‘Blacklisting’: Big bank’s major change

One of Australia’s biggest banks has revealed a big change in how it handles fossil fuel companies in a bid to tackle climate change.

One of Australia’s biggest banks has revealed a big change in how it handles fossil fuel companies in a bid to tackle climate change.

Australia’s biggest bank has just delivered some heartening news for struggling mortgage holders.

Commonwealth Bank has revealed loan arrears are on the rise, as it posts a $9.48bn statutory profit for the full year.

Bumper results from a bellwether retail giant injected renewed confidence into the Aussie sharemarket on Monday.

A man at the top of the Reserve Bank of Australia has warned Aussies against “false prophets” who claim to know what will happen in the future.

A former bank employee’s life has been “destroyed” by allegations she defrauded multiple banks out of tens of thousands of dollars, a court has been told.

Mortgage holders have been given a reprieve after the Reserve Bank kept interest rates on hold at 4.35 per cent, but should not expect a cut anytime soon.

One of Australia’s banking giants has shut down a home loan lender, ending a 33-year-run for the troubled business.

The largest employer in the country has ordered its staff to get back into the office as working from home appears done for good.

A financial expert has revealed a genius way to save $8500 a year in tax by making some simple changes.

There was ‘nowhere to hide’ for traders on Friday as the ASX saw $59bn evaporate by the closing bell.

Inflation has hit 3.8 per cent for the June quarter, but some economists say that figure has given the Reserve Bank room to keep rates on hold.

The Albanese government will force social media companies, banks and telcos to comply with new codes aimed at fighting scammers online.

The sharemarket retreated on Tuesday on the back of a sharp mining slump.

With one simple act, a common financial gripe can be avoided and Australians can save $200m a year, the consumer watchdog says.

A growing number of Australians are turning to a lender that finances people the major banks deem too risky.

The Australian sharemarket slumped into a sea of red on Thursday as a gruesome tech rout on Wall St crippled confidence.

A Queensland couple thought they were investing their cash safely, but when their bank got involved, they learned how close they’d been to losing a small fortune.

One of Australia’s biggest banks has just delivered a big gift to Aussies desperate to lock down a home of their own.

A glamorous former bank employee has scored a win as she prepares to fight allegations she used her role to defraud banks.

The fallout from the CrowdStrike global tech outage and US President Joe Biden’s decision not to run again have helped push down the Australian sharemarket on Monday.

An alarming number of mortgage holders might need to sell their home, should interest rates stay elevated into next year, new research has revealed.

Computer systems at businesses across the Australian economy could be dealing with the fallout from the Microsoft outage for weeks to come.

One of Australia’s largest banks has crunched the numbers to show Aussies are pulling back on streamers and ‘micro treats’ to maintain spending on the two key things that are most important to them.

The Australian sharemarket lifted on Wednesday on the back of a rising Wall St bull run.

Some dark economic data out of China triggered a sell-off in heavyweight mining stocks on Tuesday, pulling the Aussie market down from record highs.

Australia’s big four banks have loaned more than $3.6 billion to fossil fuels projects and companies in 2023.

Aussies shares continued to rally higher on Monday, crossing the 8000 threshold for the first time in history on speculation of imminent rate cuts in the US.

The Australian sharemarket has closed out the week on a record high as investors position themselves for imminent US Federal Reserve rate cuts.

The benchmark ASX200 has flown close to record highs on Thursday following a huge night of trading on Wall St.

A disturbing inequality between one group of Aussies and everyone else has been highlighted in a new report.

Mining stocks have weighed down the sharemarket again this week, with the benchmark ASX200 dipping into the red on Wednesday.

Australia will continue to provide support to its Pacific neighbours in order to bolster its ability to identify and stop money laundering.

Treasure Jim Chalmers has called on major Aussie banks to continue servicing Australia’s closest international neighbours, pledging $6.3m to help.

Demand in Australia’s housing market could be easing off, with a shock fall in new lending commitments.

Heads of state and senior banking executives will convene in Brisbane for a two-day forum to address concerns banks could pull out of Australia’s Pacific neighbours.

The Australian share market drifted lower in quiet trading on Friday as investors stepped cautiously before Wall St’s big Friday.

The consumer watchdog has granted interim approval for the multimillion-dollar deal to ensure the transport of cash across Australia.

Westpac has launched proceedings against an employee of another bank who allegedly used her role to defraud multiple banks to fund her lavish lifestyle.

A major bank has resolved an outage after customers flooded social media with frustration when they couldn’t access accounts.

One of Australia’s top banking executives has revealed the big four are under constant attack from cyber criminals.

ANZ Bank has been given the final approval for its $4.9bn takeover of Suncorp’s banking arm.

Westpac has been sanctioned, with the industry watchdog saying the bank’s move put vulnerable customers at “high risk” of harm.

The Australian sharemarket notched a powerful rebound rally on Tuesday on the back of iron ore and oil price rises and a surge in banking behemoth Commonwealth Bank.

Finance behemoth Commonwealth Bank has released its latest economic health check on the nation and there is one state blowing everyone else away.

One group of Aussie workers are the most burnt-out in the world, alarming results in a new global study reveal.

Australians have been warned about leaning on risky high-cost credit options like buy now, pay later and payday loans.

Millions of people have been pushed to the brink by rising prices yet a report has revealed Aussie companies made billions from devastating world events.

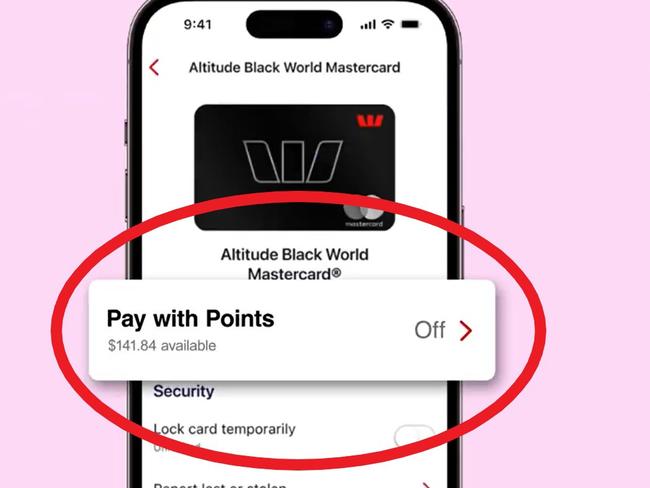

Westpac has made a big change to its app that will affect how millions of Aussies are able to pay for everyday items.

Aussies have rushed to ATMs all over the country to withdraw thousands in cash – here’s why so many are doing it.

Australians are already “struggling” with the cost of living crisis and now a new innovation from Apple has some worried.

Commonwealth Bank has sparked controversy among some customers with a change to how its ATMs can be used.

Australians experiencing financial stress are being urged to exercise their right to seek assistance from their bank or lender.

A family has been left stunned after learning about the huge amounts of money their mother mysteriously withdrew on 70 occasions before her death.

Australian shares slumped on Wednesday after hotter-than-expected CPI numbers renewed inflation fears and narrowed the likelihood of rate cuts this year.

The Australian sharemarket fell lower on Tuesday after weak retail sales data hit discretionary stocks.

A simple prompt could help earn Aussies hundreds of dollars, as a major bank announces a new alert system.

Australia’s biggest bank is hoping to claw customers away from its competitors, announcing a below-average home loan rate.

With hundreds of bank branches closing in recent years, a parliamentary probe into the matter has delivered its final recommendations.

One major Aussie bank has made a huge call about how people will use their tax cut cash boost in the coming months, warning not to expect a shopping spree.

Customers of one of the big four banks were unable to access their accounts online after a major outage to its app and internet banking services

A major bank is just days away from starting its shift towards digital only payments – and Aussies are not happy.

One of Australia’s largest financial services providers is going cashless at its offices but has promised customers cash withdrawal fees from ATMs will be covered.

Locals are fuming over ANZ’s shock move after the bank posted a profit of more than $7 billion last year.

Aussies are about to get a tax cut cash boost and most will ‘spend’ it in a surprising way.

As the Commonwealth Bank boss announced a profit slide, he said one thing was providing a “tailwind” for the Australian economy.

The Aussie sharemarket has remained strong in the wake of a less than ‘hawkish’ interest rates decision by the Reserve Bank of Australia.

Homeowners are feeling the pinch of the cost-of-living crisis, with the number of loans past due at ANZ increasing double digits.

Ahead of the central bank’s impending interest rate decisions, investors on the Australian share market were in an upbeat mood.

The chief executive of one of Australia’s biggest banks has laid bare the stress Aussie homeowners are going through.

Australian shares notched a tepid bounce on Thursday following some dovish rhetoric from the US Fed and positive sentiment around half-year results from NAB.

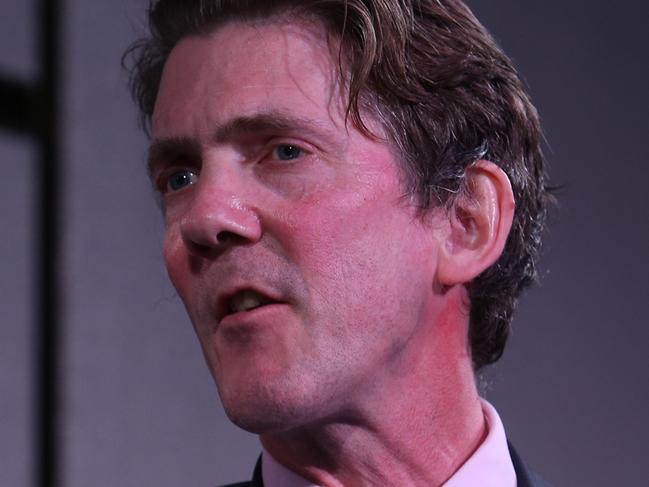

Despite the decline in earnings, freshly minted NAB boss Andrew Irvine hinted that the competitive home loan market was easing.

An Australian bank will go completely cashless from later this month as it switches to a fully digital offering.

Aussie shares slumped on the first day of the new month as anxieties mount about US inflation and interest rates.

Aussie stocks edged higher on Tuesday after a slump in retail sales pushed back fears of impending rate hikes.

Ahead of consumer price figures for the March quarter, the benchmark notched its second session of gains.

Markets regained their composure on Monday after an apparent easing in hostilities between Iran and Israel.

The Aussie sharemarket has ended the week lower after investors responded to reports Israel launched air strikes against Iran.

A Brazilian woman has been arrested after brazenly wheeling the fresh corpse of her uncle into a bank branch where she tried to get him to co-sign a loan.

Firmer than expected unemployment data failed to ease concerns that the RBA will hold interest rates steady through to 2025.

Original URL: https://www.news.com.au/finance/business/banking/page/6