Apartment price falls affirm RBA fears

Apartments bought at the start of Brisbane’s unit-construction wave are selling at losses of up to 36 per cent.

Apartments bought off the plan at the start of Brisbane’s unprecedented unit-construction wave are selling at losses of up to 36 per cent, underscoring concerns from the Reserve Bank about the city’s concentrated inner-city market.

Property searches of high-rise apartment towers in Hamilton, Bowen Hills and Fortitude Valley built about five years ago show most sales this year had been at a loss.

The heaviest falls were a $152,000 plunge from an original price of $522,000 for a Hamilton two-bedroom unit with river views; a $150,000 decline on a smaller two-bedroom unit in the same complex; and a $145,000 loss on a $400,000, 60sq m unit in Bowen Hills.

RBA assistant governor Luci Ellis last week said it was “crunch time” for Brisbane’s potential oversupply but warned the older apartment market was particularly vulnerable to price falls.

Across Brisbane the preliminary auction clearance rate was 51.5 per cent last week, according to CoreLogic. This was slightly up on the same time last year. For the Gold Coast last week’s clearance rate came in at 37.5 per cent.

Andrew Coronis, managing director of Coronis real estate agencies across southeast Queensland, said price drops of 20 per cent to 25 per cent were not uncommon for resales after off-the-plan buys.

“It is just time to sit and ride it out if you can,” he said. “If rents drop a bit the yields still aren’t too bad. If you do have to sell, it’s better to do it now. I don’t believe it will get better in the short term.”

Mr Coronis said he was bullish about the long-term market, saying population and jobs growth across the region would propel the market. He also pointed to relatively strong yields based on the median unit price, which in Brisbane is $410,000, compared with Sydney’s $710,000 and Melbourne’s $499,250.

According to property searches, all the 2016 and 2017 sales in the Riverside Hamilton building failed to make a profit. Instead they ranged from an 8.7 per cent fall in off-the-plan price (a loss of $35,500) to a 29 per cent decline (a loss of $152,000).

In the nearby Hamilton Harbour building, a two-bedroom, one-bathroom apartment sold this year for $115,000 less than its off-the-plan price of $485,000, a fall of 23.7 per cent. The only profitable sale of a dozen this year was of a property that was sold by the developer with a rebate, and made less than $10,000.

At Bowen Hills’s The Green, the three sales this year were at losses of more than 25 per cent of the original prices paid. In Fortitude Valley, two resales have occurred in the Brooklyn on Brookes apartments, both at a loss. In the Watermarque complex in Hamilton, losses on the three resales this year were at a maximum of 5 per cent.

BIS Oxford Economics residential property manager Angie Zigomanis said a recent study found 40 per cent of apartments were resold at a loss or the same price since their off-the-plan purchase after mid-2011. But he said more subsequent resales were expected to be at a loss.

“We would expect that from here on in, that 40 per cent figure will steadily increase as more recently completed apartments initially sold at higher price points are placed on to the market and resold,” he said.

Real Estate Institute of Queensland spokeswoman Felicity Moore said the property group was “cautiously optimistic” that the Brisbane market fundamentals would remain strong as supply peaked over the next 18 months.

“There’s no doubt that whenever the property market turns, there will be some people caught in that crunch,” she said.

“We are cautiously optimistic the number of people forced to sell is small and it won’t be a large and ongoing situation.”

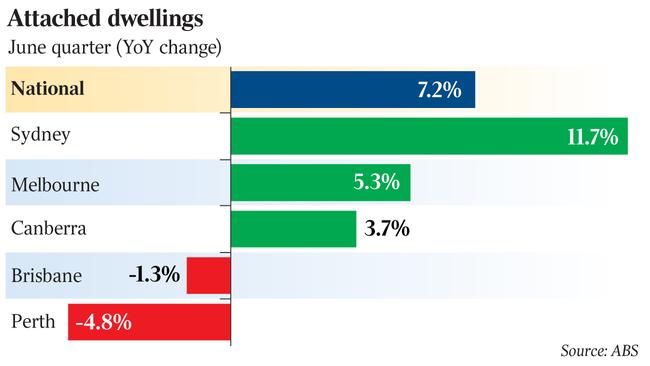

More than 5300 units have been finished in the inner city this year, and there are another 11,000 being built. The median unit price in Brisbane fell 2.3 per cent in the June quarter but house prices are still rising.

If all the building contracts were fulfilled, new supply across the city for apartments and townhouses could grow to 15,650 in the next 12 months and 39,420 in the next two years.

Following this supply, development approvals have dropped more than 50 per cent, with many projects deferred.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout