Major bank’s huge call on Trump

One of Australia’s big four banks says Australia is well placed to weather the storm coming from US President Donald Trump’s tariff policy.

One of Australia’s big four banks says Australia is well placed to weather the storm coming from US President Donald Trump’s tariff policy.

A big four bank will launch an Australian first aimed at helping stop common scam threats.

In a major win for cash advocates a big four bank has reversed its plan to close down three previously abandoned banking facilities.

One of Australia’s big four banks has been accused of behaving so badly it could amount to torture after it committed an extraordinary series of errors.

A major hurdle for people with this type of debt has been lowered, making homeownership more realistic.

The mass cyber attack on Australian superannuation funds had been ‘inevitable’, according to a security expert, who warns more attacks could follow in the coming days.

The RBA has just delivered a stark warning that Donald Trump’s trade war could trigger disorder in the global economy and hammer Australians.

A major change is on the horizon for Virgin Australia and Qatar Airways after a new partnership was green-lit by the consumer watchdog.

The major banks have slashed their deposits and savings rates, just days before the RBA will announce the nation’s official cash rate.

Australian homeowners may have to resign themselves to higher mortgage payments as political tensions in the US continue to rise.

Australian businesses have been hit with a grim forecast for the year ahead, as US President Donald Trump implements his tariff plan.

A major bank has reduced its variable rates, as experts predict a ‘rates war’ between the big four lenders is about to heat up.

Australian economic growth will likely slow over the next two years, a leading forecaster has warned, as Trump’s tariff agenda shadows the world.

The new theme for the $5 bill has been revealed, swapping out British royalty for something closer to home.

Australia’s sharemarket snapped a three-day losing streak on the back of the major miners, as the price of gold and iron ore climbed throughout the trading day.

The chief executive of one of the country’s largest banks said Australia should remain calm and use the Trump tariffs to our advantage.

US President Donald Trump has sparked a bloodbath in global stock markets and Aussie shares were not immune on Tuesday.

A key group is yet to see real relief from the RBA’s recent rate cut, a big four bank has revealed.

Australia’s biggest bank is expected to cut more than 100 jobs from its technology division.

The Australian sharemarket booked a second consecutive day in the red on Wednesday as escalating global trade tensions continued to rattle investors.

A major bank was supposed to put $450 in a client’s account and got it horribly wrong.

Rate relief for millions of Australians starts on Friday as the first of the big four banks finally pass on the RBA’s rate cut to mortgage holders.

Commonwealth Bank boss Matt Comyn has backed cash, saying his bank will provide it to customers even as customers preferences change.

The man leading America’s biggest bank has lashed out at Gen Z employees and work-from-home in a wild tirade. But where do Aussie banks stand?

Australia’s biggest superannuation fund has been fined $27m for charging duplicate fees to tens of thousands of customers.

Big four bank Westpac will cut 190 Australian jobs in its customer solutions division and move them offshore just days after announcing a bumper profit.

Anti-crime measures and wage costs have eaten into one of Australia’s major bank’s $18m-a-day profit.

Going slow on rate cuts could be good for the major banks as they cash in millions for every day homeowners wait for a mortgage reduction to be passed on.

A slump in the big banks and energy stocks pushed the Aussie market into the red on Tuesday, as the RBA struck a note of caution following its long-awaited rate cut.

Under-the-pump Australian homeowners have received a rate cut, but Michele Bullock has delivered a stark two-word warning about the future.

Banks weighed on the ASX on Monday with disappointing earnings updates from Westpac and Bendigo Bank pushing the index to the red.

A major Australian bank has posted a massive three-month profit as it expects one thing to rise in the coming months.

Westpac customers are being urged to remain ‘vigilant’ for scams after its online banking services faced widespread outages.

Consumers are regularly paying more than they should to use their own money with a debit card, but current laws render the consumer watchdog useless to investigate.

Australia is fighting back against cyber security threats, and this world-first move against scammers is leading the way.

Carrying a big student debt and can’t get a mortgage? See how much more you could borrow under new changes.

CBA has announced an eye-watering half-yearly profit despite citing cost-of-living concerns for customers.

One demographic has emerged as the most popular target for scammers – and it’s not who you would think.

Treasurer Jim Chalmers said new “commonsense clarifications” will help more Aussies buy a home.

The timing of a major announcement has been questioned as the Prime Minister looks to win over voters in key regional seats.

An Aussie bank has just dropped a huge update to its debit cards.

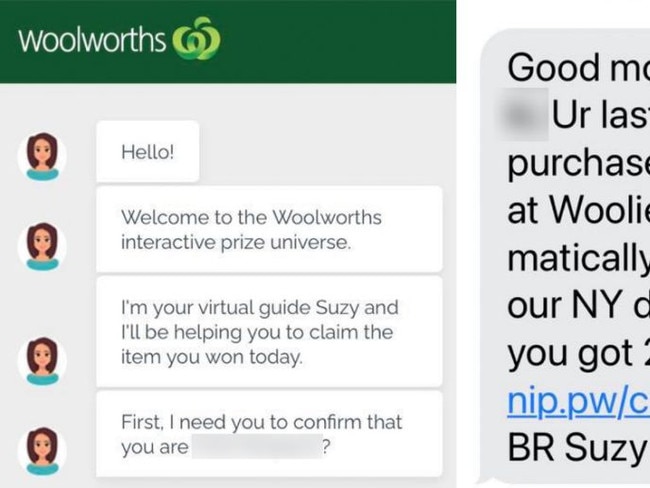

Australians are falling for scams within a matter of seconds, with a top cybercrime cop issuing a chilling warning.

An Aussie bank has been slammed for its “attack on regional communities” after announcing it will shut over a dozen branches from April.

One of the big four banks has made a major call ahead of any Reserve Bank of Australia decision to cut the cash rate.

Former Queensland Premier Anna Bligh will retire from her role in the Australian Banking Association after eight years of lobbying for the major banks.

As the major banks close more regional branches, one of the big four is taking a different approach for face-to-face dealings on Saturdays.

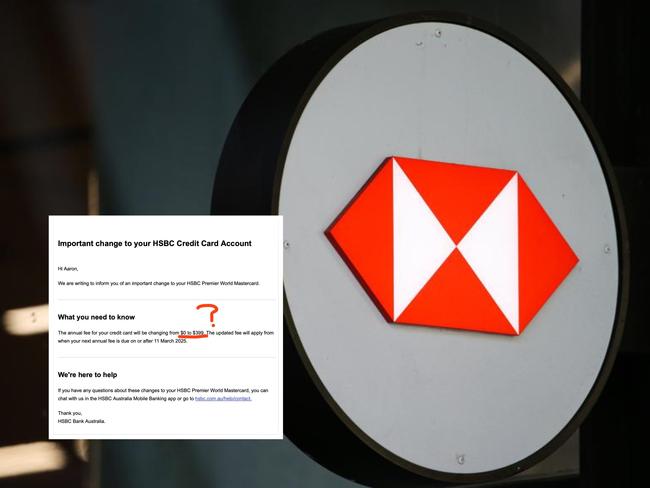

An Australian man has been left gobsmacked after being alerted by his bank that his annual credit card fee had jumped from $0 to $399.

An Australian bank has been the first mover Down Under to catch up with a key anti-scam development being used around the world.

The Australian banking lobby chief has revealed some customers are ignoring warnings about scammers, at an inquiry into new laws to help victims.

Cyndy’s family lost $1.1 million to scammers. But she was shocked to uncover how Australia’s big four banks had facilitated the crime.

The Aussie sharemarket closed up on a strong day of trading, as investors factor in the new US President and how his proposed tariffs will impact the market.

A major bank has reduced its fixed-rate mortgages just weeks out from the Reserve Bank’s official rate-cut decision.

Bank of Queensland confirms several branches will close its doors for the last time in a number of weeks.

One of Australia’s big four banks has renewed its prediction for when the Reserve Bank will cut the cash rate, as spending dropped after the Black Friday sales.

With thousands of Aussie homeowners buckling under the weight of hefty repayments and the cost of living crisis, a financial expert has laid out his best tips going into 2025.

From sextortion to cryptocurrency investment scams, here are the fresh ways scammers are trying to get money from Aussies.

An Australian bank has been slammed for “cash grabbing” after launching a controversial $2.50 fee for customers accessing their own money.

NAB says the worst of the economic cycle could be behind us, predicting a number of rate cuts in 2025 to help households and business alike.

Aussies are being warned they need to reinstall their cards on mobile and wearable devices or risk not being able to use them in just hours.

The ability to get and use cash is getting harder, prompting concerns that physical money faces an uncertain future in Australia – and that’s cause for concern.

SunRice is well along the path of cracking more than $2bn and becoming one of Australia’s biggest food exporters – and investors have been piling in.

A major bank has restored services after an outage left customers unable to access their accounts on one of the busiest shopping days of the year.

Struggling Aussie homeowners could get a rate cut sooner rather than later as the Reserve Bank says it is “increasingly confident” about a reduction.

Cost of living pressures are causing Aussies to turn to credit this festive season, which experts predict could take years to pay back.

The ASX has surged back and broken a days-long losing streak – after better than expected inflationary data out of the US sent markets higher around the world.

A major bank has apologised to thousands of its customers who were impacted by an error that led to them being massively overcharged.

Aussies are being warned to check their mobile and wearable payment devices or risk being unable to purchase items this New Year’s Eve.

Outgoing ANZ chief executive Shayne Elliott has made a huge call on his monumental bonus amid drama over the bank’s controversial year.

An Australian man who planted himself into one of the great mysteries of the digital age has been found in contempt of court.

Protesters have targeted ANZ bosses over the bank’s ties to the world’s largest weapons company and its funding of major polluters.

The ASX 200 traded slightly down ahead of a major decision by the US Federal Reserve, just after the market hit a four-day high.

NAB bosses have acknowledged that its most vulnerable customers were left in the lurch as they faced angry shareholders over the bank’s failures.

Aussies are being slugged with an unwanted Christmas gift of higher home loan repayments, fresh figures show.

The boss of Australia’s largest bank says he was unaware of the controversial $3 service fee being applied to one account before it was announced.

Westpac has announced its chief financial officer is leaving the company just months after its chief executive announced his retirement.

The ASX 200 has continued to suffer major headaches amid falling iron ore prices – with the market falling to a fresh four-week low.

The corporate watchdog is taking a multinational bank to the Federal Court over alleged failings to protect customers from scams.

Westpac says the peak of the cost of living crisis could be behind us with the number of Aussies needing the bank’s help to pay their loans falling.

The Reserve Bank has made a major call on the potential impact of Donald Trump’s second presidency on the Australian economy.

A sharp sell-off in banking and tech stocks pushed the Australian sharemarket into the red on Tuesday, even as the heavyweight mining sector soared.

Original URL: https://www.news.com.au/finance/business/banking