‘Major implications’: CBA analysts find ‘major clue’ RBA might be planning more rate cuts

Analysts have discovered a major clue that the RBA is planning to do far more than it’s letting on – and the impact could be massive for us all.

ANALYSIS

The Reserve Bank of Australia could still have a whole bag full of rate cuts to dole out in 2025, according to a new analysis that has major implications for the housing market.

The RBA made a single rate cut on Tuesday, leaving Australians mostly nonplussed.

Savings of perhaps $100 a month are minor compared to recent swings in the cost of living.

And RBA boss Michele Bullock sounded very cautious in her description of the cut, suggesting that this is not a big turning point – we are not at the start of a steep staircase to lower rates.

MORE:Call your bank: Rate cut trap revealed

“The Board remains cautious on prospects for further policy easing,” said the official monetary policy decision.

The direction of rates in this cycle is unclear. Will we have one more rate cut? Two? Or more?

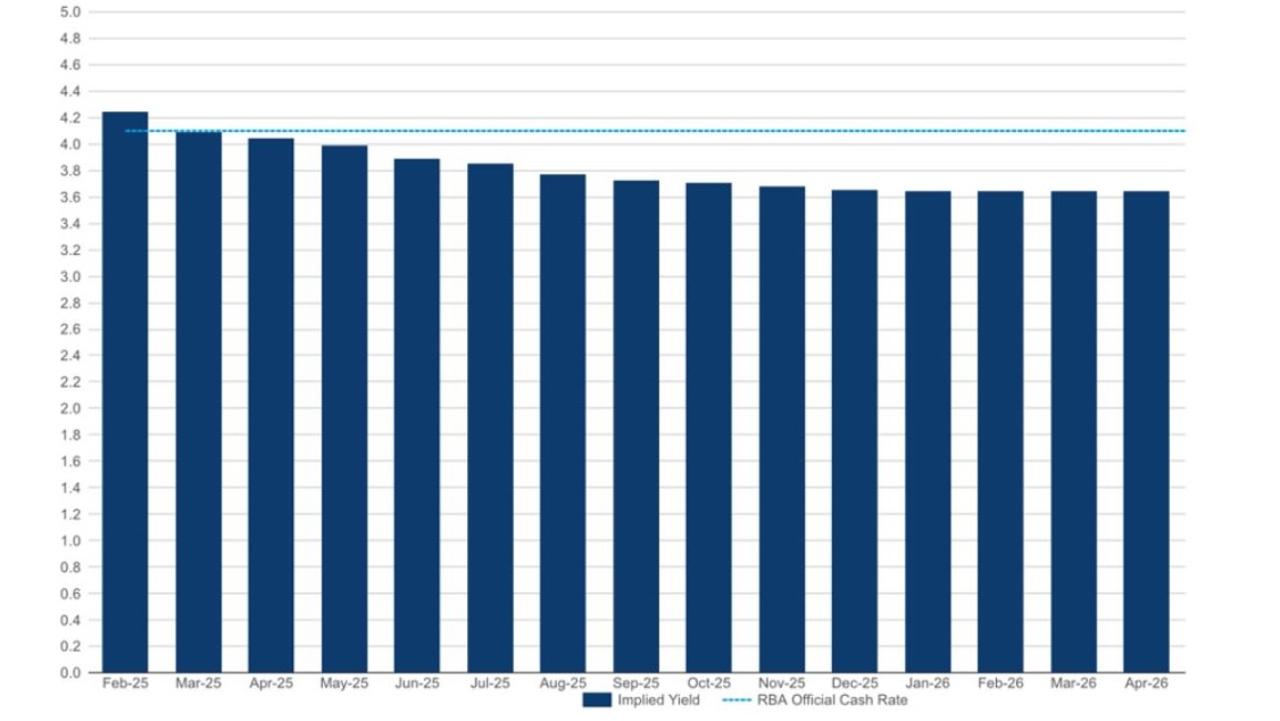

The next chart shows the forecast implied by futures markets: They are tipping two more interest rate cuts, falling to 3.6 per cent by the end of the year.

MORE:‘Killing us’: Aussies worse off after rate cut

But Commonwealth Bank analysts have found a major clue that the RBA might be planning more rate cuts than it is letting on.

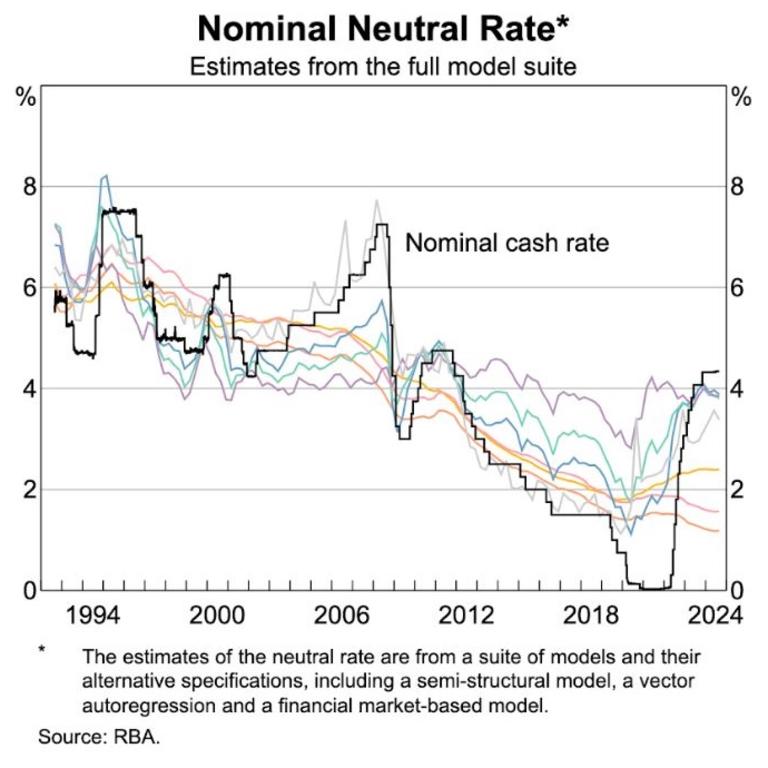

It all depends on the “neutral” interest rate. That’s the level of interest rates that stops inflation from accelerating. The RBA used to think the neutral rate was quite high, so it was not keen to cut rates.

But now, it seems, its estimate of the neutral rate has changed. Instead of official interest rates of 3.5 per cent being neutral, the Commonwealth Bank reckons the RBA may even consider 2.9 per cent per cent neutral.

“The RBA has recently refined how the models account for the pandemic period, following the techniques of other central banks. This has led to a shift downward in some estimates of neutral,” writes the Reserve Bank in its new Statement on Monetary Policy.

A “shift downward” is the key words there. They have reduced their best guess of the right level for official interest rates.

The Reserve Bank also says this: “…[F]inancial conditions remain restrictive and … private demand has been weak for some time”.

In other words, it is admitting interest rates are pretty high actually, and the economy is not so hot. That leaves a lot more room for rate cuts.

“[W]e continue to look for three further 25 basis point reductions in the cash rate at a gradual pace that sees the cash rate at 3.35 per cent by end-2025,” writes Commbank’s head Australian economist Gareth Aird.

But to be fair, the seven models the RBA uses to guess at the neutral rate are all over the place, as the next chart shows.

How does all this work again?

The official interest rate is the rate the RBA charges to banks. It affects almost all other interest rates in the market, especially borrowing to buy houses. So if the official interest rate goes down, mortgage interest rates go down.

When mortgage interest rates go down, households that have mortgages find they have more money left over at the end of the month. They probably spend some of that, and businesses find they are busy. Those businesses no longer have to cut prices to win customers. This is one of the main links between interest rates, mortgage interest rates and inflation (but it’s not a direct link, it runs via family budgets).

The RBA didn’t want to cut interest rates in the last few years because inflation was high and it didn’t want to make raising prices easy for businesses. Now inflation is falling, it can relax a bit.

Another way lower rates hit inflation is by making it easier to borrow to buy a house.

When rates are low, the housing market tends to hum along, with more sales and higher prices.

That also tends to prop up our economy – home sales lead to people spending money on real estate agent commissions and conveyancing and on furniture and tradies, while higher house prices make homeowners more comfortable spending up.

An arm and a leg for a roof over the head

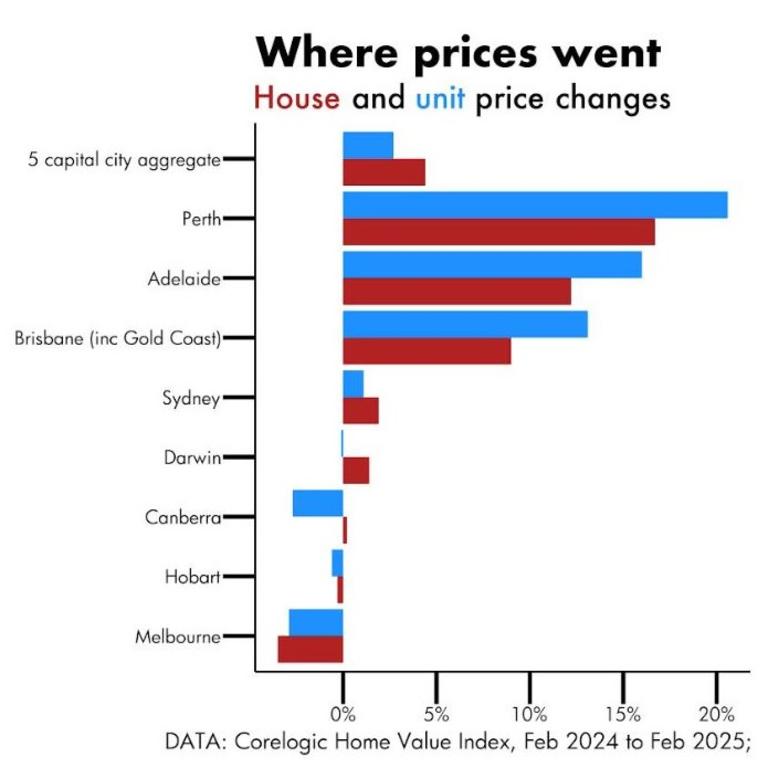

If the RBA is going on a rate-cutting spree, i.e. if the Commonwealth Bank is right, then house prices could rise yet again.

As the next chart shows, house prices have been on a bit of a downward spiral recently in the southeast of the country, but are booming elsewhere. Those languishing markets could turn up if rate cuts begin to rain down.

So what now?

Ever since the Commonwealth Bank updated its analyses and decided more rate cuts were coming, the economy has begun to look a little more saggy, which makes its insight look better still.

Not only did wages growth come in at a fairly pitiful 3.2 per cent, but unemployment rose too. The share of people looking for a job went up from 4 per cent to 4.1 per cent and the number of hours worked fell. That’s a sign of a jobs market that is cooling, and it makes the next decision of the RBA even more likely to be a cut.

The central bank will meet again at the end of March and announce its next rates decision on April 1. By that point, the election may well have been called and a quick pre-election Budget may even have been held.

The old system where the RBA met each month is finished and there will be only seven more RBA meetings this year. That raises the chance of a rate cut at any one meeting.

The government would likely be delighted if there were two interest rate cuts before we all go to the polls, but people on the brink of buying their first home might prefer rate cuts to be delayed until house prices fall just a tiny bit more.

Jason Murphy is an economist | @jasemurphy.bsky.social. He is the author of the book Incentivology