Major change coming to superannuation

Millions of Australians are set to get a boost to their superannuation under a new legislation that “offers security and rewards aspiration”.

Millions of Australians are set to get a boost to their superannuation under a new legislation that “offers security and rewards aspiration”.

Commonwealth Bank has revealed loan arrears are on the rise, as it posts a $9.48bn statutory profit for the full year.

The ASX made a third-straight day of gains after a week of global volatility, with financial and consumer stocks pushing a marginal gain.

Australian wages have ticked up nearly 1 per cent in the past three months.

There are warnings that life could be made “financially harder for younger Australians” with rents to soar and property prices to spike an extra $75,000 too.

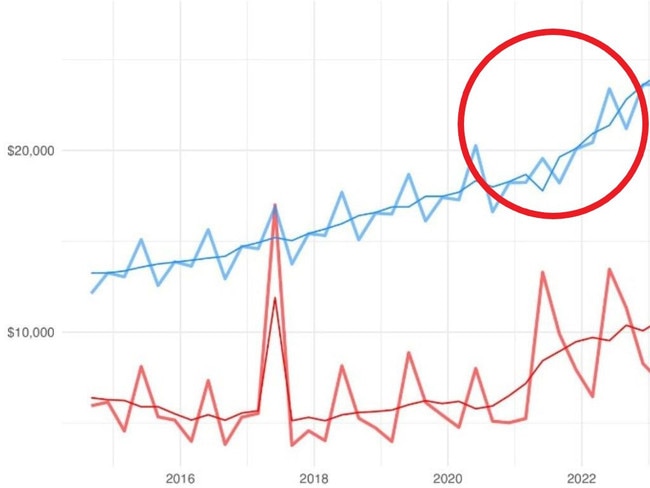

New forecast shows the average Aussie will be $21,000 richer in retirement after change in payments from this month onwards. Here’s why.

A property investor has slammed young Australians for “boomer bashing”, claiming it’s not easy to be a landlord.

Ben, 44, got the shock of his life when colleagues told him to check his pay slip. He’s part of a $3.1 million problem.

As if phone calls from random numbers couldn’t get more annoying, the alarm has been raised about these dodgy cold callers.

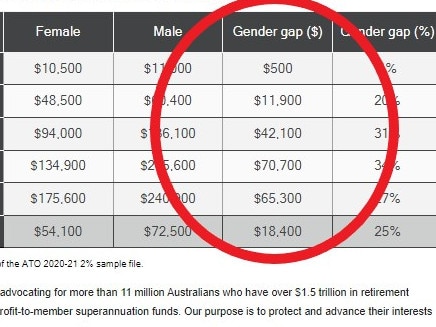

Aussie women are facing a dire gap in one key financial figure compared to their male counterparts, according to new research.

The government is making moves to address a billion dollar problem impacting Australians but there is still a delay.

The passage of Labor’s bolstered paid parental leave scheme will benefit about 180,000 Australian families, the government says.

A woman has made a TikTok to explain how millions of Aussies can claim up to $500 every year in superannuation contributions.

A claim by Australia’s largest superannuation funds comes amid a fierce political battle over how to help Australians into home ownership.

A war has broken out between two Aussie CEOs with one offering the other $1 million in free advertising and challenging his rival over his company’s sports advertising spend.

Australian women will retire thousands of dollars richer as part of a landmark change to the way they’re supported after having children.

Millions of Aussies who withdrew their super savings during the Covid-19 pandemic could be left $85bn worse off, as details of the massive taxpayer bill to come are revealed.

Superannuation might not be the most exciting topic but Aussies are missing out on $23,000 a year with this mistake.

There’s a surprisingly easy way one group of Aussies can get the government to pay $500 into their super accounts.

Australians are meant to be living on the edge – but new reports show they made a very off $50 billion move as the cost of living squeezes.

The latest report from the Reserve Bank of Australia shows how much money the men and women who determine your mortgage bill make each year.

Australians who carefully saved up through self-managed super funds are set to be walloped with a brutal new tax that could leave some struggling to pay their bills.

Millions of Aussie workers are missing out on valuable retirement savings because of a loophole the government is insistent on closing.

There are calls to close a loophole said to be costing everyday Aussies billions of dollars and stopping them from living a “decent life”.

Young Aussies are waging a ‘war’ on baby boomers but the growing resentment towards the older generation is wildly unfair, one commentator says.

Finance experts have warned Australians are losing millions of dollars a year due to a hidden problem with their superannuation accounts.

Australia’s largest superannuation fund is being sued over allegations it failed to act on duplicate accounts, costing 90,000 members $69m.

A leading small business group said an end to age-based discrimination in super would cost jobs.

A simple banking blunder almost cost a couple about $200,000, sparking a months-long battle to get it back.

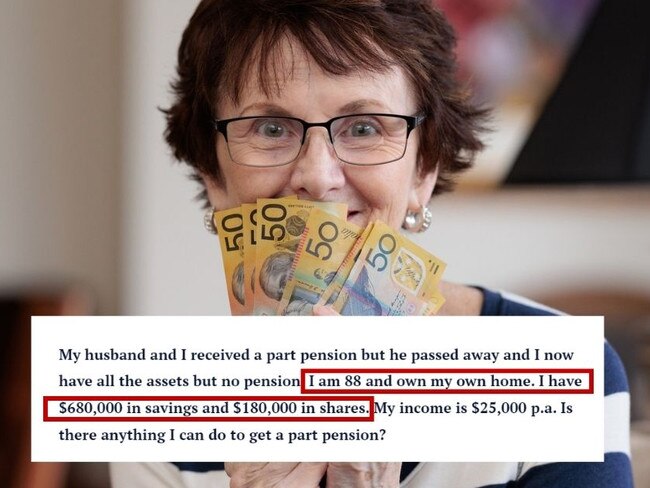

An Australian widow has sparked outrage over her “entitled” question about the pension to a money columnist.

Original URL: https://www.news.com.au/finance/superannuation/page/3