Ten tax-loss a windfall for CBS

US media giant CBS could take advantage of Australian tax credits to help it boost Ten Network’s earnings.

US media giant CBS could take advantage of several years’ worth of Australian tax credits to help it boost Ten Network’s earnings, if it succeeds in acquiring 100 per cent of the free-to-air broadcaster.

The latest twist in the Ten saga is laid out by administrators KordaMentha in the official 215-page account of the broadcaster’s collapse.

CBS can take advantage of tax credits because Ten has $58.9 million worth of unrecorded tax losses.

Because the unrecorded tax losses do not include any additional tax losses generated by Ten for the year to August 31, 2017, CBS could theoretically generate more than $200m in profit before it is liable to pay a single dollar in corporate tax to Canberra.

The tax-loss credits are only available if CBS acquires 100 per cent of Ten, a deal that is subject to decisions by the Australian Securities & Investments Commission and Foreign Investment Review Board.

Under Australian Taxation Office rules, entities can claim tax credits for transactions associated with merger and acquisition activity.

Such a corporate tax arrangement would not be available for utilisation under a rival bid from Lachlan Murdoch and Bruce Gordon because under their proposed corporate structure, shareholders in Ten would keep 25 per cent of their equity, with Ten proposed to be relisted.

Ten recorded deferred tax assets arising from tax losses for the year ended August 31, 2016.

“The unrecorded tax losses of $58.9m are available for utilisation by the entity, and their utilisation is supported by the entity’s tax forecasts,” Ten’s 2016 annual accounts said.

“The directors consider it prudent not to record these tax losses as their utilisation is not expected in the short term. However, they will remain available indefinitely for offset against future taxable profits, subject to continuing to meet the statutory tax tests.”

Lawyers representing Lachlan Murdoch, Bruce Gordon and 20th Century Fox will return to the NSW Supreme Court tomorrow for a two-day hearing.

Gordon joined forces with Murdoch and content supplier 20th Century Fox to take urgent action in the NSW Supreme Court last Wednesday to prevent Ten’s administrators KordaMentha holding a second creditors’ meeting tomorrow.

It will now be held on September 19 after the two-day hearing, where the plaintiffs will seek a court declaration that the second creditors’ report “fails to include adequate information” about Gordon and Murdoch’s bid to buy Ten and the reasons why administrators support the proposal by CBS.

It is understood lawyers for Murdoch, Gordon and Fox will argue the report did not present alternatives to the CBS bid, liquidation or the resignation of the administrator.

A delayed report by administrator KordaMentha detailing the state of Ten also failed to summarise in any meaningful way the competing bids, it is claimed. Under the CBS bid, shareholders will get nothing for their stock.

KordaMentha said: “The administrators’ recommendation to creditors followed an exhaustive sale and recapitalisation process and a comparison of the likely returns to creditors under all offers.”

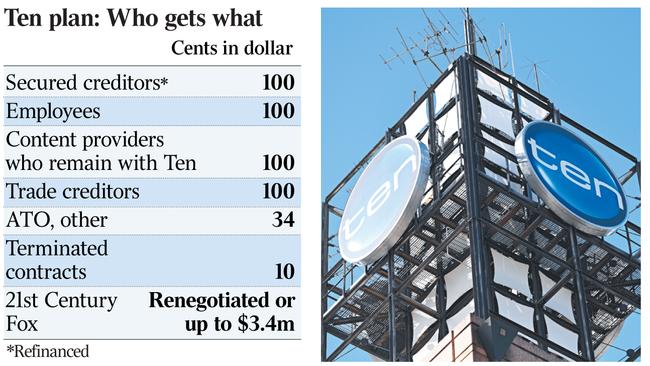

Secured creditors and employees will be paid out in full under a plan by KordaMentha to sell the broadcaster to CBS, but TV production houses will only be paid out if they commit to staying with the network. The ATO, financial and statutory creditors will receive 34c in the dollar.

Among other creditors set to receive less than 100c in the dollar is Fox, which is operated by 21st Century Fox.

Should these negotiations fail, KordaMentha said Fox would receive a one-off payment of up to $3.4m against claimed debts.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout