Sounding alarm on North Korea crisis

JPMorgan’s Asia Pacific CEO Nicolas Aguzin says investors underestimate the risk of a major financial event.

JPMorgan’s Asia Pacific chief executive Nicolas Aguzin says investors are underestimating the risk that a major financial event could emerge from the global geopolitical situation and the worsening North Korean crisis.

The Hong Kong-based Mr Aguzin has been in Sydney for the past three days meeting the bank’s major clients and staff as part of an annual trip to Australia.

He has headed the bank’s regional operations for the past five years and overseen the Australian branches’ recent reinvestment in its key business sectors.

The global economy, he said, was in strong shape but he feared investors were not prepared for the potential fallout from the North Korean stand-off.

The United Nations has voted to impose the toughest sanctions yet on the rogue nation, which carried out its sixth major nuclear ballistic missile test last week.

“I’m optimistic about the economies, but having said that there has been a crisis every seven, eight, 10, 12 years, or some kind of downturn,” Mr Aguzin told The Australian. “The last one was 2008 so we are going into the ninth year, so we are keeping an eye on that.

“I don’t see an immediate trigger in terms of an obvious bubble, but the one that the market has been talking about for some time is China and you can’t rule out geopolitical events. It’s hard to predict the outcomes on North Korea. It’s not an insignificant risk.”

Mr Aguzin said the potential fallout from a nuclear battle was difficult for global investors to digest, and an unprecedented event for financial markets.

“The problem is that it’s hard to hedge against a situation like North Korea. How do you hedge that? Where will it impact? Is it Japan, South Korea or is it the US or is it China?” he said.

“The difficulty from an investor point of view is that it’s not an easy position to hedge.

“When you possess nuclear weapons, it’s different to any financial event that we have seen. If it does not involve a nuclear confrontation we can anticipate it would be more contained. But from a financial point of view, it’s hard to see how it will play out.”

JPMorgan’s Australian chief executive, Paul Uren, said North Korea was on the radar of investors around the world.

“I was in New York last week and my colleagues were saying that the markets are pricing a zero per cent possibly of a nuclear event … so it seems that the market is underestimating that risk,” he said.

Meanwhile, Mr Aguzin said one of the better fundamentals for global markets now was the strong state of employment in most of the major economies.

“I think the markets are demonstrating the fact that we have almost full employment around the globe, with quite a lot of stability, and volatility is at the lowest level in a long time.” JPMorgan is midway through rebuilding its equities business in Australia, which has been run down in the past few years. It recently carried out a raid on its rival Goldman Sachs and hired Steve Maartensz, Andrew Tanner and Dyson Bowditch to join the business.

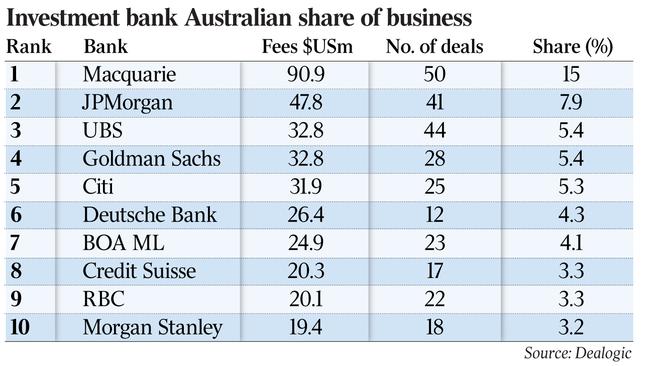

The most recent Dealogic league tables for 2017 show JPMorgan sits fourth in terms of M&A, with a 13.7 per cent market share. It is also fourth in ECM, with 4.6 per cent.

The bank tops the debt capital markets tables with 14.1 per cent, nearly double the market share of its nearest rivals Morgan Stanley and Citi.

In terms of the bank’s wallet share — which combines M&A, ECM and DCM fees — the it sits second behind Macquarie and ahead of the traditional industry leader UBS. Mr Aguzin said JPMorgan was well placed to grow its market share in M&A by strategically recruiting bankers.

He was keen for JPMorgan to work on “transformational deals” for companies rather than chase general market share.

JPMorgan was the lead adviser on Link Group’s recent $1.5 billion deal to buy Capita in the UK. “Australia is a market we don’t like to go hot and cold in; you are not going to see us overinvest and then pull back throughout the cycle. Perhaps at some point, we didn’t invest as much,” he said.

“If you look back 10 years ago, potentially we could have invested more, but over the last two to three years we have been investing. We have been methodical, we have been getting the right people, the right resources, the right capital.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout