Trading Day: live markets coverage; Rates risk resonates for ASX; plus analysis and opinion

The ASX falls as investors tread cautiously near Aussie stocks amid growing speculation of a higher rate environment.

Welcome to Trading Day for Thursday, September 21.

Bridget Carter 5.40pm: Macquarie sells $93m Bravura stake

A block of 60 million shares in Bravura Solutions is being sold through Macquarie Capital.

The stake is being sold down by former owner Ironbridge Capital at a floor price of $1.55 per share.

The value of the shares being sold is $93 million.

More to come

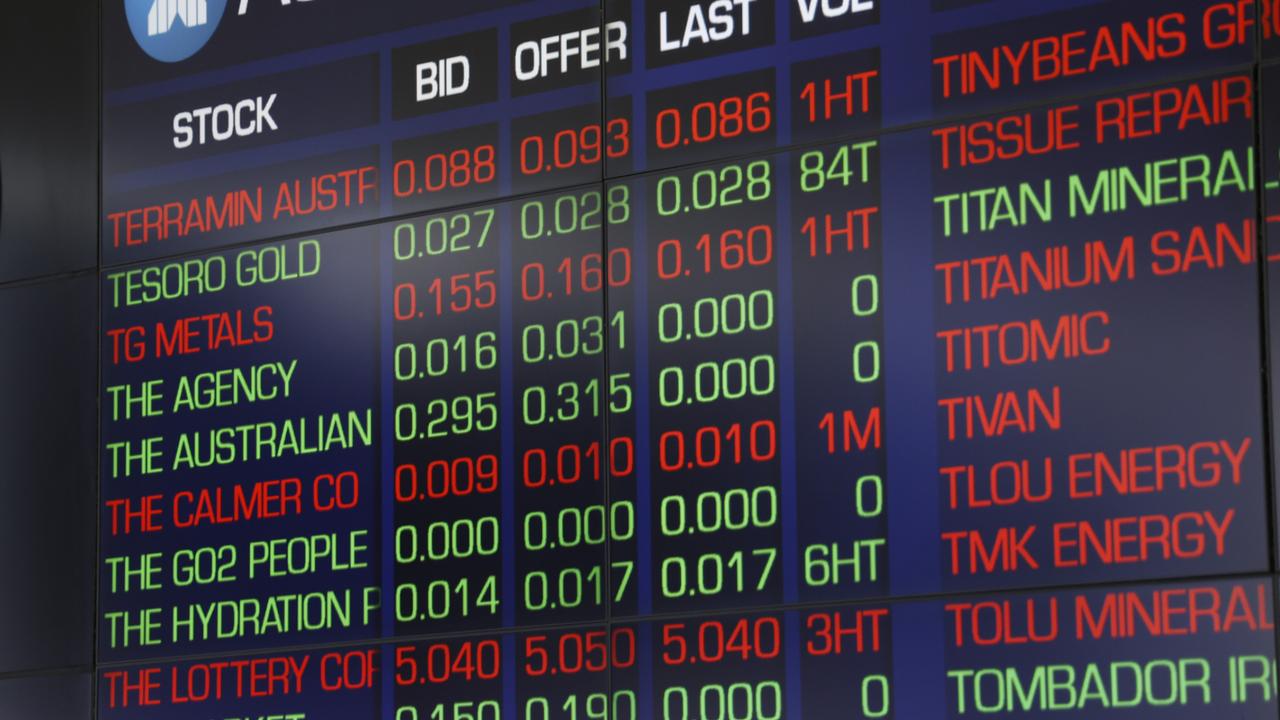

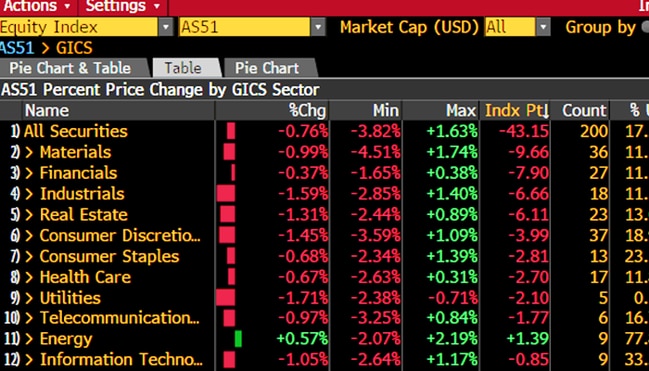

5.15pm: Stocks sink as banks weigh

The local share market fell sharply and edged below its 2017 starting point for just the second time this year as energy stocks proved the only asylum for investors amid broadbased pressure.

At the close, the S & P/ASX200 index was 0.9 per cent or 53.7 points lower on 5655.4, while the broader All Ordinaries index also closed down 0.9 per cent, or 53 points to 5716.5.

Australian stocks stood a firm outlier in the Asia-Pacific region, with global equity markets cushioned from similar losses amid fresh detail from the US Federal Reserve on the timing and rate at which it plans to taper off its quantitative easing measures.

The financial sector closed lower, while investors in big lenders have been served a paradox, according to CMC chief market strategist Chris Weston, as market speculation of a higher rate environment grows.

“We’ve got to look at the canary in the coal mines here, and I think Australia, Canada and high indebted nations are very much at the epicentre,” said Mr Weston.

“The market’s probably saying a higher cash rate is obviously good for banks and their ability to reprice loans, but what’s going to happen to the demand for credit? What’s going to happen to the housing market?”

Shares in Westpac fell 0.4 per cent to $31.28, ANZ dropped 0.9 per cent to $29.76, NAB lost 0.5 per cent to $31.00, while CBA reversed early gains in the wake of news it penned a deal to sell its life insurance arm to AIA and finished 0.3 per cent in the red on $76.07.

4.55pm: Fairfax sees slower year-to-date revenue

Fairfax Media says year-to-date group revenues are 4-5 per cent below that of last year.

More to come.

Bridget Carter 4.50pm: PNG sells out of Oil Search

The PNG government has sold its stake in Oil Search, selling 30 million shares in a trade worth $200 million.

UBS and JPMorgan are working on the deal.

The trade will see the PNG Government finalise its selldown in the company.

More to come from DataRoom

John Durie 3.55pm: Tabcorp clears air on court hearing

Tabcorp was forced to amend its statements to the market regarding next week’s court hearing, disclosing late this afternoon there will now be a directions hearing next Tuesday.

Previous advice to the ASX from Tabcorp suggested the matter could be wrapped up as early as next week but that appears unlikely.

The ACCC for one is unsure what steps it will take because the parties are yet to receive the reasons for the Full Court decision in amending the original Triubunal ruling on the Tabcorp-Tatts merger.

Tabcorp is keen to get the matter cleared up before the October 18 shareholders meeting but that remains in the balance.

TAH last down 1.9pc on $4.22

3.36pm: Debt-laden economy exposed to rates: RBA

Prashant Mehra writes:

A rise in global interest rates could have implications for debt-laden Australian households and the wider economy, Reserve Bank Governor Philip Lowe has warned.

Dr Lowe says an expected lift in interest rates would flow through to Australia over time and the high levels of household debt mean that household spending could be quite sensitive to such increases.

In an address to the American Chamber of Commerce in Australia in Perth on Thursday, Dr Lowe said a rise in global interest rates did not have automatic implications for Australia but an increase would be visible over time. “Our flexible exchange rate, though, gives us considerable independence regarding the timing as to when this might happen,” he said.

Economists widely expect the RBA to start lifting rates from a record low of 1.5 per cent by the middle of next year but some are betting the change could flow through sooner as economic growth and inflation show signs of improvement. Dr Lowe’s comments come within hours of the U.S. Federal Reserve signalling it expects one more increase in rates by the end of the year.

The central bank’s concern has been that, in this environment, a small shock could turn into a more serious correction as households seek to repair their balance sheets.

However, so far households have been coping reasonably well with the higher debt levels, Dr Lowe said.

AAP

3.30pm: Court decision scope ‘limited’: Tabcorp

Tabcorp says it will review the reasons for the Federal Court decision yesterday to uphold the ACCC appeal of its $11bn merger with Tatts Group after an embargo on the details was lifted this afternoon.

Tabcorp notes the issues of contention are “of limited scope” and says the watchdog will hold a directions hearing at 10.15am on next Tuesday, September 26 to consider its next steps.

TAH last $4.22

3.20pm: Murray Goulburn confirms approaches

Murray Goulburn says it has recently received a number of bids in a range targeting the purchase of certain assets to whole of company transactions.

While The Australian’s DataRoom flagged the approaches, the dairy producer says it has not received an offer for the units in MG Unit Trust for $1.20 per unit.

Murray Goulburn said it and its financial adviser Deutsche Bank “are engaging with a number of parties to assess their proposals, including valuation”.

“At this point it is too early to make any comment about valuation or implementation,” the dairy interest added.

MGC last $0.91

3.00pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Marcus Droga — Shaw & Partners

3.15pm: RBA governor Dr. Phillip Lowe — speaks on ‘The Next Chapter’ in Perth

3.50pm:Michael McCarthy — CMC Markets

4.00pm: Tony Farnham — Patersons Securities

4.05pm: Michael Heffernan — Phillip Capital

(All times in AEST)

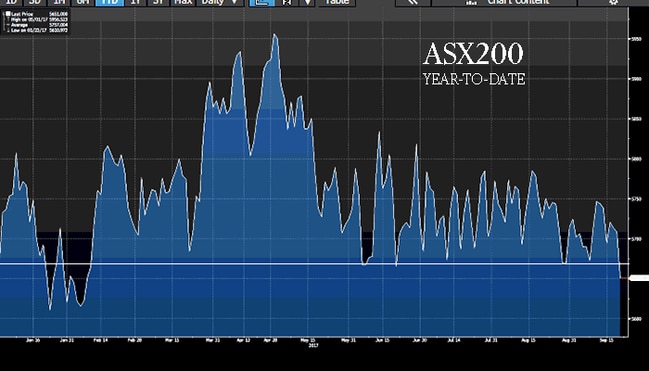

2.40pm: ASX200 outlier as Fed call resonates

The sharemarket extends losses as the firm outlier in Asian markets, broadbased pressure weighing the ASX200 index down as much as 1 per cent to 5652.4 to erase all year-to-date gains.

Local stocks emerge a firm outlier in Asia trade, Japan’s Nikkei posting gains as much as 0.7 per cent, China’s Heng Seng up 0.1 per cent, while Taiwan’s TAIEX also posts gains near 0.7 per cent.

The US Federal Reserve held firm overnight and set its sights on an October start to the unwinding of its $US3.6tn balance sheet, with fixed-income investor reaction and financials making for peak viewing.

“The banks are being used as a macro-thematic to express higher rates,” said IG chief market strategist Chris Weston.

“The market’s probably saying a higher cash rate is obviously good for banks and their ability to reprice loans, but what’s going to happen to the demand for credit? What’s going to happen to the housing market?”

“I think market’s stamped it and said the actual read through is that this [higher cash rates] is probably going to be bad for bank equity.”

Index last 0.9 per cent lower at 5656.8.

2.30pm: Gold bug lesson in cause, effect

Three panes, three plays, one common denominator.

US dollar spikes overnight as Fed watchers glean a hawkish tilt, greenback-denominated spot gold comes under pressure, while ASX gold miners litter the list of worst performers as investors shun risk plays amid stubborn losses.

2.05pm: ASX200: Read it and weep

Read it and weep ASX investors: the top 200 index edges past its 2017 starting point as banks turn out of favour with investors in the wake of a stout Fed, while resource investors find the sharemarket’s only glimmer of hope in energy as crude holds 2pc overnight gains in Asia trade.

Index last down 0.9 per cent at 5656.9 — Friday December 30, 2016 close: 5665.8

Cliona O’Dowd 1.45pm: Brickworks lobs into energy chorus

Building products group Brickworks has slammed governments across the country for failing to address Australia’s energy crisis, and warned that rising gas and electricity prices will add $20 million to its manufacturing costs every year by 2019.

Brickworks boss Lindsay Partridge’s scathing criticism comes amid ongoing government infighting over energy policy, and a fresh warning from the Australian Competition & Consumer Commission that gas export restrictions may be necessary to bring down prices — read more

BKW last down 1.4pc at $13.78

Samantha Woodhill 1.30pm: BCA boss backs AGL on Liddell

Business Council of Australia chief executive Jennifer Westacott has said the federal government should not be pressuring AGL to keep its 46-year-old Liddell coal power plant open.

“Only one per cent of coal-fired power stations stay open past this 50-year life that they have, across the world,” Ms Westacott told ABC radio this morning.

“They [AGL] have made it clear that it is unviable beyond that.”

The government has asked AGL to either commit to either keeping the plant open five years beyond its planned 2022 closure, or sell it.

Ms Westacott said that the BCA, which opposes a renewable energy target and carbon pricing, called for AGL to notify the government of the plant’s closure early on so its capacity could be replaced.

AGL last down 1.9pc at $22.82

1.10pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Simon Michael — FIIG Securities

1.30pm: Evan Lucas — The Lucas Review

1.50pm:Bloomberg Asia live cross

(All times in AEST)

Bridget Carter 1.05pm: JPMorgan primed for CBA fund plans

Commonwealth Bank of Australia is understood to be retaining JPMorgan to examine plans for its $6 billion fund manager Colonial First State Global Asset Management.

The bank is weighing a potential sale, float or demerger of the operation, as first revealed by DataRoom, and other banks could also be appointed — more to come

CBA last up 0.1pc at $76.36

12.20pm: Crude holds gains in Asia trade

The WTI index holds firm gains in Asia trade after crude spiked nearly 2 per cent overnight.

David Swan 12.10pm: Telstra lands $90m happy deal

Telstra and McDonalds have announced a $90 million network transformation deal, which will see more than 850 McDonald’s restaurants kitted out with an upgraded fibre network for both restaurant operations and customers wanting to surf the web while they eat their Big Mac.

The deal, announced at Telstra’s Vantage conference, will provide fibre to McDonald’s restaurants across the country which will give the company video conferencing capabilities and allow for more restaurant and head office collaboration.

As part of the rollout, which will take about 24 months, each restaurant will also offer Telstra Air in what os the biggest Telstra Air business deal to date. It’s Australia’s largest public Wi-Fi network — read more

TLS last down 1.1pc to $3.56

12.00pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Chris Weston — IG

12.15pm: David De Garis — NAB

12.30pm: Tony Boyadjian — Compass Global Markets

(All times in AEST)

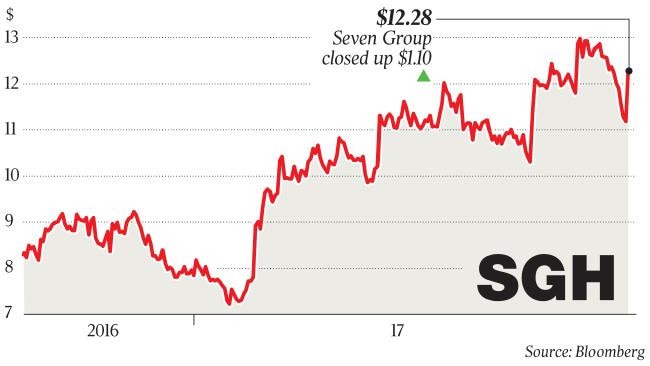

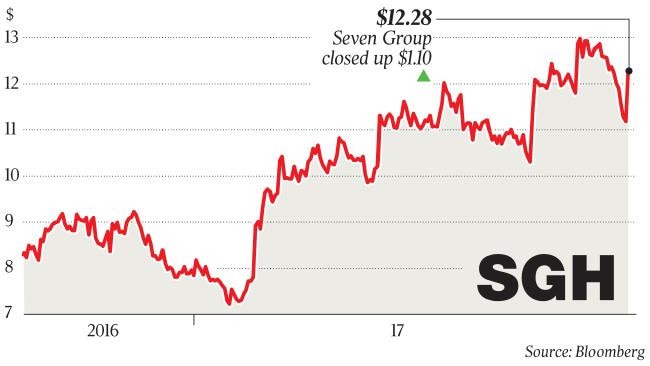

Scott Murdoch 11.40am: Multiples of Seven as investors flock

Seven Group’s $375 million capital raising has been closed early after it was oversubscribed by investors.

The deal, being run by UBS, was due to close at 5pm (AEST) today but the books were shut at 9.30am and allocations were being carried out today — read more from DataRoom here

SVW last $12.28 in trading halt

11.20am: Crude oil buoys ASX hopes

The local sharemarket suffers sweeping gains across all sectors except energy, where a blistering run by crude oil above $US50/barrel holds the only sanctuary for investors in Thursday trade.

The S & P/ASX200 index extends early losses to sit 0.7 per cent lower on 5729.9, a slight show of confidence by US investors on a staunch, tapering Fed lost on sentiment across the Pacific.

In a sea of red, it’s energy names Woodside (+0.7pc), Santos (+2.3pc) and Oil Search (1.6pc) buoying the market’s slim hopes in otherwise broadbased pressure.

“Crude oil closed above USD50bbl for the first time since July as supplies fell and the market looks for OPEC to reduce supply,” said ANZ head of Australian economics Daniel Plank.

“The weather across the US also remains conducive to gains in the energy complex, with many refineries still closed.”

Large-cap financials bear losses and pike CBA to the top of the pack on gains of 0.3 per cent after it confirmed the sale of its life insurance business to AIA, whetting shareholder’s interest with an accompanying announcement on the future of its funds manager Colonial First State Global Asset Management.

Gaming heavyweights Tabcorp (-3.3pc) and Tatts (-2.5pc) are both feeling the weight of hurt feelings after an $11bn merger between the two heads back to the ACCC’s tribunal, while Washington H Soul Pattinson (-2.5pc) edges lower as the market digests its FY17 profit results.

Meanwhile, the Australian dollar falls sharply in midmorning trade ahead of a speech by RBA governor Phillip Lowe’s this afternoon — last down 0.4 per cent at US80.03 cents.

10.50am: Tabcorp responds to court ruling

Tabcorp says it expects a decision from the ACCC over its proposed $11bn merger with Tatts group by next Thursday, September 28 if the watchdog’s issues with the deal are “narrow in scope.”

Following the Full Federal Court decision yesterday to uphold the ACCC’s appeal against the merger, Tabcorp also highlighted that the Court made no substantiate orders in relation to the CrownBet application.

TAH last down 3.4 per cent at $4.15, Tatts Group (TTS) last 2.5 per cent $3.98.

10.35am: Tabcorp, Tatts shares fall in tandem

Tabcorp and Tatts Group shares fall in tandem at the open in the first minutes of trade after the Full Federal Court upheld an appeal by the ACCC against a proposed $11bn merger between the two.

TAH last down 3.4 per cent at $4.15, Tatts Group (TTS) last 2.5 per cent $3.98.

Christine Lacy 10.30am: Crown serves shareholders $9.3m eyesore

Gaming billionaire James Packer’s Crown Resorts will ask shareholders to approve $9.3 million in pay and benefits to former chief executive Rowen Craigie at the casino and entertainment group’s annual meeting in Melbourne at the end of October.

The Crown notice of meeting reveals that Mr Craigie, who left the Packer empire in February after more than 20 years with the group, is entitled to $3.14 million in notice pay (equal to one year’s base pay), $3.14 million in severance pay and the equivalent of $3 million worth of Crown shares for a total exit package worth $9.28 million — read more

CWN last $11.38

9.55am: ASX eyes steady open in Fed wake

The Australian market looks set to open flat after the Dow and the S & P 500 scraped to further record highs but most major international markets held steady amid investor caution ahead of the US central bank’s policy statement.

At 7.40am (AEST), the share price futures index was up three points, or 0.05 per cent, at 5,702.

Globally, investors held back awaiting the Federal Open Markets Committee’s monetary policy statement at the conclusion of its two-day meeting.

The Fed left rates unchanged for now, as was widely anticipated, but investors’ expectations changed for December after the US central bank signalled one more rate hike by year-end despite recent weak inflation readings.

In line with expectations, the Fed said it would begin in October to cut its roughly $US4.2 trillion in US Treasury bonds and mortgage-backed securities holdings by initially cutting up to $US10 billion each month from the amount of maturing securities it reinvests.

CMC chief markets strategist Michael McCarthy says Australian investors face a “complicated” trading day, with currency fluctuations rippling through to commodity markets.

“The positive impulse in shares could be negated by the expiry of the September futures contract,” Mr. McCarthy said.

“Much larger than normal trading volumes are expected and potential strength in energy stocks counters recent general underperformance by the Australia 200 index. It’s a coin toss.”

Locally, in economic news today, Reserve Bank of Australia governor Philip Lowe is slated to speak at an AmCham business briefing in Perth.

With AAP

9.40am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Matt Richardson — OFX

10.00am: Tom Madden — Leyland Asset Management

10.30am: David Ellis — Morning Star

10.45am: Ben Jarman — JPMorgan

11.00am: Ben Le Brun — Optionsxpress

11.15am: Russell Zimmerman — ARA

(All times in AEST)

Damon Kitney 9.30am: Tabcorp, Tatts trading halts lifted

The market is poised to develier its verdict on Tabcorp (TAH) and Tatts Group (TTS) shares with each stock set to return to trade ahead of the open.

The fate of Tabcorp’s proposed $11 billion merger with Tatts Group should be known within a week, after it was thrown into turmoil by a Federal Court ruling yesterday that handed the competition regulator an apparent victory in its bid to clarify important issues arising from the mega-deal.

The full Federal Court in Sydney upheld an appeal by the Australian Competition & Consumer Commission against the Australian Competition Tribunal’s ruling that the merger should be allowed to proceed.

While the reasons for the judgment were embargoed for the next five days, angering all parties to the case, the ACT’s Justice John Middleton — who presided over the original ACT decision — said he was keen to fast-track the next hearing.

Matt Chambers 9.25am: Tighten power rules: ACCC

Competition boss Rod Sims says tightening electricity rules where big generators such as AGL Energy, Origin Energy and EnergyAustralia currently set wholesale spot power prices could cut power bills and reduce the impact of increased sector concentration.

The move would be a negative for the big generators, who vehemently deny accusations they have been aggressively bidding up spot prices in the wake of the closure of the Hazelwood power station in Victoria.

In a hard-hitting speech to the National Press Club yesterday, the Australian Competition & Consumer Commission chairman said his one-year review of retail power prices that started in March was likely to focus on generator bidding and gas prices as the key drivers of higher prices.

9.20am: ACCC appeals Medibank case dismissal

The ACCC is appealing the Federal Court’s decision last month to dismiss its case against insurer Medibank Private.

The completion watchdog alleges Medibank failed to notify members and those of its subsidiary brand, ahm, of its decision to limit benefits for in-hospital pathology and radiology services, despite representing across a number of its communication and marketing materials that it would.

MPL last $2.96

9.15am: IAG risk chief Whipp to retire

IAG says chief risk officer Clayton Whipp intends to retire from the company by the end of March 2018.

IAG last $6.37

Paul Garvey 9.05am: Seven Group in $375m raising

Seven Group Holdings has entered into a trading halt this morning and announced a $365m capital raising to “increase free flat and balance sheet flexibility”

Managing Director and chief executive Ryan Stokes says the broader group still has ample firepower to participate in the consolidation of the media and oil and gas industries, even after agreeing to splash out $517 million on an additional 53.3 per cent stake in Coates Hire.

Speaking for the first time since the Senate passed media reforms scrapping historic ownership restrictions, Mr Stokes said he believed Seven was well placed to be part of any deal-making in the new landscape.

“We will see how the market plays out but there’s certainly opportunity for Seven to play in that,” Mr Stokes told The Australian.

“Seven’s position is relatively strong and there are some options and opportunities to look at things.”

8.55am: Brickworks doubles annual profit

Building products group Brickworks’ full-year net profit has more than doubled to $186.2 million, helped by a land sale and increased investment earnings. Revenue for the year ended July 31 was up 12.1 per cent to $841.8 million, the company said.

It declared a fully franked final dividend of 34 cents, up two cents from a year ago — AAP

BKW last $14.00

8.50am: G8 to grab childcare centres suite

G8 Education says it has contracts in place to acquire a portfolio of 19 existing early education and childcare centres from a single vendor.

The total purchase price for the 19 centres is $27 million and will be funded by existing cash and finance reserves.

Six of the centres are located in Queensland, five in New South Wales and eight in Victoria.

GEM last $3.78

Michael Roddan 8.35am: CBA opens First State IPO avenue

Commonwealth Bank, fresh from striking a $3.8 deal with AIA Group for the sale of its life insurance business CommInsure, has put its global asset management business, Colonial First State Global Asset Management next on the chopping block.

CFSGAM, which is known outside the country as First State Investments, has around $219 billion in assets under management. Commonwealth Bank on Thursday said it was considering a range of options for the division, including a separate float, confirming reports in The Australian’s Dataroom column last night.

Annabel Spring, the bank’s group executive of wealth management responsible for CommInsure, has also “decided to leave” Commonwealth Bank in December after eight years with the company. She will be replaced by the bank’s chief financial officer of International Financial Services Michael Venter — more to come

CBA last $76.08

Bridget Carter 8.30am: AIA grabs CBA life insurance

Pan Asian insurer AIA has announced its acquisition of Commonwealth Bank’s life insurance operations for $3.8 billion.

The acquisition was flagged by The Australian.

More to come.

7.15am: Dollar slips

The Australian dollar is still above US80 cents despite slipping a little against greenback after the US central bank released its statement following its two-day policy meeting.

At 6.35am (AEST), the Australian dollar was worth US80.29 cents, down from US80.38c yesterday.

Westpac’s Imre Speizer says the US dollar, along with US interest rates, surged in response to the Federal Open Market Committee’s statement which was not as dovish as expected.

“Importantly, the Fed continued to project another rate hike in December, and affirmed its QE (quantitative easing) unwind would start in October,” he said in a morning note.

“The US dollar index is up 0.9 per cent on the day ...(while the) AUD initially rose from 0.8020 to 0.8102 but plunged to 0.7992 after the FOMC.” The FOMC left rates unchanged in a 9-0 vote, as was widely expected, but continued to project a December rate hike via a dot plot showing 12 of 16 members expecting such, Mr Speizer said.

“The projected rate hikes for 2018 were also left undisturbed, with 11 of 16 members expecting three hikes.”

The key event risk for the local currency today is Reserve Bank of Australia governor Philip Lowe’s speech an AmCham business briefing in Perth, entitled The Next Chapter.

Mr Speizer said he expected the Australian dollar would remain “inside a 0.7950-0.8050 range for the day ahead, capped by the US dollar’s FOMC-induced gains”.

The Aussie dollar is markedly higher against the yen and the euro.

AAP

6.50am: Wall St keeps rising after Fed

The Dow Jones Industrial Average and S & P 500 climbed to records and government bonds fell after the Federal Reserve kept the door open for a December interest-rate hike and eyed a slower path for future increases.

The Dow Jones Industrial Average gained 42 points, or 0.2 per cent, to 22,413, after turning negative immediately following the Fed’s announcement. The blue-chip index notched its ninth straight session of gains. The S & P 500 added 0.1 per cent and the Nasdaq Composite fell 0.1 per cent.

Despite the US rises, local stocks are set to edge slightly lower. At 7,00am (AEST) the SPI futures index was down 4 points.

US financial stocks rose alongside bond yields after the release of the Fed’s statement following the central bank’s latest two-day meeting. The Fed said it planned to start unwinding its $US4.5 trillion balance sheet in October as expected and indicated it might raise rates for a third time this year in December, adding that economic conditions would warrant “gradual” future rate increases.

The S & P 500 financial sector gained 0.6 per cent. Higher rates tend to boost banks’ net interest margins, a measure of lending profitability.

The yield on the benchmark 10-year US Treasury note edged up to 2.276 per cent, according to Tradeweb, versus 2.238 per cent ahead of the announcement and 2.239 per cent Tuesday. Yields, which were on track for an eighth straight day of gains, rise as bond prices fall.

“The Fed really tried to thread the needle here by taking a step to unwind the balance sheet without sounding too hawkish,” said Yousef Abbasi, global market strategist at JonesTrading Institutional Services. “The markets like it to some extent,” he said.

Mr Abbasi said his outlook for stocks moving forward is “cautiously optimistic because the onus is going to fall more and more on the economy.”

The dollar rose after the Fed’s latest statement and economic projections. The WSJ Dollar Index, which measures the dollar against a basket of 16 other currencies, reversed earlier losses and was up 0.4 per cent.

Energy stocks were among the best performers, rising alongside oil prices after the US Energy Information Administration reported that refiners continued to bring back operations last week following hurricane-related disruptions, increasing demand. US crude rose 1.9 per cent, while the S & P 500 energy sector, the index’s best performer this month, gained 0.7 per cent.

Dow Jones

6.45am: Fed hints at another rate rise

The US Federal Reserve says it will initiate in October its long-telegraphed plan to shrink the portfolio of bonds acquired after the 2008 crisis and left open the possibility of raising short-term interest rates by December.

The Fed left rates unchanged today, but the central bank pencilled in one more rate rise in 2017, even though persistently low inflation has given some officials second thoughts about a move this year.

“We believe the recovery is on a strong track,” Fed Chairwoman Janet Yellen said at a news conference following the conclusion of the Fed’s two-day policy meeting, explaining why officials expect to keep raising rates gradually in coming years.

6.40am: World markets stall before Fed

The world’s stock markets all but froze early today as few investors had the nerve to invest fresh money before a long-awaited interest rate call from the Federal Reserve later in the day.

“The Fed trumps all else, and with hours to go until the next decision, caution reigns supreme,” said IG analyst Chris Beauchamp.

Frankfurt equities were a touch firmer at the close, gaining little traction from a rally for shares in German heavy industry giant ThyssenKrupp, which announced a deal with Indian group Tata to merge their steel operations in Europe.

ThyssenKrupp jumped more than two per cent following news of the combination to create Europe’s second-largest steelmaker after ArcelorMittal, whose stock was up nearly 1.5 per cent in Amsterdam.

The main index in London was slightly weaker despite data revealing a surprise surge in British retail sales last month, while Paris stocks edged higher.

AFP