Trading Day: live markets coverage; Major ASX buyers’ strike to ease: Citi; plus analysis and opinion

The ASX posts gains on a tailwind from heavyweight banks, while the Aussie takes a hit from fresh RBA commentary.

Welcome to Trading Day for Friday, October 6.

Samantha Woodhill 5.00pm: Stocks surge as banks rebound

The local sharemarket closed the session higher with strong gains across most sectors.

It follows a robust lead from Wall Street after a budget resolution, a potential tax overhaul precursor, passed the House of Representatives.

Commonwealth Bank closed 1.3 per cent higher at $76.30. It came after chief executive Ian Narev assured shareholders that the bank is focused on “putting things right” amid claims it breached of anti-money laundering laws.

In other financials, Westpac rose 1.3 per cent to $32.14 and ANZ lifted 1.3 per cent, closing at $29.48. NAB also gained 1.3 per cent to $31.34.

“I think the banks have had a relatively volatile week which is sort of in line with what the market has been doing,” said Craig Sidney of Shaw and Partners.

4.50pm: Online takeaway takes the cake: Morgan Stanley

The digital means to satisfy Aussie consumers’ late-night cravings proved the bright spot of a broader retail slowdown in August, according to Morgan Stanley, the investment bank’s analysts finding 18 per cent growth in the online takeaway food market compared with 1.7 per cent growth in the situated segment.

Australian financial markets were taken back yesterday by Australian Bureau of Statistics data revealing a surprise 0.6 per cent decline in retail sales over August, and while the local currency struggles for a foothold out of bed to shake the hangover, Morgan Stanley says the consumer is one step ahead.

“We think that the acceleration in online takeaway food is driven by rising penetration of aggregators including Uber Eats,” said the analysts, “cafes and takeaway food category growth was [also] slow which shows that down trading to supermarkets isn’t providing a boost.”

The August data revealed consumers’ were increasingly putting their online lever to use for more than just food, the analysts latching onto an interesting discrepancy in growth between the national statistician’s instore retail segment (+2.4pc) and its $19bn “internet-only” business inclusive ‘n.e.c’ segment (+18.5pc) as a stark reminder of situated retailers’ lingering e-jitters.

However, for food alone there’s one clear winner on the menu for Morgan Stanley. Analysts saw “improving performance” from Domino’s, the tech-food hybrid commanding 40 per cent of the domestic online takeaway market by their estimates.

“It looks as if Domino’s ANZ SSS growth has accelerated during August despite a tougher comparable period and overall slowing in the takeaway food market.”

DMP closed up 0.4 per cent at $45.61

4.30pm: A$ extends losses, burns key chart support

The Australian dollar extends losses after a sharp fall earlier in the session on comments from RBA board member Ian Harper.

The local currency trades 0.5 per cent, or US39 cents lower for the session at US77.55 cents.

Professor Harper refused to rule out rate cuts in the current economic environment in an interview with The Wall Street Journal, and singled out the policy lever as a key response should consumption start to slow.

The market reaction to the central bank’s latest comments is the third definitive blow the dollar has taken this week after Aussie bears emerged on the RBA’s Tuesday cash rate call, while ABS data revealing a slowdown in retail sales over August hurt growth hopes and appetite for the Down Under dollar yesterday.

On the charts, the currency blew past the 100 day-moving-average (DMA) support level at US77.84 cents after the details of Professor Harper’s interview emerged, and heads toward its 200-DMA support level at US76.66 cents.

Technical analysts generally reconsider these support levels as points of resistance soon after a definitive downward break by the currency.

4.00pm: Consumption hand on rate lever: RBA

James Glynn writes:

A slump in Australian retail sales in July and August is no cause for immediate alarm, but a response through interest rates could be warranted if consumption across the economy loses momentum entirely, according to central bank board member Ian Harper.

While Professor Harper also pointed to positive economic data out recently, including employment and investment figures, his comments suggest the Reserve Bank of Australia will likely remain cautious for longer-than-expected, with the possibility of another rate cut not completely ruled out.

“The thing that is causing an issue for us [the RBA board] is slow growth in wages, which is feeding into slow growth in household income,” Professor Harper said in an interview with The Wall Street Journal. “If you start to lose that momentum, that might be the basis of some sort of policy action,” he said — more to come

The Wall Street Journal

Producers note: The Australian dollar fell sharply by 0.3pc to 77.75 cents from 77.97 cents on the release of Professor Harper’s comments.

3.45pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Kunal Sawhney Kalkine — kalkine.com.au

3.50pm: Ben Le Brun — OptionsXpress

4.00pm: Winston Sammut — Folkestone Maxim Asset Management

4.15pm: Alan Mitchell — Economics commentary

(All times in AEST)

2.40pm: Buyer’s strike shadow lifting: Citi

A “buyer’s strike” from Aussie Super funds and foreign investors should lessen in the year ahead, according to Citi.

If that occurs as expected, the S & P/ASX 200 should reach 6250 by mid-2018 and 6400 by end-2018, Citi equity strategist Tony Brennan says.

Reduced inflows from foreign investors and super funds were recorded over the first half of the year, according to Mr. Brennan, and albeit coming off a high base, the two collectively holding close to three-quarters of the market by his estimates.

In his view, stronger global growth has made other markets attractive to foreign investors, particularly in the region, and data on flows from US investors show a lift in allocations to foreign equities, both developed and emerging.

And perceived sovereign risk in Australia after the bank levy and energy market intervention may also have put investors off.

Domestically, while Super funds saw large inflows ahead of the reduction in tax concessions this year, it was largely allocated to cash at midyear.

“But given the significance to funds of Australian equities, the accelerated contributions should at least partly make their way into the market over the next 12 months,” Brennan says.

“Likewise, as Australia tends to also benefit from global growth, most obviously through commodity prices, foreign interest should also improve, and more demand should lift the market out of its malaise, supported by earnings growth.”

Of course another explanation for the lack of buying could be that investors are finding the market too expensive.

In that case, the market could be vulnerable to a further pullback.

Index last up 0.9pc at 5700.5

Ben Wilmot 2.10pm: Kaufland! German grocer march steps up

Germany’s Kaufland has confounded industry expectations by snapping up a site in Adelaide as it looks to forge into Australia’s fiercely competitive grocery market.

The company has bought an iconic property on the Adelaide CBD’s fringe, paying $25 million to buy the sprawling Le Cornu site on Anzac Highway in Forestville.

The Schwarz Group, which in addition to Kaufland also owns discount chain Lidl, had been trying to gain a foothold in the $90bn-plus local supermarket sector for the past year and the Adelaide operation, will be its inaugural and flagship store, The Advertiser reported.

Kaufland favours large warehouse style stores of up to 20,000 sqm compared to the more traditional Coles and Woolworths stores, that are generally less than a fifth of that size, which made the site attractive to the grocer.

1.45pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

1.50pm: Live cross — Bloomberg Asia

2.10pm: Justin Smirk — Commodity Analyst, Westpac

2.20pm: Live cross — FIIG Securities

3.00pm: Live cross — Shaw and Partners

(All times in AEST)

Michael Roddan 1.25pm: Narev ‘sorry’ for Austrac woes

Commonwealth Bank boss Ian Narev has apologised to shareholders and shouldered the blame for the lender’s alleged breaches of anti-money laundering laws.

Mr Narev, who has already announced he will step down by next June following the allegations, said the bank was focused on “putting things right” after failing to meet the appropriate standards and letting down stakeholders.

“l am sorry for that (and) as the chief executive I take accountability for it and can assure you we are taking it extremely seriously,” Mr Narev told a Morningstar investor conference in Sydney — read more

CBA last up 0.9 per cent at $76.02

12.35pm: LifeHealthcare feels prostheses cut

Australian medical device distributor LifeHealthcare has taken a dip on the local bourse today after UBS downgraded the stock on the back of expected cuts to device prices.

Respected UBS analyst Andrew Goodsall dropped his price target on the company from $2.75 to $2.30. He said he made the cut ahead of an expected announcement by Federal Health Minister Greg Hunt of a 10 per cent to 15 per cent cut to prices on the prostheses list, which sets the price that health insurers must pay for a device.

Shares in LifeHealthcare were off almost 4 per cent at midday trade at $2.23.

Mr Goodsall says that LHC’s exposure to prosthesis is around 35 per cent of revenue. He adds that the negative incremental margin impact of price cuts is likely to be more material to EBITDA, even after any modest mitigation.

“At this point we have not adjusted earnings outlook, as we lack clarity on the magnitude and timing of cuts, together with any potential offsets and other mitigation efforts,” he says in a client note.

UBS expects the prostheses cuts, which it says could cut spending by $200m to $300m, will be confirmed early this month to allow private health insurers to set lower premium increases in price submissions to Mr Hunt, which are due early next month.

Mr Goodsall adds that he believes that over the next 12 months the government is expected to examine other savings measures for prostheses list savings, including elimination of items not deemed to be prostheses and addressing the anti-competitive features of the list.

LHC last down 3.9 per cent at $2.23

12.20pm: ‘Prepare for next crisis now’: Lagarde

Global policy makers are becoming complacent during a moment of calm, doing too little to prepare their economies for a future downturn, the leaders of the International Monetary Fund and World Bank say.

As finance ministers and central bankers from 189 member countries prepare to descend on Washington for the annual meetings of the World Bank and IMF, the institutions’ leaders, World Bank President Jim Yong Kim and IMF Managing Director Christine Lagarde previewed the message they will be delivering in coming days.

“We should not let a good recovery go to waste,” Ms Lagarde said in a speech in Boston. “We know what can happen if we let the moment pass. Growth will be too weak, and jobs too few.”

After nearly a decade dealing with a financial crisis and its subsequent slow recovery, economic policy makers will be gathering during a moment of unusual calm, which is precisely the time nations can take steps to prepare for future downturns, Ms Lagarde and Mr Kim will argue.

11.45am: A$ hits fresh lows on greenback strength

The Australian dollar has hit a 2.5-month low this morning against a firmer US dollar.

AUD/USD fell to 0.7773 — lowest since mid-July — as the US dollar index hit a 1.5 month high.

The Aussie also cracked its 100-DMA at 0.7784, its first move below this line since June.

Thursday’s close below the August 15 low at 0.7808 suggests the Aussie has formed a major double top pattern with a target of at least 0.7550.

A weekly close below 0.7808 would reinforce this view.

Once the 100-DMA is decisively broken, the next support is the 200-DMA at 0.7666.

Former support at 0.7808 now offers potential resistance.

AUD/USD last 0.7783

11.40am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Daniel Hynes — Senior Economist, ANZ

11.45am: Simon Segal — Deloitte

12.00pm: Ric Spooner — Chief Market Analyst, CMC Markets

12.15pm: Judith Fox — CEO, ASA

(All times in AEST)

11.20am: ASX lifts in sea of green

Local investors meet opening Friday trade on a fresh tailwind after regional concerns weighed into hesitant trade earlier in the week.

The S & P/ASX200 trades 0.7 per cent higher at 5691.

It’s a sea of green on the local bourse as large-caps across sectors all share in a morning run from local buyers.

It’s been like a broken record all week, with futures suggesting we’re to see strength and as soon as the cash market opens it just runs into wave after wave of selling,” says OptionXpress’ Ben Le Brun.

“I want to see how we sign off here before we start calling a big comeback.”

“[The market] has been very much range bound for the last four months but 5650, as we touch time and again this week, seems to be your entry point.”

Concerns emerged throughout the week that a downtrend in the local currency and increasing foreign uncertainty over domestic financial regulation affecting heavyweight banks had hit offshore demand for local stocks.

Meanwhile, the nation’s largest trading partner China remains on week-long national holidays that has led to an inevitable slowdown in activity.

The Australian dollar trades 0.1 per cent lower at US77.88 cents after falling sharply this week on disappointing retail sales data and the RBA cash rate hold.

Rachel Baxendale 11.08am: Xenophon quits parliament

Crossbench senator Nick Xenophon has announced that he is resigning from the federal Senate to run in the South Australian seat of Hartley in the 2018 state election.

Senator Xenophon said he had been planning the move for some time, denying that it was related to the High Court citizenship case.

He says he expects to be replaced by a Nick Xenophon Team candidate, regardless of next week’s High Court verdict.

Elizabeth Redman 10.52am: Simonds chief Chun steps down

Home builder Simonds Group’s chief executive Matthew Chun has stepped down from the top job by mutual agreement, effective immediately, after a board restructure last month that saw its founding family and allies take most board spots — read more

SIO last $0.34

Adam Creighton 10.45am: Bank fines too small to bite

Common explanations for the money-laundering allegations against Commonwealth Bank include the inherent difficulty of managing large companies and the unintended consequences of vigorous competition, in this case winning ATM deposit market share.

But what if breaking the law were rational, a deliberate considered act by a self-interested firm?

Certainly no one is making that accusation against CBA. But the allegations by Austrac against the country’s biggest bank precede an intriguing new study in the US, by top Chicago University economist Luigi Zingales. It examines chemical giant DuPont’s release of poisonous chemical C8 into the Ohio water systems for decades from the 1950s, as part of its Teflon manufacturing operations.

The venerable US company knew C8 was potentially deadly from the early 1980s, and ultimately endured a barrage of health and environment related lawsuits that cost it more than $US600 million by early this year. Thousands contracted diseases.

“How come the company chose the option that seems worse for society and for the company itself?” the authors asked.

10.25am: Analyst rating changes

Magellan Financial raised to Buy — Shaw & Partners

Life Health Care cut to Neutral — UBS

APN Outdoor raised to Outperform — CLSA

10.15am: Brisbane Broncos chairman to step down

Dennis Watt, chairman of ASX-listed rugby league franchise Brisbane Broncos, has announced his intention to step down from the Broncos board by calendar year-end.

Mr. Watt joined the board in 2003 and has held the chairman role since 2013 and told the ASX this morning the club was “disappointed” by the season’s finals loss to the Storm but can look back on successive seasons of top-table performance.

“Whilst winning Premierships remains the ultimate goal, our on-field success has continued to help drive the growth of the business, which includes expanded game development, indigenous education and community programs across much of Queensland and northern New South Wales,” said Mr. Watt — read more

BBL last $0.50

9.50am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

10.00am: Evan Lucas — The Lucas Report

10.30am: Live cross — Shaw and Partners

10.45am: Mike Kendall — JBWere

11.10am: Alex Fala — CEO, Vend

11.30pm: Dr. Peter Burn — AI Group

(All times in AEST)

9.40am: Construction slows in September

Australian Industry Group’s index of construction activity growth across the country fell in September by 0.6 to 54.7.

An index read above 50 indicates increase performance relative to the month prior, while a read below similarly indicates relative underperformance.

9.30am: ASX200 set to saddle global bulls

The local sharemarket is set to rise, overnight SPI200 futures trade tips a 36 point jump by the S & P/ASX200 index at the open.

Global leads are positive after Wall St hit yet more fresh all-time highs and caution around European shares ebbed side-by-side with Catalonian tensions.

“US jobless claims and durable goods orders outstripped forecasts, pushing the S & P 500 index to yet another record high,” said CMC chief market strategist Michael McCarthy, “Spain’s IBEX index rallied 2.5pc ... taking most continental exchanges into the green.”

“If local traders follow the global impulse shares should find safer, higher ground.”

“However on two days of three this week the index bucked positive leads. If it does so again today chartists will take it as a sign of further falls to come.”

Investors eye energy stocks for early strength after oil prices surged 2 per cent, production cut conviction firmer on signs of stability in Russia-Saudi relations, while retail stocks ready after sellers emerged on disappointing August retail sales data from the ABS midway through yesterday’s session.

The Australian dollar too fell sharply in response to the data and remains near flat at US77.94 cents.

9.20am: Seek seals $225.8m Zhaopin proceeds

Online job ads site Seek has received the $225.8m in proceeds from the privatisation of its Chinese jobs portal Zhaopin after it was delisted from the New York Stock Exchange earlier this year.

SEK last $16.45

9.05am: Market split on media value

Bridget Carter and Scott Murdoch write:

There appears to be two schools of thought in the media space.

One is where a flurry of deals would occur when the relaxed industry laws come into force later this month and another suggests all the hype about corporate activity in the sector may in fact come to nothing.

This is because many believe finding opportunities where synergies and greater earnings growth can be achieved through merging Australian-listed media companies is harder than people think.

It comes as discussion in the market centres on Nine Entertainment and whether it will look at buying its regional rival South Cross Media Group.

Read more from DataRoom

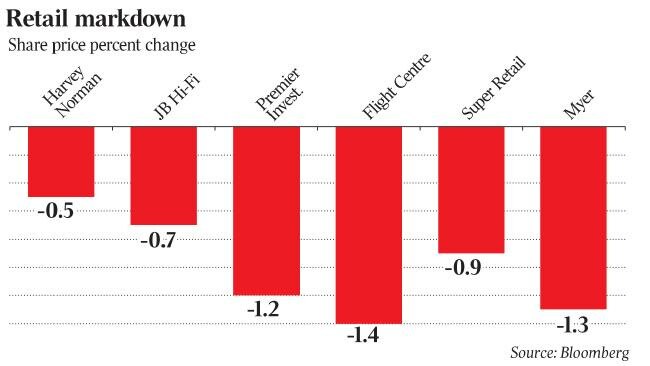

Eli Greenblat 8.35am: Retail hit as ABS talks slowdowns

A surprise contraction in retail sales, which racked up the weakest growth in four years, took investors by surprise, causing shares in retail stocks to tumble and strip more than $200 million in value with the pressure now on retailer CEOs to deliver growth.

Nervous investors will now turn to the upcoming annual meeting season where chief executives will release trading updates for the first half of fiscal 2018 that on the most recent figures from the Australian Bureau of Statistics has shown a sudden slump in consumer spending across categories such as food, cafes, restaurants and household goods.

Matt Chambers 8.32am: $3bn dream to ease energy crunch

Former Santos chairman Stephen Gerlach has launched ambitious plans to build a $3 billion coal-to-gas plant in the Northern Territory to supply tight east coast markets.

He says the move will get around existing onshore gas bans and could supply 10 per cent of east coast domestic demand.

And Mr Gerlach, who is Flinders University Chancellor, has called on the nation’s pension funds, with their vast financial muscle, to take a more active role in helping to solve what he says is a national energy security problem.

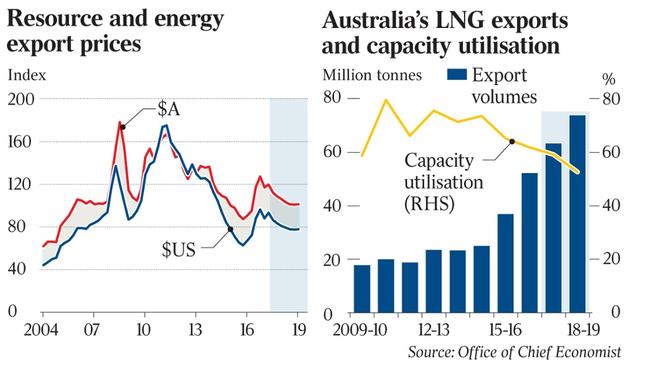

Matt Chambers 8.30am: Cheap exports deflate LNG windfall

Australian LNG exports are likely to be sold under contract to foreign buyers for the next two years at cheaper rates than most east coast domestic gas supply contracts are being offered, as lower oil price forecasts curb LNG prices and export revenue, according to the Office of the Chief Economist.

The subdued price outlook for LNG, which is expected to overtake coking coal as the nation’s second-biggest export after iron ore next year, has cut LNG export value forecasts issued by the federal Industry, Innovation and Science Department by $5.1 billion over the next two years.

8.20am: Retail bears take swipe at dollar

David Rogers and Samantha Woodhill write:

A slump in domestic retail sales has injected a note of caution into the debate over the outlook for economic growth and interest rates, keeping downward pressure on the dollar.

Retail sales fell 0.6 per cent in August versus July, undershooting expectations of a 0.3 per cent rise. July retail sales were revised down to a fall of 0.2 per cent, marking the biggest two-month fall since 2009. A 2.1 per cent rise for the year to August was the weakest annual growth rate since mid-2013.

The weakness was widespread across the country, with Victoria and Queensland both recording falls of 0.8 per cent in the month, though NSW fell just 0.2 per cent.

All types of retail sales fell except department stores and “other” retailers, the Australian Bureau of Statistics said.

The dollar fell from US78.55c to US78.24c after the retail data, although its decline was limited by a stronger-than-expected international trade surplus of $989 million for August.

Economists said retail sales appeared to be weakened by unseasonably warm weather, along with reduced spending potentially related to energy price rises and out-of-cycle increases in mortgage rates, after a further tightening of so-called “macroprudential” restrictions on riskier loans.

7.35am: ASX looks set for strong open

The Australian market looks set to open higher, following on from Wall Street’s optimism with key indexes there again closing at record highs.

At 7am (AEDT), the share price futures index was up 36 points, or 0.64 per cent, at 5,670.

In the US, strong economic data and positive comments by Federal Reserve chiefs had helped buoy equities, bond yields and the greenback, says Westpac’s Imre Speizer.

“US factory orders rose 1.2 per cent in August (vs. 1.0 per cent expected), less affected by the hurricanes than expected. Durable goods orders for August were finalised at +2.0 per cent (vs. 1.7 per cent expected),” he said. “Fed speakers included (San Francisco Fed Bank president John) Williams, who said one more hike this year and another three next year are appropriate given the economy’s strength, and (Philadelphia Fed president Patrick Harker, who said much the same thing.”

The Dow Jones Industrial Average closed up 0.50 per cent, the S & P 500 rose 0.56 per cent and the Nasdaq Composite added 0.78 per cent.

Locally, in economic news today, the Australian Industry Group performance of construction index (PCI), which measures construction sector activity for the month just ended, is due out.

In equities news, Programmed Maintenance shareholders are slated to vote on a takeover by PERSOL.

The Australian market yesterday closed flat as banks continued their recent declines, Qantas hit new highs and the major iron ore companies managed minor gains.

The benchmark S & P/ASX200 index lost 0.3 points, or 0.01 per cent, to 5,651.8 points.

The broader All Ordinaries index gained 0.7 points, or 0.01 per cent, at 5,720.3 points.

AAP

7.20am: Dollar sharply lower

The Australian dollar is sharply lower against its US counterpart which has strength amid strong US economic data and comments from Federal Reserve officials.

At 6.35am (AEDT), the Australian dollar was worth US77.88 cents, down from US78.27 cents yesterday.

Westpac’s Imre Speizer says the US dollar has risen, along with US equities and bond yields, with Federal Reserve comments upbeat.

“The US dollar index is up 0.6 per cent on the day, to a two-month high ... (while the) AUD extended its earlier fall, which was triggered by disappointing retail sales data,” he said in a morning note.

The Aussie had gone from US78.40.

Also helping were some positive US economic data and comments from the US central bank.

“US factory orders rose 1.2 per cent in August (vs. 1.0 per cent expected), less affected by the hurricanes than expected. Durable goods orders for August were finalised at +2.0 per cent (vs. 1.7 per cent expected).

“Fed speakers included (San Francisco Fed Bank president John) Williams, who said one more hike this year and another three next year are appropriate given the economy’s strength, and (Philadelphia Fed president Patrick Harker, who said much the same thing.” Mr Speizer said the Australian dollar would likely “break below 0.7785 would then target 0.7710 (30 June peak), probably dependant on the USD recovering further (for which tonight’s US payrolls data is key).”

The Aussie dollar is also lower against the yen and the euro.

AAP

7.10am: Wall St surges to new records

The S & P 500 notched its longest streak of record closes in 20 years, as shares of financial firms pushed major indexes higher.

The broad index added 0.6 per cent, its sixth straight all-time closing high. The Dow Jones Industrial Average gained 114 points, or 0.5 per cent, to 22775, while the Nasdaq Composite added 0.8 per cent.

Australian stocks are set to follow Wall Street higher. At 7.05am (AEDT) the SPI futures index was up 32 points.

Strong corporate earnings have buoyed stocks for months, and a recent run of economic data reflecting stability and growth in the US have added to stocks’ momentum, analysts said. The three major indexes each have hit more than 40 records this year, even as some investors remain wary of persistently low volatility and lofty valuations.

“We’ve pared back on US exposure and made a tilt overseas, but not a dramatic one,” said Doug Cohen, managing director of portfolio management at Athena Capital Advisors. “The reality is this is one of the more expensive markets in the last 100 years, but equities are still the most attractive asset class.”

A measure of expected stock swings, the CBOE Volatility Index, was recently down 2.9 per cent at 9.35, near its all-time closing low of 9.31 set in December 1993.

Shares of financial firms in the S & P 500 added 1 per cent as bond yields rose. Higher yields tend to portend better profits for lenders.

Data showed applications for new unemployment benefits fell in late September, the latest indicator to portray a strong US economy even though recent hurricanes continued to disrupt economic activity in several regions. Earlier in the week, data showed manufacturing activity in the US reached a 13-year high last month, while service-sector activity rose to its highest level since 2005.

Technology companies, big contributors to this year’s rally, continued to support indexes Thursday. Netflix surged 5.4 per cent after the company said it plans to raise prices for its videostreaming services in an effort to raise revenue amid rising content costs. Apple gained 1.2 per cent after the company released a software update that it said addresses some cellular-connectivity issues that have affected its newest smartwatch. Apple suffered its worst month of the year in September after falling per cent.

Dow Jones

6.50am: Oil prices boosted

Oil prices have advanced, boosted by discussions between OPEC and Russia to continue a plan to curb production and support prices.

Light, sweet crude for November delivery rose 81 cents, or 1.6 per cent, to $US50.79 a barrel on the New York Mercantile Exchange. Brent, the global benchmark, gained $US1.20, or 2.2 per cent, to $US57.00 a barrel.

Saudi Arabia’s King Salman and Russian President Vladimir Putin met last night to discuss continuing efforts to push up oil prices by limiting output from major producers within and outside of the Organization of the Petroleum Exporting Countries.

Last month, US oil futures entered a bull market on signs that OPEC cuts were finally having an impact on the global supply glut. In last night’s meeting, the two leaders talked about extending Russia’s participation but came to no new agreements, The Wall Street Journal reported.

The original deal, struck nearly a year ago between OPEC and 10 other non-OPEC countries, was to cut production by 1.8 million barrels a day for six months. The agreement was extended in May of this year to continue through the first quarter of 2018, though some analysts have speculated that it may be extended even further.

Dow Jones

6.40am: Spanish stocks rebound, pound hobbled

The Madrid stock market rebounded as the Spanish government moved to block a move by Catalonia to declare independence crisis, while doubts about the future of British Prime Minister Theresa May hobbled the pound.

The Spanish capital’s benchmark IBEX 35 shares index jumped 2.5 per cent, largely offsetting the previous day’s 3.0-per cent slump.

Trade was more muted elsewhere in Europe, with Frankfurt dipping, while Paris and London posted modest gains.

The euro meanwhile slid towards $1.17 — having topped $US1.20 just two weeks ago — as Spain’s Catalonia crisis dragged on.

“The IBEX 35 is the best performer in Europe, which make a nice change seeing the Spanish market lost the most ground this week,” said CMC Markets UK analyst David Madden.

Meanwhile, the British pound sank as investors fretted over Prime Minister Theresa May’s political future one day after a “shambolic” speech to the Conservative Party’s annual conference, analysts said.

Sterling touched a one-month low at $1.3122, while the European single currency had hit a three-week pinnacle at 89.33 pence per euro.

London closed up 0.5 per cent, Frankfurt ended down 0.02 per cent and Paris finished 0.3 per cent higher.

AFP