‘Call that uncovered my boss’s deception’

Employees were ripped off more than $82,000 but despite complaints they haven’t seen a cent. Now the company has gone into liquidation.

Employees were ripped off more than $82,000 but despite complaints they haven’t seen a cent. Now the company has gone into liquidation.

The issue costs workers billions and one Aussie company has called on the government and other business to stop the “unfair” penalty.

Millennials and Gen Z could use this long term wealth strategy to score themselves hundreds of thousands. Here’s how to do it.

Huge numbers of workers are being denied their hard-earned retirement entitlements and are missing out on thousands of dollars.

Most of Australia’s 200 super funds failed this crucial test, with calls for more scrutiny into where the sector’s $3 trillion in money is going.

The Covid-19 pandemic has changed how rich Aussies are but it hasn’t impacted everyone equally – one group in particular is better off.

Experts have revealed the occupations offering the best superannuation. So is your job on the list?

A quarter of Aussies think they will need more than $1 million to have a good life when they hit old age. Find out if your retirement pot is on track.

Aussies are being urged to do one thing that could boost their super by tens or even hundreds of thousands of dollars.

The financial regulator has warned it wants to see Australia’s worst performing super funds close down or merge, as it highlighted poor performance.

If the people managing your nest egg aren’t doing a good job, check out the latest data from the regulator who has vowed more ‘relentless’ scrutiny.

Millions of Australians are owed an average of $1700, with new research showing where those eligible are most likely to live.

Many Australians don’t know enough about superannuation and are heading towards an uncomfortable retirement if they don’t take action.

The fast food worker has been fighting for the money but is concerned his former employer is never going to pay it.

The Aussie describes the huge windfall as “mind blowing” and has even used the investment strategy to boost her superannuation.

Alarmingly millions of Aussies have no idea how their super fund are performing, which could cause real “damage” if urgent action isn’t taken.

There’s some simple ways to get your hands on thousands – but hurry as one deadline looms at the end of October.

Vi is only 20 years old and in her second year of uni, but she’s already on track to pocket a whopping $282,000 thanks to her weekly habit.

Although moving in with your significant other can be exciting, under certain circumstances, this could spell disaster for your superannuation.

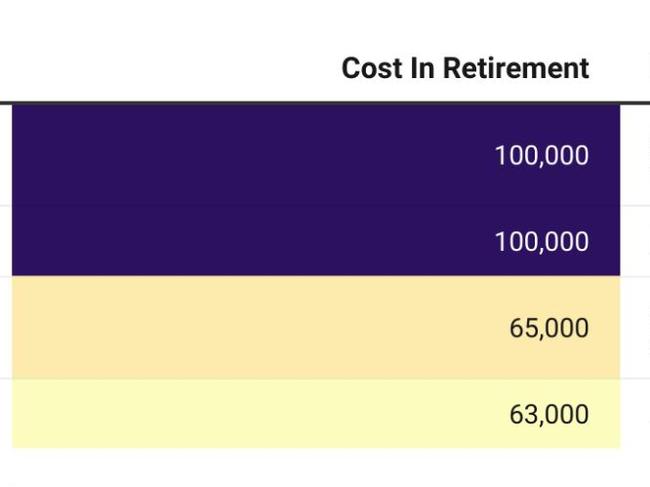

There’s an amount you need in superannuation to lead a “comfortable” life in retirement and many need to save a lot more to get there.

Some Australians are being cheated out of hundreds of thousands of dollars by sticking with their employer’s default super fund.

There are calls for the Federal Government to prove it values women by making a change, which could keep them from falling into poverty.

More than one million Aussies have their retirement money sitting in funds that are underperforming and they are being urged to find an alternative.

A new plan calls for up to $1000 a year be tipped into retirement funds as well as a 50 per cent rebate to help women catch up on lost money.

![Couple trying to come to an agreement in Berlin, Germany.LIFESTYLEExclusive only at istockphoto ¥ stevecoleimages ¥ Atlanta, Georgia[url=http://www.istockphoto.com/file_search.php?action=file&lightboxID=9072846[img]http://dl.dropbox.com/u/40249541/ISP%20Banners/Lifestyle.jpg[/img][/url][url=http://www.istockphoto.com/file_search.php?action=file&lightboxID=8589339[img]http://dl.dropbox.com/u/40249541/ISP%20Banners/SeniorLifestyle.jpg[/img][/url][url=http://www.istockphoto.com/file_search.php?action=file&lightboxID=8282165[img]http://dl.dropbox.com/u/40249541/ISP%20Banners/RoadTrip.jpg[/img][/url][url=http://www.istockphoto.com/file_search.php?action=file&lightboxID=9099715[img]http://dl.dropbox.com/u/40249541/ISP%20Banners/Portraits.jpg[/img][/url][url=http://www.istockphoto.com/file_search.php?action=file&lightboxID=5758984[img]http://dl.dropbox.com/u/40249541/ISP%20Banners/OutdoorAdventure.jpg[/img][/url]](https://content.api.news/v3/images/bin/305f8ab677004e5c30570f7e2c90fb51?width=650)

Married for 17 years, the South Australian man said he was manipulated and wants to stop his ex-wife from taking all his money.

There’s a new movement gaining speed that means you could retire at 30 – but it does mean adopting some extreme measures.

The 29-year-old from NSW is on track to finish up work in just six years and still live off up to $100,000 a year.

It may have seemed like a good idea at the time, but a $20,000 government scheme could cost hardworking Aussies $100,000 in the long run.

An experiment conducted on The Project has been a huge eye opener for young Aussies, with one question particularly causing angst.

The average worker can boost their retirement by a massive amount with a simple change. Find out the “gamechanger” that’s just been introduced.

An experiment conducted on The Project has left some millennials “petrified” and “emotional for their future after what they discovered.

Every Aussie worker is being encouraged to check their contract as soon as possible for three words that could cost them a fortune.

Millions of Australians are set to benefit from an increase in superannuation payments paid into their nest eggs.

Many Aussies are set to sink into poverty when it comes to retirement. Find out how something you do every day could boost your superannuation.

A magistrate who made headlines over his relationship with a law clerk 45 years his junior has claimed her $180,000 super death payout.

From July 1, some employees are going to be hit with a superannuation rise which will come out of their salary, cutting their take home pay.

Controversial new laws being debated in the Senate this week could see some Aussie workers up to $230,000 worse off.

With home ownership rates falling off a cliff, it could end up being a ticking time bomb for young Aussies for one key reason.

The Australian sharemarket keeps soaring to fresh record highs. What’s driving it, will it continue and what does it mean for your super?

There’s one question most people ask when it comes to securing their future but it could be costing them thousands.

An Australian bank has announced it will sell off its wealth business to a Queensland superannuation fund.

A Queensland man has described his financial woes as like “monsters” under his bed. He is one of millions who went down this path.

New data has shown Australians accessed their superannuation early during the coronavirus pandemic for these reasons.

A big change is due to kick in come July and it could mean more money in your bank. Here’s how much you could collect under the reforms.

Here’s the best ways to make the most of your money at each stage of your working life, so you can live the good life in retirement.

A plan to let Australians use superannuation to buy a home is ‘dangerous’, critics say, fuelling an already overheated property market.

One of the nation’s biggest industry funds seeks to absorb Australia Post’s superannuation scheme as it becomes even larger.

Despite her accountant advising against the early withdrawal of the money, this Melbourne woman wanted to back her dream.

The peak industry fund has launched a new attack on the federal government over speculation it could ditch a rise in super payments.

Australians need far more saved up in super than they do to be able to retire comfortably. This is how much you should have.

It’s an idea designed to make it easier for first home buyers to break into the market. But experts say it could push ownership further out of reach.

Former prime minister Malcolm Turnbull has revealed which side of the fence he is on when it comes to increasing superannuation payments to 12 per cent.

Aussie women are far worse off when it comes to a secure future compared to men, and the gender pay gap is to blame, according to the latest research.

Real estate prices are going through the roof again leaving many locked out of the market. But one expert warns our obsession is a mistake.

People are voting with their wallets and seeking out ways to have their hard-earned cash do good and protect the environment.

The corporate watchdog has blasted a popular superannuation fund, accusing it of ‘deceptive conduct’ and misleading customers.

Young Australians have a major concern about what will happen before they retire which is ‘unfounded’, the Treasurer says.

A woman ripped off for millions by a missing Sydney businesswoman only found out about her death moments before going on radio.

The woman found a clever way to pay off her debts and secure a new home.

The country’s prudential regulator has revealed how much money has been sapped from retirement funds through the early release of super.

There’s an “overwhelming” lack of knowledge and understanding of superannuation across the board in Australia, new independent research reveals.

Women, young workers and low-paid Australians have been left more vulnerable in retirement after accessing a controversial scheme.

Election battlelines are being drawn as the government considers a proposal that would force workers to choose between superannuation and take-home pay.

A plan to allow first-home buyers to dip further into their super is a step closer to reality after it gained support from three key players.

With interest rates at record lows, many Aussies are keen to take the leap to buy a home. But one move may hurt your chances of scoring a good deal.

A bold idea to help Australians buy their first home has been floated again. But the concept could have ‘devastating impacts’, politicians say.

Speculation is mounting a boost to super could be scrapped, with the government switching focus to boosting homeownership.

A planned boost to Aussies’ mandatory savings is facing the axe after the revelation the change would make most people worse off.

Australia’s biggest superannuation fund has refused to provide details to various questions at a parliamentary hearing, but denies being secretive.

The prudential regulator has warned too many Australians remain in underperforming super funds and are paying too much to do it.

A stoush has erupted between Treasurer Josh Frydenberg and former prime minister Paul Keating over the performance of the Reserve Bank.

More than half a billion dollars will be repaid to almost 400,000 Australian workers after 24,000 business admitted to underpaying staff.

Tax authorities warn the full force of the law will be brought down upon people illegally accessing JobKeeper and early release of superannuation.

The ATO has hit more than 1500 businesses with a harsh penalty after they were caught stealing money rightly owed to their workers.

One of Australia’s major industry superannuation groups says the scheduled rise in payments to workers will help boost rather than hinder the economy.

Former prime minister Paul Keating says a bunch of “little bitchy Liberals” aren’t playing fair and are trying to “knock off” people’s incomes.

A staggering four in 10 Australians who withdrew retirement savings recently haven’t actually lost any income. And it could cost them.

Fears a superannuation increase will come at the cost of future wage growth is posing a threat to an already-legislated plan.

The Australian Taxation Office has warned people who rort the early release of super for tax benefits will be met with harsh fines.

Australians are continuing their mad rush to access their retirement savings early with more than $30 billion being sapped from the superannuation pool.

Original URL: https://www.news.com.au/finance/superannuation/page/6