Hunt still on for ASIC boss to replace Greg Medcraft

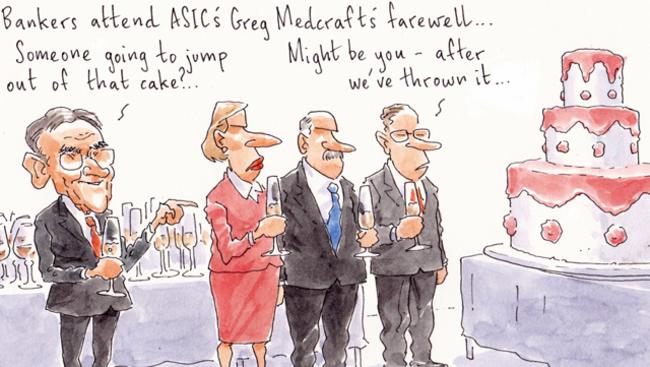

It is now less than six weeks until Australia’s top corporate watchdog Greg Medcraft finishes in the top office at ASIC.

Invitations have started flowing for his farewell do on October 30 in Sydney’s Martin Place (an easy walk for many of his banking prey), with the cocktail space reserved by Medcraft’s party planners way back in July for a modest $22,000.

While there’s clarity around the knees-up, there’s still no word from Financial Services Minister Kelly O’Dwyer about who will replace Medcraft as ASIC chair when he hangs up the dog collar on November 12.

Prime Minister Malcolm Turnbull’s close friend and Credit Suisse banker John O’Sullivan was on a list of candidates. But O’Sullivan is believed to have been ruled out.

The advanced stage of the countdown could see O’Dwyer name an interim, or acting chair, as the process towards naming a permanent watchdog continues.

If that happens, ASIC commissioner Cathie Armour is the hot tip to fill the breach. The well-regarded former corporate counsel at Macquarie Capital is believed to still be in the running for the permanent gig.

One name Margin Call understands is no longer on the shrinking shortlist is Sean Hughes, now chief general counsel at David Attenborough’s gaming outfit Tabcorp.

Before moving to the gambling house in June, Hughes’s experience included running the Financial Markets Authority, ASIC’s equivalent over the ditch in Winston Peters’ New Zealand.

Most recently Hughes was chief risk and legal officer at UniSuper.

But it seems that’s now all by the by. The hunt continues.

Fagen’s new work

Outgoing chief executive John Neal’s Sydney-based global insurer QBE has had a catastrophic year.

As disclosed to the ASX this week, hurricanes Harvey, Irma and Maria, along with Mexico’s earthquakes, have battered the now $13.67 billion insurer. Its shares have lost almost 20 per cent in value in the year to date.

So it’s a relief to report some sunnier news from the wider QBE family, concerning favourite of the column Colin Fagen.

The insurer’s former group chief operations officer (and, for a while, a hot tip to replace Neal in the top job), Fagen shot to prominence when he was abruptly removed from Neal’s QBE in February.

An unimpressed Fagen hired scarlet workplace relations firm Harmers to help negotiate his exit terms. That mediation may, or may not, have been settled. QBE won’t comment.

Either way, it seems that mediation is not taking up all of Fagen’s time.

Margin Call understands Fagen has been setting up an insurance underwriting business. The preparations are said to be well advanced.

Word is the new venture will see him reunite with a former QBE colleague or two. After all the flux near the top of the insurer’s executive team, there are a few to chose from.

Cut-price Costello

Nine chairman Peter Costello, with a bit of encouragement from his biggest shareholder Bruce Gordon, has given himself a 20 per cent pay cut.

The Liberal grandee’s pay as Nine chairman had been set at $425,000, which Bermuda-based billionaire Gordon thought was too high.

That was made clear at last year’s Nine annual general meeting when Gordon voted his 14.9 per cent of shares against the media company’s remuneration report. Nine came embarrassingly close to crossing the 25 per cent “no” threshold and earning an ominous first strike.

In an effort to avoid any such Gordon-led trouble at Nine’s AGM next month in Sydney, Costello has cut his pay to $340,000.

The former federal treasurer’s fellow board members Catherine West, David Gyngell, Janette Kendall and Samantha Lewis had their director fees cut by 25 per cent, trimming their pay from $180,000 to $135,000, plus additional committee fees.

That followed a “benchmarking review” of comparable listed companies that Costello committed to after last year’s near miss.

Coincidentally, the cut to Nine’s directors pay took effect on February 1, only a fortnight after Holly Kramer revealed she couldn’t fit the media gig in her NED portfolio.

Elizabeth Gaines left the Nine board at the same time when she was lured by the exciting challenge (and $1.3 million-plus pay cheque) to be the CFO of Andrew Forrest’s iron ore miner, Fortescue.

Will the pay cut be enough to allay Gordon and his new choppers when they arrive Down Under in time for Nine’s AGM?

Best to wait and see. As the WIN billionaire demonstrated last week with his raid on rival regional broadcaster Prime, Gordon’s nothing if not surprising.

The apple of his eye

Former environment minister Tony Burke loves Tasmania.

Back in the Rudd-Gillard-Rudd government, Burke was a key force behind listing much of the Apple Isle’s wilderness as a UNESCO World Heritage Site.

And, in opposition, the Member for Watson and Labor’s head of business in the House of Representatives has continued his support of Tasmania, albeit in a personal capacity.

Burke has gone and bought himself a second slice of paradise in the Apple Isle, right next door to the first property he purchased in 2015.

Burke’s new block of land is at Jackeys Marsh, a verdant spot south of Devonport, adjacent to the rustic three-bedroom home (with composting loo) that he bought two years ago for $220,000.

Just the thing to mark the new big corporate job Burke’s partner Skye Laris has, running public advocacy at Andy Vesey’s coal-divesting energy company AGL.

Both rural properties are mortgaged to Ian Narev’s Commonwealth Bank, and complement the couple’s bolthole in Punchbowl, in Sydney’s southwest, which they purchased in February.

Seems Tassie is the place to splash cash.

Fellow parliamentarian Andrew Wilkie, the federal Member for Denison, has recently bought a new house in South Hobart after selling his 6ha property at Neika, on the side of Mount Wellington.

And in other recent parliamentary regional property sales, South Australian Liberal MP Tony Pasin has flogged his Mount Gambier investment property.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout