Major ‘risks for future’ as 1.6m NSW households in financial stress

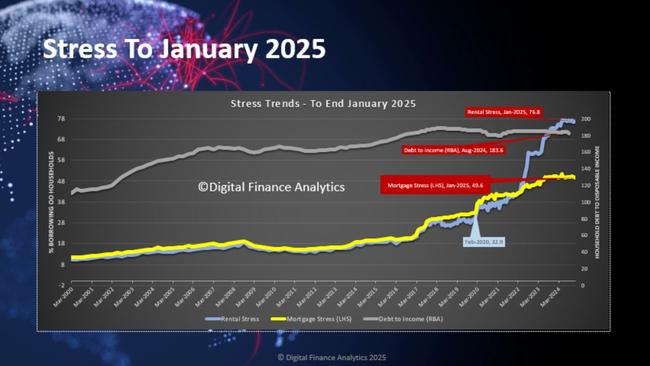

Almost 1.6 million NSW households are at financial breaking point, according to staggering new figures. Is there a way out or will it get worse?

Almost 1.6 million NSW households are living with rental or mortgage stress, as families desperately await the Reserve Bank’s interest rate call on Tuesday.

An exclusive analysis released by research firm Digital Finance Analytics (DFA) showed almost half the state’s homeowners are struggling to keep up with their repayments, while four out of five tenants are stretched to pay their rent.

Leading property analyst DFA principal Martin North claimed rate cuts would not be enough to rescue many Australian families’ serious financial stress.

The data, which surveyed more than 52,000 households shows there are 85 suburbs across NSW where nearly all households with home loan debt were in mortgage stress.

MORE: Why fixing my home loan rate was the best decision of my life

Surprise way rate cut could backfire

The Liverpool region including suburbs Casula, Chipping Norton, Liverpool CBD and Warwick Farm had the highest levels of mortgage stress in the country, with an estimated 39,000 households under pressure to repay their debt. It was also the NSW locale with the worst rental stress with approximately 13,685 tenanted households.

Mr North said financial pressure is most intense in the high growth corridors around major urban centres, but it was spreading into regional areas too.

“In some cases, the pressure is sufficient to force homeowners to consider selling up,” he said.

Suburbs in the Gosford region were at the highest risk of defaulting on their payments, according to DFA.

MORE: Real reason behind Aus $4k bank handout

Rate cut move that’ll make you richer

Record numbers of people in NSW are seeking legal assistance because of housing and tenancy problems, with demand growing 19 per cent in the last financial year, according to Legal Aid NSW.

New figures show almost 4,500 people per year are now seeking help from Legal Aid to deal with those issues.

Legal Aid lawyer Pip Martin said clients commonly sought advice about negotiating financial hardship arrangements with their lender and mortgage issues relating to elder financial abuse or irresponsible lending.

“The rising demand for housing assistance is primarily due to tenants struggling with rent payments,” Ms Martin said.

MORE: Serena Williams’ incredible multi million property portfolio

Average mortgage interest charges were up 14.7 per cent over the year, down from an annual rise of 18.9 per cent in the September 2024 quarter, according to Mr North.

“The smaller annual increase reflects the unchanged cash rate over the last 12 months, and a fall in the share of expired fixed rate mortgages rolling over to higher variable rate mortgages,” he said.

“This is still way higher than inflation overall, or indeed pay rises, so in real terms many continue to go backwards. Cost of living will be a key theme for the upcoming election.”

In contrast, areas with the lowest levels of mortgage stress included Alexandria, Chatswood, Strathfield, Glenorie and Kingsgrove.

DFA defines financial stress as when a household has more outgoings than income, excluding one off discretionary spending.

“Unless things change substantially, this higher for longer level of financial stress could well morph into social issues, with crime rates notably rising in some of the high stressed areas,” Mr North said. “All this points to massive policy failure, and risks for the future.”

Originally published as Major ‘risks for future’ as 1.6m NSW households in financial stress