Rinehart breaks silence on $554m scandal

Gina Rinehart has broken her silence on Australia’s super mega-fund controversy, providing the first clue in the “who owns the $544m fund” debate.

Gina Rinehart has broken her silence on Australia’s super mega-fund controversy, providing the first clue in the “who owns the $544m fund” debate.

Despite being born on the same day, Anthony Albanese and Jim Chalmers are facing accusations they are at “war” with each other.

There’s an easy mistake people make when choosing a super fund and it could cost the average Aussie $314,000 – or even more.

Peter Dutton has unleashed on a plan to overhaul superannuation, warning that ordinary Australians could be next on the hit list.

Jim Chalmers was attempting to sell the government’s decision to lift taxes on superannuation funds when he found himself in hot water.

Younger people in particular are ignoring this huge money-making opportunity, and it’s costing them hundreds of thousands of dollars.

The Coalition has slammed the government for a major superannuation change they claim is a breach of trust.

The opposition has ‘gone to war’ over the top 0.5 per cent of earners – despite having backed in the changes to super years ago.

Labor’s plan to change superannuation has been labelled a “money-go-round scheme for the rich” as tax cuts for high earners remain on the table.

Anthony Albanese has found himself with a pair of unlikely allies after the government questioned whether it should overhaul superannuation.

A staggering $16 billion is waiting to be claimed, and people don’t even need to buy a lottery ticket to get their hands on it.

A plan to overhaul superannuation has been lashed, with one MP raising concerns the Treasurer is using it as an excuse to not talk about the cost of living.

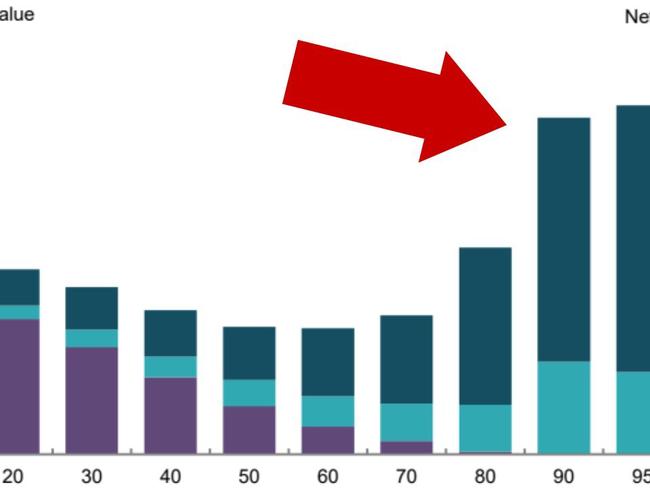

A graph has revealed the extraordinary super savings of some of Australia’s wealthiest people – but one balance in particular has sent social media into overdrive.

The federal government wants to have a “national conversation” on superannuation. Here’s what you need to know.

The Treasurer is denying the conversations about superannuation are a sign of a ‘broken election promise’ as the super wars rage on.

The Prime Minister has once again said there will be “no major changes” to the superannuation system, despite allegations of backflipping by the Coalition.

Nobody has asked this pertinent question and the truth exposes a divide in Australia that benefits the richest to a disgusting degree.

Despite Jim Chalmers saying he would bring an end to the ‘super wars’, the opposition is fired up and hitting back.

Anthony Albanese says there are no plans for a major overhaul of the super system as changes are being considered to stop “bad decisions”.

A review into superannuation has been met with criticism from some, including Today Show host Karl Stefanovic who has labelled it nonsense.

A proposed change to a major tax concession has the Prime Minister defending himself against claims he’s broken an election promise.

Recounting how she herself fled an abusive home, tennis commentator Jelena Dokic has smashed the government’s proposed superannuation plan.

The Coalition, which gave Australians $36bn worth of their super during Covid, are unhappy about the proposed changes to retirement savings.

Anthony Albanese has suffered his first major defeat in parliament after an unlikely team united against him.

You may not like them but the answers can help you avoid common savings mistakes.

The issue is causing a “crushing financial blow” to millions of Aussies with calls for the federal government to make urgent changes.

It’s an easy money mistake to make – but the cost is $166,000 and there’s an easy way to avoid it from happening.

A major employer has announced a plan that could leave its employees thousands of dollars better off.

One of the ABC’s top finance presenters is leaving behind journalism after 15 years in the industry.

Getting on to the property ladder is tough. But there’s a trick to save up to $15,000 and it could be a game-changer for first-time buyers.

Original URL: https://www.news.com.au/finance/superannuation/page/5