Trading Day: live markets coverage; ASX erases gains, loses bank steam; plus analysis and opinion

The ASX steadies as investors turned a cold shoulder toward global politics and a push by big banks ran out of steam.

Welcome to Trading Day for Monday, September 25.

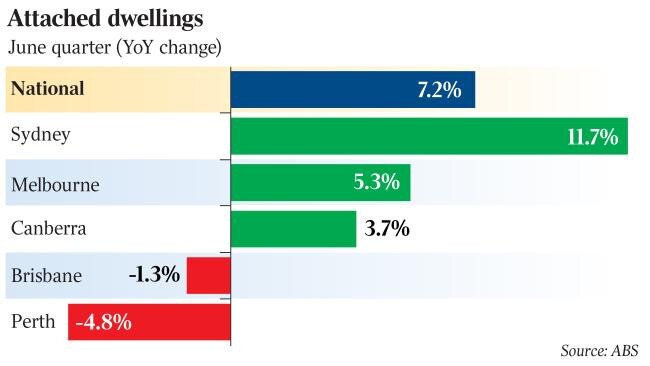

Turi Condon 4.55pm: ANZ tightens Brisbane loans

ANZ has tightened its restrictions on lending to apartment buyers in 18 suburbs in Brisbane and seven of Perth’s suburbs as regulators continue to warn on the apartment glut, most recently singling out the rash of development in Brisbane.

The bank issued a list of postcodes to its mortgage brokers where loan to value ratios must not breach 80 per cent for off-the-plan and existing apartment lending — read more

ANZ closed up 0.2pc to $30.00

4.40pm: ASX steady as traders turn cold shoulder

Local stocks closed steady as sentiment numbed toward offshore political developments and a fresh shot of North Korean aggression.

At the close, the S & P/ASX200 index was just 1.6 points higher on 5683.7, while the broader All Ordinaries closed up 1.1 points to 5741.7.

Traders wired into the open after the German and New Zealand elections over the weekend, however markets registered a lacklustre reaction either way with the Euro showing only slight signs of weakness, according to CMC chief market strategist Michael McCarthy.

“The markets have quickly moved on and it appears those election had little impact at all on trading today,” said Mr McCarthy, “nor did the sabre rattling that came out of the North Korean diplomat’s address to the UN when he said the US would be subject to a pre-emptive strike.”

CBA diverged from the rest of the big four banks to post a 1 per cent loss to $75.81, Westapc added 0.7 per cent to $31.86, ANZ edged up 0.2 per cent to $30.00, while NAB shares closed flat on $31.28 in the first session since the majors announced a sweeping overhaul of customer ATM fees.

Diversified mining heavyweights lofted above a sharp 3 per cent fall in the nation’s largest export iron ore. BHP rose 0.1 per cent to $25.98, Rio Tinto also added 0.1 per cent to $66.01, while in energy Woodside Petroleum shed 0.2 per cent to $29.14.

3.40pm: Citi sures up GDP growth forecast

Brokerage Citi has upgraded its forecast for Aussie domestic GDP to 2.5 per cent in calendar 2017, from 2.1 per cent.

The broker also upgrades GDP to 2.8 per cent in calendar 2018, from 2.6 per cent.

“The growth outlook for Australia is improving but we don’t think by enough to trigger RBA action until late next year,” Citi’s economists say.

They point out the growth outlook is very mixed and unsynchronised across sectors. Infrastructure spending and exports are growing strongly; non-mining business investment is improving, employment is growing solidly but unemployment is likely to remain above levels consistent with full employment for another year at least.

Even so, they see the consumer likely to remain sluggish and housing investment no longer adding to growth.

3.25pm: Fonterra joins Murray’s suitor suite

New Zealand dairy giant Fonterra has confirmed it’s made a bid for Australia’s largest dairy processor, Murray Goulburn.

“The answer is yes we have put forward a proposal,” managing director of Fonterra Australia, Rene Dedoncker, told ABC radio today.

“It’s non-binding and indicative and at this point we are going to sit tight and give the MG board the respect they deserve to consider all proposals.”

It comes after investment bank Deutsche called for first round bids for Murray Goulburn by Friday, September 15 — read more

3.15pm: Wall Street’s pool of virtue widens

Maybe weary of its role as a punchbag for moralists, and certainly in search of products with widespread appeal, Wall Street has taken to selling products linked to virtue. That is not easy: how does an industry focused on financial returns go about gauging goodness?

The approach started years ago with funds that called themselves “socially responsible”. More recently the terminology has evolved, with many claiming to pursue “ESG” investing, standing for “environmental”, “social” and “governance”.

Morningstar, a data-tracking firm, places any fund that uses terms such as sustainable investing, ESG and so on in its prospectus into a category that now has 204 members with $US77 billion ($97bn) in collective assets. The oldest fund in the Morningstar group dates back to 1971. But nearly half have been launched in the past three years.

More quietly, the wealth management offices of many American investment firms constantly roll out investments touting these sorts of characteristics and Morningstar counts in excess of 2000 funds worldwide.

Endowments and pension funds, the big global money pools, are beginning to suggest they, too, want to invest along these lines.

Two perennial questions have accompanied the deluge of money. The first is whether the approach comes with special costs: ie, is there a virtue discount? Second is the question of what should be measured. Neither is easy to answer — read more

The Economist

Matt Chambers 2.55pm: ACCC flags looming Bass Strait slump

Bass Strait gas production from Exxon Mobil and BHP Billiton will drop 35 per cent next year, taking more than the Australian Energy Market Operators expected shortfall out of the east coast gas market, according to the Australian Competition and Consumer Commission.

In the ACCC’s gas inquiry report released today, which has been using its special power to compulsorily acquire information, says Exxon and BHP’s Gipplsand Basin Joint Venture will dramatically reduce output next year.

“Production in 2018 from the Gippsland Basin Joint Venture GBJV, which is by far the biggest producer in the Southern States, is expected to fall from a record level of 330 PJ this year to 244 PJ due to both natural decline in legacy gas fields and investment decisions made by the GBJV,” the ACCC said — more to come.

2.40pm: Murray Goulburn shares surge

Shares in dairy producer Murray Goulburn’s linked trust MG Unit Trust (MGC) leap higher to $0.90 and session gains of over 5 per cent.

2.20pm: ASX200, US futures edge lower

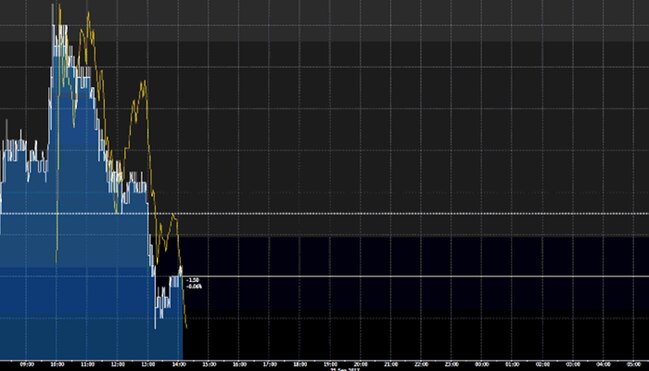

The local sharemarket erases gains in late trade as a reversal in CBA fortunes buffets early buying in big banks shares.

The S & P/ASX200 index edges down one point below flat at 5680.3 after gains as much as 0.5 per cent at the open.

CBA lumbers along 0.5 per cent in the red after posting gains similar to those onto which the rest of the big four still hold at around 0.6-0.8pc.

Large-cap miners loft above a sharp downturn in iron ore, BHP adds 0.1 per cent to $25.98, Rio Tinto jumps 0.5 per cent to $66.31 and Woodside Petroleum adds 0.2 per cent to $29.24.

From around 11.00am AEST, S & P500 futures turned toward the red and have since erased gains of up to 0.2pc to sit the same level below flat — no significant news from the US has emerged since the open.

Matt Chambers 1.50pm: Norwest strikes, ends Perth Basin drought

Norwest Energy has made the first offshore oil discovery in the Perth Basin for 15 years at its Xanadu-1 well, where it says it found reservoir quality sand intervals and oil shows over a 330m section and 4.6m of net pay in one of three sand intervals.

But despite the discovery causing internal excitement about what will be revealed in a planned horizontal side-well, shares of Norwest and 1 its locally listed partners, Whitebark Energy and Triangle Energy, have slumped.

At 1.50pm, Norwest was off 25pc at $0.006, Whitebark was off 6 per cent and Triangle was down 16 per cent.

The fall in shares was variously attributed to short-term punters taking profits, concerns a capital raising was on the way, or a focus on the relatively small net pay rather than other news in the announcement — read more

NWE last $0.01

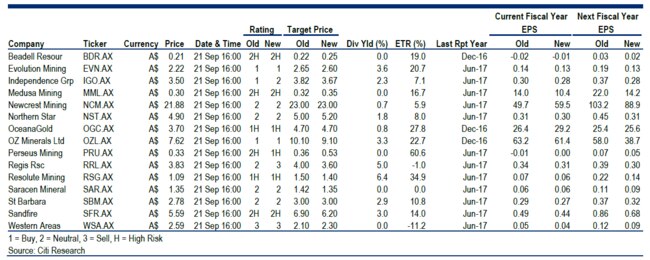

1.45pm: Miners exposed to the elements: Citi

Aussie mining stocks are yet again making for golden viewing, catching the eye of Citi analysts amid a broad undulation of market forces that have set analysts into motion.

“Overall, USD commodity price expectations move up for DecQ17 and CY18,” said Citi, “this is offset for local producers by higher AUDUSD resulting in earnings downgrades.”

“However, valuation multiples also move higher, in-line with current sector averages.”

A recent surge of interest in energy storage components has doubled down market action in the materials space, the investment bank picking up the scent of corroded electrode while remaining cautiously optimistic.

“We’re still constructive on the copper sector but the run to US$3/lb came sooner than expected,” said analysts, “prices are likely to be supported at elevated levels.”

“Similarly, nickel ran ahead of our expectations but has pulled back.”

Generic first nickel futures fell more than 5 per cent overnight on the London Metals Exchange.

The tiddler end of materials pulls lower in lunchtime trade — Independence Group (-0.7pc) and Regis Resources (-1.2pc) at the pointy end of Citi’s analysis — while fresh upgrade Perseus Mining lifts 1.5 per cent.

1.25pm: East coast faces 55PJ gas shortfall: ACCC

East coast gas supply will fall short by 55 petajoules (PJ) in calendar year 2018, according to a new report by the ACCC, while elevated demand could drive the shortfall higher to 108 PJ.

The consumer watchdog sees the supply pinch reflected in prices being offered to commercial and industrial customers for 2018 supply that are at multiples of historical price levels of $3-4/GJ.

“The effect of higher gas prices is felt right across the economy, from households to big business,” said ACCC chair Rod Sims.

“Export controls may go some way to addressing this shortage in the short term. However, further steps are needed to address the underlying problems of lack of gas supply and lack of diversity of suppliers in the east coast gas market.”

Richard Gluyas 1.05pm: Big Four ATM talks ran deep

The nation’s banks have held private discussions about the creation of a utility company to service their massive ATM networks.

The utility, to provide cash-handling and maintenance services, would be engaged by the major banks as well as second-tier and regional operators.

While there would be significant cost savings for all the banks, one source said this morning that the main driver of the initiative was the planned removal of the industry’s deeply unpopular, foreign-ATM fees.

Commonwealth Bank jumped the gun over the weekend, announcing the removal of the $2 fee charged to customers of other banks when they withdraw from any of CBA’s 3,400 ATMs.

ANZ, Westpac and National Australia Bank followed suit within hours.

Eli Greenblat 12.25pm: Lew stews over ‘New Myer’

Retail billionaire Solomon Lew has launched a blistering attack on department store Myer and its management team led by Richard Umbers, as well as the board, saying the retailer was selling old stock that consumers didn’t want and belonged in the Salvation Army.

He blasted Myer as now being run by consultants, lamented the chain had lost its way and reflected with horror at what was being sold in the shops.

Mr Lew, a former chairman and director of the old retail conglomerate Coles Myer, said he had never met Mr Umbers but openly questioned if the market had been misled by the board about Myer’s earnings performance between last year’s AGM and a profit warning in July.

Mr Lew, whose Premier Investments is Myer’s biggest shareholder after buying an 10.77 per cent stake in the business earlier this year, damned Myer’s turnaround strategy and argued the market might have been misled before its profit warning that saw Myer shares plummet in July — read more

PMV last down 2.7pc at $13.38

11.45am: Propertylink rejects Centuria bid

Real estate portfolio manager Propetylink has rejected a 5.5 cents/share conditional bid from Centuria Capital Group after the suitor raided its share register earlier this month to grab a combined 17 per cent stake.

The offer was comprised of Centuria Capital Group (CNI) and Centuria Industrial REIT (CIP) securities and a cash offer of $0.055/security equivalent to 6 per cent of the total deal value.

PLG last $0.90

Tessa Akerman 11.30am: Bendigo fosters golden child

The Fosterville goldmine near Bendigo is producing strong results for its Canadian owner, Kirkland Lake Gold, which says it is rapidly becoming one of the world’s great underground gold mines.

And it has companies with nearby exploration licences, such as Catalyst Metals, buzzing, with mining veteran Bruce Kay saying current developments near the historic gold mining town are some of the most exciting things to happen to Victorian mining in a century. Kirkland Lake Gold’s report on the mine, released this month, listed current gold production guidance for 2017 as between 200,000 ounces and 225,000 ounces.

Samantha Woodhill 11.15am: Fresh jolt to supermarket honeymoon

The grocery “honeymoon” may be over for Australia’s major supermarkets as competition tightens and consumers face increasing cost pressure, new research released by Morgan Stanley has found.

Analysis found that the price gap between the major supermarkets and Aldi now stands at 18 per cent after bottoming at 14 per cent two years ago, following a period of investment by Coles and Woolworths. Grocery prices at Aldi dropped by 1.6 per cent year-on-year in August.

“Given that Aldi effectively sets the supermarkets pricing umbrella, we think Coles and Woolworths will need to continue to incrementally invest in price,” the report said.

“We estimate that now around 75 per cent of the Australian population is now able to shop at Aldi and/or Costco relatively easily” — more to come

WOW last down 0.4pc to $25.24, WES down 0.3pc to $41.09

Robert Gottliebsen 11.00am: Will banks hear ‘The Cat’ call?

Can Domain’s Antony Catalano succeed where a string of bank CEOs have failed?

Catalano, known to all as The Cat, believes that Domain’s customer base is much more likely to want an insurance and/or banking product than the general public. In addition he gets to discover they are in the market very early in the potential real estate transaction.

To capture the advantage he has bought a mortgage broker to offer his customers banking products emanating from leading banks and he has linked up with an insurance operator to provide insurance.

10.45am: Premier falls, CLSA calls profit miss

Premier shares are down 2.6pc at $13.40 after its FY17 results.

Sales rose 5.7pc to A$1.1b on a comparable 52 week basis, but that was 2pc below consensus according to CLSA.

Like-for-like sales rose 1.1pc on a constant currency basis and underlying NPAT of A$111m was 2pc behind consensus.

“Smiggle was again the main attraction, with a 24pc increase in store numbers and 29pc revenue growth,” says CLSA’s Richard Barwick.

“Importantly, management today announced plans to expand into Continental Europe (40-50 stores in Belgium and The Netherlands over the next 4-5 yrs) in CY18, with forecast total brand sales of more than A$400m by FY20.”

While he sees the expansion plan as a the key reason to own Premier, he notes that the more mature apparel brands continue to drag as they battle ongoing cyclical and structural headwinds.

“We continue to like Premier for its well-regarded management, balance-sheet strength and vertically integrated brands,” Mr Barwick says.

“The offshore growth opportunities offered by Smiggle appear attractive and given management’s track record, we consider the execution risk to be manageable.”

CLSA has an Outperform rating and $14.90 target.

10.25am: ASX200 lifts on fresh bank surge

Australia’s S & P/ASX 200 rose 0.5pc to 5710.4 in early trade.

SPI 200 futures rose just 0.1pc on Friday but US index futures are up about 0.2pc this morning.

Financials are accounting for most of the strength with the major banks up 0.6-1pc and insurers up about 1 pc.

Gold miners are weakest after Citi downgraded a number of companies in the sector.

But iron ore miners are mostly holding up despite a further slide in iron ore prices on Friday.

Overall, the index is trading sideways in the 5630-5836 range of the past three months.

Index last up 0.4pc at 5703.6

10.05am: Worley flaunts synergies to DAR

WorleyParsons offers a “reasonable” level of cost and revenue synergies for DAR Group should it make another takeover attempt, according to Deutsche.

“Our LBO scenario analysis suggests DAR Group could pay a 20-30 per cent premium to WOR’s last close and generate an IRR of 14-17 per cent,” Deutche analyst Craig Wong-Pan says.

While noting that a 14-17 per cent IRR is low for a private equity fund, he feels DAR Group could be comfortable with that return since there would be additional revenue synergies, while collaboration raises the likelihood of diversification and improve operational performance.

Mr Wong-Pan has a “buy” rating and $16.47 target price on the stock.

WOR last $13.59

9.58am: KKR sweetens Pepper deal

Private equity firm KKR says Pepper shareholders will now receive $3.70/share, or an extra 10 cents to KKR’s original takeover offer for the non-bank lender in July after Pepper announced an improved proposal this morning.

PEP last $3.50

9.35am: Oz Minerals to bear energy hit: CLSA

CLSA has cut OZ Minerals to “buy” vs. “underperform” and lowered its target price 25pc to $7.95 due to a combination of risks including copper price downside, summer power supply disruption and Carrapateena project delays.

CLSA analyst Dylan Kelly is also increasingly concerned over power supply disruptions during the upcoming peak summer months, with market regulators projecting SA shortfalls of up to about 90MW implying 2-4 hour outages.

With copper rising 34pc to $US3/lb this year, he doubts its short-term sustainability relative to fundamentals and weaker Chinese demand, saying that spot prices are 30pc higher than justified by fundamentals.

Mr Kelly says Chinese demand appears particularly weak and notes that OZL has a relatively high US dollar copper beta of 1.0x, raising the likelihood that any correction in the commodity could be equally borne by the equity.

He has also included the Carrapateena update into his valuation, including a six month delay and higher power costs.

OZL last $7.42.

9.20am: Analyst rating changes

OZ Minerals cut to Underperform vs. Buy; target price cut to $7.95 vs. $10.63 — CLSA

CBA target price cut to $80 vs. $84.30; Hold rating kept — Deutsche Bank

Independence Group cut to Neutral vs. Buy — Citi

Regis Resources cut to Sell vs. Neutral — Citi

Perseus Mining raised to Buy vs. Neutral — Citi

9.15am: Pencils, PJ’s Premier return

Solomon Lew’s retail empire Premier Investments has reaped stronger sales and earnings despite the challenging trading conditions that have crimped consumer demand and shaken business confidence, with his twin power brands of Smiggle and Peter Alexander driving growth.

Both brands recorded double-digit sales growth in 2017, helping to counter flat to slightly negative sales for its other retail brands.

Premier Investments this morning posted revenue of $1.1 billion, up 4 per cent, to see profit for fiscal 2017 rise 1.2 per cent to $105.1 million.

Total online sales were $68.1 million, up 44.3 per cent, and the online business has grown from 1.1 per cent of sales in 2011 to 7.1 per cent in 2017.

Buttressing the result was the $170.6 million of cash on hand the company held as well as its stake in appliances company Breville which was valued at $383.8 million. However, Premier Investments decision to grab a 10 per cent stake in retailer Myer weighed down the balance sheer as its shares in Myer plummeted over the last few months — more to come

PMV last $13.75

Scott Murdoch 9.10am: Migration on Macquarie’s mind

Macquarie Group’s new chief economist, Ric Deverell, said Australia’s capital cities outside Sydney and Melbourne could begin to benefit as more workers moved out of the highest priced cities in Australia and net migration started to pick up.

Prices in the two major cities have remained resilient despite ongoing forecasts that residential housing could crash as a result of the steady increases in values.

Sydney prices have grown 13.6 per cent in the past year while Melbourne is 16.8 per cent higher, according to CoreLogic figures, and the outlook remains stable.

Mr Deverell said he believed net migration between the states was natural during strong housing market cycles and Brisbane could be a major beneficiary in the current climate — read more

MQG last $88.64

Rosanne Barrett 9.05am: Brisbane flats cleave value

Apartments bought off the plan at the start of Brisbane’s unprecedented unit-construction wave are selling at losses of up to 36 per cent, underscoring concerns from the Reserve Bank about the city’s concentrated inner-city market.

Property searches of high-rise apartment towers in Hamilton, Bowen Hills and Fortitude Valley built about five years ago show most sales this year had been at a loss.

The heaviest falls were a $152,000 plunge from an original price of $522,000 for a Hamilton two-bedroom unit with river views; a $150,000 decline on a smaller two-bedroom unit in the same complex; and a $145,000 loss on a $400,000, 60sq m unit in Bowen Hills.

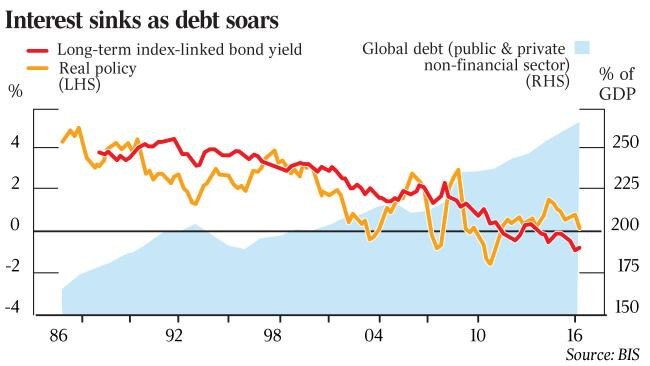

David Uren 9.00am: Inflation target under attack

One of the world’s leading monetary economists has launched an unprecedented attack on the inflation targeting framework that has guided central banks for the past 20 years, saying it is “like a compass with a broken needle” and needs to be overhauled.

Claudio Borio, who is head of the monetary and economic department of the Bank for International Settlements, says central banks have much less influence on inflation and much greater impact on “real” (after inflation) interest rates than the globally accepted theories of central banking suggest.

In a provocative speech in London on Friday, Borio said central banks should relax their efforts to get inflation back to their target bands and instead pay greater attention to the dangerous build-up of debt that ultra-low interest rates have encouraged.

8.50am: Fonterra n et profit slides 11pc

Ben Collins writes:

The world’s largest diary exporter, Fonterra Co-operative Group, says reduced margins across the business saw its after-tax profit and earnings decline in the year through to July.

Still, it has increased its payout to farmers despite poor weather leading to lower milk volumes, and said there was stronger demand for its higher-value consumer products. Sales of its advanced ingredients category also rose 9 per cent on-year — read more

Dow Jones Newswires

8.35am: Premier lifts profit, dividend

Retail operator and portfolio manager Premier Investments booked a 1.2 per cent increase in profit to $105.1m in FY17 on the back of a 4 per cent increase in revenue over the period to $1.1bn.

Alongside results, the company announce a 8 per cent lifts to its final dividend to 27cps.

Online sales rose 44.3 per cent to $68.1m, while the company cited sales growth in its Peter Alexander and Smiggle brands — up 14.4pc and 28.8pc respectively.

PMV last $13.75

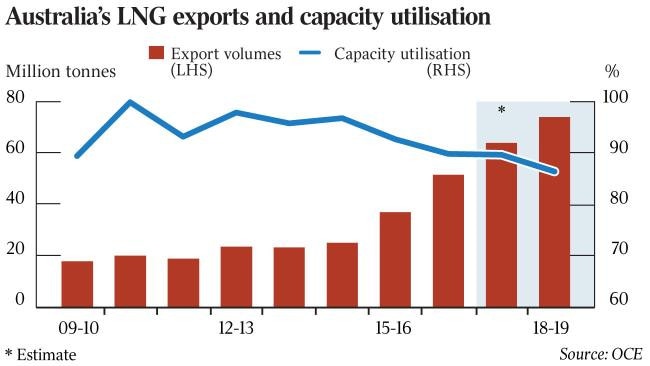

8.26am: Gas crisis to worsen

Paul Garvey and David Uren write:

A new forecast of a massive shortfall in east coast gas supplies will intensify pressure on the federal government to introduce dramatic restrictions on liquefied natural gas exports, amid growing expectations that the pain will be spread across the whole Queensland LNG sector.

A critical gas forecasting report from the Australian Energy Market Operator, which will be submitted to the government today, will show that the group expects the shortfall in east coast gas supplies to worsen to as much as 107 petajoules next year.

Prime Minister Malcolm Turnbull, Deputy PM and Resources Minister Barnaby Joyce, Treasurer Scott Morrison and Energy Minister Josh Frydenberg will meet today with Australian Competition & Consumer Commission chief Rod Sims in a key step towards a final government decision on how to enforce retroactive powers designed to tackle the east coast energy crisis.

7.45am: ASX set to open up slightly

The Australian market looks set to open slightly higher on a weak lead from Wall Street, which closed little changed as worries about Washington’s latest healthcare legislation proposal eased and investors shrugged off concerns about North Korea.

At 7am (AEST), the share price futures index was up seven points, or 0.12 per cent, at 5,679.

In the US, the S & P 500 closed slightly higher after Republican Senator John McCain said he opposed his Republican peers’ latest effort to replace former president Barack Obama’s healthcare law.

Investor jitters over a fresh exchange of barbs between North Korea and the United States also eased.

The Dow Jones Industrial Average fell 0.04 per cent, the S & P 500 gained 0.06 per cent and the Nasdaq Composite added 0.07 per cent.

Locally, in economic news today, CoreLogic releases its survey of capital city house prices for the week just ended.

In equities news, Premier Investments is expected to release its full-year results.

Meanwhile, the 2017 Sydney China Business Forum is on in Sydney.

The Australian market on Friday broke a three-day losing streak as some buyers returned to the market despite negative overseas leads, although volumes were muted with no strong theme directing trading.

The benchmark S & P/ASX200 index rose 26.7 points, or 0.47 per cent, to 5,682.1 points.

The broader All Ordinaries index gained 23.9 points, or 0.42 per cent, to 5,740.6 points.

AAP

7.00am: Aussie slightly higher

The Australian dollar is slightly higher against its US counterpart which, along with equities and interest rates, has remained little changed since Friday.

At 6.35am (AEST), the Australian dollar was worth US79.51 cents, up from US79.46 cents on Friday.

Westpac’s Imre Speizer says the US dollar, interest rates, and equities were little changed on Friday night, amid a series of Federal Reserve speeches. “The US dollar index closed Friday little changed. (The) EUR made a round trip from 1.1950 to 1.2004 and back for little net change, but the German election result is expected to weigh when it opens this morning,” he said in a Monday morning note.

“(The British pound) GBP was the worst performer, following a speech by (British) PM May, and Moody’s downgrade to Aa2, falling from 1.3596 to 1.3451.

“(The) AUD rose from 0.7940 to 0.7986. NZD rose from 0.7280 to 0.7344. AUD/NZD slipped from 1.0897 to 1.0842, iron ore shedding 3.8 per cent to a two-month low.”

He said Federal Reserve speakers included Dallas president Robert Kaplan (open minded about another rate hike in 2017), Kansas City president Esther George (need to keep rate hike momentum), and San Francisco president John Williams (”2.5 per cent is about the new normal” for the Fed rate).

Mr Speizer expects the local currency to be “neutral in a 0.7900-0.8000 range, but possibly weighed down today by any negative EUR reaction to the German election”.

The Aussie dollar is also higher against the yen and the euro.

AAP

6.40am: ASX set for modest open

The Australian sharemarket is set to open modestly higher after some small gains on wall Street on Friday night.

It was a listless day on US markets, as strength in energy, phone and industrial companies offset losses elsewhere.

A new round of tensions between the U.S. and North Korea helped send bond yields lower, which weighed on banks and other financial stocks. The sector notched daily gains earlier in the week.

“Geopolitical tensions coming out of North Korea caused a flight to quality, which kind of put the brakes on the momentum in financials,” said David Schiegoleit, managing director of investments at U.S. Bank Private Wealth Management.

The Standard & Poor’s 500 index rose 1.62 points, or 0.06 per cent, to 2,502.22. The Dow Jones industrial average shed 9.64 points, or 0.04 per cent, to 22,349.59. The average was held back by a loss in Apple, which slid $1.50, or 1 per cent, to $151.89.

The Nasdaq composite added 4.23 points, or 0.07 per cent, to 6,426.92.

Australian stocks are set to open modestly higher. At 7am (AEST) the SPI futures index was up seven points.