‘Dangerous’: Bank-owned and fee-free ATMs are disappearing – and that’s a worry

Getting access to your own cash isn’t just getting harder – it’s costing a lot more too, and one leading expert says Aussies should worry.

The number of bank-owned and fee-free automatic teller machines has more than halved in the past seven years, replaced with privately operated devices that slug users up to $4 per transaction.

While major financial institutions rapidly shutter branches and mothball ATMs, major corporations and small-time investors alike are flocking to fill the void – and cash in.

Professor Steve Worthington from Swinburne University said banks, particularly the big four, have become “obsessed with their cost-to-income ratios”.

“Anything they can do to reduce their costs will improve the gap between their outgoings and their incomings, hence improving their profitability,” Prof Worthington said.

“One of the biggest costs for banks and other financial institutions is running branches, in terms of the premises themselves and the personnel in them. That’s why there have been a lot of branch closures.

“And very often, ATMs operated by major banks are located in their branches, so when they close a branch, they remove an ATM.”

Plummeting numbers

Since June 2017, banks have collectively closed 2100 of their branches, data from the Australian Prudential Regulation Authority (APRA) shows, with 424 shutting in the 12 months to June 2023 alone.

On top of those ATM removals, another major factor in bank-owned machines becoming an endangered species is the industry-wide decision in 2017 to stop charging customers of other financial institutions a $2 fee to withdraw cash.

At the time, it was heralded by the government as a major win for consumers, but in reality it marked the beginning of the end of fee-free and convenient access to cash.

When that decision was made, there were 13,814 bank-owned ATMs right across Australia, but by June 2023, that number had more than halved to 5693.

Of those 8121 fewer machines, almost 23 per cent – or 1863 in total – were lost in regional and remote parts of the country, APRA data shows.

APRA doesn’t carry statistics on the number of non-bank ATMs in Australia and a spokesman pointed out that “there are no legal requirements for banks to operate ATMs or branches”.

However, in its latest annual report, the industry association Australian Payments Network reports that in 2022-23 there were a total of 24,695 operational ATMs in Australia. Subtracting the bank-owned machines reported by APRA suggests there are some 19,000 private devices.

That’s considerably more than every bank-owned machine combined in 2017 before financial organisations stopped charging customers to use them.

The fact that private enterprises have swept in to take up market share suggests there’s still a place for ATMs, Prof Worthington said.

“There’s clearly still demand out there,” he said. “And it’s obviously very profitable.”

Indeed, APN reports a total of 358 withdrawals from ATMs in the 12 months to June 2023, which was up 5.5 per cent on the previous year, although a significant drop on the 2018-10 figure of 572 million transactions.

In 2020, ANZ sold all of its non-branch ATMs to currency management service provider Armaguard as part of its then-emerging network of machines.

That business, ATMx, now has 1750 machines across the country – and counting.

Cash is no longer king?

According to a report release by the Australian Banking Association (ABA), the overwhelming majority of bank transactions now occur digitally – 98.9 per cent.

Aussies have been the fastest adopters of mobile and cashless payments in the world, driven in large part by a “world-class payments infrastructure”, the ABA said.

The report also shows that Australia has a higher branch density than comparable countries at 24 branches per 100,000 people.

And the ABA pointed out that more than 3000 Australia Point outlets have banking capabilities, including deposits and withdrawals, via the Bank@Post service.

In late 2022, the Reserve Bank released its sixth triennial Consumer Payments Survey, examining 13,000 transactions made by a representative sample of 1000 people.

The results suggest that in just three years, the share of cash payments halved from 32 per cent of all in-person transactions to just 16 per cent.

“If one considers all payments, including online payments, cash payments made up 13 per cent by number and around eight per cent by value in 2022,” the RBA said.

“While cash was used less across payments of all sizes, the decline was particularly pronounced for smaller-sized payments. Indeed, the share of payments under $10 made with cash nearly halved over the three years to 2022 … (while) cash use for higher value transactions also continued to decline, although at a slower pace.”

Prof Worthington isn’t convinced by the RBA data, pointing out that a mammoth amount of money is circulating in the economy.

“It was determined by a group of people keeping a diary on what they’d spent and how they paid for it, and it was only 1000 people, so I think it’s pretty limited,” he said.

“Roughly speaking, if you were to collect all of the money that’s been printed and floating around, and divided it by Australia’s population, we’d each get about $4000. That’s a lot of cash.”

ATMs can be a cash cow

While major players are rushing into the ATM market, plenty of smaller and sole operators are also getting in on the action.

There are ATM brokers who make the process of buying or leasing and operating a machine pretty straightforward – and affordable.

Someone with an appropriate place to install one – for example, a convenience store or petrol station owner – can buy a brand-new ATM for between $8000 and $12,000, or a used one for as little at $3000.

Those without that kind of budget can rent an ATM for as little as $300 per month.

The company engaged to process payments from the machine will typically take a cut of $1 per transaction, leaving the owner or renter to determine how much they get by setting the fee.

Privately owned machines can slug users as much as $4 per transaction, so an ATM in a high-traffic area, like an inner-city shop or a pub with a pokies lounge, can rake in big bucks.

Cash matters to many

An interesting paradox of the RBA’s findings on dwindling cash usage across the population is what the research reveals how attitudes to physical money.

While more and more Aussies are going digital, very few support the notion of a cashless society – in fact, most are vehemently opposed to it.

“Consistent with previous surveys, the 2022 (results) indicated that some Australians would be negatively affected if cash was difficult to access or if shops stopped accepting it as a payment method,” the RBA noted.

“Overall, just over one-quarter of respondents – regardless of how intensively they used cash – reported that they would experience a ‘major inconvenience’ or ‘genuine hardship’ if cash was hard to access or use.”

Prof Worthington pointed out that for many people, cash is the only way for them to pay for goods and services.

“It might be someone who’s elderly or who has intermittent or no access to the internet, and for whom cash is vitally important,” he said.

“We’re also reminded time and time again about how important cash is when there are natural disasters. In Victoria recently when there were mass power outages, you couldn’t do anything all. The only way to get by was using cash.”

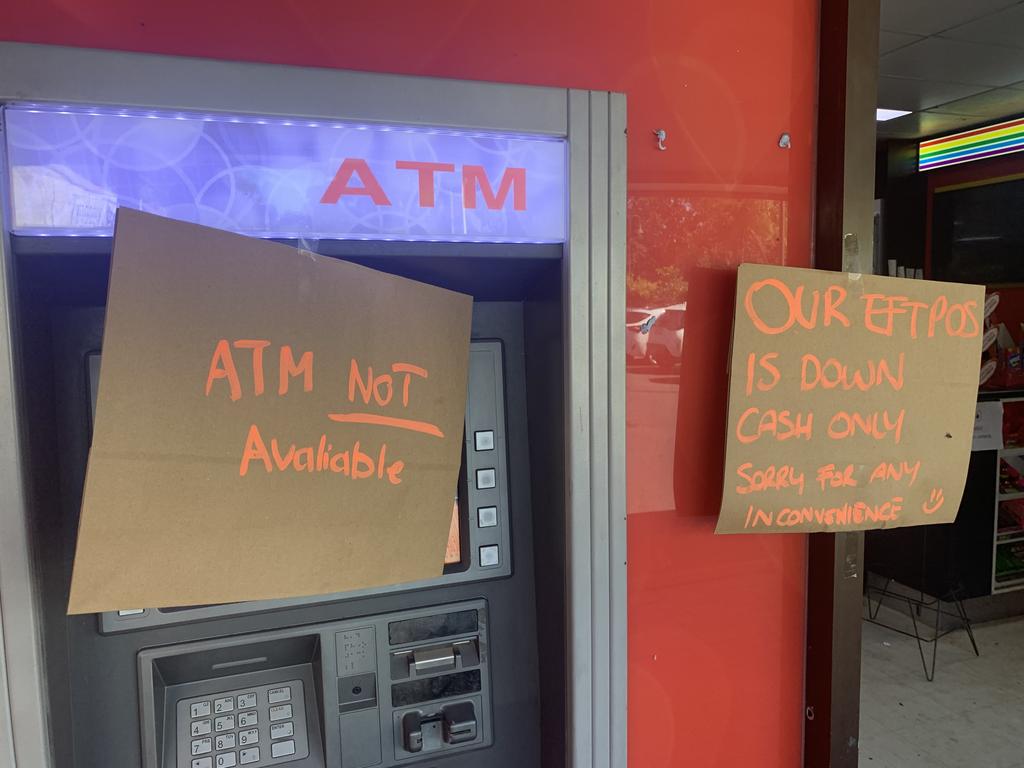

Similarly, the total outage of the Optus telecommunications network late last year left countless business owners unable to take payment via EFTPOS.

“If we don’t use it, we’ll lose it,” Prof Worthington cautioned.

“That’s the danger, that if we keep using less and less cash, then as with the bank branches and the ATMs, there’ll be less and less access to it – fewer ways to use it. Already we see merchants not accepting cash anymore.

“That could be a sign of things to come. I think that’s a dangerous (reality) to consider.”

What the banks say

As part of this story, news.com.au reached out to each of the big four banks to ask about their ATM networks, the trend of fewer bank-owned machines, and what it means for customers.

Westpac has invested significantly in technology and partnerships to offer its customers a vast network of fee-free ATMs.

For example, its customers can use ATMx machines without being slugged a charge.

“We are proud to offer our customers access to the largest combined fleet of fee-free ATMs of any of the four major banks in Australia, at almost 7000 locations nationwide, including 857 that are owned by Westpac,” a spokesperson said.

“Our customers can make fee-free withdrawals at Westpac, BankSA, Bank of Melbourne and St. George ATMs, as well as ATMs operated by Precinct, ATMx by Armaguard, and the other major banks.

“Customers can also withdraw fee-free cash over the counter in any of our branches and via Australia Post’s Bank@Post facility.”

In response to a flurry of branch closures, CBA chief executive Matt Comyn has previously reassured customers that there are no plans to abandon cash.

It also has the largest footprint of branches of all banks in Australia.

“We have 1956 ATMs, which is the largest bank-owned ATM network in Australia,” a CBA spokesperson said.

“While the number of ATMs we offer has reduced, we have chosen to maintain the largest and most convenient network – which is twice as large as our nearest major bank competitor.”

NAB did not provide a response but it’s understand the bank has a policy that if it removes an ATM, a Bank@Post service must be accessibly nearby.

NAB also hasn’t privatised any of its ATMs and all transaction on its machines remain fee-free.

ANZ did not respond before publication.