Update for Aussies hit by bank outage

Customers of one of the big four banks were unable to access their accounts online after a major outage to its app and internet banking services

Customers of one of the big four banks were unable to access their accounts online after a major outage to its app and internet banking services

A major bank is just days away from starting its shift towards digital only payments – and Aussies are not happy.

One of Australia’s largest financial services providers is going cashless at its offices but has promised customers cash withdrawal fees from ATMs will be covered.

Locals are fuming over ANZ’s shock move after the bank posted a profit of more than $7 billion last year.

Aussies are about to get a tax cut cash boost and most will ‘spend’ it in a surprising way.

As the Commonwealth Bank boss announced a profit slide, he said one thing was providing a “tailwind” for the Australian economy.

The Aussie sharemarket has remained strong in the wake of a less than ‘hawkish’ interest rates decision by the Reserve Bank of Australia.

Homeowners are feeling the pinch of the cost-of-living crisis, with the number of loans past due at ANZ increasing double digits.

Ahead of the central bank’s impending interest rate decisions, investors on the Australian share market were in an upbeat mood.

The chief executive of one of Australia’s biggest banks has laid bare the stress Aussie homeowners are going through.

Australian shares notched a tepid bounce on Thursday following some dovish rhetoric from the US Fed and positive sentiment around half-year results from NAB.

Despite the decline in earnings, freshly minted NAB boss Andrew Irvine hinted that the competitive home loan market was easing.

An Australian bank will go completely cashless from later this month as it switches to a fully digital offering.

Aussie shares slumped on the first day of the new month as anxieties mount about US inflation and interest rates.

Aussie stocks edged higher on Tuesday after a slump in retail sales pushed back fears of impending rate hikes.

Ahead of consumer price figures for the March quarter, the benchmark notched its second session of gains.

Markets regained their composure on Monday after an apparent easing in hostilities between Iran and Israel.

The Aussie sharemarket has ended the week lower after investors responded to reports Israel launched air strikes against Iran.

A Brazilian woman has been arrested after brazenly wheeling the fresh corpse of her uncle into a bank branch where she tried to get him to co-sign a loan.

Firmer than expected unemployment data failed to ease concerns that the RBA will hold interest rates steady through to 2025.

The Australian sharemarket edged down slightly on Wednesday, as investors settled into a new narrative on inflation.

One of Australia’s major banks has announced a huge change to how thousands of people do their banking – and it’s coming soon.

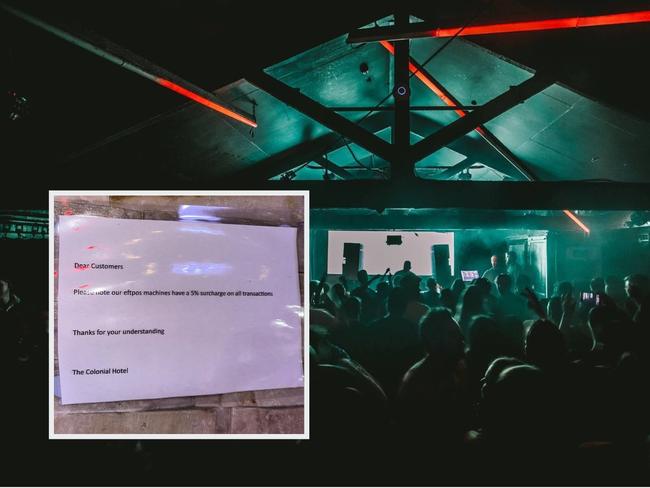

A trendy Melbourne nightclub has been criticised over claims of “ridiculous” surcharges at the popular establishment.

Softer-than-expected producer price data failed to ease the concerns of inflation-worried investors.

An Aussie financial services firm has been forced to close after links to an alleged sinister money laundering operation.

Citi banker Lucy Baldwin is one of the few market bears still standing. This is why she thinks there could be a hard landing.

After household spending jumped during February due to Taylor Swift’s sold-out stadium tour, turnover in March was weaker.

In a startling spray, the Treasurer has challenged the economic understanding of his political foes as he defends a major policy change.

A rally in material stocks helped push the benchmark into the green, as investors awaited fresh inflation data due Wednesday evening.

Aussies are battling explosive house price growth with a smart new trick that means they can buy a property without moving out into the boondocks.

The Albanese government’s overhaul of mergers policy follows concerns that anti-competitive takeover deals are stifling innovation and cause price hikes.

The Australian share market was up slightly as investors await new inflation data from the US, which will be key to its path on interest rate cuts.

Even as household budgets come under pressure, tens of thousands of Aussies took on additional debt in February, new data shows.

Galloping cots come to life in the desert, a couple looking on adoringly, and a guy with a mullet firing up a laser gun. What is going on in this bizarre ad?

An online banking customer has urged others to update their passwords after they couldn’t access their account.

Australia’s 2.6 million small and medium businesses could be key to unlocking the next wave of productivity growth.

As Australians lose hundreds of millions of dollars to scammers each year, a tech insider says the banks’ data troves are a significant hurdle to tighter security.

A NAB teller has been praised for refusing to allow a Melbourne woman to make a $2,000 deposit to help out her sick boyfriend overseas.

While the cash transit business previously claimed it was teetering on the brink, a $26m funding lifeline has been rejected.

Shares clawed back losses from Tuesday’s session to come within less than 35 points of the benchmark’s all time high.

The woman was trying to cancel her home insurance and sell her home so she could send money to a new boyfriend.

While criminals siphon hundreds of millions of dollars via scams each year, one bank has launched a new defence.

Lower gold and oil prices weighed on the Australian sharemarket on Friday, but overall the ASX 200 ended the week 1.3 per cent higher.

The ASX booked a ‘relief rally’ on Thursday on the back of a US Federal Reserve meeting that maintained its outlook for three rate cuts in 2024.

A devastated Aussie dad has revealed how he lost his entire life savings after opening one simple email.

Australians have been hit with a record number of fraudulent credit card purchases and withdrawals, new data has revealed.

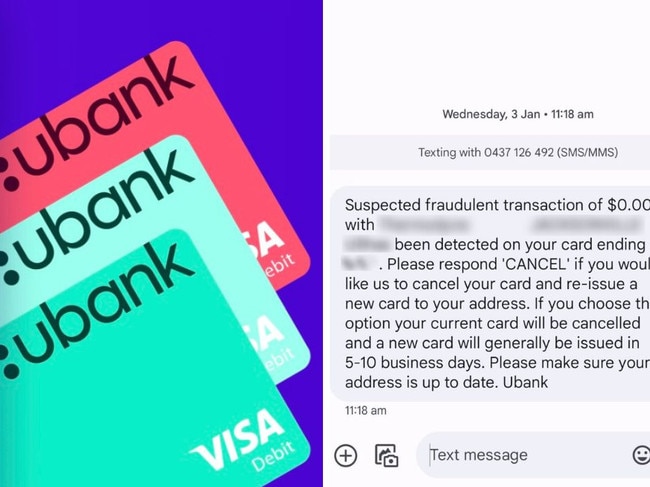

A Melbourne man who saw $20,000 drained from his account after a few minutes on the phone has blamed a “random” text from his bank.

Australia’s surging mining giants pushed the ASX higher on the day the Reserve Bank left the cash rate unchanged.

Snapping a two-day winning streak, Australian shares sank on Thursday.

An Australian bank has hiked its interest rates, as new data reveals the shocking rise in average mortgage payments since the pandemic.

Local shares rose on Wednesday, led by retail and bank stocks, after a positive lead from Wall Street.

One of Australia’s big four banks has announced another round of bank branch closures in two major cities.

One of Australia’s big four banks has announced another round of bank branch closures in two major cities.

Customers at one of the big four banks were left outraged after its app went down.

Buoyed by the financials sectors, the Australian sharemarket raced ahead to close out the week at an all-time high.

Buoyed by a bumper session for Australia’s largest retail bank, the benchmark set a record close on Thursday.

A senate inquiry examining the difficulties of regional banking has asked Bankwest to explain its decision to close 45 branches.

Australians, under pressure from the increased cost of living, took out fewer home loans across the first month of 2024.

Customers are furious as a major regional Australian bank, which is part of CBA, announced closures of every branch in favour of online banking.

The benchmark eked out a 0.1 per cent gain on Wednesday after the financials sector rallied late in trading.

Australians are feeling more confident about their home buying plans, and they’re prepared to make big changes to crack into the housing market.

The local share market was off to a record breaking start in March, as fresh highs on Wall Street and positive manufacturing data from China bolstered the benchmark.

The ASX surged to a near record high on Thursday after soft inflation and retail data suggested an end to the RBA’s rate hiking cycle.

One of Australia’s biggest banks has just announced a new round of job cuts, with some of the positions set to move offshore.

An Australian man has captured the moment a scammer lost his cool while trying to access the man’s bank details.

With profit season nearing its end, the share market advanced for a fourth straight session on Tuesday.

The benchmark ASX 200 fell 0.74 per cent midweek, with a slump in mining stocks and ‘mixed results’ from supermarket giant Woolworths.

Competition should be an essential part of Aussie prosperity but a recent decision in banked shows the whole system is screwed.

Getting access to your own cash isn’t just getting harder – it’s costing a lot more too, and one leading expert says Aussies should worry.

Australia’s biggest bank has raised mortgage holders’ hopes by predicting interest cuts will start rolling earlier than expected, with at least three reductions before Christmas.

Bank closures in regional Australia have increased the demand for cash withdrawals at supermarkets, but one Aussie giant is fighting back.

Michele Bullock has defended a contentious move to lift interest rates as she made a stark warning of what’s to come.

Major banks are also being impacted by the cost of living pressures and the results are playing havoc with the Aussie sharemarket.

One of the nation’s biggest banks has made a major call on cash transactions, with many Aussies up in arms over the decision.

With banks closing up shop in remote parts of the country, Australia Post is forking out thousands to ensure there’s cash in the towns.

A string of bank branch closures in major cities marks a devastating shift due to impact millions of Aussies.

Bob Katter’s embarrassment at having his cash refused at a cafe has highlighted a glaring problem with Australia’s move towards being a cashless society.

It was a mixed day for the Australian sharemarket, which was down overall for the week.

The Australian sharemarket made gains on Thursday in sectors including technology, banking and utilities.

One of Australia’s biggest banks has issued an urgent warning to stay vigilant ahead of a day that attracts heartbreaking scams.

Original URL: https://www.news.com.au/finance/business/banking/page/8