Westpac scraps cardless cash withdrawals

One of Australia’s major banks has cut against the grain in the age of digital wallets and will no longer offer a key service, claiming declining interest.

Westpac has scrapped cardless cash withdrawals, blaming declining physical cash use.

Customers will need a physical card to get cash from 8pm AEST on Friday.

Cardless cash entails a user creating a number in the banking app, and that pin is used at an ATM to get cash without a physical card - while other people can extract the cash using a code.

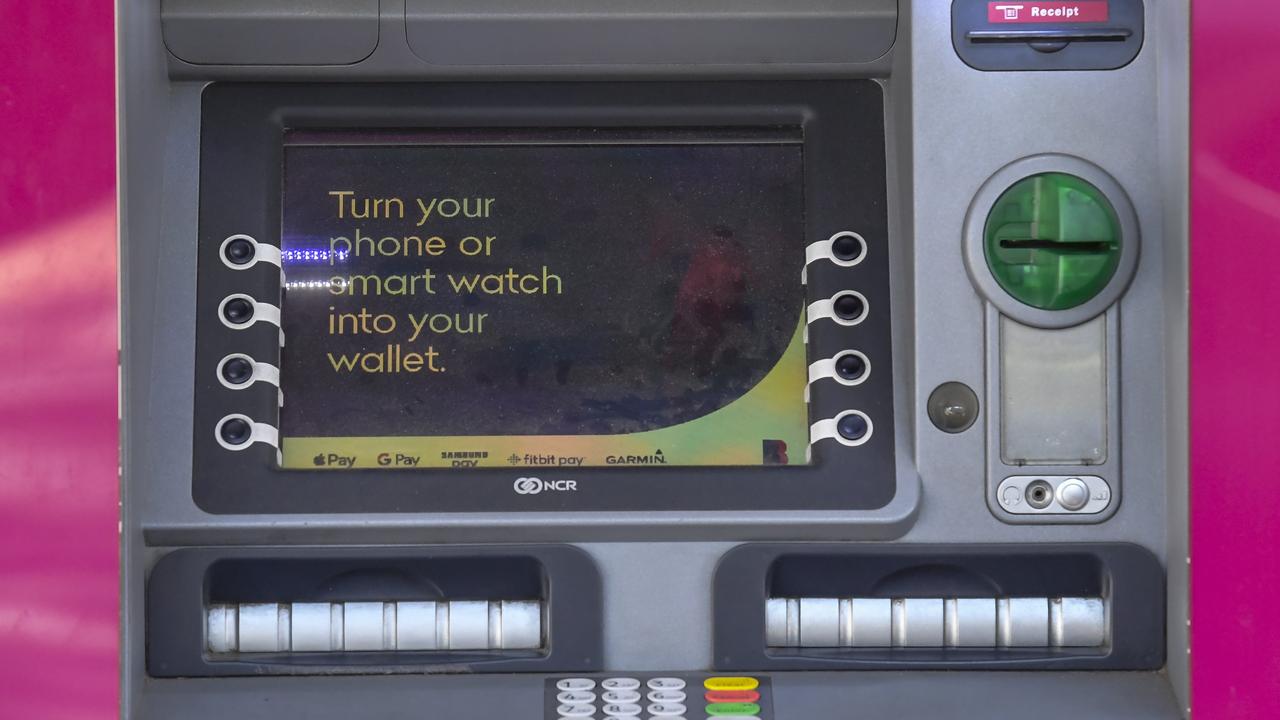

Westpac said the change has been driven by more people using digital payments as opposed to spending cash.

“Over a 12-month period, we’ve seen a 21 per cent increase in mobile wallet transactions as more customers choose the speed, security and convenience of digital banking,” a spokesperson said.

“At the same time, there has been a decline in cardless cash withdrawals.”

Westpac has 7000 ATMs across the country and 500 branches.

People can still deposit cash without a card. Westpac’s move comes at a time when many people do not usually have their wallet with them, using digital wallets to pay for everyday expenses.

Cash use in Australia is not declining as smoothly or as widespread as many people predicted.

Reports in the past few months have shown a quarter of Australians still rely on cash when purchasing from small businesses. This correlates with small businesses largely preferring cash, with only 55 per cent of Australian small businesses offering debit or credit as a way for customers to pay, a report from small business accounting outfit Xero found.

In its annual results in August, Commonwealth Bank said it had cut the number of ATMs from 3542 to 1916 machines in the space of five years.

But Australia’s biggest bank spent $410m in the past financial year providing “cash services” across the country.

In 2007, about 70 per cent of all transactions were made using cash, but that fell to 13 per cent in late 2022, the latest comprehensive Reserve Bank data shows.

The share of in-person transactions made with cash halved over the three years to 2022, the data shows.

“I’d say we’ll be functionally cashless by the end of 2025 – it’ll just be a complete rarity,” UNSW Business School professor Richard Holden said last year.

The overall decline in cash has cost the private sector. In June, Australia’s last cash transport company, Armaguard, had to rely on a $50m bailout from its eight largest customers, as there is less and less work for the armoured cash transit businesses.

The corporates who covered the bailout were ANZ, Australia Post, Bunnings, Coles, Commonwealth Bank, NAB, Westpac and Woolworths.