Rate cut firms on latest inflation read

The Reserve Bank of Australia is tipped to cut interest rates when it meets in May following the latest inflation print.

Find the latest news and finance updates for the Reserve Bank on Australia, from cash rate increases to economic forecasts.

The Reserve Bank of Australia is tipped to cut interest rates when it meets in May following the latest inflation print.

Households will get a rate cut in May regardless of April’s inflation reading, one major bank’s chief economist has boldly declared.

A leading economist predicts struggling Aussie mortgage holders will get much-needed rate relief next month, as the RBA turns its focus to this new threat.

A major bank has announced the new lowest fixed interest rate, but it still seems unlikely Aussies will lock in their mortgage.

Mortgage holders are tipped to get much needed rate relief when the Reserve Bank of Australia board meets again in May.

The RBA has been forced into a corner by US President Donald Trump and one expert says that can only mean one thing for interest rates.

The Reserve Bank of Australia has revealed why it poured cold water over back-to-back rate cuts for mortgage holders.

Homeowners could be in for savings, with NAB slashing rates and tipping bold RBA cuts despite global economic uncertainty.

RBA governor Michele Bullock has cast doubt on predictions of a double rate cut in May amid Donald Trump’s ongoing tariff war.

The Reserve Bank of Australia has poured cold water over a major hope for homeowners in the coming months.

As the Prime Minister prepares for his first election debate, Treasurer Jim Chalmers held crisis talks with bank bosses over Trump’s tariffs.

Treasurer Jim Chalmers says interest rates could be slashed by 50 basis points next month with more cuts to follow, as the world plunges into economic turmoil.

The RBA has just delivered a stark warning that Donald Trump’s trade war could trigger disorder in the global economy and hammer Australians.

Donald Trump’s looming trade war could smash global growth and hit Australia, but RBA Governor Michele Bullock says she’s ready to defend economic growth with rate cuts.

Aussies have been warned the next Reserve Bank rates call could be overshadowed by a looming bank threat.

The major banks have slashed their deposits and savings rates, just days before the RBA will announce the nation’s official cash rate.

Cost of living relief and a modest tax cut are unlikely to slow the RBA’s progress on cutting rates, according to analysts.

A steep decline in employment figures has raised alarm bells as older workers quit the workforce – but the sudden exit has raised the prospect of an April rate cut.

Trainers Mick Price and Michael Kent Jr have decided the time has arrived to test talented colt Reserve Bank at Group 1 level in Saturday’s William Reid Stakes at The Valley.

The Reserve Bank says the data will decide when it cuts the official cash rate again, as developments from US tariffs complicate the decision.

The new theme for the $5 bill has been revealed, swapping out British royalty for something closer to home.

The Reserve Bank concedes there is still uncertainty around Australia’s cost of living and has hinted what its next move on rates will be.

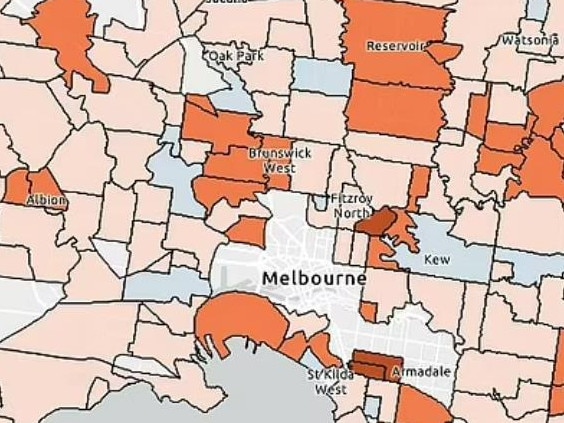

Melbourne’s housing market is mounting a nation-leading home price lift, less than two weeks after the Reserve Bank cut interest rates. And experts are predicting there are more to come.

The RBA’s rate cut has not delivered the pre-election bump Anthony Albanese had hoped for, but it isn’t good news for Peter Dutton either.

Decade-high interest rates are not “the source” of Australia’s cost of living problem, former Reserve Bank governor Philip Lowe has said.

Rate relief for millions of Australians starts on Friday as the first of the big four banks finally pass on the RBA’s rate cut to mortgage holders.

Trainer Michael Kent Jr cannot fault equal favourite Reserve Bank who will seek to protect his perfect first-up record in the $1m Inglis Sprint at Flemington on Saturday.

The RBA deputy governor has shared how Donald Trump’s tariff threat affected the central bank’s decision to cut interest rates earlier this month.

In the seven days since the Reserve Bank slashed its cash rate for the first time in four years, attention in specific types of house hunters has jumped across the state. SEE WHY.

Aussies with savings in their accounts have been warned to consider moving their money following a stunning bank change.

The Reserve Bank’s cash rate cut may have a bigger impact on the nation’s property future than any policies from the federal or state governments in the past two years. Here’s why.

Treasurer Jim Chalmers has called on landlords to consider this week’s long-awaited rate cut when setting their rents.

RBA governor Michele Bullock says cash use is likely in “long-term decline”, acknowledging its withdrawal would hit “vulnerable” communities.

Bosses have been warned that workplaces across the country could soon face a major shake-up, and the recent rate cut could be the thing that kicks it off.

Analysts have discovered a major clue that the RBA is planning to do far more than it’s letting on – and the impact could be massive for us all.

It’s only going to get worse for Aussie savers already on their knees after the Reserve Bank’s decision to cut interest rates.

Almost everyone was celebrating when the RBA cut rates this week, but there was one ominous detail that shows how far we’ve fallen.

The RBA will be closely following the unemployment level after the central bank cut rates for the first time in four years on Tuesday.

Aussie households are feeling the pinch, with a single rate cut unlikely to relieve them of their mortgage stress.

Homeowners and others will get relief from today’s rate cut but it will also strike a blow to some already struggling sectors.

The Reserve Bank of Australia has switched things up, meaning eager homeowners will have to wait a little longer to find out if they will get another rate cut.

While the Treasurer welcomed the RBA’s decision to cut rates, he sidestepped questions on how it could affect when Aussies will go to the polls.

Going slow on rate cuts could be good for the major banks as they cash in millions for every day homeowners wait for a mortgage reduction to be passed on.

Landlords have revealed how the property market will become temporarily “frantic” after today’s rates decision.

Under-the-pump Australian homeowners have received a rate cut, but Michele Bullock has delivered a stark two-word warning about the future.

Unions and interest groups ratcheted up the pressure on the Reserve Bank ahead of its decision to cut interest rates.

As homeowners celebrate the Reserve Bank’s decision to cut the cash rate, experts have crunched the numbers on what it means for the average Aussies.

Even though the RBA has cut interest rates, there are thousands of Australians doing vital work for the nation that are facing a grim reality.

Mortgage holders celebrating today’s long-awaited rate cut by the RBA might not be smiling for long, a leading economist has warned.

The Reserve Bank’s big call on interest rates could set the scene for Anthony Albanese to make a big decision himself.

Peter Dutton and several Labor MPs have urged the RBA to take action amid predictions homeowners are set to receive their first cut in four long years.

Competition among mortgage providers has spurred a big four bank to cut its variable interest rates ahead of tomorrow’s RBA decision on the cash rate.

One of Australia’s biggest banks has laid out the expected impact on the housing market of the Reserve Bank cutting interest rates, and some are in for a shock.

Aussie mortgage holders might need to wait nine months to fully feel the impacts of a rate cut, should the Reserve Bank board decide to cut the cash rate on Tuesday.

Almost 1.6 million NSW households are at financial breaking point, according to staggering new figures. Is there a way out or will it get worse?

More than one million households are living in mortgage or rental stress — and Tuesday’s Reserve Bank of Australia could be ‘make or break’ for many of them. See the state’s most stressed postcodes.

Long-suffering homeowners could be set for home loan repayment relief in as little as days. Experts have revealed what you should do after the Reserve Bank meets on Tuesday.

Banks are cutting one particular offering as they gear up for the Reserve Bank of Australia to do the same to the cash rate.

Another of Australia’s big four banks has cut interest rates for one group of borrowers, ahead of the RBA’s highly anticipated February meeting.

A second big four bank has joined National Australia Bank in slashing its interest rates on fixed loans less than a week before the Reserve Bank is due to meet this month.

Another major financial institution has changed its rates ahead of the Reserve Bank of Australia’s decision on the official cash rate.

A cut in interest rates expected to be announced in just days will drive some of the biggest household savings ever due to a quirk in the housing market from Covid.

Australian homeowners could be the big winners if the Reserve Bank of Australia does what is expected later this month.

The money markets are rapidly backing the idea that the Reserve Bank will cut interest rates when they meet in a weeks’ time.

How much mortgage holders in every Queensland suburb will save on their repayments after one, two, three or four interest rate cuts. INTERACTIVE

A massive interest rates prediction has been revealed as a major RBA decision looms – but it’s not what millions of us want to hear.

Mortgagees could save anywhere up to $600 a month if interest rates are cut following the Reserve Bank of Australia’s first meeting later in February. SEE HOW.

See which Geelong suburbs will be the biggest winners, saving up to $210 a month, once the Reserve Bank starts slashing interest rates. SEARCH YOUR SUBURB

A big four bank has become the first to slash interest rates ahead of the Reserve Bank’s meeting – with more cuts expected to follow.

One of the big four banks has made a major call ahead of any Reserve Bank of Australia decision to cut the cash rate.

All four of the big banks now agree on when the Reserve Bank board will cut interest rates following welcome inflation data this week.

Australians are still feeling the pinch of cost-of-living rises even though the rate of inflation is slowing.

Hope has emerged for homeowners after a surprise economic finding that’s paved the way for the RBA to cut interest rates – but any relief will come with a catch.

Struggling borrowers could finally get a rate cut in February, with inflation tipped to fall faster than the Reserve Bank has been expecting.

The Prime Minister says his government has “done all it can” to tame inflation to allow the RBA to cut rates and deliver households much needed relief.

A huge number of Aussie households have said they are desperately needing a rate cut when the Reserve Bank next meets.

Australia’s weak dollar could see inflation tick up slightly, but it is unlikely to move the RBA on its next rate cut decision, a leading economist says.

A major bank has reduced its fixed-rate mortgages just weeks out from the Reserve Bank’s official rate-cut decision.

Experts are forecasting the property market could look very different once the RBA starts to drop interest rates. Here’s how a February rate cut could shape the year ahead.

As Australians deal with cost-of-living pressures, these unpopular fees are collectively setting families back hundreds of millions of dollars per year.

Original URL: https://www.news.com.au/topics/reserve-bank