.

After posting strong opening gains, indices swung repeatedly as the session unfurled investors around the world edged toward the sidelines ahead of a pivotal meeting of the US Federal Reserve due to commence overnight.

“The session has been backed up by fairly low volume, so it doesn’t take too much to push the market in either direction,” said Optionsxpress’ Ben Le Brun.

“Financials and materials just clung onto positive territory, well and truly off their highs. It’s been the likes of the property trusts, consumer related stocks and healthcare — all significantly lower — that have weighed on trade.”

CBA edged down 0.5 per cent to $76.28, Westpac lost 0.3 per cent to $31.58, ANZ held onto gains to close 0.1 per cent higher on $30.22, while NAB shares finished just north of flat on $31.19.

Resource stocks posted slim gains as underlying commodities quietened. BHP inched up 0.1 per cent to $26.30, Rio Tinto rose 0.3 per cent to $66.89, while Woodside Petroleum closed flat on $28.52 — read more

Richard Gluyas 4.00pm: BIS raises cryptocurrency flags

Central banks have raised concern about the cyber-resilience of digital currencies like bitcoin amid continuing discussion about the possible emergence of central bank cryptocurrencies.

According to the Bank for International Settlements, new cryptocurrencies are emerging almost daily, with many observers wondering if central banks should issue their own versions.

Already, some central banks have been experimenting with distributed ledger technology — the technology that underlies bitcoin.

“But making sense of all this is difficult,” the BIS says.

“There is confusion over what these currencies are, and discussions often occur without a common understanding of what is actually being proposed.”

The BIS says a central bank cryptocurrency would allow consumers to hold bank liabilities in a digital form.

Olivia Caisely 3.50pm: Woolies caught in SSM boycott threat

Woolworths has been forced to restate its support for same-sex marriage in the face of a shopper boycott threat after the supermarket giant’s former boss Roger Corbett advocated a No vote.

Mr Corbett, who was Woolworths chief executive between 1999 and 2006 and is a former chairman of Faifax, spoke out against same-sex marriage in an interview last night on ABC TV’s 7.30.

Faced with the backlash, Woolworths today issued a statement, without directly referencing Mr Corbett’s comments, backing marriage equality.

“We believe marriage equality is not just a social but also a workplace issue. For that reason, we pledged out support for marriage equality in August,’’ the company said — read more

WOW last down 0.4pc at $25.18

— Woolworths (@woolworths) September 19, 2017

3.45pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

3.50pm: Ben Le Brun — Optionsxpress

4.00pm: John Milroy — Ord Minnett

4.05pm: Andrew Wielandt — Dornbusch Partners

4.30pm: Tony Farnham — Patersons Securities

5.00pm: Peter McGuire — XM.COM

5.15pm: Steven Keen — Debunking Economics

5.30pm: Henry Jennings — Marcus Today

(All times AEST)

Stephen Bartholomeusz 3.40pm: What to expect from Fed milestone

In the US later today the Federal Reserve Board starts what will be one of the milestone meetings in its post-crisis history, with a general expectation that when the meeting ends tomorrow it will announce the beginning of the protracted process of shrinking a balance sheet bloated by its response to the crisis.

The Fed has conditioned markets to expect that it will move cautiously and in a very measured and predictable fashion to begin unwinding the $US3.6 trillion of bond and mortgages it made during the three quantitative easing programs that began in 2008 and which inflated its balance sheet from about $US900 billion to $US4.5 trillion.

It is expected that when it stops reinvesting all the proceeds of maturing securities, perhaps from next month, it will initially reduce its balance sheet by about $US10 billion a month, with the level of non-reinvestment rising subsequently every quarter until it eventually reaches $US50 billion a month.

Michael Roddan 3.20pm: Code combats fees on idle funds

A proposed code of practice covering the life insurance and superannuation industries will face stiff criticism for failing to stop companies draining member savings with high insurance fees when the customer has stopped contributing to their fund.

The draft code of practice, which will be released by the Insurance in Superannuation Working Group tomorrow for a month of consultation, outlines several moves to prevent super balances being unnecessarily eroded by insurance fees. Around two-thirds of Australians gain life insurance through their super fund, where cover is provided on an automatic opt-out basis, which sees more than $8 billion in premiums going to insurers ever year.

John Durie 3.00pm: Way to play the executive pay game

Executive pay is hitting the headlines again and next week it will be AGL boss Andy Vesey’s time to shine given he has, on top of his annual stipend which last year totalled $5.1 million including short term pay, earned 376,229 shares worth $8.8m in his 31 months at the company.

Last year and this year he also sold 100,000 shares in total, collecting $2.2m, which no doubt was to help his tax bill.

He has long term rights for another 305,161 shares worth some $7.2m but they are yet to fully vest, so can’t really be included as “his shares”.

The point being, Vesesy has not had to open his wallet to buy a single share, he has earned them under his pay contract and since arriving in February 2015 the AGL share price has risen by some 1.6 times, so arguably shareholders have done just as well and everyone has enjoyed the ride.

2.40pm: Toys ‘R’ Us files for bankruptcy

Lillian Rizzo and Suzanne Kapner write:

Toys ‘R’ Us, the rainbow-coloured toy emporium that for decades was the go-to spot for birthday and holiday gifts, has filed for bankruptcy protection in the US, undone by a hefty debt load and the rapid shift to online shopping.

As part of the restructuring process, Toys ‘R’ Us plans to close some underperforming stores, according to people familiar with the matter.

Its remaining locations would be reconfigured to be more experienced-based, incorporating amenities such as in-store play areas, they added.

The company expects most of its stores will be open for the holidays and it will use a large bankruptcy loan to continue buying merchandise and funding its operations, the people said.

The company, which operates about 1700 stores around the world, was a classic example of a “category killer,” a huge specialty store with low prices that squeezed independent shops.

2.10pm: ASX trades choppy as banks waver

The local sharemarket holds slim gains in afternoon trade as a rush into big bank stocks eases and while the dollar remains similarly buoyed after the release of the RBA September meeting minutes.

The S&P/ASX200 index trades 0.1 per cent higher at 5726.8 with heavyweight banks and miners doing the heavylifting with modest gains shy of 1 per cent in large-cap territory.

Teclos prove the standout sector on the bourse with Telstra up 0.9 per cent and rival TPG best performer on the top 200 index as it holds gains over 6 per cent following its full-year profit figures released before the open.

Meanwhile, the Australian dollar hovers 0.2 per cent or US0.17 cents in the black following the release of RBA’s September meeting minutes and ABS house price data.

1.46pm: Ten creditors back CBS takeover

A meeting of Ten Network creditors has voted “overwhelmingly” in favour of a bid for the network by US entertainment giant CBS, which overnight sweetened its takeover offer.

CBS had lifted its bid in answer to an updated offer from rivals Bruce Gordon and Lachlan Murdoch, which creditors today rejected.

“I’m not an industry expert — you guys probably all know better than me — but I think the industry is genuinely excited about having a $27 billion big brother looking after Channel 10,” administrator Mark Korda said after the meeting.

Ten receiver and manager Christopher Hill said the outcome secured the future of Australia’s third largest free-to-air broadcaster.

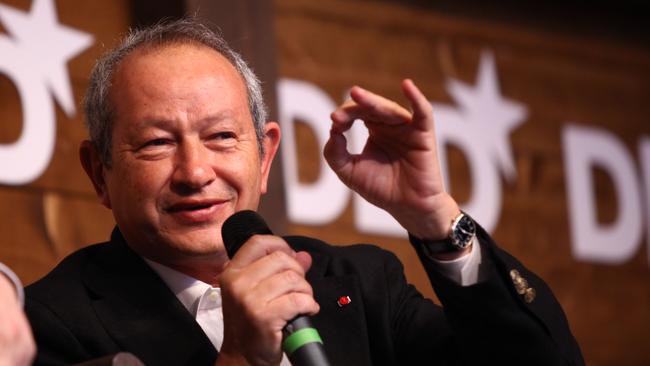

Paul Garvey 1.15pm: Evolution loses Egyptian gold

Egyptian billionaire Naguib Sawiris has sold down some of his holding in Australia’s second-biggest gold producer Evolution Mining.

Sawiris, who made his fortune through telecommunications, has sold just over 20 million Evolution shares worth almost $50 million on-market and representing around 1.5 per cent of the company. His company La Mancha Group continues to own a 26.9 per cent stake in Evolution and remains the company’s single biggest shareholder.

Unusually, the bulk of the shares sold did not generate any cash for Sawiris. Instead, according to his ASX disclosure, some 14.6m of his shares were sold on market for nil consideration “by derivative writer following termination of derivative”. Those shares would have been worth around $34m on the market at current prices.

The other 5.8m shares sold in recent days by Sawiris collected him just under $14.5m at an average price of around $2.47 each.

Sawiris became Evolution’s biggest holder back in 2015, when he sold Evolution his Frog’s Leg gold mine near Kalgoorlie. Since then the stock has climbed from around $1.23 a share to a recent high of $2.66.

Elsewhere in the mining space, Independence Group Peter Bradford has taken advantage of the diversified miner’s recent price weakness and added another 30,000 Independence shares to his holding.

Bradford paid $105,900 or $3.53 each for the shares, taking his total holding to 830,000 shares plus 352,391 performance rights.

EVN last down 1.9pc at $2.36

Eli Greenblat 1.00pm: Surfstitch unravelling pulls on thread

The unbundling and dismembering of failed online retailer SurfStitch took another step today after the administrators announced the sale of the Magicseaweed and Metcentral surfing content sites for an undisclosed sum.

It marks the retreat by SurfStitch from the media and online publishing sector which the online retailer burst into soon after it listed on the Australian Securities Exchange, fuelled by a string of capital railings that saw it spend more than $50 million on acquisitions — most of which were outside its traditional retail operations.

Last week SurfStitch administrators sold Rollingyouth, the owner of Stab Magazine, back to its co-founders for a small amount of cash after paying more than $6 million for the publisher in 2015 — more to come.

12.40pm: CBS bid approval ‘low risk’: Korda

Partner of Ten Network administrator Korda Mentha Mark Korda has described the US network CBS’ bid for the Ten Network as “relatively low execution risk” from “a company that has a market value of $27bn.”

More to come.

Darren Davidson 12.15pm: Ten creditors vote in CBS favour

A meeting of Ten Network creditors has voted “overwhelmingly” in favour of a bid for the network by US entertainment giant CBS, which overnight sweetened its takeover offer.

CBS had lifted its bid in answer to an updated offer from rivals Bruce Gordon and Lachlan Murdoch.

Administrators KordaMentha had earlier favoured a CBS bid for Ten — read more

TEN last $0.16 in trading halt

12.00pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

TBA: Mark Korda on Ten Network — Korda Mentha

12:15pm: Gerard Burg — NAB

12:30pm: Geoff Bazzan — Maple-Brown Abbott

12:45pm: Janu Chan — St George

1.00pm: Ben Le Brun — Optionsxpress

2.00pm: Jonathan Barratt — Ayers Alliance

2.15pm: Tim Larkworthy — Fiig Securities

2.30pm: Fernando Fanton — Just Eat

2.40pm: Peter Devine — Uniseed

2.50pm: Dean Jones — Glam Corner

(All times in AEST)

11.50am: $A spikes amid RBA, house prices

The Australian dollar jumped higher before settling at its previous level as the market pieced through the RBA’s minutes from its September meeting and as Australian Bureau of Statistics released second-quarter house price data showing steady 10.2pc growth on the same period a year prior.

“Housing price growth had slowed over 2017 in Sydney, but had remained strong in Melbourne,” it said, “a similar pattern was evident in auction clearance rates, which had declined by more in Sydney than in Melbourne.”

The central bank also alluded to concerns over sluggish wage growth and growing household debt levels, noting “subdued” growth in household income and easing core inflation.

“The pattern of growth in wages across industries had broadly mirrored the pattern of employment growth,” it said, “with higher outcomes in the healthcare and education sectors and lower wage increases in the mining and retail sectors.”

The local currency trades its levels before the releases at 11:30am AEST, 0.3 per cent or US0.21 cents higher at US79.79 cents — read more

11.23am: CBS ups Ten Network bid

Bridget Carter and John Durie write:

US Entertainment group CBS has increased its offer for the Ten Network to answer a higher bid from Bruce Gordon and Lachlan Murdoch.

CBS’s new bid comes as creditors meet in Sydney, and follows last week’s updated offer for Ten by Mr Gordon and Mr Murdoch.

Administrators KordaMentha had earlier favoured a CBS bid for Ten — read more

TEN last $0.16 in trading halt

Eli Greenblat 11.10am: Retail sinkhole claims Fineline

The worst conditions in the retail sector for decades has claimed yet another victim as Fineline Home Products enters into the hands of administrator BDO, the retailer trading as homewares brand Moss River through eight stores in Australia.

The homewares retail chain has been in business since 1978 and specialises in manchester and premium linen. Its stores are spread across Queensland, New South Wales and Victoria and include sites in up-market suburbs such as Mosman and Woollahra in Sydney and Canterbury and Toorak in Melbourne.

It employs approximately 40 people — more to come.

Ben Butler 10.55am: Tabcorp-Tatts verdict nears

A court will rule tomorrow on whether Tabcorp can go ahead with its $12bn merger with rival gambling giant Tatts, almost a year after the transaction was first proposed.

Despite fierce objections from corporate bookies including James Packer’s CrownBet, the deal was approved by the Competition Tribunal in June.

However, both the Australian Competition and Consumer Commission and CrownBet asked the full Federal Court to review the decision.

The ACCC’s appeal is based on chairman Rod Sims’ belief three points of law, which it relies internally on to make its own authorisation decisions, need to be clarified following the Competition Tribunal’s ruling — read more

TAH last down 0.9pc at $4.34, TTS last down 0.3pc at $4.06

10.45am: ASX200: Heavyweights haul index higher

The S&P/ASX200 index trades 0.4 per cent higher at 5741 as the bourse’s largest stocks haul the broader sharemarket higher.

Big Four bank shares all trade over 0.5 per cent in the black, while large cap miners BHP and Rio Tinto surge ahead with gains as much as 1 per cent as dearer crude oil offsets uncertainty for the nation’s largest export iron ore.

TPG Telecom goes from strength to strength, proving best performer on the top 200 index as it swings into the black to post gains as much as 4 per cent — the market sifting through its latest set of results and commentary.

New Hope shares are over 2 per cent higher as it sweetened its dividend on a beefed up profit result, while media watchers eye the latest turn of events in Ten Network ahead of administrator Mark Korda of Korda Mentha taking questions on Trading Day — tune into Sky News Business Channel 602 for the latest developments.

10.30am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Steve Allen — Essence Media

10:45am: Tom Kennedy — JP Morgan

11:15am: Rudi Filapek-Vandyck — FN Arena

11:30am: Martin Whetton — ANZ

12:15pm: Gerard Burg — NAB

12:30pm: Geoff Bazzan — Maple-Brown Abbott

12:45pm: Janu Chan — St George

TBA: Mark Korda on Ten Network — Korda Mentha

(All times in AEST)

10.20am: TPG shares lift amid dividend cut

TPG shares lift 3.3 per cent to $5.39 at the open after it slashed its final dividend and warned of pressure from the NBN rollout alongside a 9 per cent rise in annual profit — read more

10.00am: ASX200 to lift as heavyweights rotate

Index futures tip the local sharemarket to rise in early trade as investors eye strength in Aussie financials and resource stocks piece through a muddled lead from commodity markets.

The session previous saw momentum roll into a cycle out of resources into financials, while a clear lead from commodity markets proves difficult to glean despite signs of life from gold, copper and oil according to IG chief market strategist Chris Weston.

“All-in-all there should be some mixed moves in materials plays,” said Mr. Weston, “but the leads don’t seem to be the catalyst to see a reversal of the recent rotation in Aussie financials.”

Telco investors eye TPG shares at the open after it slashed its dividend alongside a 9pc increase in full-year net profit, while New Hope pegs the market’s interest after a swing to profit.

The Australian dollar fell sharply overnight against its US counterpart overnight but has since recovered to trade 0.2 per cent higher at US79.72 cents ahead of the RBA minutes released at 11:30am AEST.

9.50am: Credit Suisse, UBS to raise Syrah’s $110m

Bridget Carter writes:

Syrah Resources is raising $110 million in equity through joint lead mangers UBS and Credit Suisse.

The raise is by way of an entitlement offer and a placement.

The equity will be used to help fund its Balama Graphite project and other costs.

Shares are being raised at $3.38 each, which equates to a 11.1 per cent discount to their last traded price — read more from DataRoom

SYR last $3.80 in trading halt

9.45am: Goldman snatches Macquarie’s McLennan

Bridget Carter writes:

Goldman Sachs has hired Andrew McLennan from Macquarie Group as its new Consumer and Retail Analyst in its Research division.

He will join as an Executive Director and is expected to start in January 2018.

Mr McLennan is currently Macquarie’s lead consumer analyst.

He has also previously worked at CBA Institutional Equities, Credit

Suisse and MIR Investment Management — read more from DataRoom

9.38am: Analyst rating changes

Evolution Mining cut to Neutral; target price $2.22 — Credit Suisse

Fortescue raised to Hold — Morningstar

Transurban initiated at Overweight — JP Morgan

9.35am: TPG cuts payout, warns on NBN

Robb M. Stewart writes:

TPG Telecom has slashed its final dividend and warned of pressure from the rollout of Australia’s national broadband network even as it reported a 9 per cent rise in annual profit.

Fixed-line residential broadband margins will be squeezed across the industry as the federal government’s network continues to roll out, the telecommunications firm said.

TPG said its net profit rose to $413.8 million in the 12 months through July from $379.6 million the year before, while revenue for the period rose by 4.3 per cent to $2.49 billion from $2.39 billion. Earnings the prior year were boosted by $90.7 million in one-time gains, including the sale of a stake in rival Vocus Group — read more

TPM last $5.22

9.25am: Congress sidelines China buyers

Bridget Carter and Scott Murdoch write:

The Communist Party’s 19th National Congress opens in Beijing on October 18 and deal-makers in Australia say interest from mainland Chinese buyers in local assets has fallen in the past few months.

The big sales like Lattice, Laser Clinics Australia and I-MED Radiology would in the past have attracted a number of Chinese names. Deals in the healthcare sector are popular.

But mainland China has ground to a halt ahead of the five-yearly political meeting, and the authorities there have started to pay extra attention to international investment.

Read more from DataRoom

9.13am: New Hope as miner swings to profit

Robb M. Stewart writes:

Mining company New Hope swung to an annual profit on the back of stronger sales and sharply improved coal prices.

New Hope on Tuesday reported a net profit of 140.6 million Australian dollars (US$111.9 million) for the year through July, rebounding from a year-earlier loss of A$53.7 million. Revenue for the year climbed by 59pc to A$844.0 million from A$531.5 million.

The miner said it planned to pay a final dividend of 6 cents a share, a jump on the 2 cents paid last year, for a full-year payout of 10 cents.

In late August, New Hope recorded an 18pc rise in raw coal production for the year to 14.7 million metric tons and a 23pc jump in total coal sold to 8.5 million tons as it benefited from the acquisition of a 40pc stake in the Bengalla joint venture in New South Wales state. It also lifted barrels of oil sold over the year by 61pc on the back of acquisitions in the last two years — more to come

NHC last $1.78

Bridget Carter 9.10am: CBS ups Ten Network bid to $40m

The contest for the Ten Network has taken an unexpected twist as CBS last night lifted its bid for the network, which is said to trump an already sweetened deal put forward by shareholders Lachlan Murdoch and Bruce Gordon.

The new offer will see Ten’s trade creditors receive $40 million compared to $32m under CBS’ previous offer.

Ten’s creditors are due to vote on the deal at a meeting today.

However, sources say with the fresh bid on the table that apparently trumps an offer by the interests of Bruce Gordon and Lachlan Murdoch, the vote may now be deferred.

Under the previous CBS offer, trade creditors would receive $32m, including $3.4m to US network Fox if it’s on going contract for television content was not renegotiated — more to come from DataRoom

Join the conversation as Trading Day speaks to Mark Korda of Korda Mentha on Sky News Business (Ch: 602)

Damon Kitney 9.05am: Private equity promise seizes interest

A growing number of retail investors are joining superannuation funds, sovereign wealth funds and high net worths in moving money into private equity funds, as the sector looks to deploy record levels of capital, according to one of the world’s top private equity executives.

Sandra Horbach, managing director and co-head of US buyouts at The Carlyle Group, where she oversees Carlyle’s two largest private equity funds with about $US40 billion ($49.95bn) in capital under management, also said the firm saw good opportunities for fresh investments in Australia.

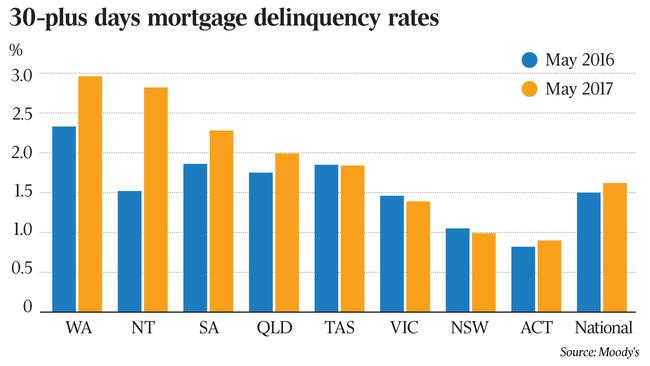

Michael Roddan 9.03am: Falling behind on repayments

Signs of rising mortgage stress have emerged as the rate of missed home loan payments across Australia hits a five-year high and more than $26 billion worth of mortgages have fallen behind.

Even with the official cash rate sitting at a record low, mortgage delinquencies hit record highs in the mining downturn hit states of Western Australia, Northern Territory and South Australia, where unemployment is squeezing more borrowers, according to figures tracked by Moody’s.

The apartment hot spots of Sydney, Melbourne and Brisbane have relatively low rates of late mortgage payments, showing buyers are largely on top of loans.

8.45am: TPG cuts dividend amid mobile play

TPG Telecom booked a $413m net profit in FY17 and has increased its debt facility by over 40 per cent to $2.5bn ahead of the planned rollout of its mobile network in Australia.

Alongside results, the telco announced a 2cps final dividend amounting to a 10cps total FY17 dividend — a 30 per cent cut to its FY16 distribution.

TPM last $5.22

7.15am: Dollar sharply down

The Australian dollar is sharply lower against its US counterpart as the greenback strengthened despite little major news to drive it.

At 6.35am (AEST), the Australian dollar was worth US79.66 cents, down from US80.18 cents yesterday.

Westpac’s Imre Speizer says that amid little major news flow for markets, the US dollar and US interest rates have risen, while equities have nudged to fresh record highs.

“The US dollar index is up 0.2 per cent on the day ... (while the) AUD fell from the Sydney peak of 0.8035 to 0.7940 — a two-week low,” he said in a morning note.

The key risk event for the local currency today would be the minutes of the last Reserve Bank of Australia’s monthly board meeting.

“The RBA minutes will provide more information on the Board’s expectations but note that the meeting took place before the Q2 GDP (second quarter gross domestic product data) release.

“In a post meeting speech, Governor (Philip) Lowe reiterated that balancing support for the labour market and risks to household debt remain front of mind.

“He also noted that this month’s meeting special discussion was on the Chinese economy.”

Mr Speizer said the Australian dollar could well fall further today. “Yesterday’s technical reversal pattern signals further probes below 0.7950 during the day ahead (and the) RBA minutes present minor event risk.”

The Aussie dollar is also lower against the yen and the euro.

AAP

7.00am: Wall St rally continues

Gains in financial shares helped the Dow Jones Industrial Average extend its record streak.

Stocks traded in a narrow range, continuing a recent pattern of mostly quiet trading.

With the third-quarter earnings season yet to begin in earnest, and several potential risks — including a potential Republican tax proposal and a Federal Reserve meeting — on the horizon, there are few reasons to make big moves, investors and analysts said.

Still, stocks should continue grinding higher as long as data suggests growth in the US economy remains solid, analysts said.

The Dow industrials rose 63 points, or 0.3 per cent, to 22,331, its seventh consecutive session of gains and its 40th closing high of the year.

The S & P 500 edged up 0.2 per cent, a fresh record, and the Nasdaq Composite added 0.1 per cent.

Australian stocks are set to edge higher at the open. At 7am (AEST) the SPI futures index was up 7 points.

Shares of financial companies rose with bond yields Monday, lifting major indexes. Higher rates tend to benefit banks by boosting their net-interest margins, a key measure of lending profitability.

Later this week, the Fed is widely expected to announce that it will leave interest rates unchanged and begin unwinding its $US4.5 trillion balance sheet later this year.

While a string of muted inflation readings had made many investors sceptical the Fed would be able to raise rates for a third time in 2017, data last Thursday showing a rebound in US consumer prices pushed some to rethink their bets.

Federal-funds futures, used by investors to place bets on the Fed’s rate-policy outlook, showed last night (AEST) a roughly 57 per cent chance that the central bank will raise interest rates again by December, according to CME Group data, up from 41 per cent a week ago.

The stock rally could stall if the Fed moves to normalise monetary policy faster than expected, investors and analysts say.

Dow Jones Newswires

6.50am: Oil ends mixed

Oil prices were mixed, with the US benchmark edging up to a seven-week high and the global benchmark falling, as investors paused after last week’s rally.

US crude futures for October delivery settled up 2 cents, or 0.04 per cent, at $US49.91 a barrel on the New York Mercantile Exchange — their highest settlement since July 31. The more actively traded November contract fell 9 cents to $US50.35 a barrel. Brent, the global benchmark, snapped a five session winning streak, falling 14 cents, or 0.25 per cent to $US55.48 a barrel.

Prices were buoyed last week by data showing tightening supplies. But analysts said investors will need more convincing for the US benchmark to push above the $US50 mark and stay there.

Dow Jones

6.40am: Global markets advance on easing tensions

Global stock markets rose overnight, buoyed by cooling geopolitical tensions before this week’s US interest rate call.

Asia kicked off the firmer trend, followed by London, Frankfurt and Paris which all closed higher on burgeoning investor optimism after yet another record finish on Wall Street ahead of the weekend.

Fading North Korea tensions have persuaded many investors to remove their cash from haven investments like gold and plough it back into riskier equities.

Fears over North Korea receded soon after Friday’s second missile test in a month. While the launch over Japan revived geopolitical worries — especially as it came soon after Pyongyang’s provocative nuclear test — analysts said investors were calm for now.

“European stocks market are in positive territory today as geopolitical tensions cool,” said David Madden, market analyst at trading company CMC Markets UK.

Investor focus is now turning towards this week’s US Federal Reserve monetary policy meeting, which ends Wednesday.

Markets will be closely watching the US central bank as its policymakers deal with the fallout from Hurricanes Harvey and Irma, which hammered the country and are expected to hit economic growth.

While the Fed is tipped to keep borrowing costs on hold, the bank’s plans for cutting back crisis-era bond-buying stimulus and any signals about the future of interest rates will be pored over.

But analysts were unsure about any further increases this year with inflation remaining subdued — apart from a bigger-than-expected jump in August — and other indicators still soft.

The pound meanwhile continued to shine against the dollar after the Bank of England indicated last week that it would probably tighten monetary policy itself very soon.

BoE governor Mark Carney said Thursday that the chances of a rise had increased. This was followed on Friday by another policymaker signalling a move in the coming months.

Lopndon closed up 0.5 per cent and Frankfurt and Paris both ended 0.3 per cent higher.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout