Commonwealth Bank confident of February rate cut as December spending dips

One of Australia’s big four banks has renewed its prediction for when the Reserve Bank will cut the cash rate, as spending dropped after the Black Friday sales.

One of Australia’s big four banks is doubling down on its prediction the Reserve Bank will cut the official cash rate next month after a drop in household spending.

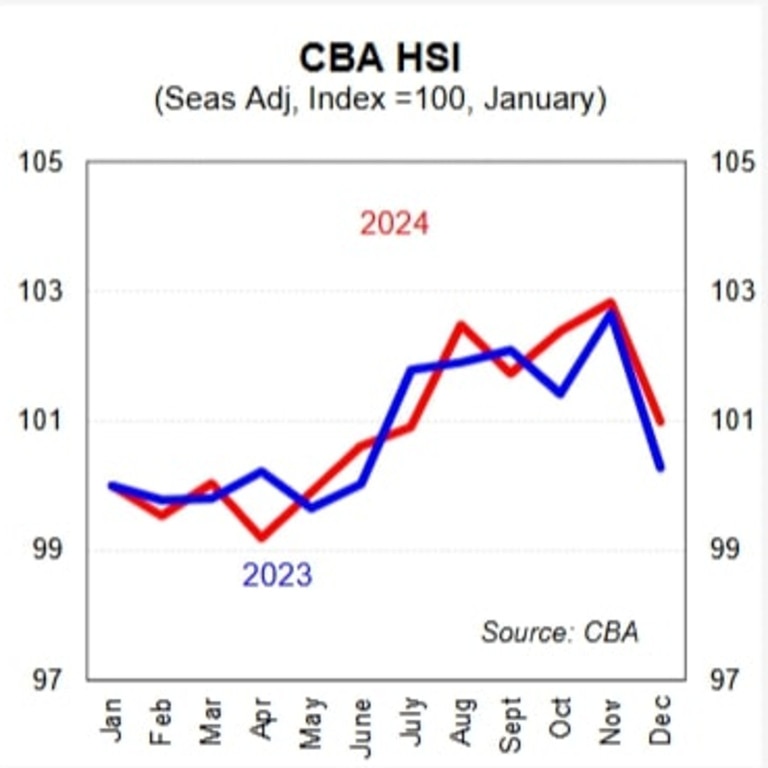

The Commonwealth Bank said on Wednesday its month household spending index fell by 1.8 per cent in December, despite Christmas and summer holidays.

The slump was driven by an 8.3 per cent decline in spending on household goods after strong results following Black Friday sales in November.

“Given the weakness in spending in December, combined with the improving inflation environment, we continue to hold the view that the RBA can begin to lower interest rates at their first meeting of the year” on February 18, CBA chief economist and head of global market research, Stephen Halmarick said.

“We expect 100 basis points of monetary policy easing through 2025, taking the cash rate down to 3.35 per cent”.

The RBA board will meet for the first time since mid-November on February 17-18, where they will consider whether to cut the official cash rate that has been on hold at 4.35 per cent since November 2023.

Relatively large declines in spending were also reported in hospitality, with a fall of 2.6 per cent over the month, as well as on food and beverages and recreation.

“Over the year to December, the largest contributions to spending was restaurants, food delivery services, fast food outlets, pubs, bars and caterers,” Mr Halmarick said.

“This was offset by reduced spending on cafes and breweries and wineries”.

As for household goods, the largest lifts in spending occurred on online marketplaces, hardware stores, men’s and women’s clothing, furniture and department stores.

The results reinforced what the CBA said was a recent historical spending pattern in Australia whereby strength in November is replaced by weakness in December.

Mr Halmarrick said the fall in spending also reflected the view that consumers continued to struggle, with summer and holiday spending brought ahead in 2024.

By doing so, consumers were able to take advantage of the Black Friday and Cyber Monday sales, with some shoppers enticed to spend earlier in October.

Conversely, spending on utilities grew by almost five per cent in December, as did spending on “communications and digital”, transport and insurance.

Airconditioning and heating services reported the highest increases in spending in the year to December in utilities, followed by childcare services.

Commonwealth Bank said the drop in spending came amid underlying inflation which fell by 30 basis points to 3.2 per cent in November.

Predictions of a February rate cut have been mirrored by ANZ, which is also forecasting the RBA would slash the cash rate, but not by all of the country’s big four.

Westpac’s group chief economist Luci Ellis told Sky News the RBA will drop rates in May 2025. NAB also expects a May cut at this stage.

Meanwhile, the latest job figures will be released on Thursday, which the RBA will be watching closely as the job market has be more resilient than expected despite the cost of living crisis and softer economy.

Economists are also awaiting more comprehensive inflation data for the December quarter due on January 29 which will be key to the RBA’s cash rate decision in February.

The recent falls in the Australian dollar have put a question mark on whether inflation would be affected.