Macquarie cuts fixed rates a month out from RBA cash rate decisions

A major bank has reduced its fixed-rate mortgages just weeks out from the Reserve Bank’s official rate-cut decision.

Australia’s fifth largest lender has announced it’s dropping its one-to-three-year fixed mortgage rates by up to 0.16 per cent just weeks before the Reserve Bank of Australia makes an official move on Australia’s cash rate.

Macquarie Bank will now offer customers a one-year fixed rate of 5.55 per cent for owner-occupiers paying principal and interest assuming they have at least a 30 per cent deposit.

For owner-occupiers with a smaller deposit, they will pay 5.69 per cent for a one-year fixed rate.

Macquarie has also announced its two and three-year rates fixed rates are down 0.14 per cent to 5.55 per cent.

Canstar says the two-year rates are competitive, just 0.06 percentage points off the lowest available on the comparison site’s database.

Macquarie is now behind Easy Street, Bank Victoria and Community First Bank that all offer two-year interest rates of 5.49 per cent.

The lowest three-year fixed rate according to Canstar is SWSbank at 4.99 per cent.

The move comes four weeks ahead of the RBA’s next cash-rate decision on February 18.

Canstar data insights director Sally Tindall said Tuesday’s Macquarie Bank cut might seem small, but it could fire up competition among the banks on fixed interest rates ahead of the RBA’s next meeting.

“While fixed rates often reflect the cost of wholesale funding, the prospect of cash rate cuts in the next few months is likely to encourage more lenders to take the knife to their fixed rates,” she said.

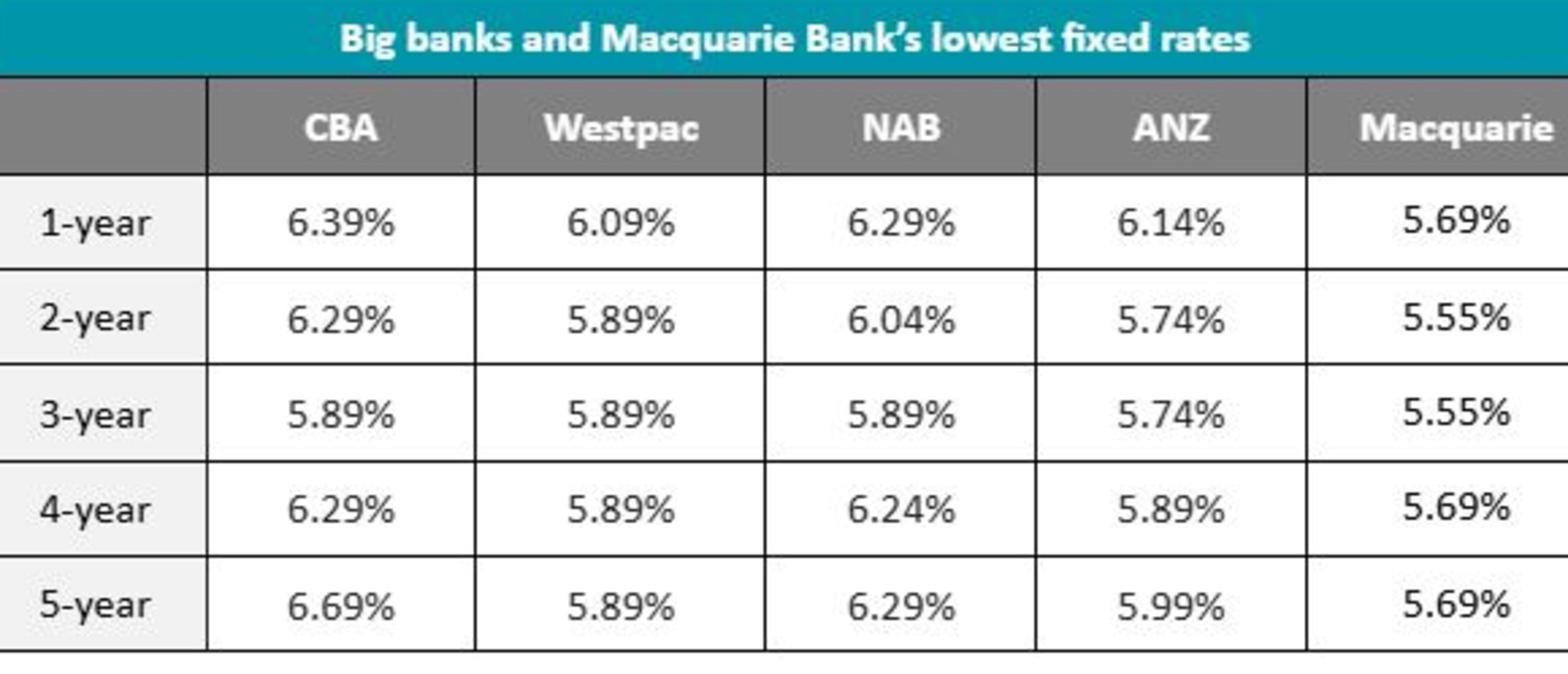

Macquarie Bank’s new rates continue to undercut the big four.

“The fixed-rate market has been relatively quiet over the summer break, with more lenders hiking these rates in the month of December than cutting. However, this move from Macquarie could push other lenders into taking a look at the competitiveness of their fixed rates in the lead-up to the RBA’s next meeting,” Ms Tindall said.

“While Macquarie Bank’s new lowest fixed rate of 5.55 per cent is highly competitive when stacked up against the rest of the pack, it’s unlikely to push many borrowers into fixing now cash rate cuts are now firmly on the radar.”