‘Fiddling’: Surcharge crackdown lashed

A crackdown on card surcharges has been criticised as “fiddling around the edges while Rome burns”.

A crackdown on card surcharges has been criticised as “fiddling around the edges while Rome burns”.

Westpac, St George and two regional banks have been hit by an outage affecting app access and online banking, with Aussies left unable to access their money.

A Sydney MP is pushing for an overhaul of 20-year-old regulations that cost Aussies billions of dollars every year.

One of Australia’s major banks has cut against the grain in the age of digital wallets and will no longer offer a key service, claiming declining interest.

One of Australia’s biggest banks has issued a warning about business confidence after the latest figures were revealed.

One of Australia’s big four banks has made a huge call on its fixed home loan rates – putting it on the level with its competitors.

The Australian sharemarket fell on Friday as the big miners wobbled and uncertainty courses through Wall Street.

One of Australia’s biggest banks has agreed to a whopping $85 million settlement over an alleged car loan fiasco.

Nearly two million Aussies could soon receive hundreds of dollars after multiple major banks were ordered to issue more than $28m in refunds.

The sharemarket inched higher on Thursday as investors braced for Israel’s response to Iranian missile and terror attacks and the release of crucial US jobs data.

A job cull is sweeping through one of Australia’s biggest insurance companies, even as the company rakes in big profits.

An industry-first agreement will look to protect one Australian fund’s workers in the age of ChatGPT with a new “gold standard”.

The Australian sharemarket retreated from record highs on Tuesday on a sharp sell-off in the mining sector.

One of the big four banks has slashed the interest rate on one of its most popular savings accounts unless customers comply with a new condition.

The Australian sharemarket snapped a three-day losing streak on Thursday in a frothy rebound propelled by consumer stocks.

The Aussie sharemarket dipped lower on Wednesday as bank stocks tumbled.

One of Australia’s largest banks has been slapped with a record-breaking multimillion-dollar fine.

The sharemarket dipped lower on Tuesday as the RBA delivered some hawkish rhetoric on interest rates, even as the miners boomed on fresh Chinese support.

Countless Australian mortgage holders are being slugged an extra $6000 per year by their bank – for one infuriating and unnecessary reason.

An economist has issued a dire prediction about the “really dangerous” interest rates in Australia on the eve of the Reserve Bank’s rates decision.

The world’s biggest economy has just cut interest rates by a “jumbo” 50 basis points. Here’s what that means for Australia.

The Australian sharemarket booked a fresh record high on Thursday as investors celebrated the US Fed’s “jumbo” rate cut.

One of Australia’s big four banks is exploring the prospect of trialling an AI-style chatbot that could replace its call centre staff.

The rate cut rally in Australian shares continued on Tuesday, with the local bourse hitting fresh highs once again as it booked a fourth consecutive session in the green.

Growing jubilance around this week’s interest rate cut in the world’s largest economy propelled Aussie shares to a record high.

Aussie homeowners have been smashed with interest rate pain for years now and a leading economist warns the stress isn’t going to end anytime soon.

As Australia’s biggest companies do all they can to cut costs, the corporate juggernauts are pulling back profits to pay shareholders.

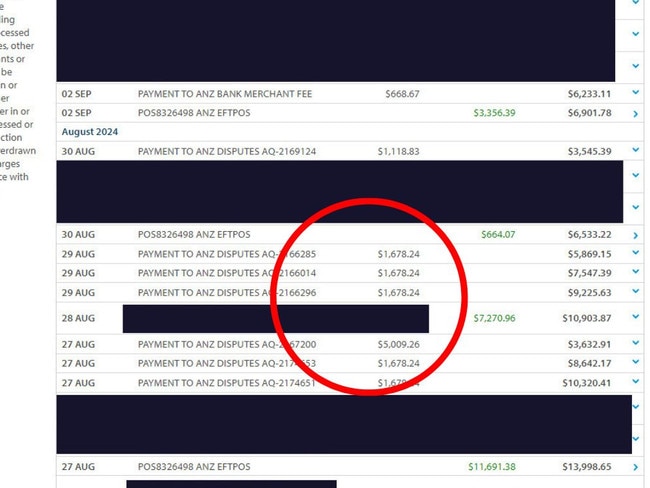

An Australian company is on the brink of collapse after scammers stole nearly $40,000 from it and the bank refused to reimburse the business.

Economic activity jumped last month, but Australia’s biggest bank warns the frothy spending could be temporary.

A judge has issued a stern warning after the trial of a former banker was delayed at the last minute when the prosecution significantly altered their case.

The Australian sharemarket lifted on Tuesday on the back of a rally in energy stocks and some relief from a rattled Wall St.

Aussies and business are growing increasingly fearful of a stagnating economy, with new concerns about potential job losses.

Attempts to overhaul the RBA through bipartisan support have been quashed, but the Treasurer has suggested he’ll seek the backing of a surprise group.

Westpac has announced its new chief executive, who has a vision to return the big-four bank to a “position of leadership”.

An Aussie bank has cut most of its fixed rate loans by up to 0.5 per cent in welcomed relief for prospective homeowners who are eyeing off a potential cut in the cash cut in the coming months.

The cost of managing your money, getting a loan, and insuring your possessions has gone up way more than the actual inflation rate in the past year.

Two people will likely be deported after being caught running a scam putting card-reading devices into the card slots of ATMs.

The Aussie share market finished the week, and the reporting month of August, in the green as it marked the third straight week of gains.

Two out of the four chief executives of Australia’s major banks have tipped an early-2025 cash rate cut.

Despite concerns about scams and criminal behaviour, Australia is seeing the fastest expansion of crypto ATMs in the world.

Slow moving reforms to the way Aussie workers are paid superannuation is costing the workforce billions of dollars every year.

The Australian share market fell again on Thursday, after a poor start thanks to Wall St, as several big name companies report results.

The Westpac Group boss believes the Reserve Bank will begin cutting rates from early next year, forecasting the figures rates will settle at.

One major bank has made a huge move on its fixed rates for home loan customers after the inflation rate eased slightly.

The Australian Stock Exchange ended Wednesday flat after some of the country’s biggest companies reported some less than stellar results.

Facing mounting student debts and the cost-of-living grind, younger people are getting savvier on who holds onto their money.

The local sharemarket lifted on Monday as buoyant investors cheered the prospect of a September rate cut in the world’s largest economy.

As the big four Australian banks continue making billion-dollar profits, more and more families are falling behind on their house payments.

Another major bank has moved to slash fixed and variable rates, following other lenders including Westpac and NAB.

A major bank was briefly plagued by an outage, with customers flooding social media with frustration before it was resolved.

The Australian sharemarket advanced for a 10th consecutive session on Thursday, marking the longest rally in stocks since 2015.

Another of the major Aussie banks has cut mortgage rates, helping people scraping together repayments or a house deposit.

Australia’s largest bank has detailed the huge cost of keeping cash circulating nationwide, saying what we take for granted is “challenging”.

A major bank is poised to axe up to 600 jobs, following on from similar action that brought on 250 job cuts just last year.

A major commercial property player has taken a huge financial hit, as negativity around iron ore leaves room for investors to pounce.

Small Aussie businesses have glaring holes in their cyber security, and it’s costing them dearly as tougher penalties take effect.

Chinese manufacturing, and it turns out Chinese babies, have left their mark on the ASX on Monday despite the market closing up.

More Westpac mortgage holders are falling behind on their payments while the bank posts a flat $1.8bn profit for the latest quarter.

A staggering number of dodgy investment and crypto sites are being pulled offline in a crackdown by Australia’s corporate watchdog.

A new report has made surprising findings about the use of cash and the number of businesses accepting cash in Australia.

One of Australia’s biggest banks has revealed a big change in how it handles fossil fuel companies in a bid to tackle climate change.

Australia’s biggest bank has just delivered some heartening news for struggling mortgage holders.

Commonwealth Bank has revealed loan arrears are on the rise, as it posts a $9.48bn statutory profit for the full year.

Bumper results from a bellwether retail giant injected renewed confidence into the Aussie sharemarket on Monday.

A man at the top of the Reserve Bank of Australia has warned Aussies against “false prophets” who claim to know what will happen in the future.

A former bank employee’s life has been “destroyed” by allegations she defrauded multiple banks out of tens of thousands of dollars, a court has been told.

Mortgage holders have been given a reprieve after the Reserve Bank kept interest rates on hold at 4.35 per cent, but should not expect a cut anytime soon.

One of Australia’s banking giants has shut down a home loan lender, ending a 33-year-run for the troubled business.

The largest employer in the country has ordered its staff to get back into the office as working from home appears done for good.

A financial expert has revealed a genius way to save $8500 a year in tax by making some simple changes.

There was ‘nowhere to hide’ for traders on Friday as the ASX saw $59bn evaporate by the closing bell.

Inflation has hit 3.8 per cent for the June quarter, but some economists say that figure has given the Reserve Bank room to keep rates on hold.

The Albanese government will force social media companies, banks and telcos to comply with new codes aimed at fighting scammers online.

The sharemarket retreated on Tuesday on the back of a sharp mining slump.

With one simple act, a common financial gripe can be avoided and Australians can save $200m a year, the consumer watchdog says.

A growing number of Australians are turning to a lender that finances people the major banks deem too risky.

The Australian sharemarket slumped into a sea of red on Thursday as a gruesome tech rout on Wall St crippled confidence.

A Queensland couple thought they were investing their cash safely, but when their bank got involved, they learned how close they’d been to losing a small fortune.

One of Australia’s biggest banks has just delivered a big gift to Aussies desperate to lock down a home of their own.

A glamorous former bank employee has scored a win as she prepares to fight allegations she used her role to defraud banks.

Original URL: https://www.news.com.au/finance/business/banking/page/4