‘Wildly unexpected’ RBA move breaking us

A massive interest rates prediction has been revealed as a major RBA decision looms – but it’s not what millions of us want to hear.

Find the latest news and finance updates for the Reserve Bank on Australia, from cash rate increases to economic forecasts.

A massive interest rates prediction has been revealed as a major RBA decision looms – but it’s not what millions of us want to hear.

Mortgagees could save anywhere up to $600 a month if interest rates are cut following the Reserve Bank of Australia’s first meeting later in February. SEE HOW.

See which Geelong suburbs will be the biggest winners, saving up to $210 a month, once the Reserve Bank starts slashing interest rates. SEARCH YOUR SUBURB

A big four bank has become the first to slash interest rates ahead of the Reserve Bank’s meeting – with more cuts expected to follow.

One of the big four banks has made a major call ahead of any Reserve Bank of Australia decision to cut the cash rate.

All four of the big banks now agree on when the Reserve Bank board will cut interest rates following welcome inflation data this week.

Australians are still feeling the pinch of cost-of-living rises even though the rate of inflation is slowing.

Hope has emerged for homeowners after a surprise economic finding that’s paved the way for the RBA to cut interest rates – but any relief will come with a catch.

Struggling borrowers could finally get a rate cut in February, with inflation tipped to fall faster than the Reserve Bank has been expecting.

The Prime Minister says his government has “done all it can” to tame inflation to allow the RBA to cut rates and deliver households much needed relief.

A huge number of Aussie households have said they are desperately needing a rate cut when the Reserve Bank next meets.

Australia’s weak dollar could see inflation tick up slightly, but it is unlikely to move the RBA on its next rate cut decision, a leading economist says.

A major bank has reduced its fixed-rate mortgages just weeks out from the Reserve Bank’s official rate-cut decision.

Experts are forecasting the property market could look very different once the RBA starts to drop interest rates. Here’s how a February rate cut could shape the year ahead.

As Australians deal with cost-of-living pressures, these unpopular fees are collectively setting families back hundreds of millions of dollars per year.

One of Australia’s big four banks has renewed its prediction for when the Reserve Bank will cut the cash rate, as spending dropped after the Black Friday sales.

The chances of an interest rate cut in early 2025 are falling faster than the Aussie dollar, with experts saying the drop in our currency could cause the Reserve Bank to baulk at a cut.

Another major bank says a February rate cut is on the cards, with ANZ making a big change to its expectation of when Aussie mortgage holders will get a reprieve.

Struggling Aussie homeowners could get a rate cut sooner rather than later as the Reserve Bank says it is “increasingly confident” about a reduction.

In the biggest reform to the RBA in more than three decades, Jim Chalmers has revealed the new names tasked with determining the cash rate.

The RBA’s slow response to the post-Covid economic boom is to blame for Australians paying more on their mortgage today, a consulting firm has found.

The RBA has defended the economic forecasting it does to help the board when it considers changes to the cash rate, admitting the predictions are likely wrong.

The Reserve Bank has made a major call on the potential impact of Donald Trump’s second presidency on the Australian economy.

The Reserve Bank’s latest interest rates decision is expected to drive a desperate move from struggling homeowners that could shift the housing market.

Homeowners desperate for some rate relief will need to wait until 2025, as the Reserve Bank of Australia held official interest rates for the ninth time in a row.

Struggling Aussies have gotten no relief from the RBA before Christmas and it is going to cost you more than you realise.

The RBA board will meet on Tuesday and announce the final cash rate decision for 2024 later in the day.

Mortgage holders and business owners should not hold their breath for any interest rate relief on Tuesday.

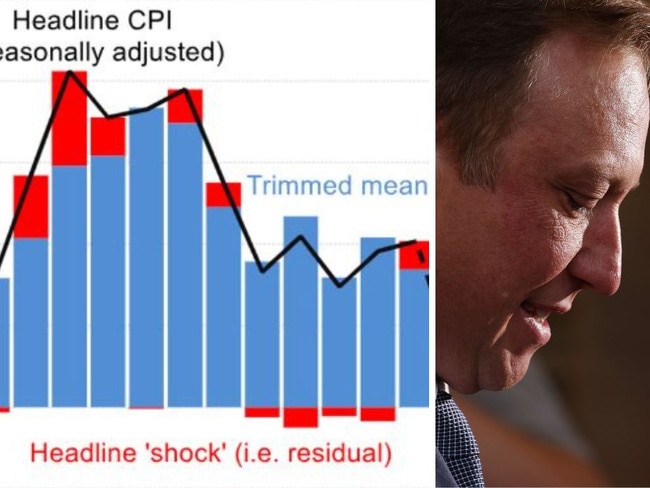

Aussies have been hit hard by the Reserve Bank’s brutal interest rate hikes – and now, a very weird pattern has started to emerge.

The big four bank is the latest institution to push out its timeline for a Reserve Bank interest rate cut, as customers start spending their stage 3 tax cuts.

The RBA governor surprisingly came out in support of Australia’s big spending budget saying the economy “would be worse without it”.

The RBA has been warned there could be a new issue for the housing market if it doesn’t change course following the publishing of alarming new data.

Inflation is “collapsing” in Australia – but the Reserve Bank just keeps on making the same mistake, as the rest of us suffer.

Black Friday is tipped to be one of the best sales events on record, but a leading economist warns it is not a sign that household pressures are easing.

The Reserve Bank will be hard-pressed to cut interest rates before May, here’s a breakdown of why.

The Reserve Bank of Australia is steadfast in its fight against inflation, even if it means mortgage holders will pay even more in the coming months.

Aussies are doing what the Reserve Bank of Australia is asking and cutting back on spending, but they might need to wait nine months for a reduction on their mortgage.

We were all but promised a rate cut in 2024, but now, that’s looking like a pipe dream. And Donald Trump could be partly to blame.

Australians will get no respite from paying high prices for everyday items, the Reserve Bank has warned.

The central bank says if incoming US President Donald Trump were to impose his promised tariff on China, there could be big consequences for Australia.

The Reserve Bank has more bad news for Australians, warning workers the job market is about to get tighter and wages growth to decline.

Homeowners desperate for some relief were left disappointed as the Reserve Bank of Australia held interest rates for the eighth time in a row.

The Reserve Bank of Australia has been blasted over its latest refusal to cut interest rates, with claims the move “makes no sense”.

Aussies have reduced spending in line with Reserve Bank expectations, but it’s not enough to spark a rate cut.

The RBA has announced its latest decision on the direction of interest rates, but it creates a surprising dilemma for anyone who wants a home.

Nearly a million Aussies have refinanced their loans as the Reserve Bank of Australia is tipped to hold interest rates higher for longer.

Homeowners with an average mortgage could save $100 a month if the Reserve Bank cuts interest rates today.

Close to half of Aussie households with a mortgage are staring down a major problem with their loans after recent lending policy changes.

New inflation figures could change the outlook for interest rates, but the RBA has also been warned there could be a new issue for the housing market if a cut doesn’t come soon.

Inflation figures have fallen to a three-year low, but the chances of the Reserve Bank cutting rates before Christmas have been revised.

The Queensland election result is set to widen the already yawning gulf between the government in Canberra and the RBA.

The latest report from the Reserve Bank of Australia shows the major pay rise Michele Bullock received after she stepped into the top job.

The Australian economy is growing at its slowest pace since the early 1990s, and a key group claims the RBA is focusing on the wrong thing to fix it.

The RBA’s deputy governor Andrew Hauser has made a big call on the likelihood of a 2024 rate cut for Aussies.

A number of telltale signs have emerged indicating the Reserve Bank is planning a major, surprising pivot within a few short weeks.

On the very first day King Charles and Queen Camilla were out and about in Sydney, a series of worrying signs soon emerged.

The chances of Aussies getting an interest rate cut before Christmas have been predicted. Here’s what to expect.

The RBA is shifting the blame for the rental crisis, saying Australia needs more of this to solve the issue.

It seemed like a good idea at the time, but a third of Aussies say they now regret a popular financial decision made during the Covid pandemic.

Commonwealth Bank predicts homeowners will get an early Christmas present, with a rate cut coming in December.

The RBA will signal to the market that the fight against inflation is largely won, and its response may surprise some.

Australian lenders are jockeying for position in anticipation of an interest-rate cut by the Reserve Bank, and here’s the proof.

A Sydney MP is pushing for an overhaul of 20-year-old regulations that cost Aussies billions of dollars every year.

The Reserve Bank is steadfast it will use the blunt tool of interest rates in any way necessary to get inflation down to its target range.

Retailers slammed by a slow economy are begging the RBA to cut rates before an “invaluable” six-week pre-Christmas trading period.

Brilliant colts First Settler and Reserve Bank fought out an exciting finish in the Group 2 Danehill Stakes and the Group 1 Coolmore Stud Stakes now beckons.

Home prices have done something seldom seen in recent years as ‘desperate’ Aussies give up hope of an early interest rate cut.

Australia’s biggest home builder has warned the nation’s fight to fix housing affordability is “going backwards” as the “pessimistic” Reserve Bank smashes homebuyer confidence.

The Coalition is renewing its attacks on the Albanese government after the Reserve Bank’s decision to hold rates.

A huge inflation change will provide a boost to the housing market but the shift could be problematic for one group making up a third of the country.

RBA Governor Michele Bullock has taken a thinly veiled shot at the government after yesterday’s decision to keep interest rates on hold.

An alarming number of Aussie mortgage holders remain on the brink as looming Reserve Bank decisions and high inflation make the future unclear for homeowners.

The Reserve Bank is sticking to its guns not to cut the official cash rate while inflation remains too high, despite growing pressure to do so.

Holding rates at 4.35 per cent, RBA governor Michele Bullock has said what needs to be done for interest rates to come down, hinting it won’t be any time soon.

The sharemarket dipped lower on Tuesday as the RBA delivered some hawkish rhetoric on interest rates, even as the miners boomed on fresh Chinese support.

Homeowners struggling after missing out on a rate cut from the Reserve Bank today have been urged to “create their own rate cut”.

Australians struggling with skyrocketing mortgage payments and the cost of living crisis will get no relief from the RBA just yet after the board decided to keep interest rates on hold.

Finance Minister Katy Gallagher has issued a scathing takedown of the Greens after they demanded unprecedented action against the Reserve Bank.

Pressure is mounting for the RBA to cut interest rates in Australia after the US jumped last week. With multiple cuts predicted, will struggling Aussies get their first tomorrow?

As plenty of Aussies struggle with the cost of living and high interest rates, this is the size of the relief many need to help them breathe easy again.

Original URL: https://www.news.com.au/topics/reserve-bank/page/3