CBA cuts daily cash deposit limit

Commonwealth Bank has sparked controversy among some customers with a change to how its ATMs can be used.

Commonwealth Bank has ignited controversy among some of its customers by reducing the daily deposit limit when using mobile phone numbers.

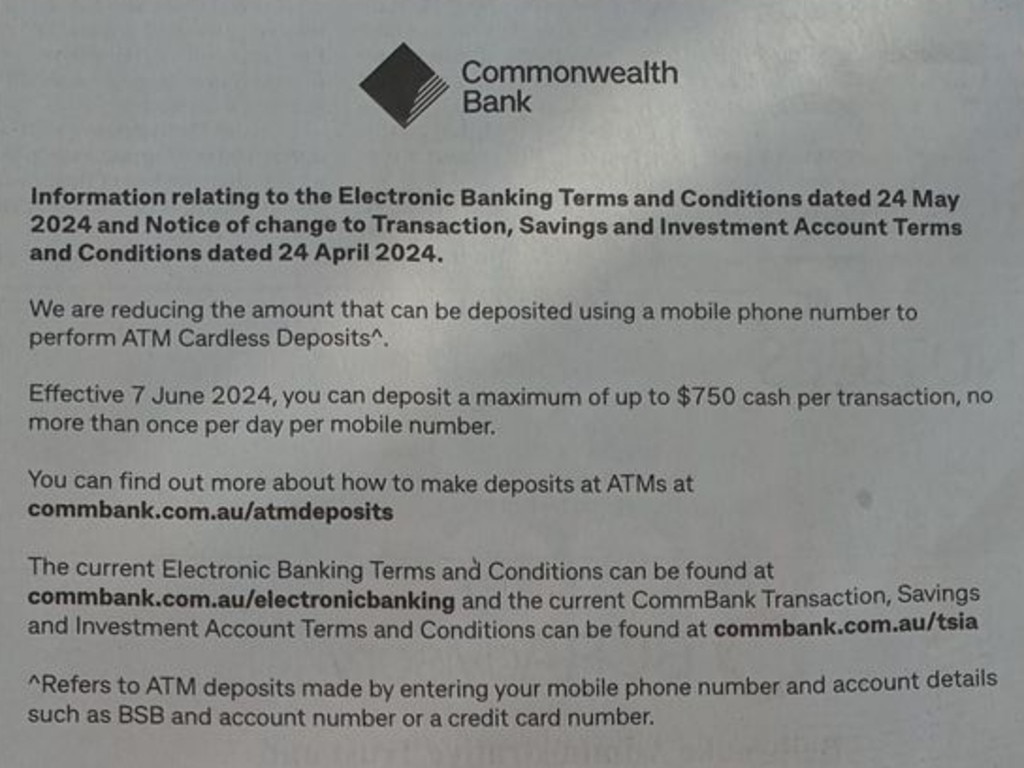

From this week, the maximum amount that can be deposited into accounts using this method has been cut from $1,000 to $750 per day.

This change has sparked dissatisfaction among customers and business owners who rely on making substantial daily deposits.

The new limit applies to CBA’s Cardless Deposit function, allowing customers to deposit cash using their mobile phone numbers.

A CBA spokesperson explained the rationale behind this decision, saying it aims to enhance customer protection against financial crimes.

“As part of this, one cardless deposit of up to $750, per mobile phone number, can now be deposited each day using our Cardless Deposit function,” they told Yahoo Finance.

“When using our deposit ATMs, CBA customers can use their CBA card to make deposits more than once per day, or for amounts over $750 in cash.”

Despite the reduction in cardless deposits, customers can still use their bank cards to deposit up to $10,000 per day.

Additionally, the ‘Pay Someone Else’ feature allows deposits of up to $5,000 per day per card.

The recent adjustment follows previous measures taken by CBA to curb potential money laundering activities.

In 2018, the bank halved the maximum deposit limit at its ATMs from $20,000 to $10,000.

While the bank’s intent is to bolster security, the new limit has frustrated some customers.

One posted an image of the notice to Facebook with the words: “This seems incredibly low for any small business wanting to deposit their daily business takings.”

A business owner expressed their dissatisfaction on social media, stating, “Will be changing banks. I run all my businesses via Commonwealth.

Another customer echoed this sentiment, remarking, “The war against cash is going into overdrive now.”

Comparatively, other major Australian banks offer varied limits on their deposit functions.

Westpac customers can deposit up to $4,000 using their mobile phones, with cash deposits using a card also capped at $10,000.

NAB’s Smart ATMs allow deposits of up to $10,000 per day, with a limit of 50 notes per transaction.

Similarly, ANZ’s Smart ATMs accept up to 50 notes and cheques per transaction, with a daily deposit limit of $10,000 per account.

Aussies ‘will never go totally cashless’

CBA’s move comes as a financial expert claims Aussies will never go cashless because regional and remote communities are still use it for day-to-day transactions.

Recent data shows cash withdrawals are increasing, despite a push for the widespread adoption of digital-only payments.

Reserve Bank of Australia data showed Australians made 30,859,700 ATM cash withdrawals in February, up 3.6 per cent compared with February 2023.

The previous month there were 30.2 million ATM withdrawals, worth more than $9 billion, the highest collective sum since July 2020.

ING financial expert Matt Bowen said this was because regional and remote Aussies still needed cash for transactions.

“If you’re one of the few Aussies spending your $50 and $20 notes, you are in the minority. Cash has declined significantly,” Bowen told Sunrise.

“About 70 per cent of transactions face-to-face in 2007 were using cash, it is down to around 13 per cent now. Will we see the decline of cash? I’m not sure.

“There is still around 25 per cent of Aussies who live in regional and remote communities still very reliant on cash for day-to-day transaction, which is unlikely to change any time soon.

“There is still a big portion of consumers that believe you actually spend more when you’re tapping your card.

“It is easier to save money and control your budget when you’re using cash and, of course, the one thing we can’t replicate is that feeling of the $20 bill falling out of a birthday card from grandma.

“That’s something that can’t be replicated with a bank transfer.”