Melbourne man’s $20,000 in savings gone after phone call

A Melbourne man who saw $20,000 drained from his account after a few minutes on the phone has blamed a “random” text from his bank.

A young Australian man who lost a large chunk of his savings in a phone scam claims a lot of the blame lies at the feet of his bank.

The 32-year-old Melbourne man is a customer of Ubank, a subsidiary of NAB, and claims the digital only bank’s strange security measures are what coaxed him into handing $20,000 over to fraudsters.

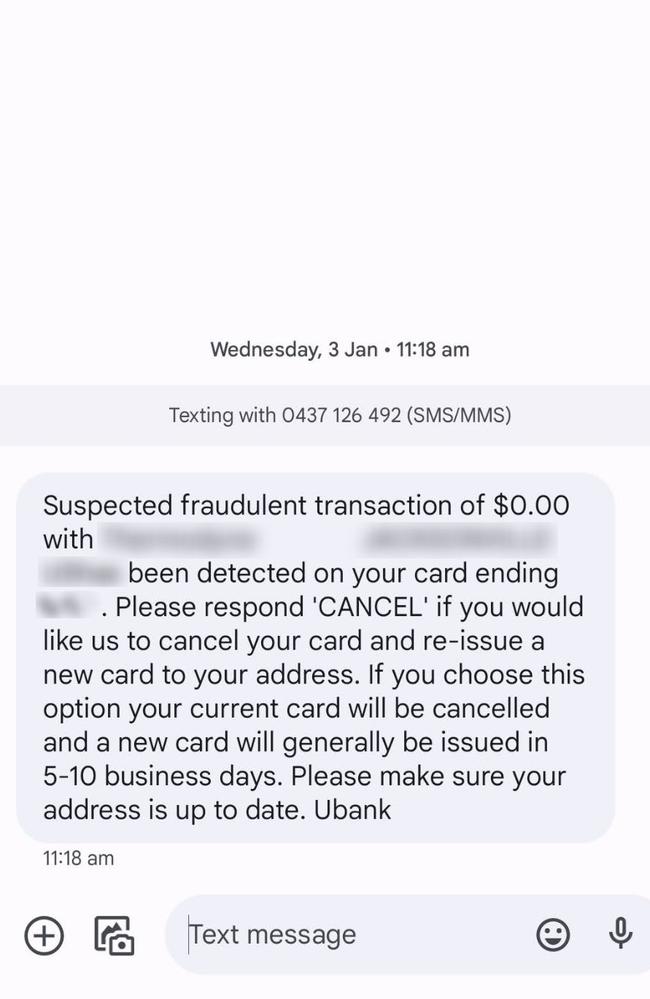

The customer did not wish to speak directly about his ordeal, but his older sister, Lanie*, told news.com.au that in January this year, her sibling received a strange text message with the sign-off “Ubank”.

The message was from what appeared to be a random Australian number, and read “Suspected fraudulent transaction of $0.0 has been detected … Please respond CANCEL if you would like us to cancel your card and reissue a new card to your address”.

He thought this was a scam.

But after ringing Ubank, Lanie’s brother learnt this text thread was legitimate and had indeed been sent by the financial institution.

So when scammers did actually call him three weeks later, on January 25, the Melbourne man, who had been saving hard to buy his first home, believes he was already primed to give them what they wanted.

“A few minutes on the phone and suddenly $20,000 gone, that’s hard to accept,” Lanie lamented.

Lanie’s brother received a call from an unknown number and, upon answering it, the caller claimed they were an employee of Ubank.

The man on the other end of the phone had an Australian accent, he recalled.

This person knew the last four digits of his credit card, the most recent transactions on his bank account and they also gave him a reference number.

Armed with this information, the scammers were able to convince him to send through a pin that had been texted to him to confirm his identity.

In actuality, this was the security code they needed to access his bank accounts.

“It’s really clever in hindsight,” Lanie said, adding that “the scammer was really professional sounding”.

The scammer kept Lanie’s brother on the phone for half an hour while they drew the information out of him and tried to distract him from checking his bank accounts.

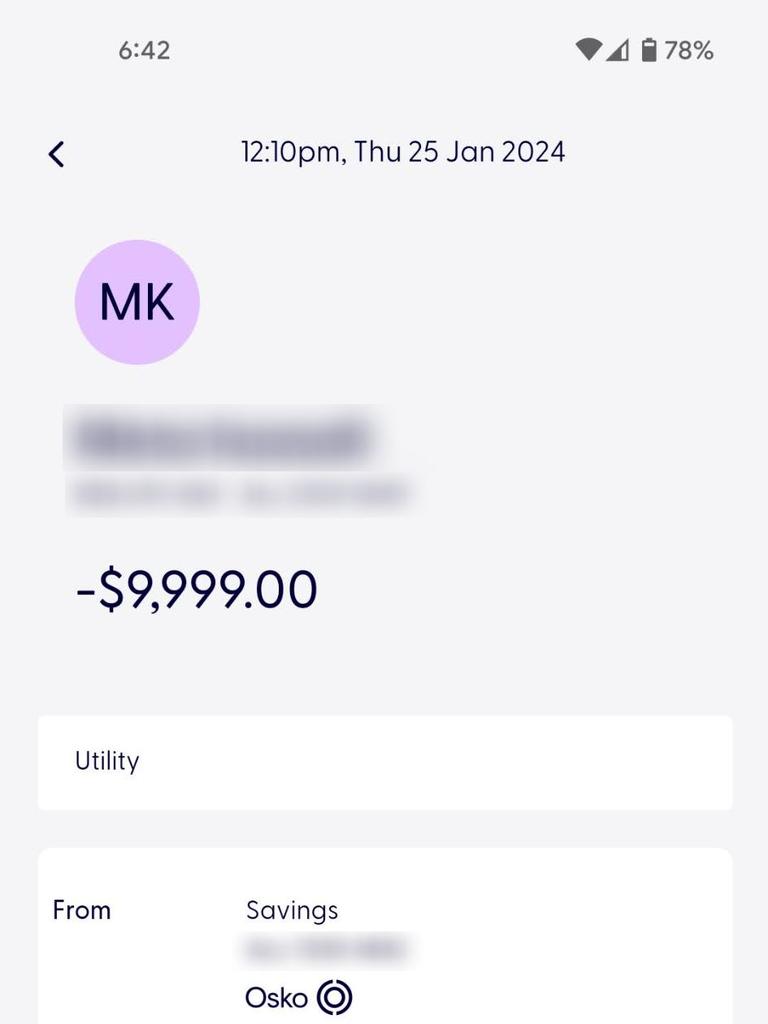

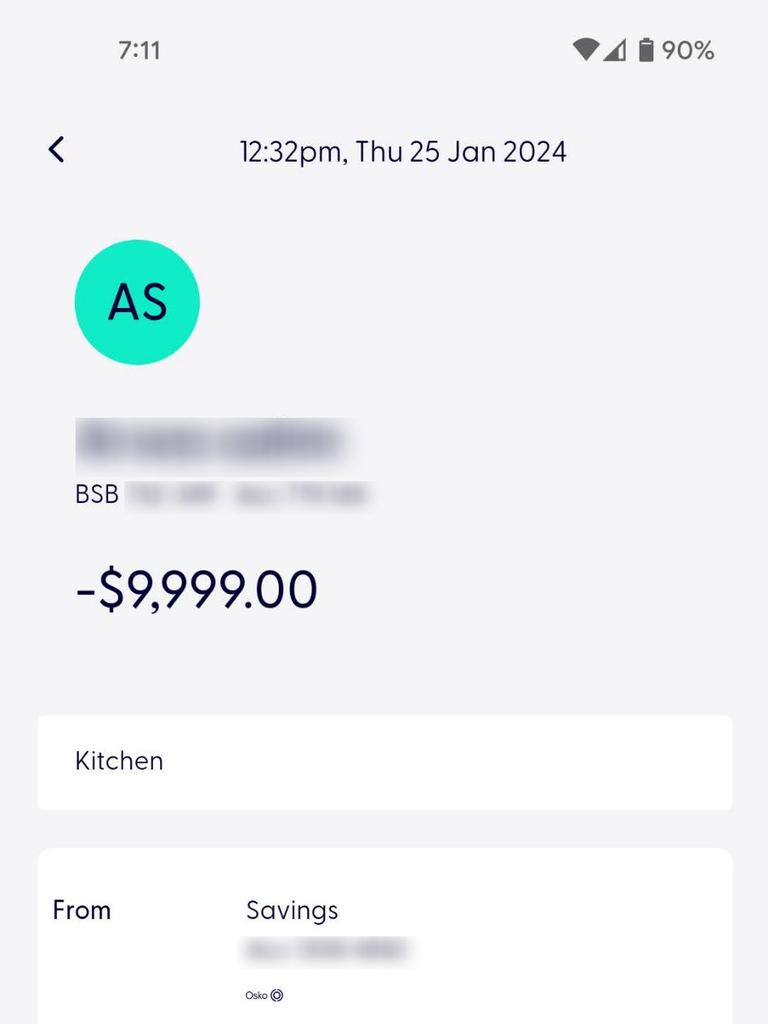

“While he was on the phone with the scammers, he saw the transaction go through, two lots of $10,000,” Lanie said. “He hung up right away.”

He immediately contacted Ubank about the confidence scheme but a staff member informed him their investigation would take 45 days.

And despite him calling his financial provider within minutes of the fraud eventuating, he later learnt that Ubank didn’t contact the recipient bank for another three days.

The bank claimed this did not hamper its recovery efforts, as the money was drained from that account on the same day it was transferred out.

Have a similar story? Get in touch | alex.turner-cohen@news.com.au

A Ubank spokesperson said they were unable to make a specific comment due to privacy concerns and denied a request for the customer to sign a waiver for more information to be shared with news.com.au.

They emphasised that the two incidents — first the text message from them, then the call from the scammer — were in no way connected.

Although Ubank confirmed the original text message was legitimate, they noted that they “don’t send links in unexpected SMSs”.

“So never click on a link in a text claiming to be from Ubank, it’s likely a scam,” the spokesperson added.

“Additionally, we will never text or call customers and ask for them to provide personal information, one-time passcodes or PIN numbers. If customers receive a call purporting to be from Ubank that feels suspicious, hang up. Then call us immediately.”

Ubank offered Lanie’s brother $1000 as a goodwill gesture, which he declined.

He has since lodged a complaint with the Australian Financial Complaints Authority (AFCA).

“Out of the two of us he’s the more diligent one,” Lanie said.

“I was shocked this happened to him.

“It’s a lot of money to get over, especially when you’re trying to save for a house in Melbourne. It happened so quick.”

She called into question some of Ubank’s processes which she claimed softened her brother up for this to happen.

“Why did they text him with a random SMS number from Ubank when they (banks) teach people not to respond (to that),” Lanie asked.

Ubank has been the subject of other news.com.au articles as scam victims have spoken out.

Ubank has also been hit by a spate of complaints from customers in recent times, who were “disgusted” and “frustrated” over upgrades that made it difficult to access their money.

In 2021, NAB inked a $220 million deal to acquire another digital bank called 86 400, which has resulted in changes to all Ubank accounts, but the transition was not smooth.

One customer went through the arduous process of having her BSB, account number and new debit card changed as part of the merger – only to have her entire account closed and her access to $40,000 cut off for days.

*Name withheld over privacy concerns

alex.turner-cohen@news.com.au