Westpac

From Westpac interest rates and credit cards to home loans, we have all the latest banking news.

ASX snaps four-week losing streak

Major bank’s huge call on house prices

Big bank’s $50m underpayment shock

‘Ominous sign’: Major bank move on rates

A big four bank is lifting fixed interest rates in an “ominous sign” for all mortgage holders.

Westpac boss’ huge call on WFH case

Westpac cuts 200 bank teller jobs

Major bank slashes home loan rates

Major bank takes ‘chainsaw’ to rates

ASX jumps as Westpac hits decade high

‘Dirty secret’: Big bank’s call on rate hold

One thing stopping Aussies getting rate relief

Bank predicts bad news for homeowners

Aussie bank chief’s brutal Trump call

Big bank to cut 1500 jobs in huge cull

Major bank’s huge call on Trump

‘Locked in’: Major bank’s big rate cut call

Fugitive’s daughter breaks down in court

Major bank’s huge cash backflip

Major bank reveals huge rate cut

Australia urged to remain calm on Trump tariffs

Major bank to move 190 Aussie jobs offshore

Westpac, Bendigo drag down ASX

Big bank posts eye-watering profit

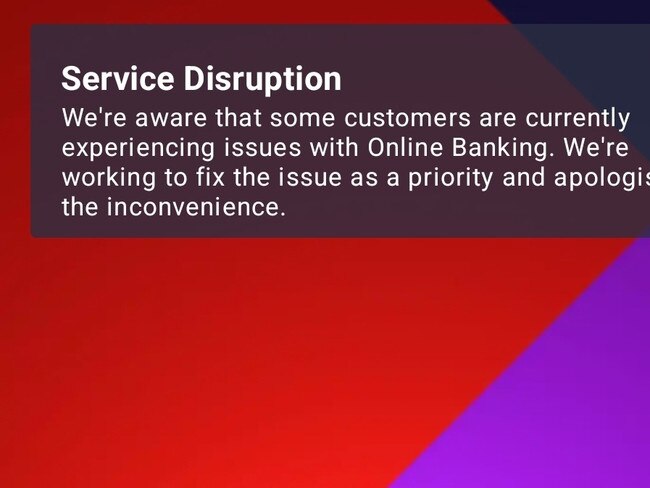

Relief for millions of Westpac customers

Second major bank cuts interest rates

‘It’s on’: Major bank expects Feb rate cut

Major bank’s huge $6.35m error

‘Team player’: Major bank’s CFO retires

Big bank’s surprise call on cost of living

Original URL: https://www.news.com.au/topics/westpac