Trading Day: live markets coverage; ASX falls in fickle trade; plus analysis and opinion

The ASX erases gains as sustained dollar weakness hits offshore appetite and leaves heavy lifting for small-caps.

Welcome to Trading Day for Thursday, October 5.

Samantha Woodhill 4.45pm: Stocks lower as dollar hits demand

The local share market closed down after banks dragged the market lower and despite miners making minor gains.

The benchmark S & P/ASX200 was down 0.3 points, or 0.01 per cent, at 5,651.8 points. The broader All Ordinaries index was up 0.6 points, or 0.01 per cent, at 5,720.2 points.

“The lower Australian dollar has weighed on the larger cap banks and REIT’s over the last couple days, with most of the selling coming from offshore. That looks to have settled a little today and the broader market is trading more in line with the buoyant overseas markets,” said Ophirm Senior Portfolio Manager Andrew Mitchell.

“In line with the trend of recent months, the smaller capitalised businesses are again proving to be the better performers.

“Small caps are again leading the way today, led higher by the mining services and telco names.”

BHP gained 0.35 per cent to $26.09 at the close. Rio Tinto lifted 0.83 per cent to $67.99 and Fortescue was unchanged at $5.15 — read more.

4.40pm: Fresh Diagou play pops 300pc on debut

The first China consumer-targeted chain to list on the local exchange AuMake popped almost 300pc on its debut today to 23.5c from an 8c float.

Malaysian-born, Perth-based businessman Keong Chan and Sydney-based Chinese couple Joshua Zhou and Lyn Zheng have so far developed five Sydney-based outlets, with two more on the way, selling Australian-made products such as baby formula, vitamins and healthcare products in vogue with China consumers.

The stocks comes online the same day as peer China play a2 Milk hits yet another fresh all-time record closing high of $6.61 and amid fervent investor appetite for promising China consumer market exposure — read more

AU8 last $0.235

4.15pm: TecnhologyOne’s ‘minor blemish’: Bell Potter

TechnologyOne’s revision to its FY17 earnings outlook on consulting division profit is a ‘minor blemish’ on the business with continued momentum from licence fees as well as its UK and Cloud arms, according to Bell Potter.

Analysts at the investment cites delays in contract closures to which TechnologyOne is the preferred party as the source of sluggishness this fiscal year and as such have pushed back their forecast of >20pc pre-tax profit growth by a year, settling for an 8.5pc target for the FY17 results to come.

TechnologyOne sunk over 10 per cent on Tuesday after it lowered guidance and prepared the market for its end-of-year books, a hiding after which Bell Potter has picked up the scent of overzealous tech wrecking.

“The net result is a 4pc decrease in our price target from $5.75 to $5.50 which is a 21pc premium to the current share price and so warrants an increase in the recommendation.”

TNE closed 4pc higher at $4.73

3.50pm: ASX shelter in sideways September

A step back from daily ups and downs reveals what has been a storm in a teacup for the Australian share market, swings in either direction capped by the tight range in which it has traded from early June.

Macquarie analysts have taken on the task of looking back on what it calls a “volatile” month of September to find those pushing and cushioning a mediocre 0.6 per cent decline on the Australian share market.

Marred by Telstra’s dividend woes, telcos provided the most significant 4.8pc drag over the month (or 32pc annual decline) according to the analysts, while large-cap miners BHP (-3.9pc), RIO (-1.9pc) FMG (-10.3pc) were stung by year-to-date lows in iron ore.

“Energy was the real star, with all of the large cap stocks providing positive contributions (WPL +0.9pc, STO +6.9pc, OSH +5.1pc) as crude oil rose 7pc,” said Macquarie.

“Banks also performed well as the yield curve steepened due to firming expectations around Fed tightening. NAB (+4.3pc), WBC (+2.1pc) and BOQ (+3.1pc) were particularly good and outside of the majors CYB rose a strong +9.4pc.”

“[However], utilities were the second worst performers, in particular AGL (-2.6pc), and APA (-5.8pc).”

Meanwhile, the analysts cited the MSCI index as an indicator that global equity growth ticked along at a pleasant 2.1 per cent, lead by Europe and Japan, while domestically second-quarter GDP data showed the economy rebounded from a weather-affected first-quarter with 0.8pc growth.

Aussie equity investors, however, would be forgiven for slight cynicism at the outset of October, the slim 0.1 per cent gains the top 200 index is on track to close out today failing to offset a now 0.4 per cent false start to the month so far.

3.17pm: Market’s travel bug fuels Qantas highs

Qantas shares (QAN) hit an all-time record high of $6.15 on a morning launch pad full of fresh travel analysis, leaving behind a sorry sector peer with a face full of soot.

After 4 years of “negligible growth”, Goldman analysts tip a 3 per cent resurrection in domestic travel volumes on tourist flow, increased demand and an easing mining contraction.

Six per cent growth in international volumes over the same period backed by China, US and Asia transit traffic is to add more fuel to the fire, according to the analysts.

Allaying concerns recent highs in Qantas mightn’t leave it much headroom, Goldman posits: “we believe the strong share price performance of the A/NZ airlines earlier this year was representative of a global peer re- rating, rather than an improvement in the underlying outlook or financials.”

However, an uptick in domestic travel isn’t good news for all in the ASX travel space. Morgan Stanley pitches downside Webjet’s way as a result of its latest survey finding Australians are likely to “trade down” holiday expenditure, save the hassle of online international itineraries and put tires on the dusty trail Down Under.

“We believe the share price will fall in absolute terms over the next 60 days,” say Morgan Stanley analysts.

WEB last down 1.7 per cent at $10.37, QAN last up 3.2 per cent at $6.12

John Durie 3.05pm: Aussies adept technology tourists: ANZ

The way ANZ’s Maile Carnegie sees it, Australian management is good at doing the “technology tourist trip” to Silicon Valley and coming back speaking the right language. But not everyone is doing the necessary fundamental rewiring to change their company.

Fourteen months into her journey at ANZ she figures the bank has the strategy in place, is now completing the essential rebuilding of its management to fill the capability gap, and at the same time get moving on the execution.

The capability Carnegie is looking for includes design skills, strategic marketing and data management.

2.45pm: ASX200 troops higher, retail feels pinch

The local sharemarket ticks higher in afternoon trade, showing signs of conviction after back-to-back sessions of underperformance on the global stage.

The S & P/ASX200 remains 0.2 per cent in the black at 5661.6 after chopping around flat for most of the morning session.

Miners Rio Tinto and BHP do the heavy lifting with 1.3 per cent and 0.7 per cent gains respectively, while the Big Four all post losses between 0.1-0.2 per cent.

A 0.6 per cent decline in retail sales over August and a revision by the ABS to its July figure mark the worst two-month fall in the data series since 2009 and discretionary retail stocks swoon in the wake — Harvey Norman (-1pc), JB Hi-Fi (-1.8pc) and Myer (-2pc) feeling the heat.

Qantas shares continue to trade near the all-time record high of $6.15 it hit earlier this morning, Morgan Stanley upgraded the stock to “buy” in the face of considerable share price performance year-to-date.

Meanwhile, the troublemaking Australian dollar fell sharply on the retail data released and continues to trade 0.5 per cent in the red at US78.28 cents.

Rowan Callick 2.15pm: Regional China’s ghostly pocket

Some of China’s ghost towns are starting to come to life, like skeletons in a Pirates of the Caribbean movie, as regional economies pick up thanks to vast government spending.

But one of the largest and most spectacular appears doomed to remain deserted until the downfall of North Korean dictator Kim Jong-un, if and when that happens. The relationship between North Korea and the rest of the world, especially the US, still runs through China even more than it does through South Korea, with considerable economic and business ramifications.

This week, the border city of Dandong has seen queues of hundreds of North Koreans, including restaurant and factory workers, mostly young women, waiting to return as their workplaces have closed for China’s National Week holiday. No one, including the workers themselves, knows whether they will be coming back. But the likelihood is they will not.

Matt Chambers 1.55pm: New $3bn domestic gas plan

Former Santos chairman Stephen Gerlach has launched plans to build a $3 billion coal-to-gas plant in the Northern Territory to supply tight east coast markets, in a move he says will get around existing onshore gas bans and could supply 10 per cent of east coast domestic demand.

And he has called on the nation’s pension funds, with their vast financial muscle, to take a more active role in helping solving what he says is a national energy security problem that is not being addressed.

Mr Gerlach is the chairman of Sydney-based Ebony Energy, which today revealed it is planning a $50 million initial public offering early next year to raise funds to study a coal mine and gas plant on the Andado cattle station 250km south east of Alice Springs and a 670km pipeline to the Moomba gas plant in South Australia.

“Energy security is a considerable unaddressed risk to Australia for many years, requiring long term solutions now to be found and implemented,” he told The Australian yesterday.

“This project will make a contribution to delivering on energy security in a sustainable and cost-effective manner” — read more

Eli Greenblat 1.00pm: Analyst runs amok in Costco: results

It’s not so much a postcard from the edge, but a report from an outer Sydney Costco warehouse by a canny retail analyst who had packed his family in the car and, armed with a shopping list, went to find out just how cheap the US chain is compared to Woolworths and Coles.

Like some kind of National Lampoon’s Vacation road trip, Thomas Kierath, an analyst with Wall Street bank Morgan Stanley, ventured out to the newest and ninth Costco store in Marsden Park in north western Sydney over the long weekend.

His mission was to buy a basket of supermarket goods such as garbage bags, eggs, nappies, pasta sauce, rolled oats and diced tomatoes.

But the Costco format also allowed him to change the tyres on his car, saving him $400, and fill up with petrol at the Costco petrol station at a price of $1.30 per litre compared with the nearby Marsden Park BP, where petrol was $1.63.

Stephen Bartholomeusz 12.40pm: Trump’s high-stakes Fed hire

Donald Trump appears to be on the cusp of making a decision that has the potential to significantly change monetary policy in the US, destabilise financial markets and influence capital flows and economic settings throughout the globe.

Last week, Trump met two of the potential candidates to replace Janet Yellen as chair of the Federal Reserve Board, current board member Jerome Powell and former governor Kevin Warsh. While they are not the only prospective candidates — Stanford University economist John Taylor is another name touted — there are indications that Yellen’s successor will be named before the end of this month.

Eli Greenblat 12.20pm: Papa cola tightens Amatil grip

The Coca-Cola Company, the Atlanta-based beverage giant, has tightened its grip on local bottler Coca Cola Amatil to just over 30 per cent just as the duo face a downturn in sugary carbonated drink sales, challenges from healthy beverages and a potential crackdown on junk food.

Earlier this year, CC Amatil announced a $350 million share buyback program, and it was revealed that morning that its biggest shareholder, The Coca-Cola Company, had not taken part in the buyback which meant its holding had inched higher — read more

CCL last $7.72

11.55am: RBA may have to make do: Edwards

The Reserve Bank may raise interest rates if economic growth is “satisfactory”, even if inflation and wages growth remain low, former board member John Edwards said.

“Very low interest rates at a time of firm economic expansion invite trouble,” Edwards said in a column published on the blog of the Lowy Institute for International Policy, where he is a nonresident fellow.

“There is otherwise too great a risk that the price of assets like houses and shares may get too far out of whack with what prove to be sustainable levels.”

11.40am: DATA: Retail sales data disappoints

Retail sales fell 0.6 per cent in August to its weakest monthly retail reading since March 2013.

The Australian dollar fell sharply in response from US78.55 cents to US78.29 cents and now trades 0.4 per cent below its opening mark.

Australia’s August trade balance rose above expectation in August to a $989m surplus vs. $850m surplus expected and up from an $808m upwardly revised surplus in July — read more

11.00am: DATA: Retail sales, international trade ahead

Australian retail sales and international trade data for August are due at 1130 AEDT.

Expectations are for a 0.3pc rise in retail sales and an $850 million trade surplus, Bloomberg says.

Retail sales in particular has been a missing ingredient in the Australian economy, amid weak income growth, consumer cautious due to pressures on household finances.

Bridget Carter 10.45am: Cromwell’s ‘good outcome’: CLSA

Analysts at CLSA have described Cromwell’s sale of its entire 10.1 per cent stake in Investa Office Fund this week for $281 million per share as “a good outcome”.

The sale at $4.65 per share was a 3.3 per cent premium to the closing price in the previous day’s trade of $4.50 and a 9.7 per cent premium to Cromwell’s entry price — more to come from DataRoom

IOF last up 0.5 per cent at $4.40

10.40am: ASX lifts as investors hesitate

The sharemarket lifts in early trade after swings either side of flat at the open, tempting a repeat performance of the last two session in which it drew a stark contrast with an updraft in global equities.

The S & P/ASX200 index trades 0.3 per cent higher at 5664.3.

10.07am: Select Harvests halts trade

Select Harvest shares have entered a trading halt ahead of a proposed capital raising announcement.

SHV last $4.20

10.00am: ASX200 defiance raises rout risk

Australia’s S & P/ASX 200 share index is expected to open up 0.2pc based on overnight futures relative to fair value.

That follows slight gains to fresh record highs on Wall Street amid better-than-expected ISM services survey and in-line September ADP employment report ahead of Friday’s September non-farm payrolls release.

If the local market defies positive offshore leads for a third day in a row, “there is potential for a rout in the coming days and weeks,” says CMC Markets chief market strategist Michael McCarthy.

He says notes the local index is near major support around 5630.

“A breach and lower close today would of itself provide a sell signal to professional investors,” he warns.

Utilities and property may get a tailwind after those sectors outperformed the S & P 500 with respective gains of 1pc and 0.9pc while technology fell 0.2pc.

The seventh-straight gain in the S & P 500 might encourage global markets although the S & P/ASX 200 has fallen recently amid concerns that the Australian dollar is peaking.

In commodity markets, iron ore remained closed due to China’s holiday, though zinc notched a new 10-year high amid mine closures and healthy Chinese demand.

9.42am: Analyst rating changes

Qantas raised to Buy — Goldman Sachs

Virgin Australia raised to Neutral — Goldman Sachs

Technology One raised to Buy — Bell Potter

Reliance Worldwide cut to Sell — CLSA

Rosie Lewis 9.40am: States defy Turnbull on gas

The NSW and Victorian governments are staring down calls from Malcolm Turnbull to relax restrictions on gas development, with Gladys Berejiklian declaring her state “will not be budging” from its position.

Fears of a predicted gas shortfall and higher costs are not on the official agenda of today’s first ever Council of Australian Governments national security summit and was not discussed at a leaders’ dinner last night.

The NSW Premier said she was “not going to lose any sleep” over her state’s policy after Scott Morrison threatened state and territory governments with financial penalties by cutting their GST distribution if they limit gas exploration. The Commonwealth Grants Commission also recommended GST revenue penalties on the weekend.

9.37am: ASX200 poised to open higher

The Australian share market appears set to open higher after Wall Street edged to new records.

At 7.15am (AEDT), the share price futures index was up 14 points.

In the US, stocks edged higher, extending their run of record highs, as data on the services sector added to signs of strength in the economy, although gains have been limited as a decline in oil prices weighs on energy shares. The US’ Institute for Supply Management’s non-manufacturing index rose to its highest level since August 2005 in September and the prices paid index reached its highest level since February 2012.

The data boosted the likelihood that the Federal Reserve will raise rates at its December meeting.

The Dow industrials inched up 20 points, or 0.1 per cent, to 22662. The S & P 500 rose 0.1 per cent and the Nasdaq Composite added less than 0.1 per cent.

Locally, in economic news, the Australian Bureau of Statistics releases both retail and international goods and services trade data for August.

The Australian Industry Group releases the performance of construction index (PCI).

In equities news, Aumake is slated to list on the ASX.

The Australian market yesterday fell for a second straight session as international investors sold shares on concerns about a weaker outlook for the Australian dollar.

The benchmark S & P/ASX200 index fell 49.3 points, or 0.86 per cent, to 5,652.1 points.

The broader All Ordinaries index dropped 44.6 points, or 0.77 per cent, to 5,719.6 points.

AAP

9.30am: Real estate now hot property

Bridget Carter and Scott Murdoch write:

Australia’s real estate industry appears to be back in deal-making mode after investment bank UBS executed a $276 million trade in Investa Office Fund yesterday and Citi sold a blocking stake in Propertylink to Warburg Pincus.

The sale of Cromwell Property Group’s stake in IOF to Investa Property Group involved Rothschild as well as UBS and saw investment bankers work into the early hours of yesterday to ensure the sale went through before the market opened.

Citi’s role advising Warburg Pincus on buying into Propertylink the day before proved to be a particular coup for the Australian team at a time when assignments for bankers in the equity capital markets remain scarce.

Read more from Data Room

9.10am: Bonds to boom: FIIG

Jim Stening is upbeat about Australia’s fledging corporate bond market.

The founder and managing director of FIIG Securities, Australia’s largest specialist fixed-income dealer, is now seeing “serious momentum” behind the market for debt issued by Aussie corporates.

His firm is leading the charge to develop the corporate bond market in Australia, having arranged more than $1.7 billion worth of bond issues for a range of local companies, including G8 Education, McPherson’s, Cash Converters, Sunland Group, NRW Holdings and IMF Bentham.

In his view, firms that confine themselves to raising equity capital in the stockmarket or borrowing money from the banks could face more volatility from changes in the business or financial cycles than they would if they had an alternative source of funding via the corporate bond market.

“It’s something they need to manage and it can be unpredictable,” Stening tells The Australian.

Elanor Investors Group was the latest Aussie corporate to turn to diversify its capital structure with a corporate bond offer arranged by FIIG Securities.

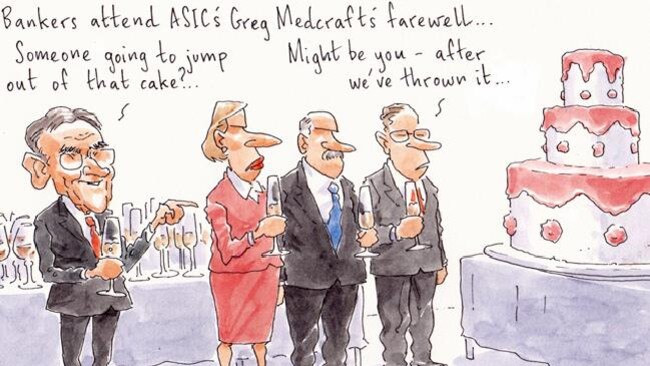

9.00am: Hunt still on for new ASIC boss

Will Glasgow and Christine Lacy write:

It is now less than six weeks until Australia’s top corporate watchdog Greg Medcraft finishes in the top office at ASIC.

While there’s clarity around the knees-up, there’s still no word from Financial Services Minister Kelly O’Dwyer about who will replace Medcraft as ASIC chair when he hangs up the dog collar on November 12.

Prime Minister Malcolm Turnbull’s close friend and Credit Suisse banker John O’Sullivan was on a list of candidates. But O’Sullivan is believed to have been ruled out.

Glenda Korporaal 8.55am: Diagous power fresh ASX listing

The growing market to supply Chinese tourists and Australia-based personal shoppers, or daigous, sending consumer goods back to China, is behind the first ever listing of a Chinese store chain on the ASX today.

Malaysian-born, Perth-based businessman Keong Chan and Sydney-based Chinese couple Joshua Zhou and Lyn Zheng, who have developed a thriving daigou business with five stores, are the key players in new listed company AuMake International.

“We have very big plans,” Mr Chan, who is AuMake’s executive chairman, told The Australian in an interview yesterday.

He said the plan was to expand the current five stores — which sell Australian-made goods that appeal to Chinese consumers, such as baby formula, vitamins and healthcare products — to nine by the end of the year.

It will open a new flagship store in Sydney’s QVB building in George Street later this month as well as another in Haymarket, in Sydney’s Chinatown. Mr Chan said there was a growing market to supply Chinese tourists visiting Australia with locally made goods they could not get in China.

Andrew White 8.50am: Pressures rise on power bills

Victoria’s biggest electricity distributors are planning to hit customers with further above-inflation price rises next year.

However, some customers can expect some relief from years of price rises, with two operators agreeing to price cuts.

A raft of proposals from five Victorian electricity distributors follows the federal government’s moves to curb the networks’ ability to appeal against rulings by the Australian Energy Regulator, amid a broader effort to reverse soaring energy bills.

Michael Roddan 8.32am: Suncorp’s cyclone hangover

More than six months after Cyclone Debbie struck Queensland, the deadliest to hit Australia since Tracy in 1974, Brisbane-based insurer Suncorp is yet to finalise one-quarter of claims received in the aftermath of the catastrophe.

Suncorp said on Wednesday it had finalised three-quarters of the almost 20,000 claims received in the wake of the storm, which caused almost $1.5 billion in damage across Queensland and northern NSW in March and April this year — read more

SUN last $13.19

8.30am: iStentia chairman to retire

iStentia chairman Doug Flynn has announced his intention to retire and will not stand for re-election at the end of the company’s 2017 annual general meeting to be held on November 23.

ISD last $1.86

Andrew Burrell 8.20am: Royalty rise puts ‘mine at risk’: Newcrest

Newcrest Mining chief executive Sandeep Biswas says a controversial plan to increase gold royalties in Western Australia has put the company’s Telfer mine at “serious risk” as he rubbished a claim by Premier Mark McGowan that the move would not cost a single job.

As the war of words intensifies over the royalty push, Mr Biswas told The Australian yesterday that the Telfer mine, which employs more than 1500 people, was the most marginal the company operated across four countries — read more

NCM last $20.99

Matt Chambers 8.15am: Anglo keen to bulk up on coal

Anglo-American chief executive Mark Cutifani says the big miner is looking to invest more money into its top-tier Queensland coking coal mines and may look at adding new local operations, after a resurgent coal price allowed the company to avoid selling them last year to pay down debt.

But the Wollongong-born head of the world’s fourth-biggest miner says the company is unlikely to purchase Rio Tinto’s remaining Queensland coalmines, despite now having the balance sheet strength to again look at acquisitions.

7.10am: US stocks edge higher

Shares of internet retailers rose, helping the S & P 500 extend its recent winning streak.

E-commerce firms like Netflix and Amazon.com have been among the market’s best performers this year, helping to power US stocks to fresh all-time highs despite concerns about their valuations and rapid rise. The Dow Jones Industrial Average, S & P 500 and Nasdaq Composite each set at least 40 all-time highs this year.

“Valuations are higher, but the fundamentals look really good still,” said Paul Quinsee, global head of equities at J.P. Morgan Asset Management, of outperforming internet stocks. “Compared to the speed of profitability growth, we think valuations make sense,” he said.

All three major equity indices finished at all-time peaks for the third day running.

The Dow industrials inched up 20 points, or 0.1 per cent, to 22662. The S & P 500 rose 0.1 per cent and the Nasdaq Composite added less than 0.1 per cent.

Australia’s SPI futures index was up 14 points at 7.15am (AEDT, pointing to a higher local open, although a similar indication yesterday proved inaccurate.

Netflix was among the biggest gainers in the S & P 500, rising 2.9 per cent after UBS raised its price target on the stock. The bank raised its subscriber-growth projections for the streaming giant, noting that the previous quarter’s momentum likely continued.

Other internet retailers also rose, with TripAdvisor shares climbing 3.7 per cent. Shares of Amazon.com edged up 0.9 per cent.

US economic data was mixed. First, a report showed hiring at private US employers grew less than expected last month, with hurricanes denting economic growth. Then, the Institute for Supply Management said its index measuring service-sector activity rose to its highest level since 2005. Investors will be closely monitoring Friday’s monthly jobs report for another reading on the economy.

Traders were also awaiting a speech from Federal Reserve Chairwoman Janet Yellen, expected today (AEDT), for clues about the central bank’s latest views on sluggish inflation.

Dow Jones Newswires

7.00am: Dollar lower

The Australian dollar is a little lower against its US counterpart which has pared losses after data showed that US service sector growth had accelerated which could lead to a December interest rate rise.

At 6.35am (AEDT), the Australian dollar was worth US78.63 cents, down slightly from US78.67 yesterday.

The US’ Institute for Supply Management’s non-manufacturing index rose to its highest level since August 2005 in September and the prices paid index reached its highest level since February 2012.

The data boosted the likelihood that the Federal Reserve will raise rates at its December meeting.

That report came after data on Monday showed that US factory activity surged to a more than 13-year high in September.

Following the Wednesday’s data, the dollar index pared earlier losses to be down 0.7 per cent.

The Aussie dollar is higher against the yen and fairly steady against the euro.

AAP

6.50am: Investors dump Spanish shares

The Madrid stock market tumbled as investors, worried by a deepening Catalan independence crisis, offloaded their shares in a hurry.

Madrid’s main index, the Ibex, was down nearly three per cent at the close after falling below the key 10,000 level.

“The eyes of the world are on Catalonia and the spike in political tensions is likely to keep investors away,” said David Madden, an analyst at CMC Markets.

The index has fallen to a level not seen since March, he added. “Today’s focus has been relentlessly on the situation in Spain, where Catalonia is seemingly headed for a declaration of independence,” said Chris Beauchamp, chief market analyst at IG, summing up a black Wednesday for the Madrid market.

“As a result, the Ibex remains under heavy pressure, with the index now down 11 per cent from its highs.” - Switch to Frankfurt —

Analysts said they detected a switch from Spanish equities into German stocks, a move that pushed the Frankfurt exchange higher and close to record peaks, bucking a Europe-wide lower trend.

Paris shares were slightly softer at the closing bell.

London ended flat as traders brushed off a survey showing activity in the British services sector, a key driver of the UK economy, rebounded last month.

AFP