Trading Day: live markets coverage; Telstra hits fresh five-year low; plus analysis and opinion

The ASX200 closed lower ahead of a key speech from Trump on tax reform, while Telstra hits its 2012 lows.

Welcome to Trading Day for Wednesday, September 27.

5.00pm: ASX slips ahead of Trump speech

The benchmark S & P/ASX200 ended down 6.7 points, or 0.12 per cent, at 5,664.3 points, while the broader All Ordinaries index was down 4.1 points, or 0.07 per cent, at 5,725.5 points.

Choppy, hesitant trade persisted on the local market as investors refused to fully commit to risk plays ahead of a widely-anticipated speech from Mr Trump on tax reform, which could provide a key indicator for the world’s largest economy.

“Trading across the region was extremely light today, locally we were down more than 10 per cent on average daily volume, unusual for a Wednesday,” said CMC chief market strategist Michael McCarthy.

“Across the region in Tokyo, Hong Kong and Shanghai we saw volume that were 25-35 per cent below average, despite a reasonable backdrop and a good lead in, it appears that investors were largely uninterested.”

In financials, Commonwealth Bank ended the session down 0.33 per cent at $74.85 and Westpac closed 0.19 per cent higher at $31.95.

NAB closed down 0.10 per cent at $31.30 and ANZ slid 0.17 per cent, ending the session at $29.81.

In resources, BHP gained 0.16 per cent to $25.83. Rio Tinto rose 1.44 per cent closing at $66.80 and Fortescue was up 3.38 per cent to $5.20 at the close.

Sarah-Jane Tasker 4.45pm: ‘Outstanding’ Neurotech finds double stock

Positive test results on a device that aids kids with autism has more than doubled the share price of Australian-listed minnow Neurotech, with experts hailing the early findings as “outstanding”.

Neurotech (NTI), which is developing an at-home product to help children with autism, saw its shares soar 115 per cent today, to close at 36 cents apiece, after revealing early results of the study.

The company, which listed on the Australian market last November, has developed Mente Autism, which is a clinical-quality device that uses neurofeedback technology to help children with autism. Designed for home use, Mente Autism helps relax the minds of children on the spectrum, which in turns helps them to focus better and engage positively with their environment.— read more

Paul Garvey 4.25pm: Pilbara delivers yet more ASX gold

The Pilbara’s new gold rush has delivered another double-bagger.

Shares in junior explorer De Grey Mining have soared by an incredible 150 per cent today as investors responded to the news it had unearthed 91 gold nuggets during early stage exploration at its Loudens Patch prospect in the Pilbara.

The watermelon seed-shaped nuggets bear a strong resemblance to the nuggets that red-hot Canadian stock Novo Resources is pulling out of the ground at its nearby Purdy’s Reward project and, like the Novo gold, were recovered from conglomerate host rock.

Novo’s market capitalisation has soared from next to nothing to more than $800 million in the space of a couple of months following its Pilbara gold discovery, with the company comparing its find to the world-beating Witwatersrand gold field of South Africa.

De Grey had already climbed from 3.6c to 6c in recent weeks amid growing excitement about the potential of its Pilbara ground.

Other juniors such as Artemis Resources and Kairos Minerals have also surged on the back of the Novo excitement.

DEG last $0.15

4.15pm: AGL mix won’t meet coal efficiency: ScoMo

“You can’t replace 1000 megawatts of coal fire with renewables and expect it to have the same cost and reliability,” said Treasurer Scott Morrison in an interview on Sky News this afternoon.

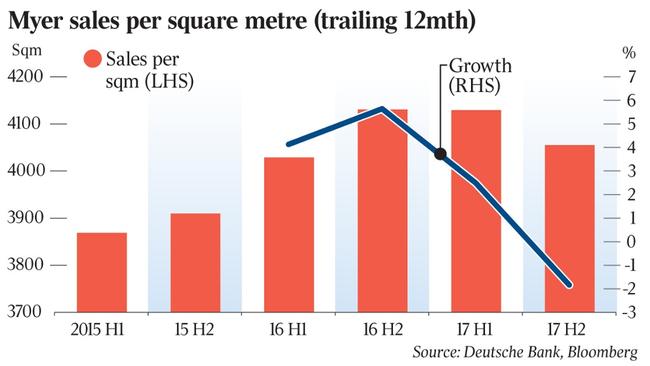

Eli Greenblat 4.05pm: Shareholders unite on Myer front

A new front has opened against embattled Myer with its second biggest shareholder, fund manager Anton Tagliaferro from Investors Mutual, joining with major shareholder Solomon Lew to call for greater retail experience on the board of the department store to help resuscitate earnings.

Mr Tagliaferro, whose Australian share fund owns 80 million shares in Myer representing just over 10 per cent of its share register, confirmed with The Australian this afternoon that he had begun discussions with Myer about the lack of directors on its board that had direct retail experience as well as other operational issues — read more

MYR last up 9.7pc at $0.79

4.00pm: Key levels to Telstra 5-year low

Telstra shares fell as much as 2.6pc to a hit fresh 5-year low of $3.44.

Despite a lack of news, concern about Telstra’s dividend outlook is ongoing.

At current prices the implied dividend yield is 6.3pc or about 8.2pc with franking credits.

Those yields might not be enough to discount the risk of further dividend cuts.

There’s minor chart support at $3.45 but a close below the August low at $3.51 could draw more selling.

Expect stronger technical support around $3.20.

TLS last down 1.8pc at $3.46

Stephen Bartholomeusz 3.45pm: Crude calm on the horizon

The great and destructive oil market share war appears to be entering a new and more optimistic phase.

This week the oil price has traded up to its highest levels in more than two years, edging closer to the $US60 a barrel that appears to be the target price for OPEC as it tries to balance the financial needs of its members against the threat of unleashing another big wave of supply from US shale oil producers.

The price of Brent crude has firmed more than 30 per cent from its year low in June, amid signs that the inventory glut that has weighed on the market despite big production cutbacks from OPEC and other major producers is finally starting to clear.

There are some one-off events behind the recent spike, including a threat by Turkish president Edrogan to shut down a pipeline that carries about 700,000 barrels a day from Kurdistan into the global market in response to the Kurdish independence referendum and the impact of Hurricane Harvey on US oil refiners.

3.30pm: Myer shares surge on Lew war horn

Myer shares have surged as much as 12 per cent to $0.80c after its largest shareholder Premier Investments requested the company’s register, chair Solomon Lew launching a scathing attack on the departments store’s turnaround strategy earlier this week.

However, long-term shareholders would be forgiven for reserving elation from today’s sharp rise — the chart below telling the story since its float in 2009.

MYR last $0.78

3.20pm: DATA: China industrial profits surge

Grace Zhu writes:

China’s industrial-profit growth accelerated in August, driven by higher prices for industrial goods and lower production costs.

China’s industrial profit rose 24pc from a year earlier in August, picking up from a 16.5pc increase in July, the National Bureau of Statistics said.

Profit growth in the petroleum, steel and electronic sectors improved significantly in August, which helped boost overall profit growth, said He Ping, an economist with the statistics bureau.

In the first eight months of 2017, China’s industrial profit grew 21.6pc from a year earlier, compared with a 21.2pc increase in the January-July period.

The statistics bureau also said the debt-to-equity ratio of China’s industrial firms decreased further to 55.7pc, compared with 55.8pc in July.

AAP

2.45pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

3.00pm: Shaw and Partners

3.05pm: Jack Lowenstein — Morphic Asset Management

3.30pm: Jo Horton — Senior Economist, St George

3.50pm: Ben Le Brun — OptionsXpress

4.00pm: TMS Capital & John Noonan — Thomson Reuters

4.05pm: Chris Weston — Chief Market Strategist, IG

4.30pm: Julia Lee — Bell Direct

(All times in AEST)

Rachel Baxendale 2.28pm: Gas giants pledge shortfall fix

Australia’s biggest gas exporters have given the Turnbull government a guarantee that they will offer the 107 petajoules identified as the expected gas shortfall next year to the domestic market.

Prime Minister Malcolm Turnbull, his deputy Barnaby Joyce, Energy Minister Josh Frydenberg and Treasurer Scott Morrison today met with the heads of gas giants Origin, Santos and Shell, after experts warned of a gas shortfall in 2018 equating to enough electricity to power 100 regional cities for a year.

Mr Turnbull said the companies had indicated they would guarantee to overcome any shortfall over the next two years, with the details of the plan to be fleshed out in a further meeting next Tuesday — read more

Eli Greenblat 2.10pm: Lew sounds Myer war horn

Shares in Myer have surged to trade as much as 6pc in the black at $0.7675 after retail billionaire Solomon Lew signalled he is set to start a new war of attrition with the department store and a fresh attack on the retailer’s financial woes at its upcoming annual general meeting in November, today requesting a copy of the Myer share register to potentially write to its shareholders.

Premier Investments, Myer’s biggest shareholder since March after it grabbed a 10.8 per cent, is considering writing to the department store’s shareholders in what could be the beginning of an orchestrated and bitter campaign by Premier chairman Mr Lew as he sets a target on the backs of Myer’s chairman Paul McClintock and its directors.

This week Mr Lew, who spent nearly 17 years attacking, lashing and ambushing former ASX-listed retailer Country Road at its AGMs, launched a scathing attack on Myer and the restructure strategy of its chief executive Richard Umbers, saying the Myer board had overseen the destruction of more than $2 billion in shareholder wealth.

— more to come.

MYR last up 5.7pc at $0.76

Sarah-Jane Tasker 1.55pm: Tabcorp bid sours in Tatts merger delay

Uncertainty around Tabcorp’s bid for Tatts Group has hit the share price of both companies today — sending the value of the deal south.

With a Tatts’ shareholder meeting scheduled for October 18 now pushed back, possibly by several weeks, concerns about completion of the deal have risen.

Shares in Tabcorp (TAH) are down more than 2 per cent at $4.23, while Tatts (TTS) is also off more than 2 per cent at $3.97. Today’s share price slump puts the value of the deal at around $3.85, a price that will not be overly attractive to Tatts’ investors.

The latest delay to the deal was fuelled by a successful appeal to an approval by the Australian Competition Tribunal. Tabcorp has indicated it will submit a new application for approval.

1.52pm: Premier requests Myer register

Premier Investments (PMV) has requested Myer’s (MYR) shareholder register just days after chair Solomon Lew launched a scathing attack on the department store chain’s management.

Mr. Lew currently owns a 11pc stake in Myer.

Matt Chambers 1.30pm: Megawatt as AGL flags bumper battery

AGL Energy says a sale or extension of the life of the Liddell power plant in NSW is unlikely, with chief executive Andy Vesey instead outlining a plan to replace output with the world’s biggest battery and a gas power station at Liddell more renewables, demand management and a Bayswater coal power station upgrade.

Mr Vesey said part of the plan would be a 250MW battery at Liddell. This would be the world’s biggest and more than twice the one being studied by Tesla in South Australia.

“We see batteries at Liddell, as well as demand response solutions, providing up to a further 150 megawatts of firm capacity,” he said.

AGL said the 250MW battery itself would be able to provide 50MW of firm capacity in peak periods — read more

AGL last $22.78

1.00pm: QBE shares near bearish target

QBE Insurance fell as much as 3pc to a 10-month low of $9.90.

Shaw & Partners analyst David Spotswood cut his rating to “sell” vs. “hold”, while slashing his target price from $11.77 to $9.50.

Mr Spotswood expects incoming CEO Patrick Regan to reveal any potential weakness in earnings when he takes over in January.

“Based on experience, Pat Regan will rebase earnings,” he says, “active investors should sell and review post that.”

Mr Spotswood adds that “long term investors can hold on for the Pat Regan turn around, but we believe more pain before gain.”

On the charts, a close below the September 6 low at $9.94 could generate a test of major support from the September 2016 low at $9.22.

While QBE could benefit from a higher bond yields and a weaker A$, both have gone against market expectations this year.

QBE last down 2.6pc at $9.94

12.50pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Paul Dales — Chief Economist, Capital Economics

1.00pm: Ben Le Brun — OptionsXpress

1.30pm: Evan Lucas — The Lucas Review

1.50pm: Live cross to Bloomberg Asia

2.15pm: Wai-Yee Chen — Ord Minnett

(All times in AEST)

Samantha Woodhill 12.45pm: Index ceiling for Aussie active funds

The majority of Australian actively managed funds continue to perform worse than their respective benchmarks according a report by S & P Dow Jones.

The latest SPIVA Australia Scorecard found that most types of active funds underperformed in the year to June, with the exception of those in the A-REIT category.

Among Australian equity funds, 61.7 per cent underperformed their relevant index benchmarks in the one-year period. The result was slightly better than longer term horizons.

International equity funds remained among the worst-performing categories, with 90 per cent of fund lagging their benchmark over the five and 10-year horizons.

Bridget Carter 12.20pm: Youth camp merger axed amid fees heat

Bain Capital’s Camp Australia and Advent Private Equity’s Junior Adventures Group have abandoned merger plans.

It comes after concerns about the deal from the Australian Competition and Consumer Commission about a loss of competition between the pair — more to come from DataRoom

Matt Chambers 12.00pm: AGL spruiks mix as Liddell replacement

AGL Energy says the sale or extension of the Liddell power plant in NSW is unlikely, with chief executive Andy Vesey instead outlining a plan a plan to replace output with a mix of renewables, battery storage, a gas-fired plant at Liddell and a Bayswater coal power station upgrade.

But in a warning to a Coalition government that has stalled on energy policy, departing chairman Jerry Maycock said that even getting existing power stations to the end of their life will need policy certainty.

“A greater degree of certainty in policy and regulatory settings will be critical if AGL and others in the industry are to invest the capital that is urgently needed for, on the one hand, existing plant to reach the end of its operating life and, on the other, the new capacity that is needed when it closes

upgraded coal-fired plant,” Mr Maycock said today at AGL’s annual general meeting in Melbourne.

It is unclear whether the chairman was hinting AGL could close Liddell before its 2022 end date without more certainty — read more

AGL last down 0.6pc at $22.91

Dana McCauley 11.35am: Ten made to wait over CBS bid

Ten creditors, shareholders and staff will have to wait until at least November to discover the network’s fate.

An application for Ten Network Holdings’ proposed takeover by American broadcaster CBS has been “tentatively” listed for a three-day hearing on October 31.

Rival bidders Bruce Gordon and Lachlan Murdoch have not yet decided on when or how to intervene in the sale of Ten to CBS, the NSW Supreme Court heard this morning.

Lawyers for Ten administrator KordaMentha have told the court the joint bid partners have indicated they are waiting for an independent expert’s report before declaring their hand on any attempt to block the final transfer to Ten shares to US broadcaster CBS.

Bridget Carter 11.00am: PE-backed youth groups quash merger

Bain Capital’s Camp Australia and Advent Private Equity’s Junior Adventures Group abandon merger plans.

More to come.

10.45am: AGL to tap mix for Liddell replacemet

AGL Energy has outlined a plan to replace generation from its ageing Liddell power station with a mix of renewables, battery storage, new gas-fired plants and an upgraded coal-fired plant.

AGL boss Andrew Vesey has told the company’s annual general meeting in Melbourne the bulk of energy lost from the forecast closure of Liddell in NSW in 2022 can come from wind and solar.

An upgrade of Liddell’s neighbouring Bayswater plant, new gas-fired power plants and battery storage will make up the balance of capacity in a plan Mr Vesey said will be presented to the federal government in December — AAP

AGL last down 0.7 per cent $22.89

10.45am: Analyst rating changes

QBE Insurance cut to Sell — Shaw & Partners

Invests Office raised to Outperform — Credit Suisse

Namoi Cotton initiated at Add; $0.54 target — Morgans

10.25am: Resource stocks diverge at the open

The ASX200 index opens mixed, swinging either side of flat as it looks to settle near flat at 5670 as big banks all post gains, while diversified miners bow to shifts in commodity exposure.

Iron ore pure play Fortescue surges over 1.8 per cent after the underlying commodity snapped a losing streak with a jump over 3 per cent.

The cooling price of crude oil and profit taking in energy takes Woodside shares down 0.7 per cent early, while diversified miners BHP and Rio Tinto trade mixed.

AGL Energy shares fall 0.7 per cent ahead of its Annual General Meeting at 10.30am (AEST), while Tabcorp shares are down 1.6 per cent after its proposed merger with Tatts Group was served up another hurdle.

9.55am: ASX200 to lift amid mixed Wall St

The sharemarket eyes gains at the open despite Wall St’s unconvincing lead and overnight commodities moves leaving resource investors fresh food for thought.

At 7am (AEST), the share price futures index was up 16 points, or 0.28 per cent, at 5,675.

US Federal Reserve chairwoman Janet Yellen spoke overnight, rhetoric diverging little from the central’s bank’s most recent hawkish commentary and garnered little in the way of a decisive Wall St reaction for local investors.

An energy sector fresh from yesterday’s outperformance felt tremors after a run by crude oil came to an abrupt stop, however there may be more to the narrative than the most recent price action suggests, according to IG chief market strategist Chris Weston.

“Pullbacks look like a buying opportunity in my opinion,” Mr Weston says, “the energy space has been getting a lot of love with talk of a far more balanced market in 2018 and prices in US crude likely to hold $50 and maintain a new trading range.”

Meanwhile the nation’s largest export iron ore snapped a losing streak overnight as the spot price ticked up over 3 per cent.

In corporate news, AGL shareholders eagerly eye clarity from the company’s AGM in Melbourne at 10.30am (AEST) as the fate of its Liddell power station hangs in the balance, while the market is set to deliver its verdict on Yancoal’s purchase of Mitsubishi’s $230m stake in ts Wakworth joint venture.

Meanwhile, the local currency trades well down from its recent highs north of US80c highs, 0.1 per cent lower at $US78.77.

Eli Greenblat 9.40am: Shoppers firm bricks, mortar resolve

Australian retailers retreating from shopping centres and suburban retail strips to shrink their bricks-and-mortar footprint might be jumping the gun because shoppers still value the option to visit a store to touch and feel a product.

While online platforms are vital for a retailer to survive in the disruptive state of the $300 billion national retail sector, they should still be investing in their bricks-and-mortar stores to drive sales.

According to a study by Australian Consumer, Retail, and Services Research Unit, and commissioned by marketing company Salmat, about 43 per cent of customers prefer to try products before they buy, with 11 per cent not interested in a virtual experiences.

Eli Greenblat 9.30am: Activists to hijack Woolies AGM

Woolworths’ annual general meeting could be hijacked by unnamed human rights and social activists after the supermarket giant revealed that two resolutions submitted by a minority of shareholders would be voted on at the late-November gathering.

In a brief release to the Australian Securities Exchange yesterday, Woolworths said the resolutions for consideration at the AGM had been received under section 249N of the Corporations Act from 106 Woolworths shareholders who represent about 0.0097 per cent of shares on issue — read more

WOW last $25.26.

9.15am: Capex discounting rife: Credit Suisse

Rising capital expenditure by Australian companies is a big positive factor for the local share market.

That’s the view of Credit Suisse Australia’s equity strategist Hasan Tevfik.

He expects a pick-up in capital expenditure and other forms of business spending to boost the corporate earnings outlook, underpinning his prediction that the benchmark S & P/ASX 200 will be at 6000 points by the year end. That implies the index will rise more than 5 per cent from the current level.

The market has drifted sideways around 5700 points for the past three months and investors have mostly discounted signs of stronger capex intentions in the August reporting season.

But while other strategists have downplayed the significance of the upturn in capex plans, Tevfik says the upgrades last month were “large and broadbased” and unlikely to be a flash in the pan.

Cliona O’Dowd 9.10am: Blockchain gives us lead: ASX

ASX chief executive Dominic Stevens says the sharemarket operator is not opposed to competition and that its early investment in blockchain-based technology to revolutionise equities clearing and settlement has put it in a world-leading position.

Over the past year, the company had been consulting with the market on the replacement for the legacy CHESS equities settlement system. Its distributed ledger technology, which it developed with US group Digital Asset Holdings, is in trial mode and a decision on whether or not to proceed with deployment is on track for December, Mr Stevens told shareholders at the company’s annual general meeting in Sydney yesterday — read more

ASX last $52.67

9.05am: What’s Lew cooking up for Myer?

Bridget Carter and Scott Murdoch write:

Solomon Lew’s remarks about Myer this week continue to keep many guessing about exactly what his interest is in the listed department store chain.

Either Mr Lew hopes to buy the company at an opportunistic price or he is betting someone else will buy the business and he will once again prove to be kingmaker, with his 10 per cent interest.

Other retailers have been taken over where he has held a major interest, such as Country Road, and he had been able to influence the outcome and cash out at a premium.

DataRoom understands the more likely scenario is that Mr Lew believes Myer to be a takeover target where he can capitalise on gains to the share price when a bid comes in — read more from DataRoom here

Producers note: Myer shares (MYR) trade ex-divided today — last $0.72

8.50am: APA Group chair to retire

APA Group chair Leonard Bleasel has advised the board he intends to retire after the company’s AGM next month, the company has advised non-executive director Michael Fraser is to succeed.

APA last $8.26

8.45am: Yancoal grabs $230m Mitsubishi JV stake

Yancoal Australia has exercised its option to buy partner Mitsubishi’s stake in its Northern NSW Warkworth joint venture for $230m.

YAL last $0.10

Matt Chambers 8.40am: Lynch leaves Rio in good shape

Rio Tinto finance director Chris Lynch says the decision to step down from the Anglo-Australian mining giant was a personal one, made with the company in good shape to return cash to shareholders after four years of hard-driving cost gains and balance sheet repair.

The Broken Hill-born mining industry veteran, who has given up to a year’s notice of his plans to leave, turned 64 on Saturday.

And he says 65 is a good age to again leave executive ranks.

“It’s purely a personal decision,” Mr Lynch told The Australian — read more

RIO last $65.88

8.35am: Industry call for action on gas

Matt Chambers and Samantha Woodhill write:

The nation’s biggest manufacturers have called for urgent gas market intervention to divert east coast exports to domestic users to ease the impact of what they say is a train wreck that has been years in the making.

As Malcolm Turnbull prepares to meet with the nation’s big gas suppliers in Sydney today, Incitec Pivot chief executive James Fazzino urged the Prime Minister to take action, saying this week’s energy market operator forecasts of a looming gas shortage were evidence of a broken market.

“We’re seeing the train wreck happening before our eyes,” Mr Fazzino, who was this month made chairman of Manufacturing Australia, told Sky Business’s Ticky program last night.

“The short-term solution is to intervene, but the long-term solution is more gas and more gas suppliers” — read more

Producers note: AGL Energy to hold its Annual General Meeting today at 10.30am (AEST) at the Melbourne Recital Centre

Scott Murdoch 8.24am: AMP dangles life insurance arm

AMP’s life insurance business could be the next asset in the popular sector to sell with China Taiping Life executives in Sydney today to meet with the wealth management group.

It’s understood that the discussions have been facilitated by UBS which is AMP’s house adviser and has been carrying out a review of the life insurance business alongside Macquarie over the past few months — more to come from DataRoom

AMP last $4.89

7.42am: ASX set to open higher

The Australian market looks set to open higher following modest gains on Wall Street overnight where comments from Federal Reserve chair Janet Yellen boosted expectations of a December rate hike.

At 7am (AEST), the share price futures index was up 16 points, or 0.28 per cent, at 5,675.

Yellen on Tuesday said moving too gradually through rate hikes would be a problem for financial stability and it would be imprudent to leave rates on hold until inflation reached the Fed’s two per cent target.

Westpac’s Imre Speizer said she spent more time discussing downside risks to inflation, which left US markets confused.

“It left markets with a mixed tone overall and yields retreated about two basis points straight after her speech,” Mr Speizer said.

The Dow Jones Industrial Average fell 0.05 per cent, the S & P 500 gained 0.01 per cent and the Nasdaq Composite added 0.15 per cent as technology shares bounced back from sharp losses in the prior session.

Mr Speizer said locally, there isn’t much in economic news that will sway the market on Wednesday.

In equities, however, power producer and retailer AGL Energy will face shareholders at its annual general meeting in Melbourne with questions over the future of its Liddell coal-fired power station likely to intrude into the agenda.

In Sydney, a federal court judge is due to publish reasons for ruling that administrators had provided creditors with sufficient information in supporting US broadcasting giant CBS’ bid for the embattled Ten Network.

On Tuesday, the share market closed slightly lower with the benchmark S & P/ASX 200 down 0.22 per cent while the broader All Ordinaries index shed 0.21 per cent.

AAP

7.01am: Mixed finish on Wall Street

he S & P 500 ended flat and the Nasdaq posted modest gains as technology shares bounced from sharp losses in the prior session and comments from Fed Chair Janet Yellen boosted expectations of a December rate hike. Yellen on Tuesday said the Fed needs to continue gradual rate hikes and it would be imprudent to leave rates on hold until inflation reached the Fed’s two per cent target.

Earlier in the session, Atlanta Fed Chief Raphael Bostic, a non-voting member this year, said he would want “clear evidence” that prices were firming before committing to another rate increase, but did not rule out another hike in 2017. Chances of a rate hike in December rose to 78 per cent from about 40 per cent a month ago, according to CME Group’s FedWatch tool.

Economic data showed US consumer confidence fell in September while home sales dropped to an eight-month low in August due to the impact of Hurricanes Harvey and Irma.

The Dow Jones Industrial Average fell 10.05 points, or 0.05 per cent, to 22,286.04, the S & P 500 gained 0.23 points, or 0.01 per cent, to 2,496.89 and the Nasdaq Composite added 9.57 points, or 0.15 per cent, to 6,380.16. Technology, which rose 0.4 per cent, was the best performing major sector, recovering somewhat from losses in the prior session.

Apple rose 1.72 per cent after four straight sessions of losses to help prop up the three major indexes, after Raymond James boosted its price target on the iPhone maker to $180 from $170.

AAP

6.42am: Dollar dips against greenback

The Australian dollar has slipped against a strengthening US dollar which rose overnight alongside climbing US interest rates and as risk aversion appeared to fade.

At 6.30am (AEST), the Australian dollar was worth US78.85 cents, down from US79.31c on Tuesday.

Westpac’s Imre Speizer said the rise in the US dollar and US interest rates came ahead of Federal Reserve chair Janet Yellen’s speech and was driven by a risk- adverse stance following tension around North Korea’s comments to the US. “With that risk aversion fading, equities also had a reasonably good night as well,” Mr Speizer said on Wednesday.

In her speech, Fed chair Yellen said moving too gradually through rate hikes would be a problem for financial stability and that it is imprudent to keep the policy on hold until inflation reaches the two per cent mark. Mr Speizer said she spent more time discussing downside risks to inflation, which left markets confused.

“It left markets with a mixed tone overall and yields retreated about two basis points straight after her speech,” Mr Speizer said.

He said locally, there wasn’t much that could sway markets on Wednesday. But, investors will be looking out for US data on durable goods and fed speeches from US Federal Reserve governor Lael Brainard on labour market disparities and St. Louis Fed President James Bullard on the economy and policy. The local currency fell to a six week low overnight and is trading lower against the euro but higher against the yen.

AAP

6.35am: ADB sticks with China growth forecast

The Asian Development Bank maintained its 2017 and 2018 forecasts for China’s growth at 6.7 per cent and 6.4 per cent. It had raised them in July. And on Monday, China’s state planner said the growth of the country’s overall leverage ratio has been clearly slowing and is now stabilising. The comments came days after S & P downgraded China’s sovereign debt rating, saying government efforts to curb debt risks were not working as quickly as hoped. Sector performance was mixed. The property sector stabilised after Monday’s slump, while the energy sector jumped nearly three per cent on higher oil prices.

6.28am: Equifax CEO steps down

Equifax CEO Richard Smith stepped down Tuesday, less than three weeks after the credit reporting agency disclosed a damaging hack to its computer system that exposed highly sensitive information for about 143 million Americans.

His departure follows those of two other high-ranking executives who left in the wake of the hack, which exploited a software flaw that the company did not fix to expose Social Security numbers, birthdates and other personal data that provide the keys to identify theft.

Smith, who had been CEO since 2005, will also leave the chairman post. Equifax said Smith was retiring, but he will not receive his annual bonus and other potential retirement-related benefits until the company’s board concludes an independent review of the data breach. If the review does not find Smith at fault, he could walk away with a retirement package of at least $US18.48 million, with the value of the stock and options he was paid out over his 12-year tenure. The board also could “claw back” any cash or stock bonuses he may have received, if necessary.

Smith, 57, who made almost $US15 million in salary, bonuses and stock last year, will be able to stay on the company’s health plan for life.

AP