Trading Day: live markets coverage, plus analysis and opinion

The local bourse has inched lower in choppy trade, as banking strength failed to offset drag from the major miners.

Welcome to Trading Day for Thursday, September 14.

5.02pm: Stocks slip despite robust data

Local stocks fell on Thursday in choppy trade as investors mulled fresh economic data blowing a tailwind for the dollar against a heavy drag in the materials sector.

At the close, the benchmark S & P/ASX200 index was down 0.1 per cent or 5.6 points to 5738.7. The All Ordinaries was also down 0.1 per cent or 5.6 points to 5798.4.

Samantha Woodhill 4.10pm: Drone aid from ASX to Irma, Harvey

Australian robotics company Aquabotix expects increased demand for its underwater drones to help assess and repair damage to offshore US oil rigs in the wake of hurricanes Harvey and Irma.

Aquabotix says it’s “actively engaging” with specialist distributors in the Gulf of Mexico, existing oil and gas industry companies and state and local governments to equip them with commercial-grade, remotely-operated vehicles.

“The reconstruction effort will involve a substantial amount of underwater work,” the company said today.

“The company expects that it will substantially increase the need for its vehicles.”

A significant amount of offshore energy production and around a third of US oil refining takes place in the Gulf of Mexico — read more

UUV last up 14.2pc at $0.014

3.50pm: ‘Pharma Bro’ tweets bite back

Rebecca Davis O’Brien writes:

A federal judge in Brooklyn has revoked Martin Shkreli’s bail and ordered him to be detained in jail while he waits to be sentenced, finding that the former pharmaceutical executive’s pattern of online threats and harassment posed a danger to the community.

“The fact that he continues to remain unaware of the inappropriateness of his actions or words demonstrates to me he may well be creating an ongoing risk to the community,” said US District Judge Kiyo A Matsumoto.

Mr Shkreli’s lawyer, Ben Brafman, tried for several minutes to convince Judge Matsumoto to let Mr Shkreli remain free until his sentencing, now set for January 16, insisting that Mr Shkreli would refrain from using social media — read more

Dow Jones

Lisa Allen 3.30pm: Superyacht tide turns Down Under

The Coalition has succumbed to pressure from the superyacht lobby and will move to increase foreign superyacht charters in Australian waters.

Highly lucrative within the tourism industry, superyachts generate nearly $2 billion annually according to an AEC Group study. With the government’s proposed reforms, the industry estimates superyachts could contribute an extra $1.1bn to the Australian economy by 2021.

3.20pm: Galaxy, lithium buzz hits new frontiers

Shares in lithium miner Galaxy Resources further gains after hitting an all-time high of $2.78 yesterday as the stock furthers its bull run amid a global buzz around lithium demand, or potential ramp up in batteries hitting new frontiers in energy storage..

Meanwhile, Wall Street’s Global X Lithium & Battery ETF (LIT) also managed to ekk out an all-time high overnight. The consumer investment vehicle aims to mimic results of the $186bn Solactive Lithium Index, also on a streak of 5 year highs this week as it tracks global lithium production.

However, it takes more than one mineral to pack a battery and big ASX miners are telling the tale of cooling counter electrodes: copper and zinc fell over 2 per cent overnight while nickel plunged over 5 per cent.

GXY last 2pc higher at $2.60 as the rest of the materials sector eyes a reprieve with less than an hour left of trade.

3.00pm: Myer miss hits Umbers’ pockets

Myer Boss Richard Umbers has taken a $150,000 pay cut after his department store chain fell short by delivering an 80 per cent drop in full-year net profit. Mr Umbers’ statutory remuneration for 2016/17 was $1.74 million, down from $1.9m a year ago, with the cash component of his pay unchanged at $1.18m, but no short-term incentive paid after Myer’s net profit missed performance targets.

The Myer boss’s take-home pay for the year was $1.42m in actual remuneration, a figure that includes short term incentive payments relating to the company’s 2016 performance but was paid in 2017.

On Thursday the retail company also announced its plans to close a further three stores, Colonnades in South Australia, Belconnen in the ACT, and Hornsby in Sydney’s north, as it struggles to turn around sluggish sales amid weak consumer spending and growing industry competition — read more

MYR last up 2.4 per cent at $0.74

Stephen Bartholomeusz 2.25pm: ‘New Myer’ strategy shaken

Richard Umbers was explicit in stating his disappointment with the Myer results for the year to the end of July, with the department store group coming in at the low end of its guidance range and undershooting the target metrics within its five-year “New Myer’’ strategic framework.

Given the difficulties being experienced within the department store sector — Myer’s most direct rival David Jones suffered a 25 per cent decline in earnings while the discount department store sector is, with the exception of Kmart, struggling for survival — the result could perhaps have been worse — read more

MYR last up 2.4 per cent at $0.74

2.05pm: ASX200 mixed in BHP headwind

Local investors bear a choppy day of trade on the local sharemarket as positive signals from the economy fail to square off with extended loss in large-cap mining stocks weigh on indices.

The S & P/ASX200 trades 0.2 per cent lower at 5735.5 as the bourse’s largest stock BHP Billiton remains over 2 per cent lower for the day, while Rio Tinto drops 1.5 per cent.

Myer shorters are feeling the squeeze after the stock jumped as much as 6 per cent at the open on its full-year profit results — the stock (MYR) last 2 per cent higher at $0.735.

The local currency trades just above US80 cents as it holds gains on surprise August jobs data and fends off a slight miss in China’s industrial production (read ‘demand’) over the month ahead of US consumer price index data released overnight.

1.05pm: DATA: Jobless rate steady, adds surprise

The unemployment rate remained steady at 5.6 per cent in August, while the number of new jobs over the month surged to 54,200 compared to 27,900 expected by economists.

The number of full-time jobs rose over the periodre by 40.1k vs. a 20.3k fall expected, while part-time jobs rose only 14.1k vs. 48.2k expected.

The participation rate rose 2 basis points to 63.3 per cent opposed to holding steady as economists expected.

The Australian dollar rose sharply on the release of the data, swinging positive and remains 0.3 per cent, or US0.25 cents in the black at US80.10 cents after trading in the red throughout the morning.

Ahead, investors eye China’s industrial production figures for August as a bellwether for demand.

Eli Greenblat 12.50pm: Myer profit edges into guidance

Myer shares have leapt up as much as 6 per cent at the open to $0.765 after the nation’s biggest department store posted a full-year profit of $67.9 million, down 1.9 per cent and at the bottom of its forecast earnings range when the retailer shocked investors with a profit warning in July.

However, the reported profit actually fell 80.4 per cent to $11.9 million, its worst profit result since it listed in 2009 as write-offs, impairments and charges of $56 million collapsed bottom line earnings.

The poorer result has also seen Myer slash its dividend by one third.

Myer’s sales and profits have hardly budged since it listed on the ASX in 2009. In 2010, when it reported its maiden full-year result as a listed company, its profit was $67.1 million on sales of $3.32 billion

Hianyang Chan, senior research analyst at Euromonitor International said Myer continues to struggle to find a place for itself in the rapidly changing fashion sector, especially in the wake of the looming arrival of Amazon and other retail disrupters.

“Myer continued to struggle within the department stores category to create a defined position in the competitive and challenging retail environment — read more

MYR last up 2.1pc at $0.735.

12.45pm: Base metals unwind gains

Miners trade mixed as those linked to base metals let off steam — BHP and Rio Tinto fall despite a 2pc surge in the price of crude oil in Asia trade.

Base metal price action since July below:

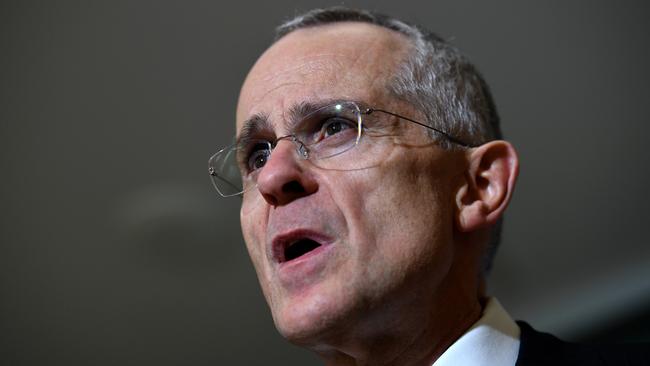

Greg Brown 12.30pm: AGL ‘anti-competitive’: ACCC’s Sims

The competition watchdog has labelled AGL’s ownership of two Hunter Valley coal stations as “anti-competitive” and says it should never have been allowed to happen.

ACCC chief Rod Sims said consumers were paying the price for AGL owning both the Liddell and Bayswater power plants, which the watchdog tried to stop from happening in 2014 by warning against the AGL’s acquisition of Macquarie Generation.

“We do think the merger we tried to stop is having an effect on increasing power prices right now. I can’t quantify what it is but I’d be very confident that it is,” Mr Sims told the The Australian Financial Review.

“You’ve got three players there and with the demand-supply balance getting tighter with Hazelwood and Northern out, that just means that when you’ve got less players they’re in a stronger position.”

The Australian reported in July Mr Sims’ warnings that of problems with state governments loosening the regulations on distribution monopolies in part to boost the privatisation proceeds — read more from PoliticsNow

AGL Energy last down 0.4pc at $24.00

12.12pm: DATA: China data falls short

China’s official industrial production growth slowed in August to 6 per cent on the same month a year prior from 6.4 per cent on the same basis in July.

The figure undershot more optimistic economists expectations of an uptick in growth to 6.6pc.

Meanwhile, China’s official retail sales growth remained steady in August on the same basis at 10.4 per cent, while official fixed asset investment growth ex-rural slowed to 7.8pc from 8.3pc the month prior.

The Australian dollar fell slightly on the release of the data but remains 0.1 per cent higher for the session at US79.95 cents after August employment figures surprised the market.

David Swan 10.50am: Shareholder backlash clouds Vocus

Aggrieved shareholders are planning a class action against embattled telco Vocus, accusing it of misleading and deceptive conduct and breaching disclosure obligations.

Law firm Slater and Gordon and shareholder claim management provider Investor Claim Partner said the proposed claim will be brought by potentially thousands of people who purchased Vocus shares between November 29, 2016 and May 2, 2017, including mum and dad investors and large institutional funds.

The companies allege Vocus shares traded at prices significantly higher than their true value during that time.

Vocus revealed its preliminary financial results for the 2017 financial year in August, showing net profit after tax (NPAT) was $152.3 million below the company’s guidance — read more

VOC last up 0.8pc at $2.43

Scott Murdoch 10.30am: Macquarie Atlas Road lifts APRR stake

Macquarie Atlas Roads has launched a $450 million rights issue today to existing shareholders.

The deal is being carried out through Macquarie Group and the first major capital raising following results season.

MQA will use the money to raise its stake in APRR, which is the concessionaire on a 2323 kilometre highway network in France’s east.

The Australian-based group’s ownership will now go from 20.14 per cent to 24 per cent — more to come from DataRoom

MQA last $5.74

10.05am: ASX200, dollar eyed ahead of data deluge

Stocks are set to open steady as caution spreads over the local market, fresh highs in Wall Street come amid a sharp drop in metals and ahead of pivitoal economic data.

At 7am (AEST), the share price futures index indicated a 0.02 per cent rise on the S & P/ASX200 index to 5,747.

The Dow hit a new record high overnight as US tax reform hopes stirred, while in London BHP and Rio Tinto’s London both lost over 1.8 per cent as industrial metals declined across the board.

“Inventories of copper on the LME fell for a second consecutive day ... stockpiles are now up 18pc this week to 246,575 tonnes,” said ANZ senior economist Giulia Lavinia Specchia.

“Investor positioning sits at record high net long position on the LME in recent days. This was enough to induce some investors to lock in their recent gains.”

However it’s not all bad news for resource stocks, underlying crude oil posted gains over 2 per cent, while the broader market remains sitting on its hands ahead of August employment numbers released at 11:30am AEST and China industrial production expected at midday.

“AUD will be sensitive as always to Australia’s monthly labour force data,” said Westpac’s Sean Callow, “consensus is for another 20k rise in jobs but a steady unemployment rate, at 5.6pc.”

“Job creation has picked up sharply after the weak summer of 2016/17, with total employment now growing at a little more than 2pc year-on-year.”

The Australian dollar last traded 0.1 per cent, or US0.05 cents lower at $79.80 cents.

Andrew White 9.30am: $250bn to replace power plants

Australia faces a $250 billion bill to replace its ageing power generation fleet amid a long-running political battle over the nation’s energy and environment policy, according to estimates by AGL Energy.

Amid mounting pressure to extend the life of its coal-fired power fleet, one of Australia’s biggest energy retailers said advances in the cost and capacity of producing wind and solar power were rapidly beating new coal generation — even without a price on carbon — and were driving the preference for renewable energy investment.

AGL chief financial officer Brett Redman estimated that replacing the generation fleet with largely renewable capacity would cost $150bn, with another $100bn for storage and firming capacity — which includes batteries and gas-fired power plants — read more

AGL last $24.80

Scott Murdoch 9.25am: JPMorgan chief sounds N Korea alarm

JPMorgan’s Asia Pacific chief executive Nicolas Aguzin says investors are underestimating the risk that a major financial event could emerge from the global geopolitical situation and the worsening North Korean crisis.

The Hong Kong-based Mr Aguzin has been in Sydney for the past three days meeting the bank’s major clients and staff as part of an annual trip to Australia.

He has headed the bank’s regional operations for the past five years and overseen the Australian branches’ recent reinvestment in its key business sectors.

The global economy, he said, was in strong shape but he feared investors were not prepared for the potential fallout from the North Korean stand-off.

The United Nations has voted to impose the toughest sanctions yet on the rogue nation, which carried out its sixth major nuclear ballistic missile test last week.

“I’m optimistic about the economies, but having said that there has been a crisis every seven, eight, 10, 12 years, or some kind of downturn,” Mr Aguzin told The Australian. “The last one was 2008 so we are going into the ninth year, so we are keeping an eye on that.

9.15am: New float tipped for Wesfarmers

Scott Murdoch and Briget Carter write:

The word around the market is that Wesfarmers is about to embark on major corporate activity and many now say it is more likely to involve asset sales than acquisitions.

One possibility could be that the Perth-based conglomerate brings Kmart, Target and Officeworks together to create a major retail business that is sold via an initial public offering on the stock exchange.

The idea — deterging operations or an IPO of what would be a $6 billion company with annual earnings of about $600m and a $4.5bn equity value — has apparently been pitched by investment bankers to Wesfarmers — read more

WES last $42.55

Michael Roddan 9.08am: APRA to psychoanalyse banking

The banking regulator will soon launch cultural investigations into all Australian financial institutions, including interviewing frontline staff and sitting in on board meetings, as it widens a pilot project based on a Dutch program that saw psychologists deployed in boardrooms.

Commonwealth Bank is now subject to a wideranging six-month investigation by the regulator following allegations it breached anti-money-laundering legislation more than 53,000 times. This came on top of financial planning scandals, life insurance claims issues, and the Storm financial collapse.

Other financial services companies can now look forward to the prudential regulator running a comb through their cultural frameworks — read more

CBA last $74.28

8.45am: APDC board backs fresh 360 bid

The Asia Pacific Data Centre board says a fresh $1.95/share bid by private equity firm 360 Capital (TGP) is “superior” to a standing rival bid by previous parent NEXTDC for $1.87.

The private equity firm lobbed the revised, all-cash bid to APDC shareholders yesterday after the board shot down its previous offer part funded by a new issue of debt.

AJD last $1.87

8.40am: Macquarie Atlas Roads in trading halt

Macquarie Atlas Roads has entered a trading halt pending an announcement in relation to a capital raising.

MQA last $5.74.

8.35am: Vocus facing shareholder class action

Law firm Slater and Gordon have this morning announced a proposed shareholder class action against telco Vocus citing breaches of its disclosure obligations and “misleading and deceptive conduct” in relation to its FY17 guidance issued on November 16 last year.

The proposed claim will be brought on behalf of those who purchased Vocus shares between 29 November 2016 and 2 May 2017 — more to come.

VOC last $2.50

7.50am: Oil up

Crude oil prices have risen after the International Energy Agency (IEA) said a global surplus of crude was starting to shrink, even though US data showed another big increase in domestic inventories due to Hurricane Harvey.

US petrol prices fell despite a record drawdown in fuel inventories. Analysts expect supply to increase as refineries return online after Harvey shut nearly a quarter of US capacity. Demand is expected to slip due to the effects of Hurricane Irma on high-consuming states of Florida and Georgia. US Energy Information Administration (EIA) data showed a build of 5.9 million barrels of crude last week, exceeding expectations.

Much of that was due to a near 10 million-barrel increase in stocks in the US Gulf region and as crude production rebounded from a brief Harvey interruption. “It’s going to take some time for the markets to figure out the full impacts of the hurricanes but certainly from an oil production standpoint there was very little, if any, disruption,” said Joe McMonigle, energy policy analyst at Hedgeye Potomac Research in Washington.

The Paris-based IEA’s monthly report noted that the US reliance on the Gulf Coast makes it vulnerable to events like Harvey. It said the United States should strengthen its energy security to address hurricanes, by steps such as adding oil products to government-held inventories.

US crude settled up $US1.07, or 2.2 per cent, to $US49.30 per barrel and Brent crude was up 89 cents to $US55.16 a barrel.

Reuters

7.40am: ASX poised to open flat

The Australian market looks set to open flat after Wall Street’s key markets gave up early gains to close hardly changed, albeit at record highs.

At 7am (AEST), the share price futures index was up one point, or 0.02 per cent, at 5,747.

In the US, stocks edged up to record highs as gains in consumer discretionary and energy stocks offset losses in technology heavyweight Apple. The Dow Jones Industrial Average rose 0.18 per cent to 22,158.18, the S & P 500 edged up 0.08 per cent to 2498.37, and the Nasdaq Composite added 0.09 per cent to 6460.19.

Locally, in economic news today, the Australian Bureau of Statistics will release August’s labour force data.

Reserve Bank of Australia deputy governor Guy Debelle is slated to speak at a business workshop at King & Wood Mallesons in Sydney.

In equities news, Myer is expected to post full-year results.

The Australian market yesterday surrendered its early gains to close relatively steady with investors cautious ahead of US inflation data and Australian jobs figures out later in the week.

The benchmark S & P/ASX200 index fell 2.1 points, or 0.04 per cent, to 5,744.3 points.

The broader All Ordinaries index lost 2.4 points, or also 0.04 per cent, at 5,804.0 points.

AAP

7.15am: Trump blocks China deal

President Donald Trump has blocked attempts by a Chinese state-owned firm to acquire an American semiconductor company, saying this posed a treat to US national security.

The acquisition of Lattice Semiconductor Corporation, a publicly traded Oregon company which produces programmable semiconductors, by the Chinese-owned Canyon Bridge Fund could endanger the US government’s use of sensitive Lattice products, the Treasury Department said in a statement.

AFP

7.10am: Dollar slips

The Australian dollar is back below US80 cents, as the greenback strengthens amid officials’ talks that US tax reform guidance is likely to be released before the end of September.

At 6.35am (AEST), the Australian dollar was worth US79.84 cents, down from US80.28 cents yesterday.

Westpac’s Imre Speizer says the US dollar had strengthened, along with US bond yields, as more US officials pointed to tax reform guidance in all likelihood, being released later in September.

“The US dollar index is up 0.7 per cent on the day ... (while the) AUD fell from 0.8044 to 0.7971,” he said in a morning note.

Australia’s jobs — or labour force — data are due out today, with the market expecting employment to increase by 20,000.

“However, the market sees unemployment steady at 5.6 per cent while Westpac forecasts a tick up to 5.7 per cent.”

He said the Aussie dollar could slip further today “to 0.7950 if the US dollar’s multi-day rebound persists”.

Australian jobs and US CPI (inflation) data today will be key”. The Aussie dollar has also slipped against the yen but is higher against the euro.

AAP

6.45am: US stocks close at records

The Dow Jones Industrial Average notched its fourth straight day of gains, boosted by shares of energy companies.

Stocks have set fresh records this week as investors have shaken off concerns over tensions between the US and North Korea, and early estimates have suggested damage from Hurricane Irma was less severe than initially expected.

While some investors say the largely uninterrupted nature of the stock rally has made them nervous, many say the earnings and economic backdrop for stocks remains favourable heading into the rest of the year.

“Momentum seems to be driving the bus,” said Terry Sandven, chief equity strategist at US Bank Wealth Management. “It’s still a buy the dips environment.”

The Dow industrials gained 39 points, or 0.2 per cent, at 22158. The S & P 500 and the Nasdaq Composite gained 0.1 per cent.

Australian stocks are set to open steady. At 7.07am (AEST) the SPI futures index was up 1 point.

In the US, energy stocks were the best performers in the S & P 500 on Wednesday, rising alongside oil prices after the US Energy Information Administration reported a record drop in gasoline inventories. That came following an International Energy Agency report that global oil supplies fell for the first time in four months in August. US crude climbed 2.2 per cent.

The S & P 500 energy sector gained 1.2 per cent, its ninth day of gains in the past 10 sessions. Last night marks the first time this year the sector has accomplished that feat.

Gains in energy and consumer discretionary stocks offset losses in technology heavyweight Apple. Shares of Apple dropped 0.8 per cent amid concerns that the company’s newly launched iPhone X is too expensive and because its availability starting in November was later than expected. With the widely held stock up 37 per cent so far this year, some analysts said it was time to cash in gains.

US stocks were little changed and the dollar rose after data was released showing the producer-price index, a measure of inflation experienced by businesses, rose 0.4 per cent in August from a month earlier. That was the largest increase since April, though still below what economists surveyed by The Wall Street Journal had expected.

The WSJ Dollar Index, which tracks the US currency against a basket of 16 others, turned positive after the data was released and was recently up 0.5 per cent. The yield on the 10-year U.S. Treasury note rose to 2.194 per cent, according to Tradeweb, from 2.171 per cent yesterday.

Yields rise as prices fall.

Dow Jones Newswires

6.40am: European markets edge higher

Europe’s main stock markets ended the session slightly higher Wednesday, shrugging off weaker prices on Wall Street, as they were buoyed by a slight softening of the euro, dealers said.

Nevertheless, sentiment was subdued as investors took a breather from the previous day’s record close on Wall Street and digested mixed reactions to Apple’s latest iPhone product launches.

“Bullishness may have waned ... but equities are well off their worst levels, back closer to break-even for the day,” said Accendo Markets analyst Mike van Dulken.

The strength of sterling was continuing to hamper the FTSE, “but the currency is back from its highs following underwhelming UK wages growth,” the expert said.

London’s FTSE closed down 0.3 per cent, Frankfurt ended up 0.2 per cent and Paris closed up 0.2 per cent.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout