‘Makes no sense’: Motive behind RBA’s refusal to cut rates

The Reserve Bank of Australia has been blasted over its latest refusal to cut interest rates, with claims the move “makes no sense”.

In the recent round of central bank reforms, a key debate was whether or not the government of the day should keep its power to overrule the Reserve Bank of Australia.

So far, the rule has remained in place, and today we get a glimpse of why that is a good idea.

The RBA has again refused to cut interest rates owing to a political judgment that makes no sense.

The stupidity is perhaps not so damaging that it warrants the dramatic step of intervention but it is dumb enough to show why the option should be available.

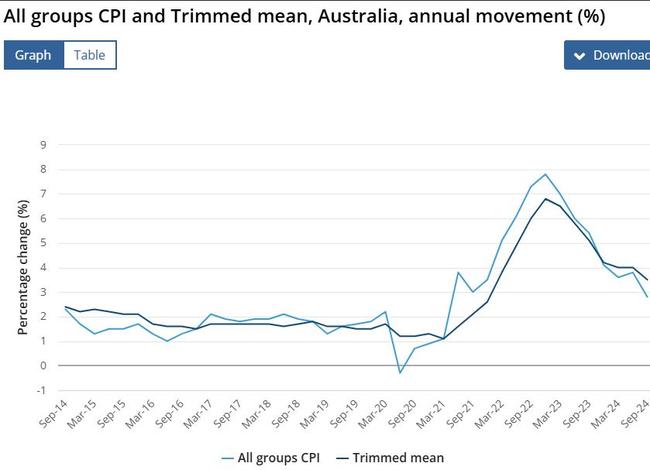

Inflation has crashed within the RBA’s inflation band but the bank is refusing to cut because it is fixated on esoteric measures like “trimmed mean”.

It is operating outside of its charter, which makes no mention of such.

Inflation is beaten

Inflation in Australia is beaten.

The CPI is at 2.8 per cent and crashing. Rental growth is coming off at a good clip owing to affordability constraints.

Food price growth is falling away.

Goods prices are outright deflating.

There are more cost-of-living rebates in the pipeline for energy.

Moreover, roughly 20 per cent of the CPI is made up of ‘administered prices’.

These are the government-mandated charges and price fixings, such as excise for booze and smokes, as well as education, health, welfare and award wages.

These are all linked to the CPI, not trimmed mean, so they will fall away sharply in 2026.

Wages growth is also cooling and was never a problem anyway, managing only briefly to get above 4 per cent, thanks to the endless mass immigration labour supply shock.

Who cares about core inflation?

So, why won’t the RBA cut? The following chart.

The bank argues that “trimmed mean” inflation is too high at 3.5 per cent.

Trimmed mean excludes such volatile items as energy and rebates.

But are the rebates volatile? The RBA assumes they are temporary and will be pulled off at any moment.

This is a political judgment that assumes policy sense will suddenly grab Australia’s venal politicians immediately before and after a federal election.

Which is poppycock. The energy rebates will be renewed.

Unless energy prices fall. And they won’t because nobody is addressing the gas cartel that is causing the price spikes.

The RBA is out of line

The RBA’s interprets its charter thus:

“Policies in pursuit of these objectives have found practical expression in a flexible, medium-term inflation target, which has formed the basis of Australia’s monetary policy framework since the early 1990s.

The policy objective is to keep consumer price inflation between 2 and 3 per cent, on average, over the business cycle.

Monetary policy aims to achieve this over the medium term as a crucial precondition for the promotion of sustainable economic growth and employment.”

There is no mention of trimmed mean inflation.

It might argue that “medium term inflation target” means it should pay attention to trimmed mean but that should not include making bold political judgments about future changes to current policies.

The economy is being smashed while a tiny gaggle of technocrats make fiscal policy judgments that they are ill-equipped to make.

In fact, they just admitted as much:

“The staff forecast of public consumption has been revised higher several times over the past year in response to announcements of additional spending … A large share of the announced additional spending has been for existing services as well as cost-of-living support packages,”

It’s time the RBA climbed down from its high horse and cut.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.

Read related topics:Reserve Bank