ASX closes in on record high

The Australian sharemarket traded strongly on Friday off the back of further rate cuts from the US central bank.

The Australian sharemarket traded strongly on Friday off the back of further rate cuts from the US central bank.

One of Australia’s Big 4 banks has posted a mammoth statutory profit for the first financial year quarter, asserting the economy is “fundamentally sound” despite cost of living pressures.

The struggling Chinese economy has few rays of hope for Australian miners, as the big iron ore producers sink the ASX to a loss on Monday.

Two of Australia’s big four banks say Aussies are finding a way to pay their mortgages despite cost-of-living pressures.

One of Australia’s biggest banks has warned of a “challenging” time for customers as it releases its full-year results.

Aussie shares rallied on Wednesday as the US vote count rolled in showing former President Donald Trump on a clear pathway to victory.

The Aussie share market rallied strongly off the back of an unexpected polling result out of the US.

Westpac has flagged the majority of mortgage holders don’t need a rate cut, as they have become accustomed to higher interest rate payments.

The big four banks are profiting a huge $200k off the average Aussie mortgage by charging higher than neccesary interest rates, new research has found.

A Brisbane woman has accused a major bank of “disgusting” behaviour after it froze access to her elderly mother’s account.

Customers at a major Australian bank have been warned to ignore scammers trying to take advantage of a near day-long outage.

A big four bank will reduce interest rates by up to 0.25 per cent, but you’ll need to meet this strict criteria.

Commonwealth Bank staff have been issued a brutal warning from their employer, with the company threatening their pay over its return-to-office push.

Amid rampant bank branch and ATM closures, new figures have revealed a surprising turn in the use of cash across Australia.

Aussies have pocketed $6.4bn in extra income since July’s Stage 3 tax cuts, but what we’re doing with it might come as a surprise.

The ASX 200 has again traded sideways on Thursday, after $48bn was wiped off the sharemarket during Tuesday’s trading.

As customers of banks were left high and dry in Broken Hill’s blackout, staff of the locally-owned bank went to extremes to help customers.

Customers have slammed a big four bank for its “outrageous disregard” after it closed a local branch, forcing them to drive 1.5 hours to do their banking.

CommBank customers woke on Saturday to find funds had been taken from their accounts for transactions they had already paid for.

A parliamentary inquiry into the response of insurers to severe floods in several states in 2022 had let down many victims by failing to meet their obligations.

The ASX 200 has fallen from a record high, as investors are disappointed with the economic growth of Australia’s largest trading partner.

Australians shopping globally online are being charged a hidden fee, leading to calls for the Albanese government to extend its action on dodgy practices.

The big four banks have rolled out a controversial change to the way Australians can access their hard-earned cash.

The ASX has closed at another record high this week, driven by stronger than expected Australian economic news.

It is getting harder and harder to use cash in Australia, as the latest data paints a tough picture for cash users and the older population.

Australia’s sharemarket has temporarily fallen from its record high on Tuesday, as tech stocks offset strong gains by banks and miners.

Customers are feeling the pinch from the cost of living crisis, with Australia’s largest bank revealing the huge number of people struggling to pay their mortgages.

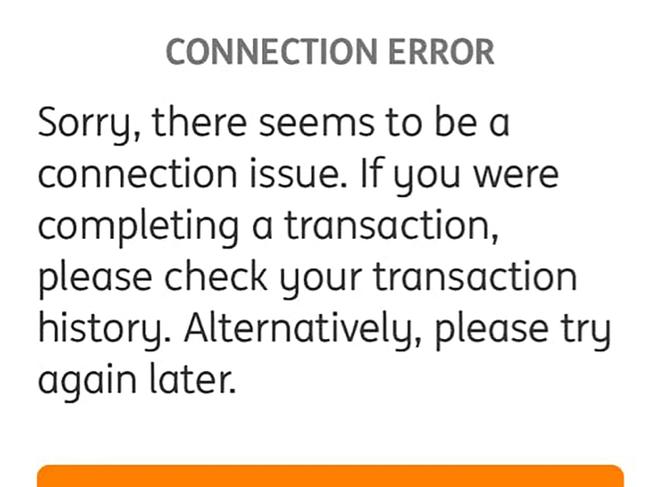

Customers have claimed outages remain despite banks announcing services had been ‘restored’.

Australia’s central bank has pointed to a theory as to why our high inflation feels like it is dragging on, and on, and on and on.

Furious Aussies say they are not able to access online banking for a second straight day as a major bank has suffered outages.

A crackdown on card surcharges has been criticised as “fiddling around the edges while Rome burns”.

Westpac, St George and two regional banks have been hit by an outage affecting app access and online banking, with Aussies left unable to access their money.

A Sydney MP is pushing for an overhaul of 20-year-old regulations that cost Aussies billions of dollars every year.

One of Australia’s major banks has cut against the grain in the age of digital wallets and will no longer offer a key service, claiming declining interest.

One of Australia’s biggest banks has issued a warning about business confidence after the latest figures were revealed.

One of Australia’s big four banks has made a huge call on its fixed home loan rates – putting it on the level with its competitors.

The Australian sharemarket fell on Friday as the big miners wobbled and uncertainty courses through Wall Street.

One of Australia’s biggest banks has agreed to a whopping $85 million settlement over an alleged car loan fiasco.

Nearly two million Aussies could soon receive hundreds of dollars after multiple major banks were ordered to issue more than $28m in refunds.

The sharemarket inched higher on Thursday as investors braced for Israel’s response to Iranian missile and terror attacks and the release of crucial US jobs data.

A job cull is sweeping through one of Australia’s biggest insurance companies, even as the company rakes in big profits.

An industry-first agreement will look to protect one Australian fund’s workers in the age of ChatGPT with a new “gold standard”.

The Australian sharemarket retreated from record highs on Tuesday on a sharp sell-off in the mining sector.

One of the big four banks has slashed the interest rate on one of its most popular savings accounts unless customers comply with a new condition.

The Australian sharemarket snapped a three-day losing streak on Thursday in a frothy rebound propelled by consumer stocks.

The Aussie sharemarket dipped lower on Wednesday as bank stocks tumbled.

One of Australia’s largest banks has been slapped with a record-breaking multimillion-dollar fine.

The sharemarket dipped lower on Tuesday as the RBA delivered some hawkish rhetoric on interest rates, even as the miners boomed on fresh Chinese support.

Countless Australian mortgage holders are being slugged an extra $6000 per year by their bank – for one infuriating and unnecessary reason.

An economist has issued a dire prediction about the “really dangerous” interest rates in Australia on the eve of the Reserve Bank’s rates decision.

The world’s biggest economy has just cut interest rates by a “jumbo” 50 basis points. Here’s what that means for Australia.

The Australian sharemarket booked a fresh record high on Thursday as investors celebrated the US Fed’s “jumbo” rate cut.

One of Australia’s big four banks is exploring the prospect of trialling an AI-style chatbot that could replace its call centre staff.

The rate cut rally in Australian shares continued on Tuesday, with the local bourse hitting fresh highs once again as it booked a fourth consecutive session in the green.

Growing jubilance around this week’s interest rate cut in the world’s largest economy propelled Aussie shares to a record high.

Aussie homeowners have been smashed with interest rate pain for years now and a leading economist warns the stress isn’t going to end anytime soon.

As Australia’s biggest companies do all they can to cut costs, the corporate juggernauts are pulling back profits to pay shareholders.

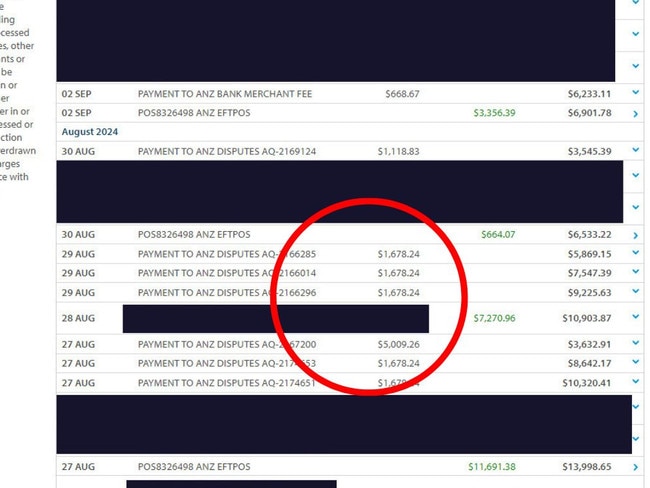

An Australian company is on the brink of collapse after scammers stole nearly $40,000 from it and the bank refused to reimburse the business.

Economic activity jumped last month, but Australia’s biggest bank warns the frothy spending could be temporary.

A judge has issued a stern warning after the trial of a former banker was delayed at the last minute when the prosecution significantly altered their case.

The Australian sharemarket lifted on Tuesday on the back of a rally in energy stocks and some relief from a rattled Wall St.

Aussies and business are growing increasingly fearful of a stagnating economy, with new concerns about potential job losses.

Attempts to overhaul the RBA through bipartisan support have been quashed, but the Treasurer has suggested he’ll seek the backing of a surprise group.

Westpac has announced its new chief executive, who has a vision to return the big-four bank to a “position of leadership”.

An Aussie bank has cut most of its fixed rate loans by up to 0.5 per cent in welcomed relief for prospective homeowners who are eyeing off a potential cut in the cash cut in the coming months.

The cost of managing your money, getting a loan, and insuring your possessions has gone up way more than the actual inflation rate in the past year.

Two people will likely be deported after being caught running a scam putting card-reading devices into the card slots of ATMs.

The Aussie share market finished the week, and the reporting month of August, in the green as it marked the third straight week of gains.

Two out of the four chief executives of Australia’s major banks have tipped an early-2025 cash rate cut.

Despite concerns about scams and criminal behaviour, Australia is seeing the fastest expansion of crypto ATMs in the world.

Slow moving reforms to the way Aussie workers are paid superannuation is costing the workforce billions of dollars every year.

The Australian share market fell again on Thursday, after a poor start thanks to Wall St, as several big name companies report results.

The Westpac Group boss believes the Reserve Bank will begin cutting rates from early next year, forecasting the figures rates will settle at.

One major bank has made a huge move on its fixed rates for home loan customers after the inflation rate eased slightly.

The Australian Stock Exchange ended Wednesday flat after some of the country’s biggest companies reported some less than stellar results.

Facing mounting student debts and the cost-of-living grind, younger people are getting savvier on who holds onto their money.

The local sharemarket lifted on Monday as buoyant investors cheered the prospect of a September rate cut in the world’s largest economy.

As the big four Australian banks continue making billion-dollar profits, more and more families are falling behind on their house payments.

Another major bank has moved to slash fixed and variable rates, following other lenders including Westpac and NAB.

A major bank was briefly plagued by an outage, with customers flooding social media with frustration before it was resolved.

Original URL: https://www.news.com.au/finance/business/banking/page/3