‘Inheritance schemes’ for the rich: Super tax breaks cost $45 billion a year

A report has warned Australia’s superannuation scheme has become “taxpayer-funded inheritance” for the wealthy, amid calls to cut tax breaks.

Tax breaks on superannuation in Australia are costing a whopping $45 billion a year and are only benefiting the rich, a new report has warned.

Generous superannuation benefits are creating “taxpayer-funded inheritance schemes” for the wealthy, according to a new Grattan Institute report, with warnings the tax breaks will soon exceed the cost of the aged pension.

Two-thirds of the value of the tax breaks benefit the top 20 per cent of income earners, who are already saving enough for their retirement, the report showed.

“These tax breaks are excessively generous – extending well beyond any plausible purpose for our superannuation system to provide for income in retirement – and their costs are unsustainable,” the authors wrote.

Retirees with big superannuation accounts pay much less tax per dollar on super earnings than younger workers do on their wages – yet much of the boost to super balances from tax breaks is never spent.

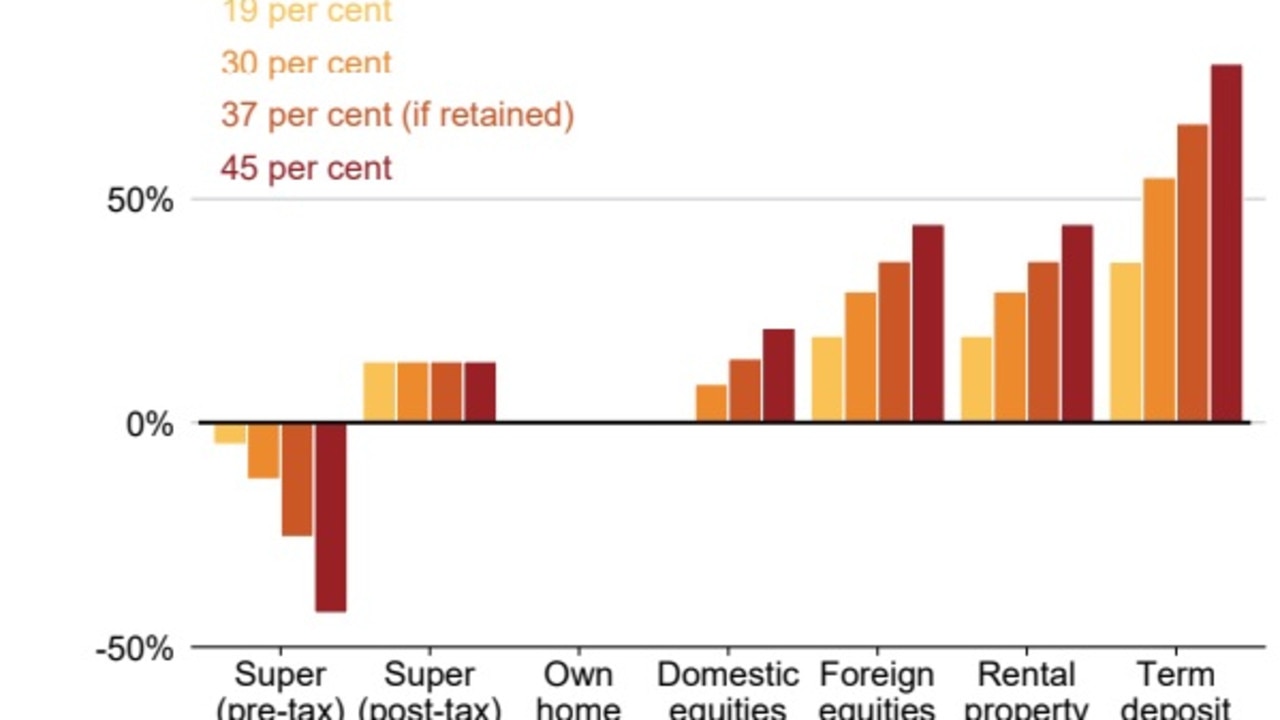

The report argued the rich were using the system to divert savings to where they could be taxed the least.

“People with higher incomes and older savers tend to switch their savings into whichever investment vehicle pays the least tax,” the report said.

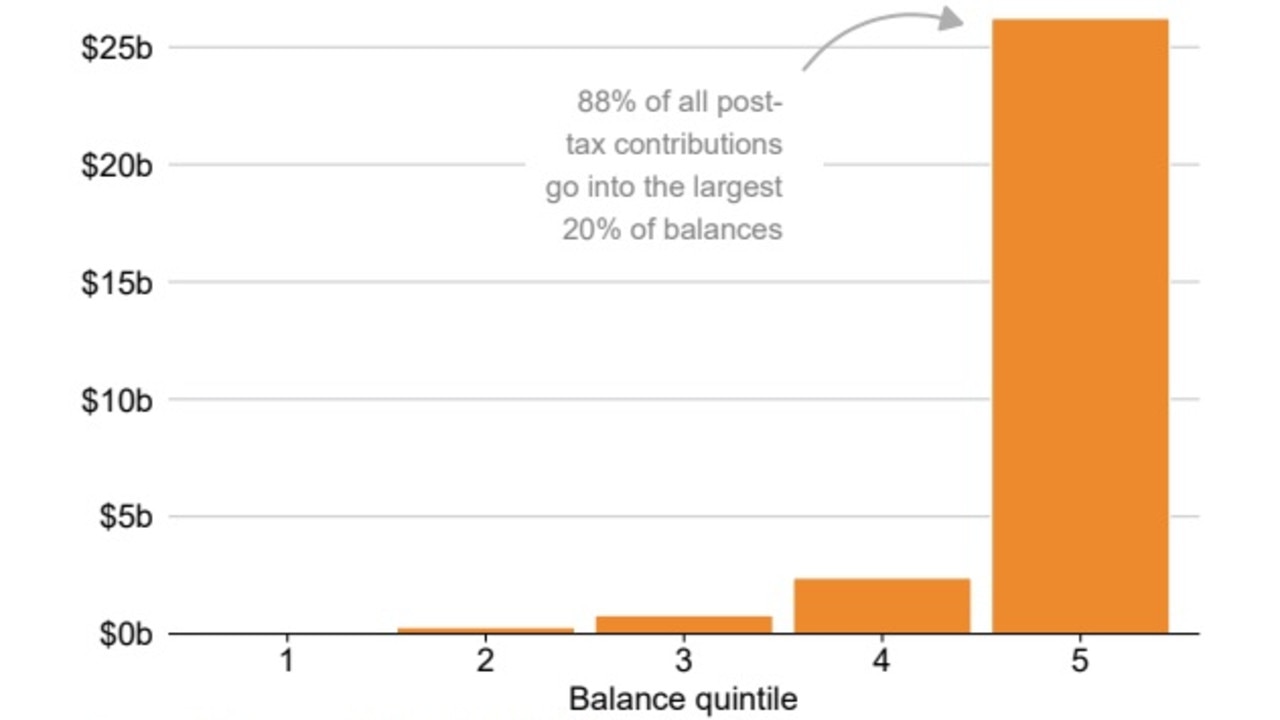

“Tax breaks on superannuation fund earnings may be a strong motivation for those making voluntary post-tax contributions, but many of these contributions appear to be prompted by tax minimisation strategies rather than additional retirement savings.”

By 2060, one-third of all withdrawals from super will be via bequests – up from one-fifth today.

“Super has become a taxpayer-funded inheritance scheme,” report lead author and Grattan Institute economic policy program director Brendan Coates said.

“Reining in super tax breaks is a responsible way to boost government revenues in a world where the Government has committed to higher spending on defence, healthcare, aged care, and disability care.”

The report recommends a reform package that would save the budget more than $11.5 billion a year.

“The warning signs are everywhere: Australia’s current superannuation system is unfair and unsustainable,” Mr Coates said.

The reforms include lowering the threshold and increasing the tax rate on super contributions from high-income earners.

This would mean those earning above $220,000 a year would pay a 35 per cent tax rate on income flowing into their super account, as opposed to the current rule that imposes a 30 per cent tax rate on those earning above $250,000.

The measure would save the budget about $1.1 billion a year and stop many high-income earners benefiting from larger tax breaks compared to low and middle-income earners, the report argued.

The new threshold would affect about 213,000 taxpayers, the report showed, while the higher rate would affect about 707,000 taxpayers.

The Grattan Institute also wants to see the low-income superannuation tax offset boosted from $500 to $800 and available to people earning up $45,000 a year, compared to $37,000 currently – benefiting around 1.1 million Australians.

“These changes would mean low and middle-income earners would receive at least a 15 per cent tax break on their contributions, compared to just 10 per cent for people earning more than $200,000 a year,” the report noted.

It also proposed lowering the cap on pre-tax super contributions, from $27,500 to $20,000 a year – impacting around 1.3 million people.

“This would save about $1.6 billion a year, mostly by reducing voluntary contributions made by older, wealthier Australians to minimise their income tax bills,” it said.

In a potentially controversial move, the Grattan Institute also proposed taxing all superannuation earnings in retirement at 15 per cent – abolishing the retirement funds’ tax-free status.

This would save more than $5.3 billion a year and would affect around two million retirees, but around 70 per cent of the budget savings would come from the 20 per cent of highest income retirees.

“These changes are fair. Retirees would pay some tax on the earnings from their super – the same as those working today – and much less than younger workers pay on their wages,” it added.

“Tax-free retirement earnings mean an increasing number of retirees are ‘checking out’ of the tax system, while the budget faces spending pressures associated with an ageing population.”

The Federal Government’s move to implement a 30 per cent tax rate on the earnings of super funds with balances above $3 million from 2025 needs to go even further, the Grattan Institute recommended.

It wants to see the threshold lowered to $2 million and indexed so that it rises with inflation.

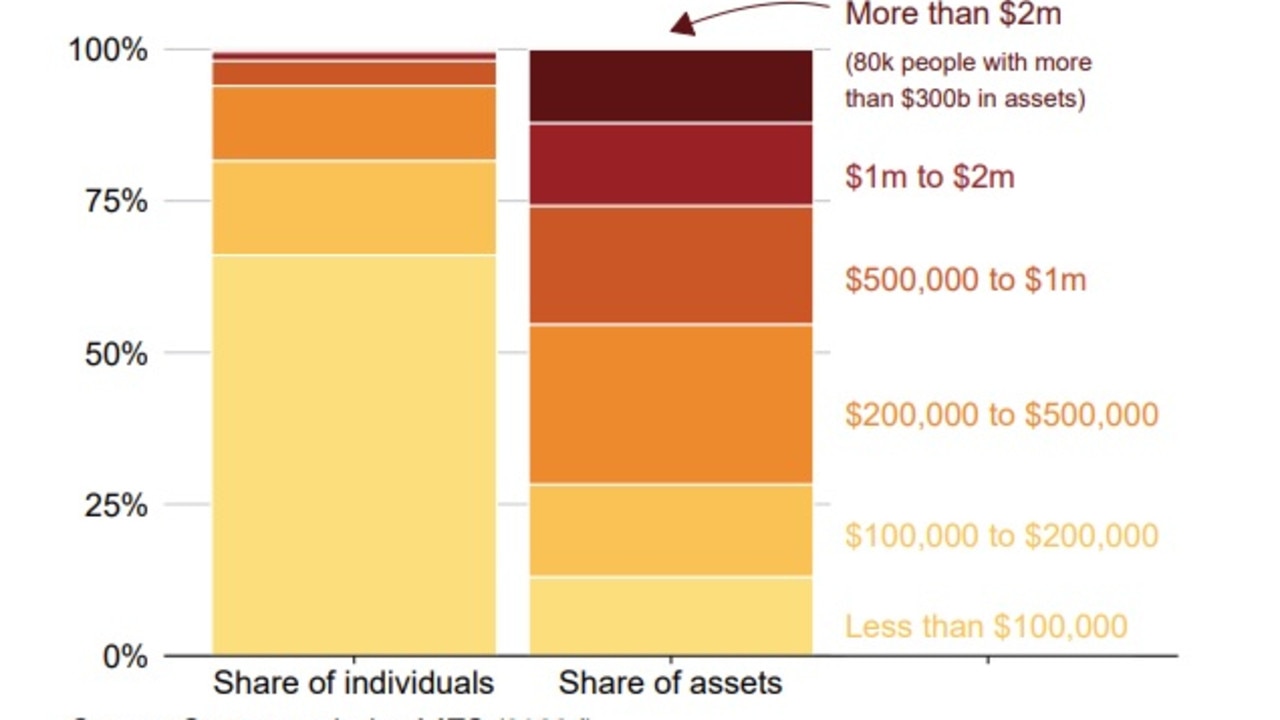

“Balances of more than $2 million make up a tiny fraction of all accounts but hold nearly as much money as the two-thirds of Australians with less than $100,000 in super,” the report said.

For the 2022-23 year, the federal budget was expected to be in the red by almost $37 billion with the shortfall set to soar to about $50 billion in 2024-25 and 2025-26.