‘Should have done that’: Jim Chalmers’ admission over family home tax bungle

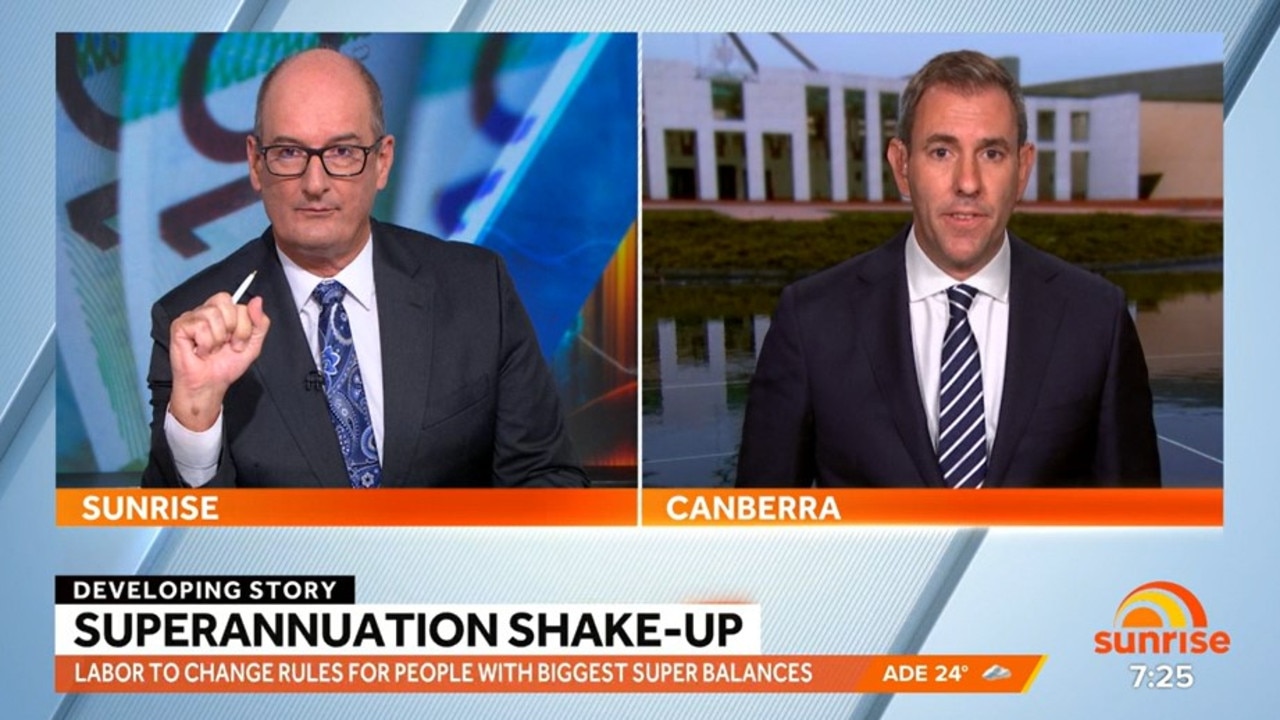

Jim Chalmers was attempting to sell the government’s decision to lift taxes on superannuation funds when he found himself in hot water.

Jim Chalmers has been forced to rule out any changes to a tax break on the family home, conceding he should have been clearer during a morning TV grilling.

The Treasurer opened a can of worms during an interview with Sunrise on Wednesday after he failed to guarantee he wouldn’t touch the capital gains tax exemption after new costings from his department showed it cost the budget $48bn.

“I can say to your viewers that we haven’t been focused on it. We haven’t been working on it. It’s not something that we have been contemplating,” he told Sunrise.

“I can’t commit future governments to changes or otherwise.”

Minutes later Anthony Albanese slammed the door shut when asked to rule out any future changes.

“We are not going to impact the family home, full stop, exclamation mark,” the Prime Minister said.

Asked if he could make the same guarantee at a press conference later in the day, Dr Chalmers backed down.

“I’m trying to maintain a focus on what we’re doing, not what we’re not doing. I am concerned that having provided in the interests of transparency a sense of all of the tax breaks across the budget and Treasury’s best assessment of how they’re growing,” he told reporters in Canberra.

“I don’t want to get into the practice of coming before you each day and working through hundreds of billions of dollars of tax concessions and playing the same rule-in rule-out game.

“I should have done that when it came to the family home this morning. And I’m happy to say that.”

Data released by Treasury on Tuesday revealed the cost of the 10 largest tax expenditures – revenue forgone due to concessional tax – has hit $150bn.

Superannuation tax concessions, the data showed, would be worth more than $50bn this financial year.

After just eight days of a “national conversation” about the issue, the government rushed through a decision to lift taxes on superannuation balances of more than $3m to 30 per cent through cabinet.

That’s despite Mr Albanese ruling out any major changes to superannuation during the election and on Sunday night declaring the debate still remained “hypothetical”.

Both Dr Chalmers and Mr Albanese rejected suggestion the change of heart was a broken promise. Both men were also quick to shoot down claims the Treasury statement amounted to government policy.

“It wasn’t a statement by the cabinet if you like, this was just a statement of fact,” Mr Albanese said.

“What we’ve done is release more information. It’s more honest than it’s been in the past.”

Opposition leader Peter Dutton warned the super changes were just the first of many.