Simple mistake almost cost couple $200k

A simple banking blunder almost cost a couple about $200,000, sparking a months-long battle to get it back.

A simple banking blunder almost cost a couple about $200,000, sparking a months-long battle to get it back.

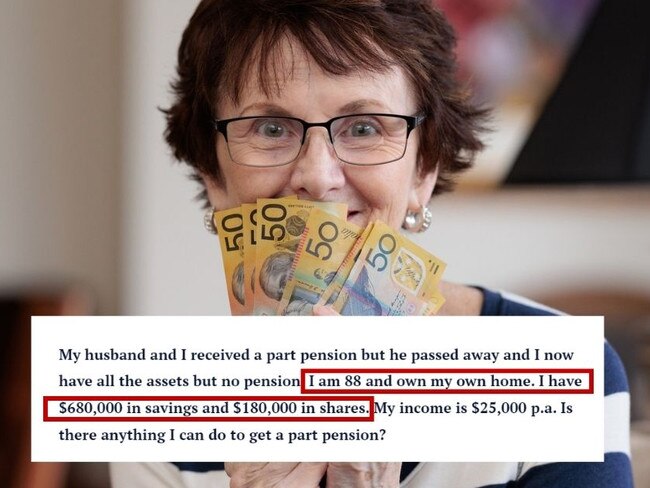

An Australian widow has sparked outrage over her “entitled” question about the pension to a money columnist.

An Aussie paramedic does not think he will make it to the new, higher pension age before he “breaks”, and he says he is not alone.

Most Australian workers automatically fall into this money trap – and it could end up costing you hundreds of thousands of dollars.

Millions of Australians will be hundreds of dollars a year better off after a welcome boost to their nest egg.

An image of a hardworking tradie with an exceptional message is going viral though his plea could be falling on deaf ears.

A leading finance expert has revealed why now is better time than any time to boost your superannuation fund and reap the rewards.

There may be talk about raising the pension age, but by following these simple tricks Millennials can clock out into retirement sooner rather than later.

Fewer Australians are listing buying their own home as their number one financial priority with two other goals taking the lead in terms of importance.

Around 100,000 Aussies are set to score a refund worth hundreds of dollars after it was revealed a major firm was double charging them.

The Opposition has labelled the latest budget a “disappointment” as they claim one group of people “won’t receive one cent”.

A finance expert has warned young Aussies to get their retirement ducks in a row and build a nest egg now, saying it will only “get worse over time”.

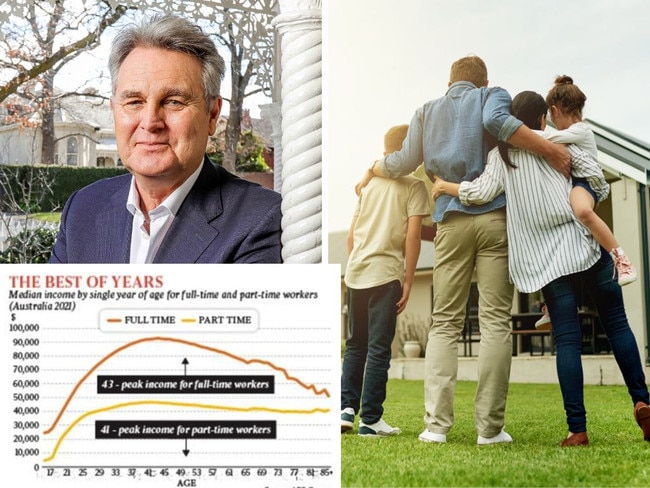

Your peak earning years may be just closer than you think, if data from the 2021 Census is anything to go by.

The average Aussie could risk losing more than $2000 in twelve months by making one simple mistake with their finances.

Alarmingly, around $10 billion of Australians’ retirement savings are invested in dud products but many wouldn’t know the “harm” they are suffering.

Australia’s biggest super funds have been criticised for decisions being made that will have a huge impact on young people’s future.

In the next 10 years, Boomers are going to have access to a whopping $1.5 trillion – and they are being told to start spending it.

Aussies might not need as much in their superannuation account as they thought to set themselves up for retirement, according to the latest figures.

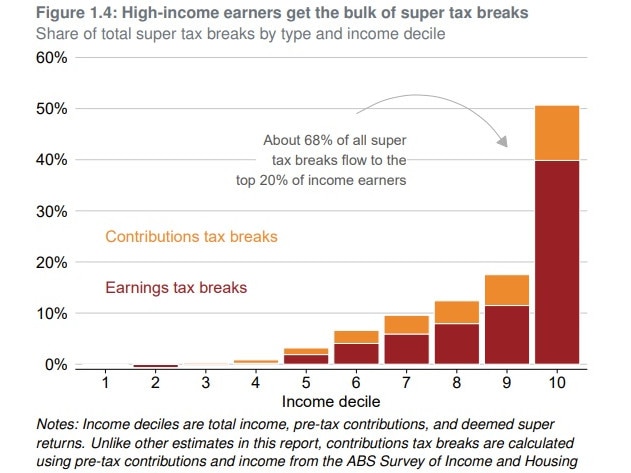

A report has warned Australia’s superannuation scheme has become “taxpayer-funded inheritance” for the wealthy, amid calls to cut tax breaks.

Australians are being “ripped off” when it comes to their retirement to the tune of billions and a simple move could tackle the “financial blow”.

An Australian researcher has detailed how heat-related impacts of climate change could have dire consequences for the elderly.

Labor’s plan to tax super balances over $3 million attracted some controversy, but new analysis has shown the huge impact of a previous change made by the Coalition.

Too many Australians ignore their super fund, but with just one move, the average Aussie could boost their fund by $429,000.

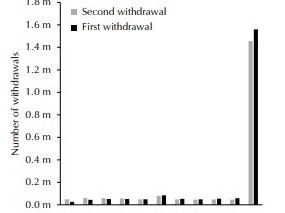

Millions of people withdrew up to $20,000 from their super accounts – costing their retirement savings six times as much.

An unlikely pairing has joined forces to compel the government to hand over secret modelling into its superannuation tax hike.

While the government’s move to more heavily tax super balances over $3 million generated endless headlines, there is one super figure you should care about.

Treasurer Jim Chalmers has hit back at ‘ridiculous and dishonest’ claims as the fiery debate over superannuation changes threatens to boil over.

A political brawl has broken out over a change to how superannuation is taxed, but what on earth does it all really mean for you?

One detail in the government’s superannuation tax change could have a major impact on young people, new analysis has revealed.

Aussies atop the superannuation food chain have spoken out about the government’s latest tax hike for bulging retirement accounts.

Original URL: https://www.news.com.au/finance/superannuation/page/4